Your Retirement plan vs nps images are ready in this website. Retirement plan vs nps are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan vs nps files here. Find and Download all free images.

If you’re searching for retirement plan vs nps pictures information related to the retirement plan vs nps topic, you have pay a visit to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

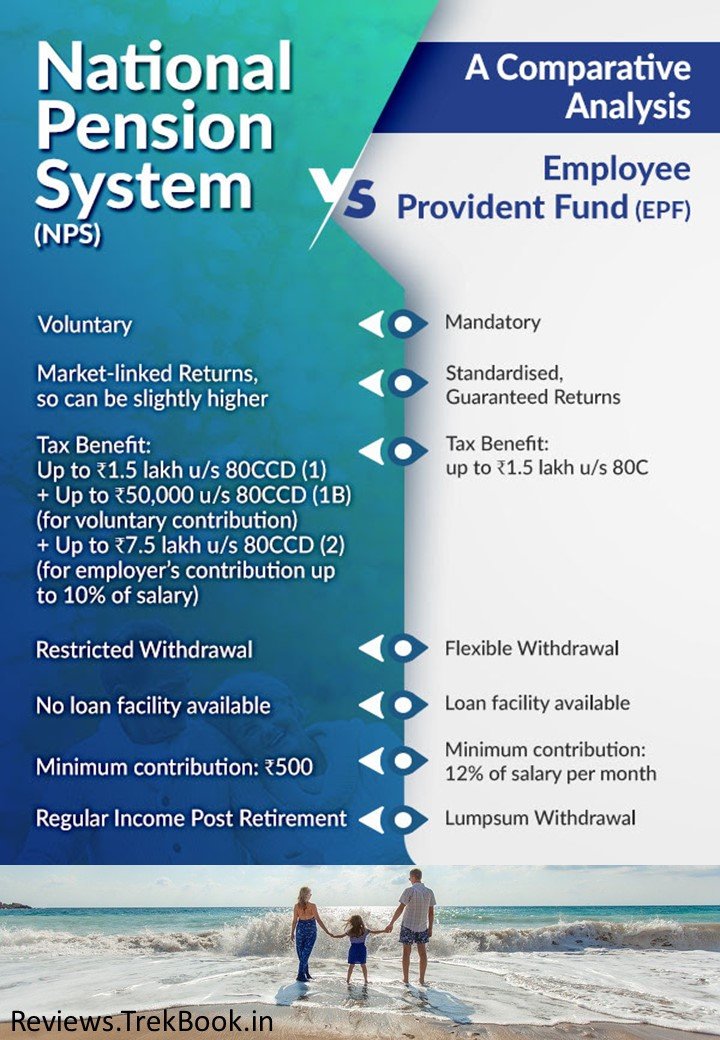

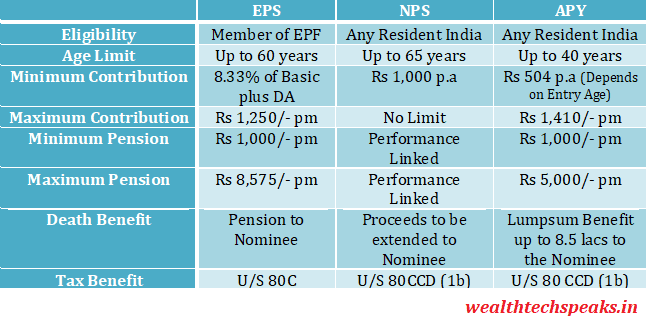

Retirement Plan Vs Nps. On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement. Eps offers a pension amount once you are 58 years old. With pension plans from insurance companies, you have this flexibility to choose the maturity age. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier.

Insurance pension plans to be flexible, but NPS still cheaper Livemint From livemint.com

Insurance pension plans to be flexible, but NPS still cheaper Livemint From livemint.com

The scheme invests across equity and debt instruments and hence can generate higher returns than eps. Nps vs pension plans from insurance companies: On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. With pension plans from insurance companies, you have this flexibility to choose the maturity age. The maximum eps contribution by the employer is 8.3% of basic salary + da.

Nps continues to score over other products in the category due to low costs.

An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. Now, this is a problem if you are planning to take early retirement. The maximum eps contribution by the employer is 8.3% of basic salary + da. Nps continues to score over other products in the category due to low costs. With pension plans from insurance companies, you have this flexibility to choose the maturity age. Eps offers a pension amount once you are 58 years old.

Source: financialexpress.com

Source: financialexpress.com

The maximum eps contribution by the employer is 8.3% of basic salary + da. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. Now, this is a problem if you are planning to take early retirement. The scheme invests across equity and debt instruments and hence can generate higher returns than eps. Eps offers a pension amount once you are 58 years old.

Source: fintrakk.com

Source: fintrakk.com

The maximum eps contribution by the employer is 8.3% of basic salary + da. If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. Now, this is a problem if you are planning to take early retirement.

Source: bemoneyaware.com

Source: bemoneyaware.com

National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. As per experts, nps scores over annuity plans because of low costs and choice of investment funds. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. Eps offers a pension amount once you are 58 years old. Nps continues to score over other products in the category due to low costs.

Source: mymoneysage.in

Source: mymoneysage.in

Nps vs pension plans from insurance companies: Eps offers a pension amount once you are 58 years old. Nps vs pension plans from insurance companies: On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement. On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture.

Source: pinterest.com

Source: pinterest.com

Now, this is a problem if you are planning to take early retirement. Nps vs pension plans from insurance companies: The scheme invests across equity and debt instruments and hence can generate higher returns than eps. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement.

Source: reviews.trekbook.in

Source: reviews.trekbook.in

As per experts, nps scores over annuity plans because of low costs and choice of investment funds. The maximum eps contribution by the employer is 8.3% of basic salary + da. Eps offers a pension amount once you are 58 years old. With pension plans from insurance companies, you have this flexibility to choose the maturity age. On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture.

Source: wealthtechspeaks.in

Source: wealthtechspeaks.in

The maximum eps contribution by the employer is 8.3% of basic salary + da. If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. With pension plans from insurance companies, you have this flexibility to choose the maturity age. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf.

Source: livemint.com

Source: livemint.com

Eps offers a pension amount once you are 58 years old. Eps offers a pension amount once you are 58 years old. Nps vs pension plans from insurance companies: On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture. On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement.

Source: bemoneyaware.com

Source: bemoneyaware.com

National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. Nps vs pension plans from insurance companies: Nps continues to score over other products in the category due to low costs. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf.

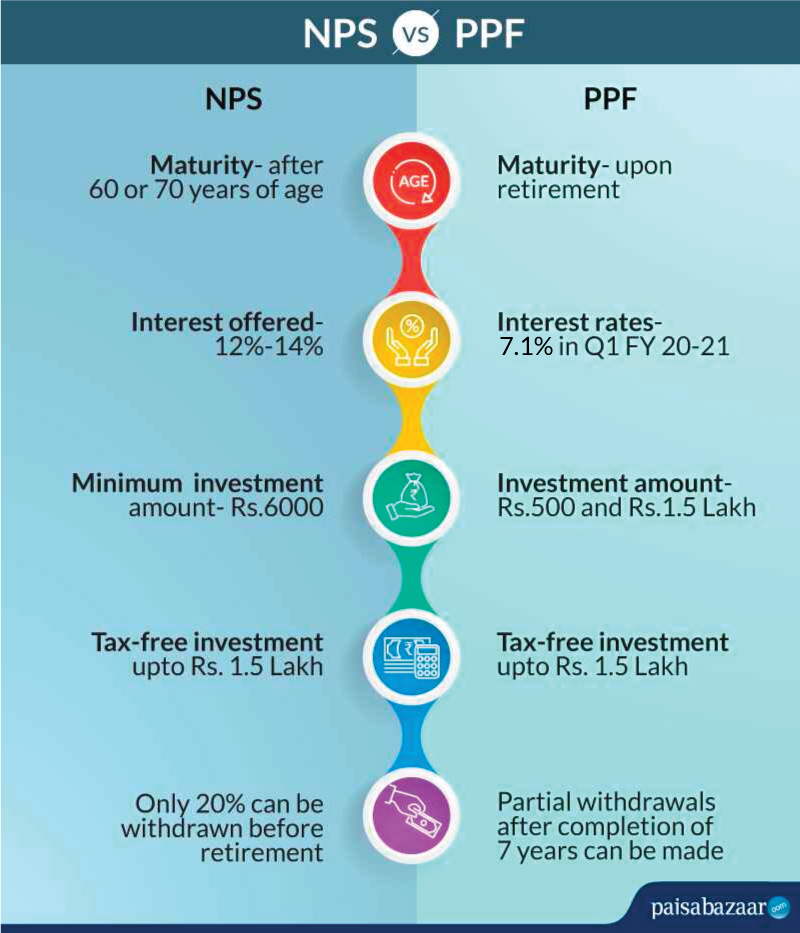

Source: paisabazaar.com

Source: paisabazaar.com

If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years. Nps vs pension plans from insurance companies: National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years. On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture.

Source: explorerpranjal.com

Source: explorerpranjal.com

Nps continues to score over other products in the category due to low costs. With pension plans from insurance companies, you have this flexibility to choose the maturity age. Now, this is a problem if you are planning to take early retirement. Nps continues to score over other products in the category due to low costs. Eps offers a pension amount once you are 58 years old.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

Now, this is a problem if you are planning to take early retirement. The scheme invests across equity and debt instruments and hence can generate higher returns than eps. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf. As per experts, nps scores over annuity plans because of low costs and choice of investment funds. If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years.

Source: mymoneysage.in

Source: mymoneysage.in

As per experts, nps scores over annuity plans because of low costs and choice of investment funds. The maximum eps contribution by the employer is 8.3% of basic salary + da. With pension plans from insurance companies, you have this flexibility to choose the maturity age. If you are 30 years and plan to retire by the age of 45, you can pick up a policy term of 15 years. Nps continues to score over other products in the category due to low costs.

On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement. Nps vs pension plans from insurance companies: An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. As per experts, nps scores over annuity plans because of low costs and choice of investment funds. Now, this is a problem if you are planning to take early retirement.

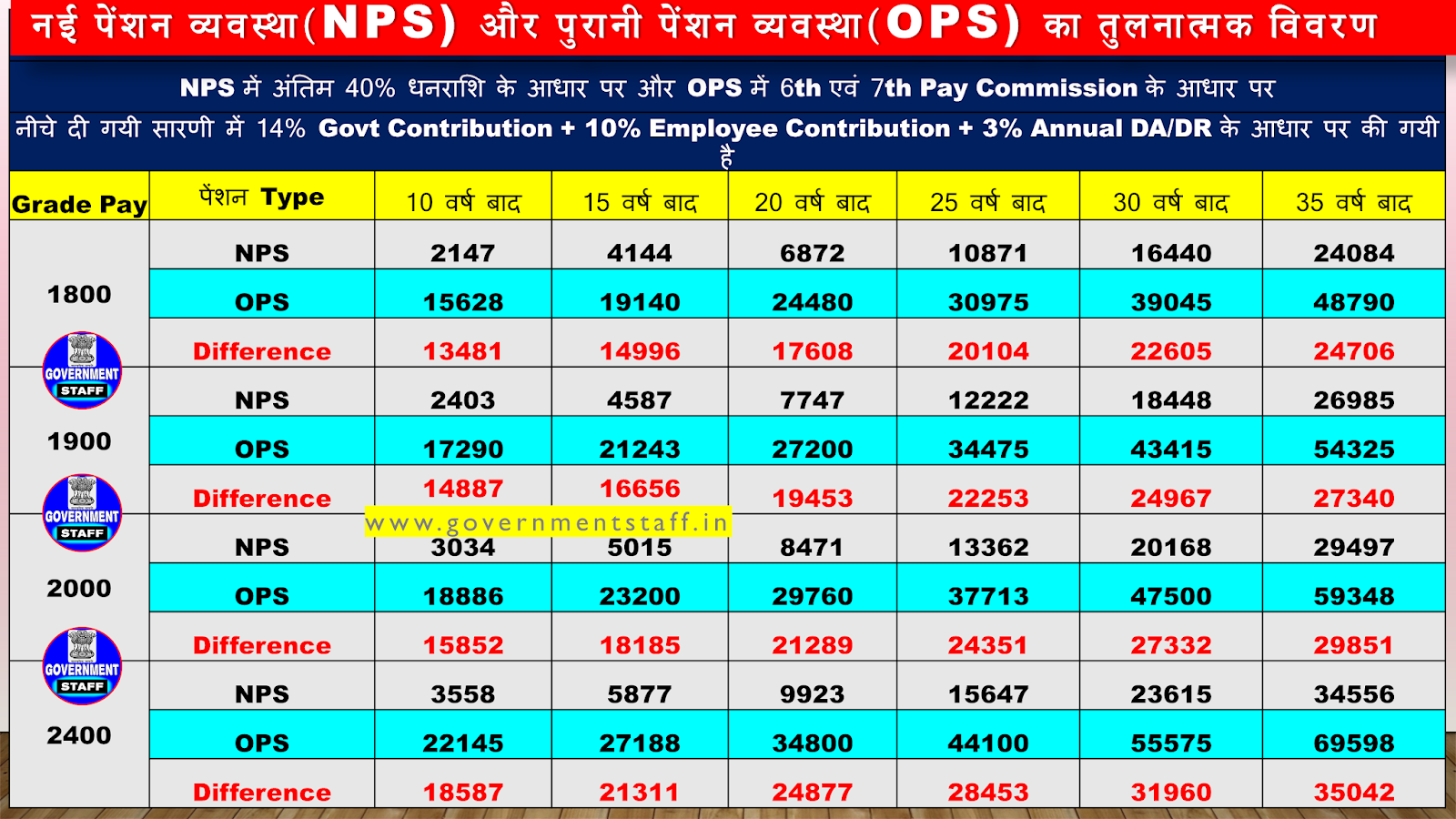

Source: governmentstaff.in

Source: governmentstaff.in

As per experts, nps scores over annuity plans because of low costs and choice of investment funds. On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture. An investor has to open an nps account on their own, wherein the minimum contribution is set at rs 500 in tier. With pension plans from insurance companies, you have this flexibility to choose the maturity age. National pension scheme (nps) nps is not a mandatory contribution scheme, unlike epf.

Source: businesstoday.in

Source: businesstoday.in

With pension plans from insurance companies, you have this flexibility to choose the maturity age. Nps continues to score over other products in the category due to low costs. Eps offers a pension amount once you are 58 years old. The scheme invests across equity and debt instruments and hence can generate higher returns than eps. Now, this is a problem if you are planning to take early retirement.

Nps vs pension plans from insurance companies: The scheme invests across equity and debt instruments and hence can generate higher returns than eps. On a global scale, nps is the cheapest pension investment product owing to economies of scale in operations of the system architecture. The maximum eps contribution by the employer is 8.3% of basic salary + da. Now, this is a problem if you are planning to take early retirement.

Source: governmentstaff.in

Source: governmentstaff.in

Now, this is a problem if you are planning to take early retirement. Now, this is a problem if you are planning to take early retirement. On the other hand, the national pension scheme (nps) is a voluntary scheme that helps you save for retirement. The scheme invests across equity and debt instruments and hence can generate higher returns than eps. Nps continues to score over other products in the category due to low costs.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan vs nps by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.