Your Retirement planning journal images are ready in this website. Retirement planning journal are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement planning journal files here. Download all free vectors.

If you’re searching for retirement planning journal pictures information linked to the retirement planning journal keyword, you have visit the right site. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

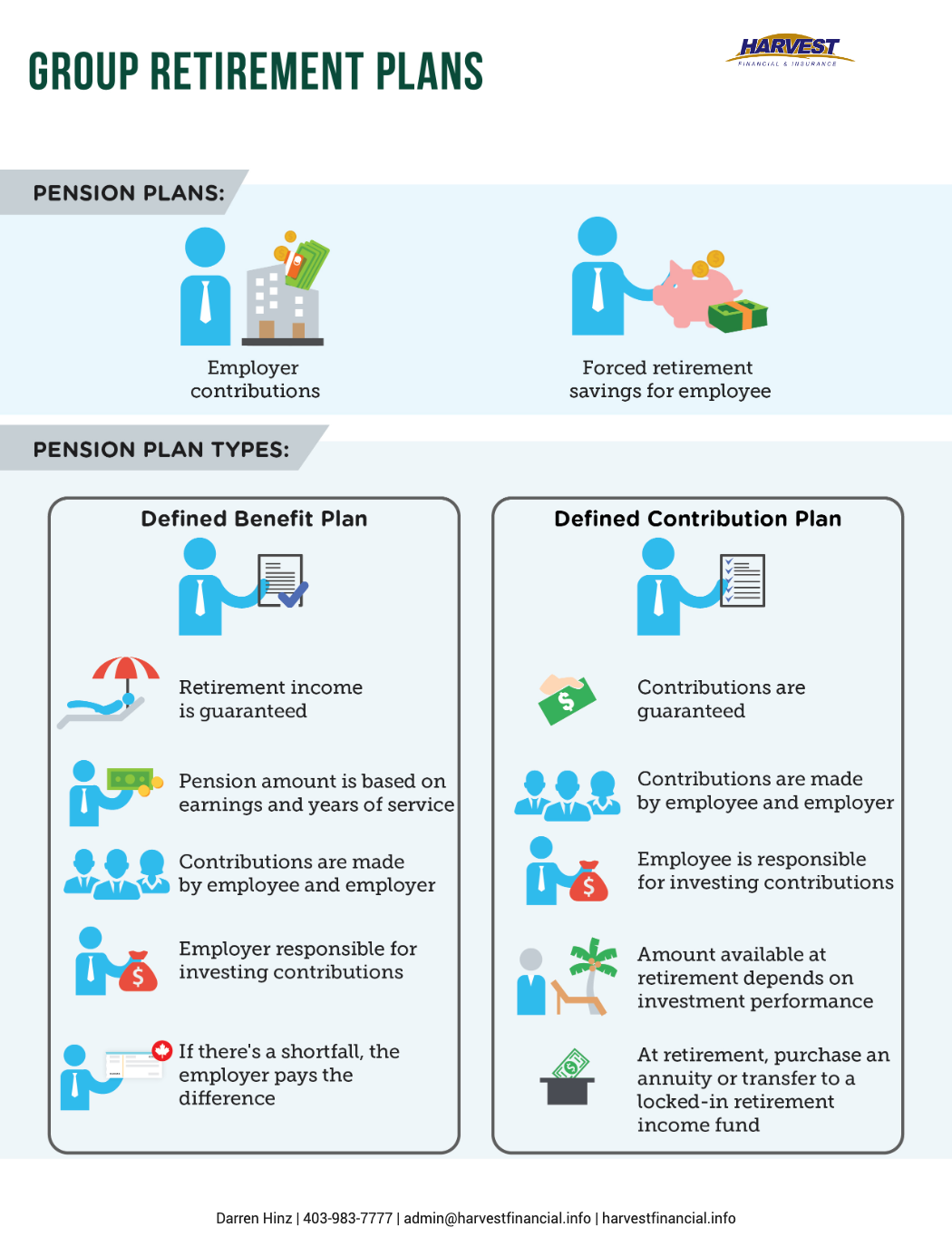

Retirement Planning Journal. To learn more about institute membership, visit the membership section. Financial planning and home equity for a safer retirement after 62. About the journal of retirement. Retirement is a time of life that has grown ever longer in the developed world, and the number of pensioners has increased accordingly, questioning the strength of social security systems and the social safety net in general.

Retirement Journal (Celebration Guest Book) Journals Unlimited, Inc From journalsunlimited.com

Retirement Journal (Celebration Guest Book) Journals Unlimited, Inc From journalsunlimited.com

About the journal of retirement. Most of the other retirement plan contribution limits stayed the same, however. Nonmembers may read articles from the current issue only below. Financial planning and home equity for a safer retirement after 62. Retirement planning is an issue that must be tackled early and solved backward. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard.

Is a professor of finance at iese business school in barcelona, spain.

About the journal of retirement. Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. About the journal of retirement. It must be tackled early because little can be done if an. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. Retirement planning is an issue that must be tackled early and solved backward.

Source: pinterest.com

Source: pinterest.com

Most of the other retirement plan contribution limits stayed the same, however. About the journal of retirement. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021. Most of the other retirement plan contribution limits stayed the same, however. To learn more about institute membership, visit the membership section.

Source: pinterest.com

Source: pinterest.com

Retirement planning is an issue that must be tackled early and solved backward. About the journal of retirement. Nonmembers may read articles from the current issue only below. To learn more about institute membership, visit the membership section. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard.

Source: designeduk.com

Source: designeduk.com

Financial planning and home equity for a safer retirement after 62. Is a professor of finance at iese business school in barcelona, spain. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. Most of the other retirement plan contribution limits stayed the same, however. Financial planning and home equity for a safer retirement after 62.

Source: fspgo.com

Source: fspgo.com

Nonmembers may read articles from the current issue only below. To learn more about institute membership, visit the membership section. It must be tackled early because little can be done if an. Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. Retirement planning is an issue that must be tackled early and solved backward.

Source: pinterest.com

Source: pinterest.com

Most of the other retirement plan contribution limits stayed the same, however. It must be tackled early because little can be done if an. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. Financial planning and home equity for a safer retirement after 62.

Source: notonthehighstreet.com

Source: notonthehighstreet.com

To learn more about institute membership, visit the membership section. Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. About the journal of retirement. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021. Retirement planning is an issue that must be tackled early and solved backward.

Source: scottsdaleazestateplanning.com

Source: scottsdaleazestateplanning.com

Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. About the journal of retirement. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021. It must be tackled early because little can be done if an. Retirement is a time of life that has grown ever longer in the developed world, and the number of pensioners has increased accordingly, questioning the strength of social security systems and the social safety net in general.

Source: journalsunlimited.com

Source: journalsunlimited.com

Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. Nonmembers may read articles from the current issue only below. To learn more about institute membership, visit the membership section. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. About the journal of retirement.

Source: pinterest.com

Source: pinterest.com

It must be tackled early because little can be done if an. Retirement is a time of life that has grown ever longer in the developed world, and the number of pensioners has increased accordingly, questioning the strength of social security systems and the social safety net in general. Is a professor of finance at iese business school in barcelona, spain. Financial planning and home equity for a safer retirement after 62. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory.

Source: pinterest.com

Source: pinterest.com

Financial planning and home equity for a safer retirement after 62. It must be tackled early because little can be done if an. Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021. Is a professor of finance at iese business school in barcelona, spain.

Source: theinspiringjournal.com

Source: theinspiringjournal.com

Retirement is a time of life that has grown ever longer in the developed world, and the number of pensioners has increased accordingly, questioning the strength of social security systems and the social safety net in general. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. It must be tackled early because little can be done if an. Most of the other retirement plan contribution limits stayed the same, however. To learn more about institute membership, visit the membership section.

Source: bizjournals.com

Source: bizjournals.com

Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. Nonmembers may read articles from the current issue only below. Retirement planning is an issue that must be tackled early and solved backward. About the journal of retirement. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard.

Source: cafepress.com

Source: cafepress.com

To learn more about institute membership, visit the membership section. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. Financial planning and home equity for a safer retirement after 62. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021.

Source: rcbizjournal.com

Source: rcbizjournal.com

Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. About the journal of retirement. Retirement planning is an issue that must be tackled early and solved backward. The irs announced that the income ranges for employee participation in workplace 401 (k) plans and ira contributions will increase from 2020 to 2021.

Source: notonthehighstreet.com

Source: notonthehighstreet.com

It must be tackled early because little can be done if an. To learn more about institute membership, visit the membership section. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. It must be tackled early because little can be done if an.

Source: journalsunlimited.com

Source: journalsunlimited.com

Most of the other retirement plan contribution limits stayed the same, however. Is a professor of finance at iese business school in barcelona, spain. Retirement planning is an issue that must be tackled early and solved backward. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. To learn more about institute membership, visit the membership section.

Source: jor.pm-research.com

Source: jor.pm-research.com

Financial planning for retirement (frp) consists of the series of activities involved in the accumulation of. Financial planning and home equity for a safer retirement after 62. Retirement is a time of life that has grown ever longer in the developed world, and the number of pensioners has increased accordingly, questioning the strength of social security systems and the social safety net in general. Most of the other retirement plan contribution limits stayed the same, however. Retirement planning is an issue that must be tackled early and solved backward.

Source: journalsunlimited.com

Source: journalsunlimited.com

Retirement planning is an issue that must be tackled early and solved backward. To learn more about institute membership, visit the membership section. Jor explores a diverse range of subjects, including retirement preparedness, pension plan design, behavioral finance, risk management strategies, demographics, longevity, social security, regulatory. It must be tackled early because little can be done if an. Investments & wealth institute members receive free access to the retirement management journal archives as a benefit of membership by logging into their dashboard.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement planning journal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.