Your Retirement rmd images are ready in this website. Retirement rmd are a topic that is being searched for and liked by netizens now. You can Download the Retirement rmd files here. Get all free photos.

If you’re searching for retirement rmd images information related to the retirement rmd keyword, you have pay a visit to the right site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

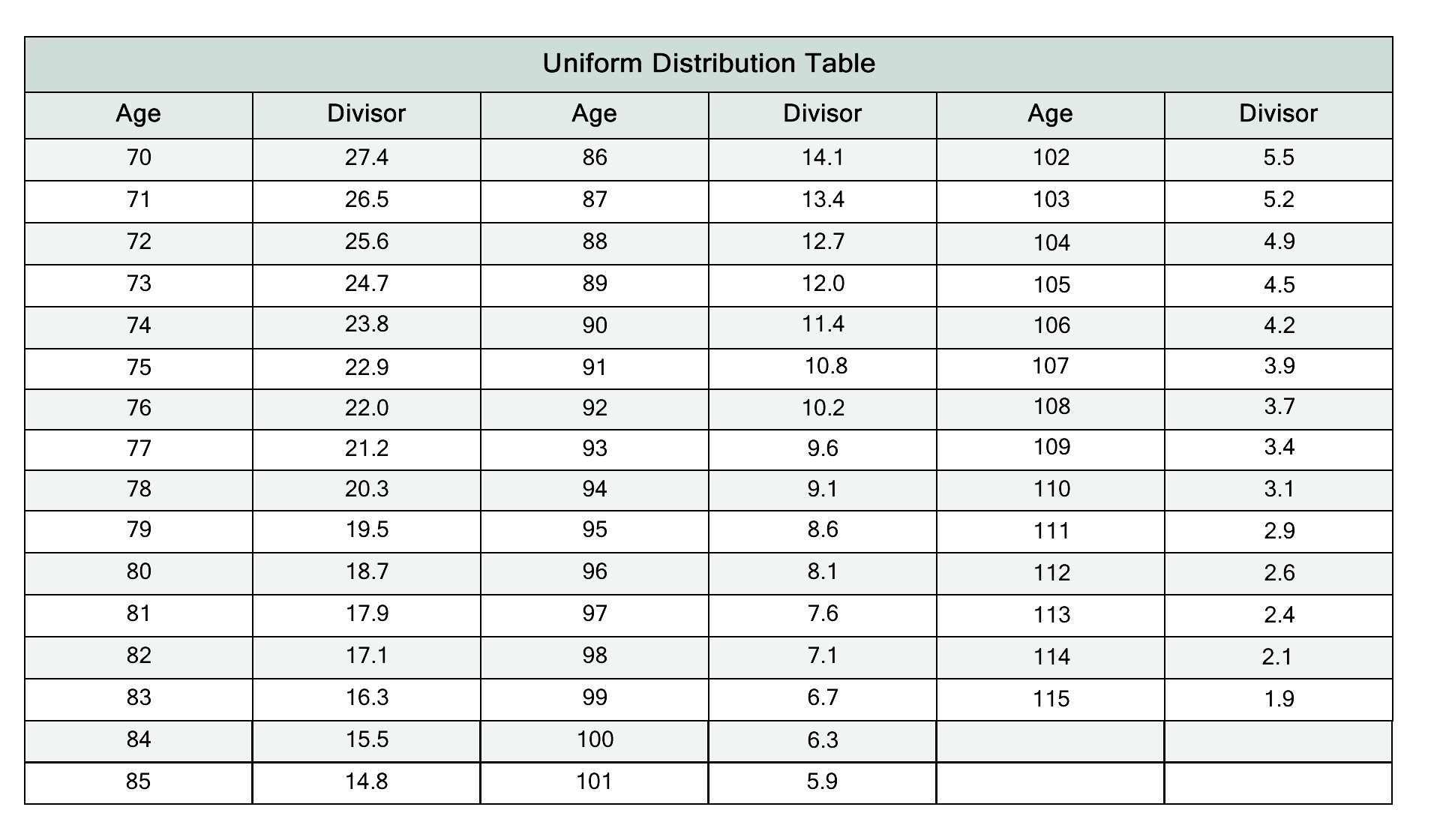

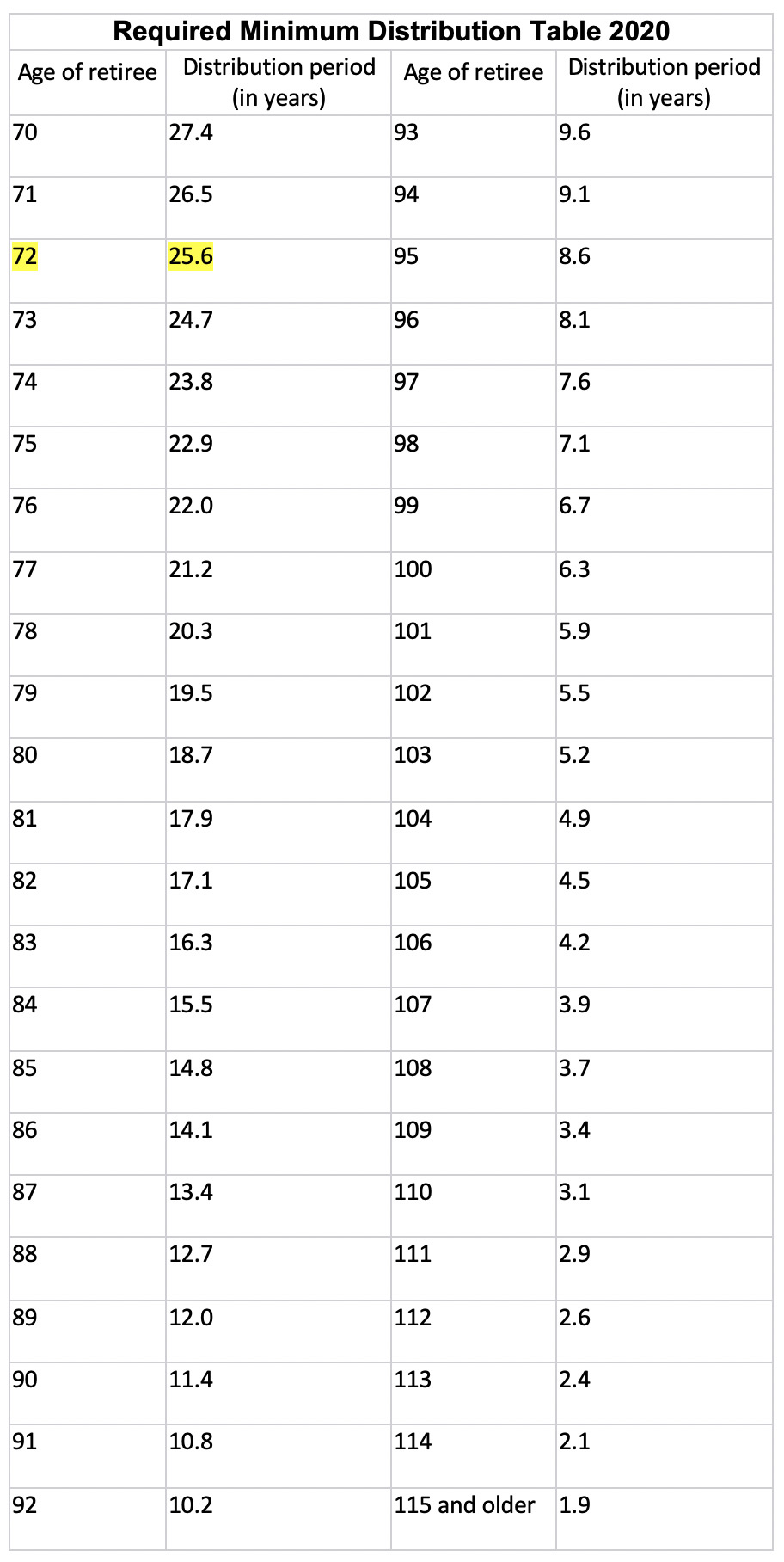

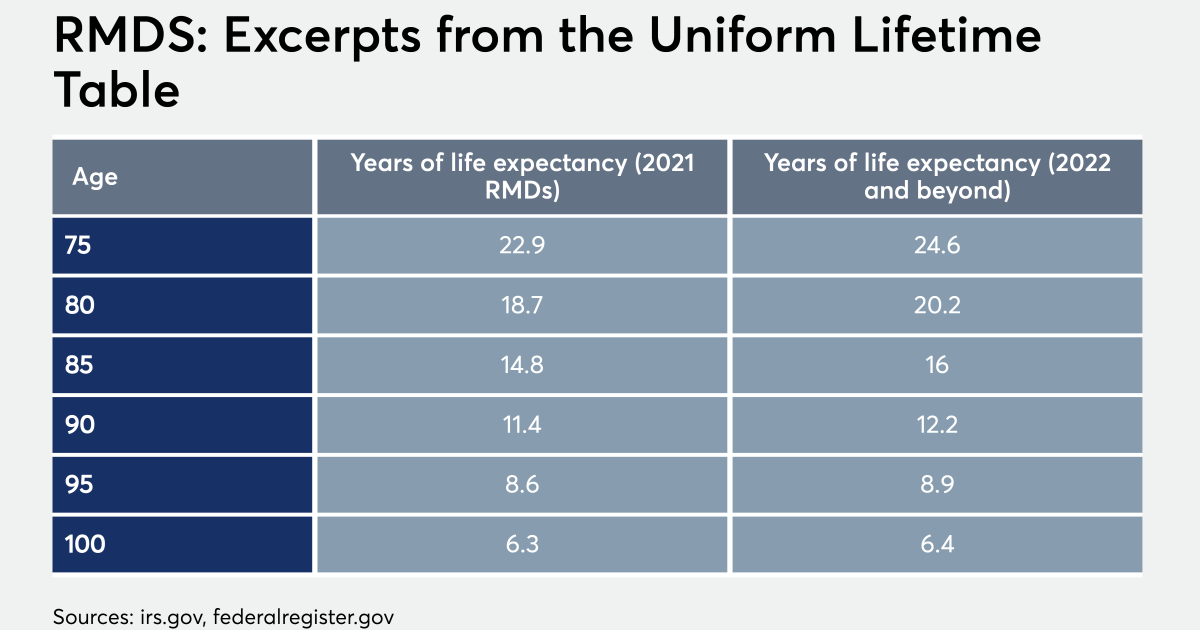

Retirement Rmd. However, if the retirement plan account is an ira or the account owner. After that your rmds must be taken by dec. Ira required minimum distribution (rmd) table for 2022. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5.

How Much Do You Need To Withdraw From IRAs at Retirement? From wealthpilgrim.com

How Much Do You Need To Withdraw From IRAs at Retirement? From wealthpilgrim.com

Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Ira required minimum distribution (rmd) table for 2022. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. However, if the retirement plan account is an ira or the account owner.

Ira required minimum distribution (rmd) table for 2022.

After that your rmds must be taken by dec. After that your rmds must be taken by dec. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Failure to do so means a penalty of 50% of the required rmd. Ira required minimum distribution (rmd) table for 2022.

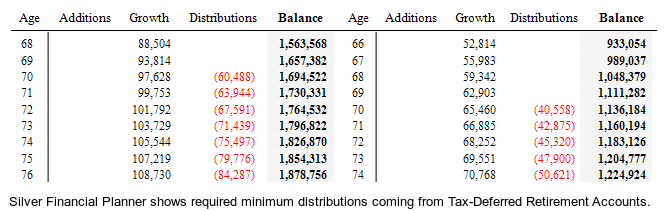

Source: moneytree.com

Source: moneytree.com

A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. However, if the retirement plan account is an ira or the account owner. Failure to do so means a penalty of 50% of the required rmd.

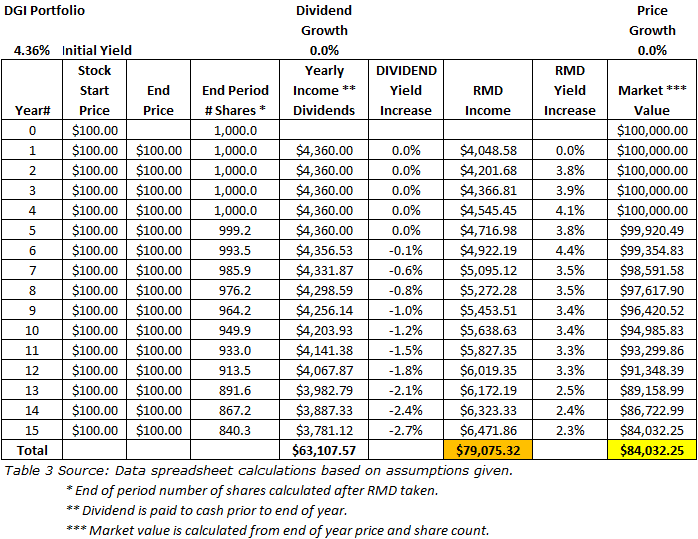

Source: dailytradealert.com

Source: dailytradealert.com

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. After that your rmds must be taken by dec. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Ira required minimum distribution (rmd) table for 2022. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from.

") Source: clickondetroit.com

Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Ira required minimum distribution (rmd) table for 2022. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72.

Source: bankers-anonymous.com

Source: bankers-anonymous.com

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. After that your rmds must be taken by dec. However, if the retirement plan account is an ira or the account owner. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72.

Source: pearsoncocpa.com

Source: pearsoncocpa.com

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. After that your rmds must be taken by dec. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. However, if the retirement plan account is an ira or the account owner. Failure to do so means a penalty of 50% of the required rmd.

Source: brokeasshome.com

Source: brokeasshome.com

Ira required minimum distribution (rmd) table for 2022. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from.

Source: forbes.com

Source: forbes.com

Failure to do so means a penalty of 50% of the required rmd. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. Ira required minimum distribution (rmd) table for 2022. After that your rmds must be taken by dec.

Source: pinterest.com

Source: pinterest.com

However, if the retirement plan account is an ira or the account owner. Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from.

Source: seekingalpha.com

Source: seekingalpha.com

After that your rmds must be taken by dec. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Ira required minimum distribution (rmd) table for 2022. Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5.

Source: fool.com

Source: fool.com

However, if the retirement plan account is an ira or the account owner. Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. After that your rmds must be taken by dec. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72.

Source: hallbenefitslaw.com

Source: hallbenefitslaw.com

Ira required minimum distribution (rmd) table for 2022. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Failure to do so means a penalty of 50% of the required rmd. However, if the retirement plan account is an ira or the account owner. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5.

Source: retirementfieldguide.com

Source: retirementfieldguide.com

After that your rmds must be taken by dec. Ira required minimum distribution (rmd) table for 2022. However, if the retirement plan account is an ira or the account owner. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires.

Source: wealthpilgrim.com

Source: wealthpilgrim.com

However, if the retirement plan account is an ira or the account owner. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. After that your rmds must be taken by dec. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Required minimum distributions (rmds) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 (70 ½ if you reach 70 ½ before january 1, 2020), if later, the year in which he or she retires.

Source: manning-napier.com

Source: manning-napier.com

After that your rmds must be taken by dec. Ira required minimum distribution (rmd) table for 2022. After that your rmds must be taken by dec. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. However, if the retirement plan account is an ira or the account owner.

Source: youtube.com

Source: youtube.com

Failure to do so means a penalty of 50% of the required rmd. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. Ira required minimum distribution (rmd) table for 2022.

Source: amichaelturner.com

Source: amichaelturner.com

Ira required minimum distribution (rmd) table for 2022. A required minimum distribution (rmd) is the amount that traditional, sep or simple ira owners and qualified plan participants must begin distributing from. After that your rmds must be taken by dec. Ira required minimum distribution (rmd) table for 2022. However, if the retirement plan account is an ira or the account owner.

Source: financial-planning.com

Source: financial-planning.com

Ira required minimum distribution (rmd) table for 2022. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72. Ira required minimum distribution (rmd) table for 2022. After that your rmds must be taken by dec.

Source: elchoroukhost.net

Source: elchoroukhost.net

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. Failure to do so means a penalty of 50% of the required rmd. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5. However, if the retirement plan account is an ira or the account owner. Therefore, your first rmd must be taken by april 1 of the year in which you turn 72.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement rmd by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.