Your Retirement planning quiz images are ready. Retirement planning quiz are a topic that is being searched for and liked by netizens now. You can Download the Retirement planning quiz files here. Download all free photos.

If you’re looking for retirement planning quiz pictures information linked to the retirement planning quiz keyword, you have visit the ideal site. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Retirement Planning Quiz. Retirees and people nearing retirement averaged just 42% on a recent retirement income literacy quiz. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. You may be able to have both, depending on your situation.

Retirement planning questions you will surely encounter in 2016 From slideshare.net

Retirement planning questions you will surely encounter in 2016 From slideshare.net

For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. Take the retirement iq quiz below and see which financial areas you may need to brush up on. The college asked more than 1,500 retirees and people. “it’s never too late,” says fidelity’s melissa ridolfi. Build a retirement plan to fit your lifestyle.

For more news you can use to help guide your financial life,.

Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. The college asked more than 1,500 retirees and people. “it’s never too late,” says fidelity’s melissa ridolfi. You may be able to have both, depending on your situation. Common options to save for retirement include 401 (k)s and iras. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services.

401 (k)s are offered through employers, so you may already have one. Common options to save for retirement include 401 (k)s and iras. You may be able to have both, depending on your situation. 401 (k)s are offered through employers, so you may already have one. “it’s never too late,” says fidelity’s melissa ridolfi.

![Retirement Planning CFP Mock Test [PDF Document] Retirement Planning CFP Mock Test [PDF Document]](https://cdn.vdocuments.net/img/1200x630/reader016/image/20181124/577cc9bf1a28aba711a48328.png?t=1622290746) Source: vdocuments.net

Source: vdocuments.net

For more news you can use to help guide your financial life,. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services. Build a retirement plan to fit your lifestyle.

Source: blog.birchwoodfp.com

Build a retirement plan to fit your lifestyle. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. 401 (k)s are offered through employers, so you may already have one. Retirees and people nearing retirement averaged just 42% on a recent retirement income literacy quiz. Take the retirement iq quiz below and see which financial areas you may need to brush up on.

Source: slideshare.net

Source: slideshare.net

Retirees and people nearing retirement averaged just 42% on a recent retirement income literacy quiz. When it comes to iras, you may be able to open an account on your own through a financial institution. For more news you can use to help guide your financial life,. “it’s never too late,” says fidelity’s melissa ridolfi. 401 (k)s are offered through employers, so you may already have one.

Source: pinterest.com

Source: pinterest.com

Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services. When it comes to iras, you may be able to open an account on your own through a financial institution. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Common options to save for retirement include 401 (k)s and iras. Take the retirement iq quiz below and see which financial areas you may need to brush up on.

Source: infographicplaza.com

Source: infographicplaza.com

For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. The college asked more than 1,500 retirees and people. Test your knowledge with an abbreviated version below. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals.

Source: slideserve.com

Source: slideserve.com

When it comes to iras, you may be able to open an account on your own through a financial institution. For more news you can use to help guide your financial life,. Build a retirement plan to fit your lifestyle. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. You may be able to have both, depending on your situation.

Source: researchgate.net

Source: researchgate.net

When it comes to iras, you may be able to open an account on your own through a financial institution. For more news you can use to help guide your financial life,. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. Common options to save for retirement include 401 (k)s and iras.

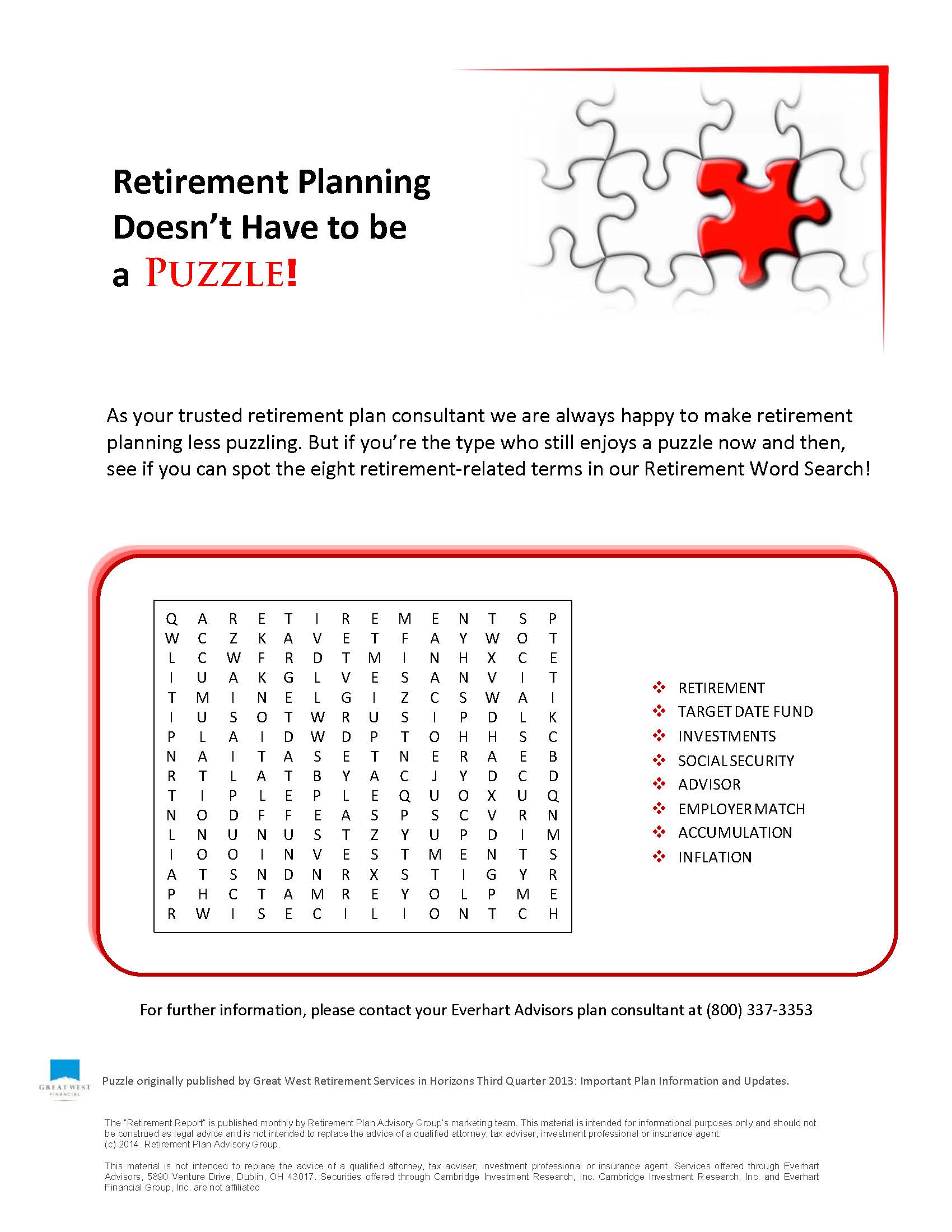

Source: everhartadvisors.com

Source: everhartadvisors.com

When it comes to iras, you may be able to open an account on your own through a financial institution. The college asked more than 1,500 retirees and people. Build a retirement plan to fit your lifestyle. Test your knowledge with an abbreviated version below. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services.

Source: coursehero.com

Source: coursehero.com

Retirees and people nearing retirement averaged just 42% on a recent retirement income literacy quiz. You may be able to have both, depending on your situation. Take the retirement iq quiz below and see which financial areas you may need to brush up on. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Build a retirement plan to fit your lifestyle.

Source: pinterest.com

Source: pinterest.com

Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Build a retirement plan to fit your lifestyle. Test your knowledge with an abbreviated version below.

Source: yourmoneyyourretirement.com

Source: yourmoneyyourretirement.com

Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services. The college asked more than 1,500 retirees and people. When it comes to iras, you may be able to open an account on your own through a financial institution. Take the retirement iq quiz below and see which financial areas you may need to brush up on.

Source: pinterest.com

Source: pinterest.com

You may be able to have both, depending on your situation. 401 (k)s are offered through employers, so you may already have one. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. You may be able to have both, depending on your situation.

Source: pinterest.com

Source: pinterest.com

Build a retirement plan to fit your lifestyle. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. You may be able to have both, depending on your situation. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. For more news you can use to help guide your financial life,.

Source: stories.wf.com

Source: stories.wf.com

For more news you can use to help guide your financial life,. Baby boomers are saving the most (and scored highest on knowledge) but a significant number of investors of all ages still held misconceptions that could lead to financial problems later. The college asked more than 1,500 retirees and people. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services.

Source: study.com

Source: study.com

Retirees and people nearing retirement averaged just 42% on a recent retirement income literacy quiz. You may be able to have both, depending on your situation. Common options to save for retirement include 401 (k)s and iras. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. Only 1 in 5 americans ages 50 to 75 passed a recent retirement income literacy quiz from the american college of financial services.

Source: researchgate.net

Source: researchgate.net

Test your knowledge with an abbreviated version below. I know when i want to retire, and how much i need to save between now and retirement to achieve my retirement goals. When it comes to iras, you may be able to open an account on your own through a financial institution. The college asked more than 1,500 retirees and people. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth.

Source: slideshare.net

Source: slideshare.net

When it comes to iras, you may be able to open an account on your own through a financial institution. Common options to save for retirement include 401 (k)s and iras. You may be able to have both, depending on your situation. Test your knowledge with an abbreviated version below. For over 31 years our financial advisors have worked with individuals and families on long island to achieve their unique financial goals and build wealth.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement planning quiz by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.