Your Retirement planning pdf images are available. Retirement planning pdf are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement planning pdf files here. Find and Download all royalty-free vectors.

If you’re looking for retirement planning pdf images information connected with to the retirement planning pdf interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

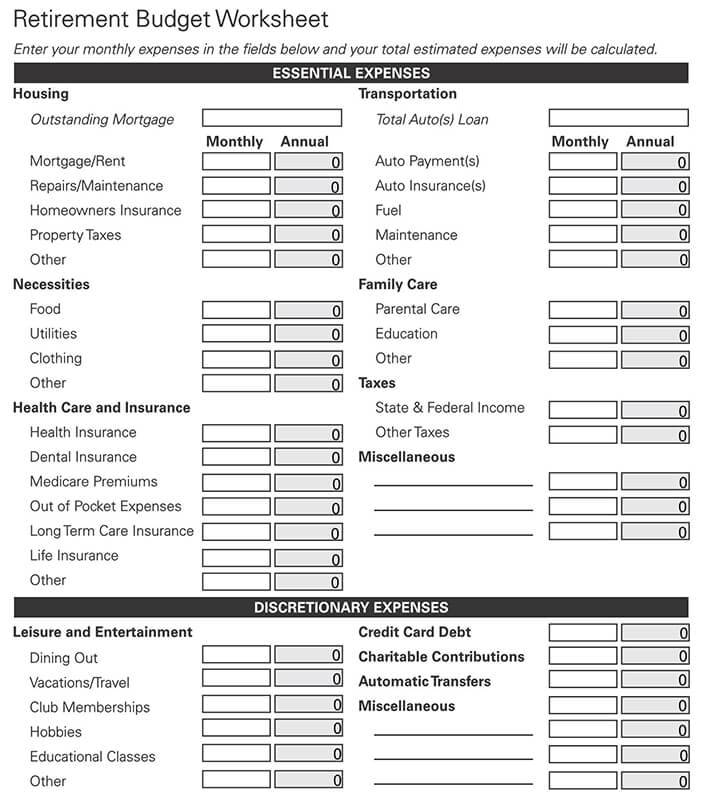

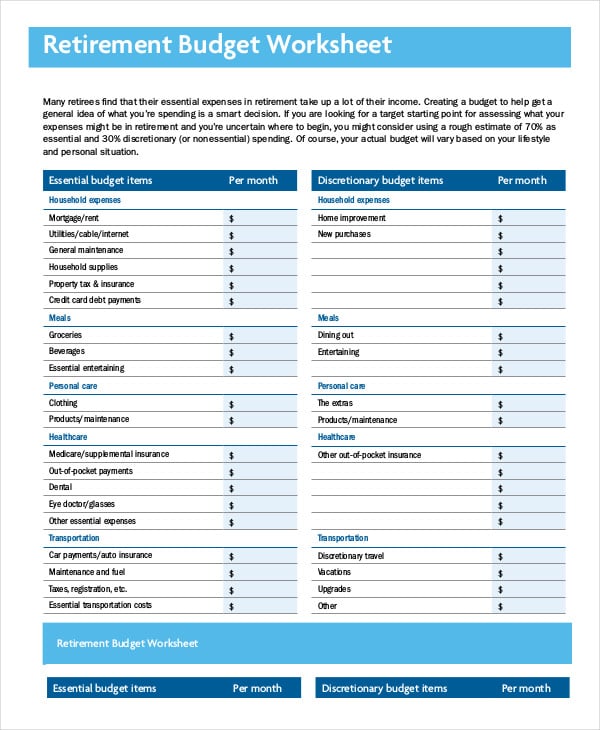

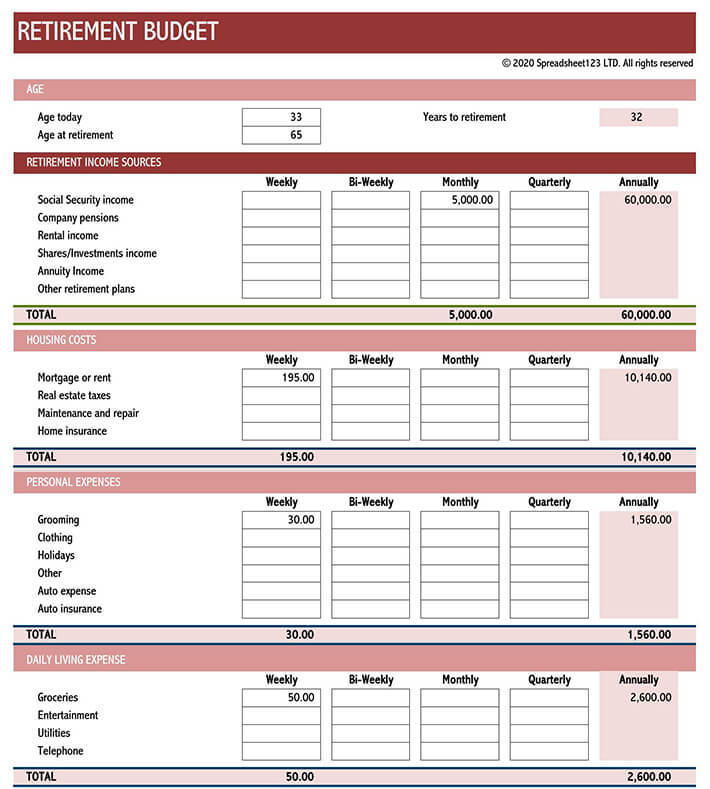

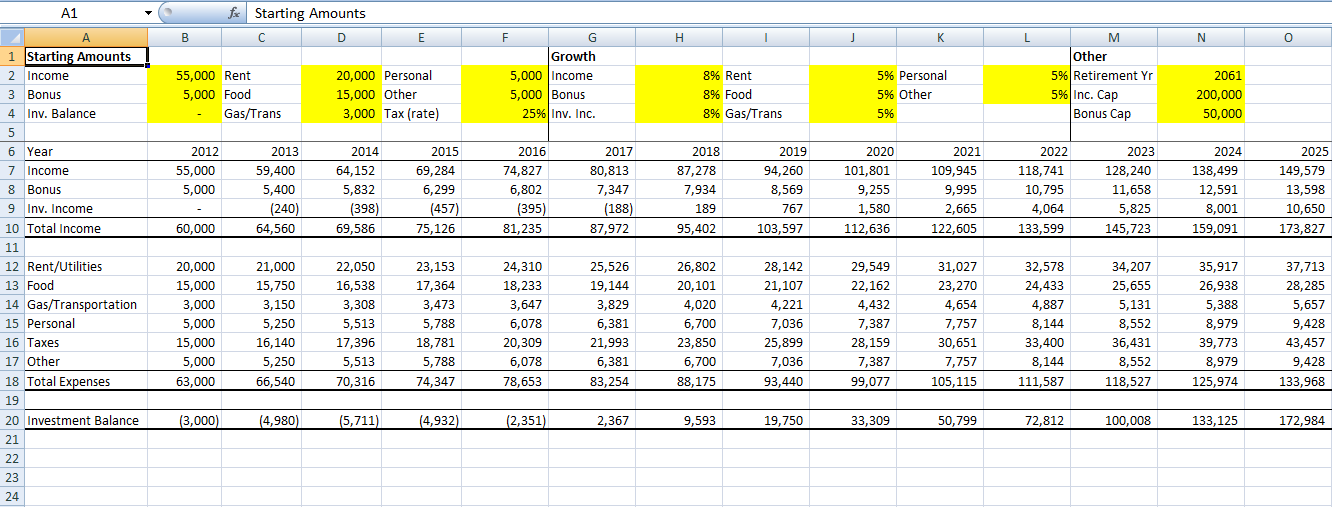

Retirement Planning Pdf. Goals are often phrased in terms of a. Review your financial plan each year to make Retirement plan and saving decisions template. Other tools may use a fixed or deterministic approach to arrive at a more specific outcome.

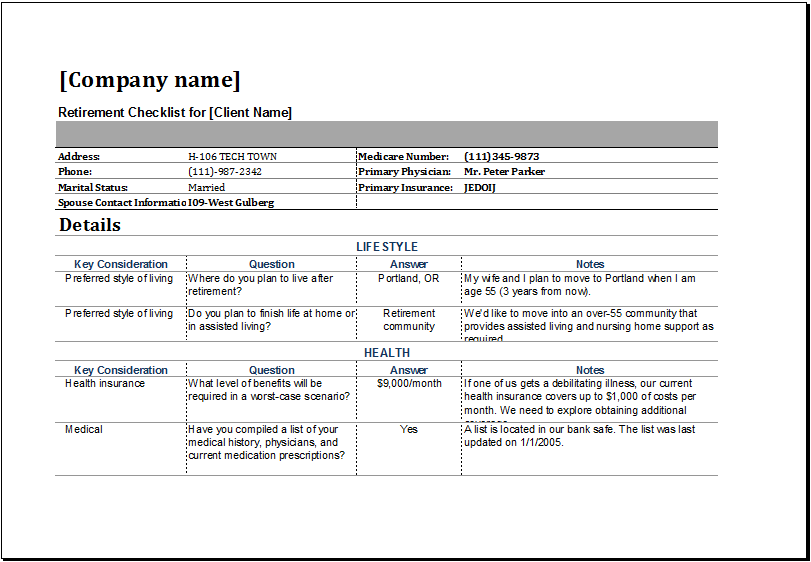

retirement_plan_checklist.pdf DocDroid From docdroid.net

retirement_plan_checklist.pdf DocDroid From docdroid.net

A very strong plan for giving yourself fewer worries in your later years. Three key saving barriers from our survey data that we could work with in devising a. Other tools may use a fixed or deterministic approach to arrive at a more specific outcome. Example, “w e want $40,000 in five. Someone who is 40 years from retirement and is putting $100 a month into a retirement fund and seeing normal returns could end Desired future financial position, for.

Other tools may use a fixed or deterministic approach to arrive at a more specific outcome.

Some tools may use stochastic modeling (simulating volatility) to forecast probabilities and ranges of future values. 10+ retirement plan templates in pdf | doc 1. Other tools may use a fixed or deterministic approach to arrive at a more specific outcome. Goals are often phrased in terms of a. Someone who is 40 years from retirement and is putting $100 a month into a retirement fund and seeing normal returns could end Desired future financial position, for.

Source: slideshare.net

Source: slideshare.net

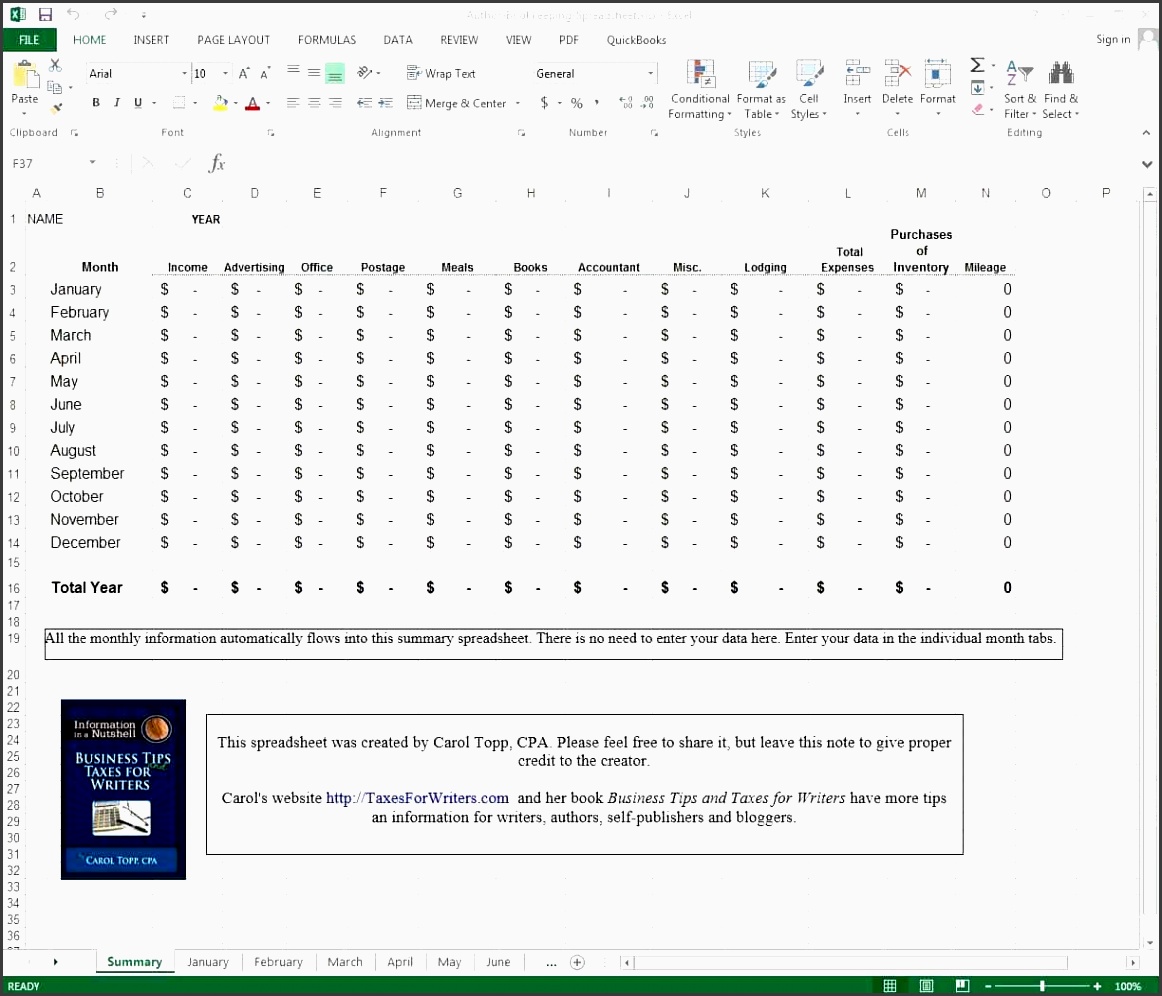

In addition, the employer must also remit the company’s portion of contributions. Review your financial plan each year to make Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. The total contribution must be 23%. Retirement plan and saving decisions template.

Source: db-excel.com

Source: db-excel.com

Other tools may use a fixed or deterministic approach to arrive at a more specific outcome. Someone who is 40 years from retirement and is putting $100 a month into a retirement fund and seeing normal returns could end Review your financial plan each year to make Personal finance 136 fretirement and pension planning chapter 7 3. (1) not having enough information and not knowing.

Source: malnadhomes.com

Source: malnadhomes.com

Review your financial plan each year to make The total contribution must be 23%. Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. Example, “w e want $40,000 in five. Making contributions every month allows you to harness the power of time and use compound interest to really see your investment grow substantially.

Source: sampletemplatess.com

Source: sampletemplatess.com

Three key saving barriers from our survey data that we could work with in devising a. A very strong plan for giving yourself fewer worries in your later years. The total contribution must be 23%. Must remain alert and to ensure that the employer deducts employee’s salary and remits the contribution to epf. Personal finance 136 fretirement and pension planning chapter 7 3.

Source: db-excel.com

Source: db-excel.com

Must remain alert and to ensure that the employer deducts employee’s salary and remits the contribution to epf. Retirement plan and saving decisions template. Some tools may use stochastic modeling (simulating volatility) to forecast probabilities and ranges of future values. A very strong plan for giving yourself fewer worries in your later years. Three key saving barriers from our survey data that we could work with in devising a.

Source: db-excel.com

Source: db-excel.com

However, some notable exceptions will be helpful for younger individuals or just in case. Must remain alert and to ensure that the employer deducts employee’s salary and remits the contribution to epf. (1) not having enough information and not knowing. Retirement plan and saving decisions template. Three key saving barriers from our survey data that we could work with in devising a.

Source: wordtemplatesonline.net

Source: wordtemplatesonline.net

Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. Retirement plan and saving decisions template. The total contribution must be 23%. A very strong plan for giving yourself fewer worries in your later years. (1) not having enough information and not knowing.

Source: montana.edu

Source: montana.edu

Three key saving barriers from our survey data that we could work with in devising a. 10+ retirement plan templates in pdf | doc 1. Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. Making contributions every month allows you to harness the power of time and use compound interest to really see your investment grow substantially. Retirement plan and saving decisions template.

Source: slideteam.net

Source: slideteam.net

(1) not having enough information and not knowing. Retirement plan and saving decisions template. 3.4 barriers to saving towards retirement. Desired future financial position, for. Personal finance 136 fretirement and pension planning chapter 7 3.

Source: sampletemplatess.com

Source: sampletemplatess.com

However, some notable exceptions will be helpful for younger individuals or just in case. Other tools may use a fixed or deterministic approach to arrive at a more specific outcome. Goals are often phrased in terms of a. Making contributions every month allows you to harness the power of time and use compound interest to really see your investment grow substantially. Retirement planning tools use a variety of methods when estimating outcomes.

Source: go.vsecu.com

Personal finance 136 fretirement and pension planning chapter 7 3. In addition, the employer must also remit the company’s portion of contributions. (1) not having enough information and not knowing. 10+ retirement plan templates in pdf | doc 1. A very strong plan for giving yourself fewer worries in your later years.

Source: docdroid.net

Source: docdroid.net

Desired future financial position, for. Like a 401(k), an ira has some penalties related to taking cash out before you hit retirement age. Desired future financial position, for. A very strong plan for giving yourself fewer worries in your later years. In addition, the employer must also remit the company’s portion of contributions.

Source: template.net

Source: template.net

A very strong plan for giving yourself fewer worries in your later years. Review your financial plan each year to make In addition, the employer must also remit the company’s portion of contributions. Example, “w e want $40,000 in five. Retirement plan and saving decisions template.

Making contributions every month allows you to harness the power of time and use compound interest to really see your investment grow substantially. The total contribution must be 23%. Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. Retirement plan and saving decisions template. Retirement planning tools use a variety of methods when estimating outcomes.

Source: excelstemplates.com

Source: excelstemplates.com

Must remain alert and to ensure that the employer deducts employee’s salary and remits the contribution to epf. Celebrationsoflife.net you have put your plan into action and it’s time to reap the benefits of your nest egg. Three key saving barriers from our survey data that we could work with in devising a. In addition, the employer must also remit the company’s portion of contributions. 10+ retirement plan templates in pdf | doc 1.

Source: wordtemplatesonline.net

Source: wordtemplatesonline.net

Personal finance 136 fretirement and pension planning chapter 7 3. However, some notable exceptions will be helpful for younger individuals or just in case. Retirement plan and saving decisions template. 3.4 barriers to saving towards retirement. Some tools may use stochastic modeling (simulating volatility) to forecast probabilities and ranges of future values.

Source: laobingkaisuo.com

Source: laobingkaisuo.com

Three key saving barriers from our survey data that we could work with in devising a. Someone who is 40 years from retirement and is putting $100 a month into a retirement fund and seeing normal returns could end Review your financial plan each year to make 3.4 barriers to saving towards retirement. Retirement planning tools use a variety of methods when estimating outcomes.

Source: thesmartnickel.blogspot.com

Source: thesmartnickel.blogspot.com

Retirement plan and saving decisions template. 3.4 barriers to saving towards retirement. (1) not having enough information and not knowing. The total contribution must be 23%. Some tools may use stochastic modeling (simulating volatility) to forecast probabilities and ranges of future values.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement planning pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.