Your Retirement plan vs annuity images are available in this site. Retirement plan vs annuity are a topic that is being searched for and liked by netizens now. You can Download the Retirement plan vs annuity files here. Download all free vectors.

If you’re searching for retirement plan vs annuity images information connected with to the retirement plan vs annuity interest, you have visit the right site. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Retirement Plan Vs Annuity. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. Still, it’s worth remembering as you shop around. Unlike other retirement account, such as a 401(k), you cannot withdraw funds.

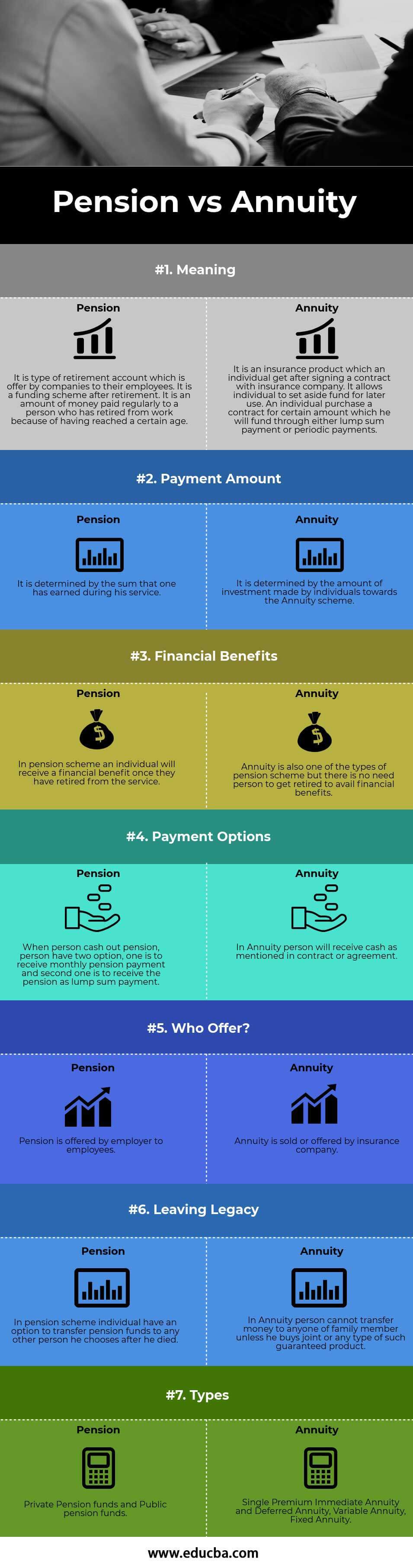

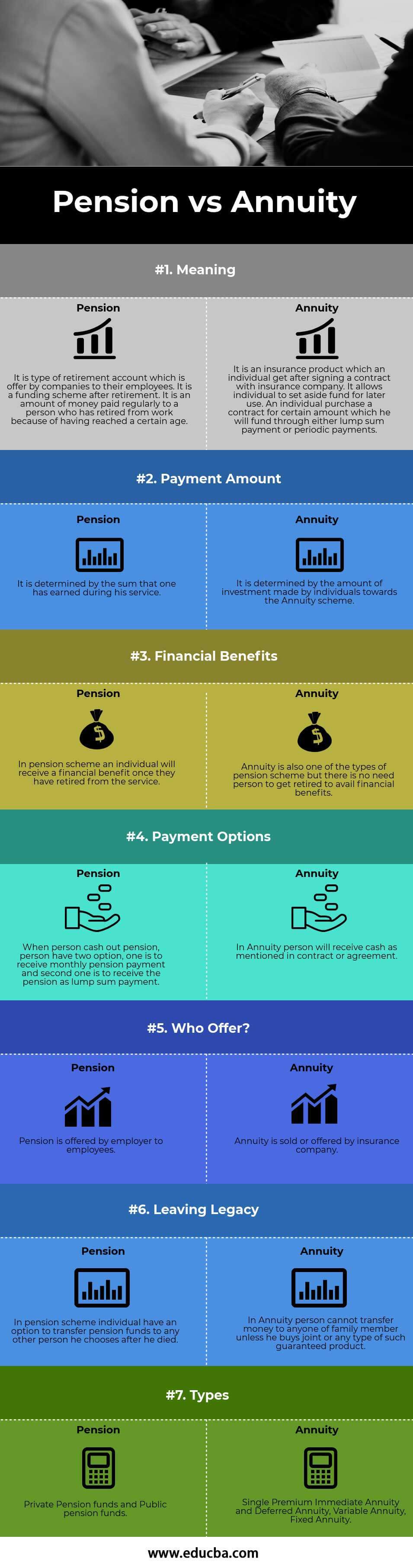

Pension vs Annuity Top 7 Differences You Should Know From educba.com

Pension vs Annuity Top 7 Differences You Should Know From educba.com

A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). Still, it’s worth remembering as you shop around. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from.

A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k).

Unlike other retirement account, such as a 401(k), you cannot withdraw funds. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. Unlike other retirement account, such as a 401(k), you cannot withdraw funds.

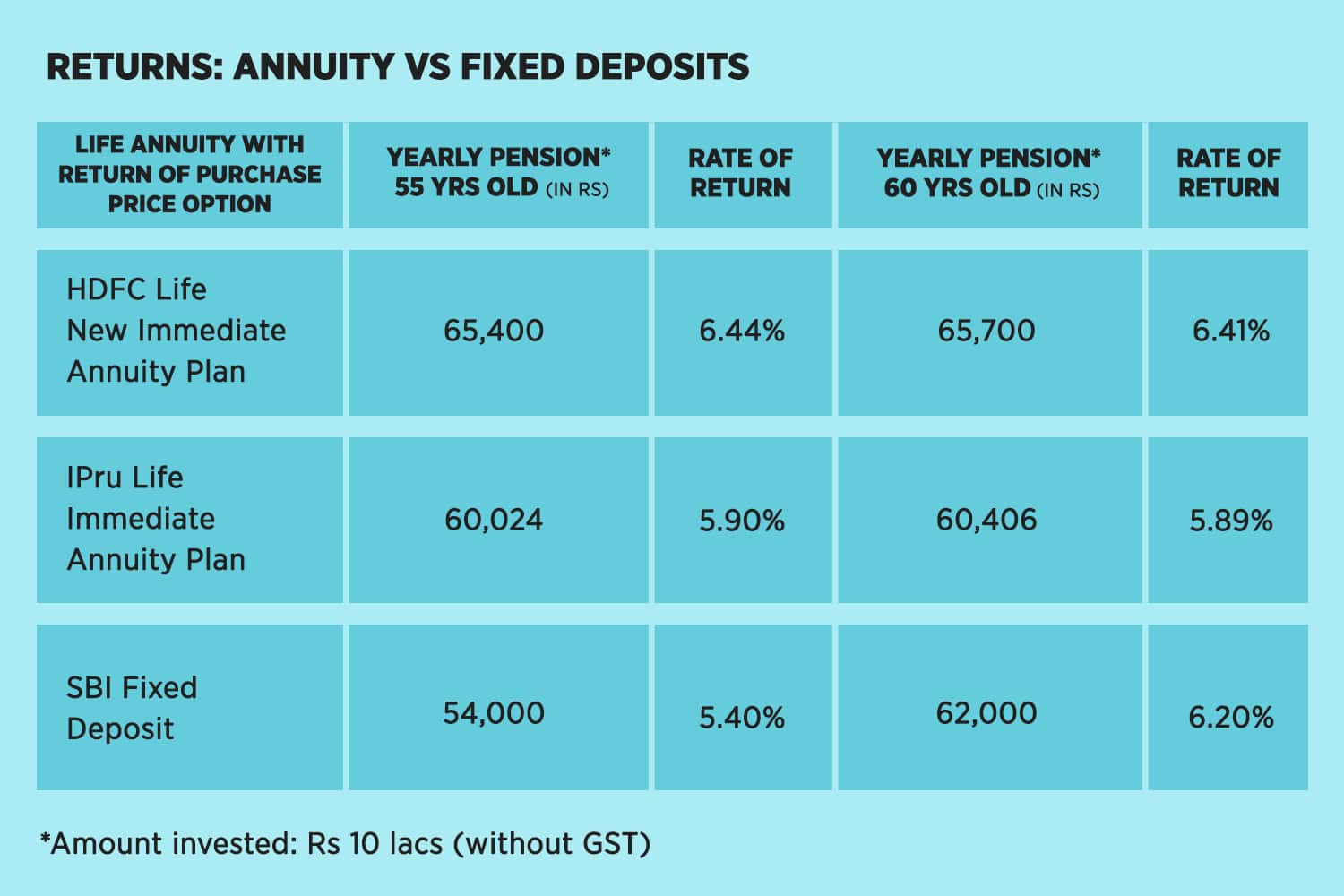

Source: policybazaar.com

Source: policybazaar.com

A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. Still, it’s worth remembering as you shop around. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike other retirement account, such as a 401(k), you cannot withdraw funds.

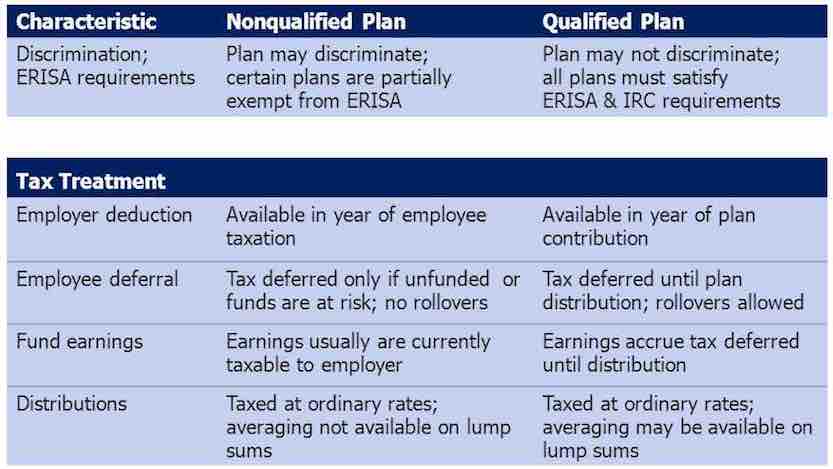

Source: slideshare.net

Source: slideshare.net

Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). Still, it’s worth remembering as you shop around. You contribute money before taxes are taken out, or transfer an old ira or 401(k. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option).

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Unlike pensions, an annuity is not insured. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). You contribute money before taxes are taken out, or transfer an old ira or 401(k.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. You contribute money before taxes are taken out, or transfer an old ira or 401(k. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash.

Source: klassenfinancial.com

Source: klassenfinancial.com

Still, it’s worth remembering as you shop around. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. Unlike pensions, an annuity is not insured. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. Still, it’s worth remembering as you shop around.

Source: pinterest.com

Source: pinterest.com

Unlike other retirement account, such as a 401(k), you cannot withdraw funds. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. Unlike pensions, an annuity is not insured. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option).

Source: oldmutual.co.za

Source: oldmutual.co.za

You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike pensions, an annuity is not insured. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option).

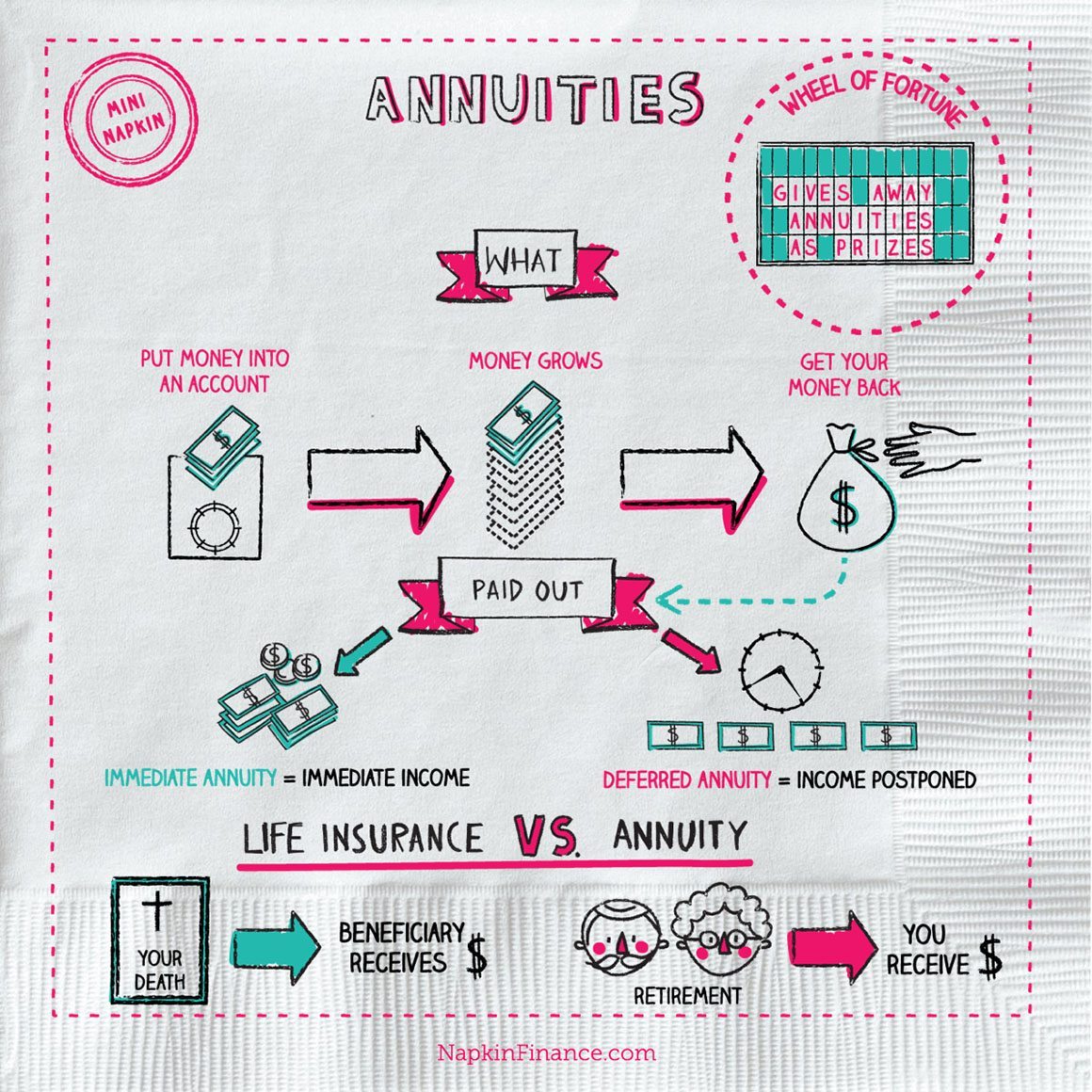

Source: napkinfinance.com

Source: napkinfinance.com

A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). Unlike other retirement account, such as a 401(k), you cannot withdraw funds. Unlike pensions, an annuity is not insured.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. Unlike other retirement account, such as a 401(k), you cannot withdraw funds.

Source: educba.com

Source: educba.com

Unlike other retirement account, such as a 401(k), you cannot withdraw funds. Unlike pensions, an annuity is not insured. You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike other retirement account, such as a 401(k), you cannot withdraw funds. Still, it’s worth remembering as you shop around.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Unlike pensions, an annuity is not insured. You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike pensions, an annuity is not insured. Unlike other retirement account, such as a 401(k), you cannot withdraw funds. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k).

Source: pinterest.com

Source: pinterest.com

You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike pensions, an annuity is not insured. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. You contribute money before taxes are taken out, or transfer an old ira or 401(k.

Source: pinterest.com

Source: pinterest.com

A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). Still, it’s worth remembering as you shop around. You contribute money before taxes are taken out, or transfer an old ira or 401(k. Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum.

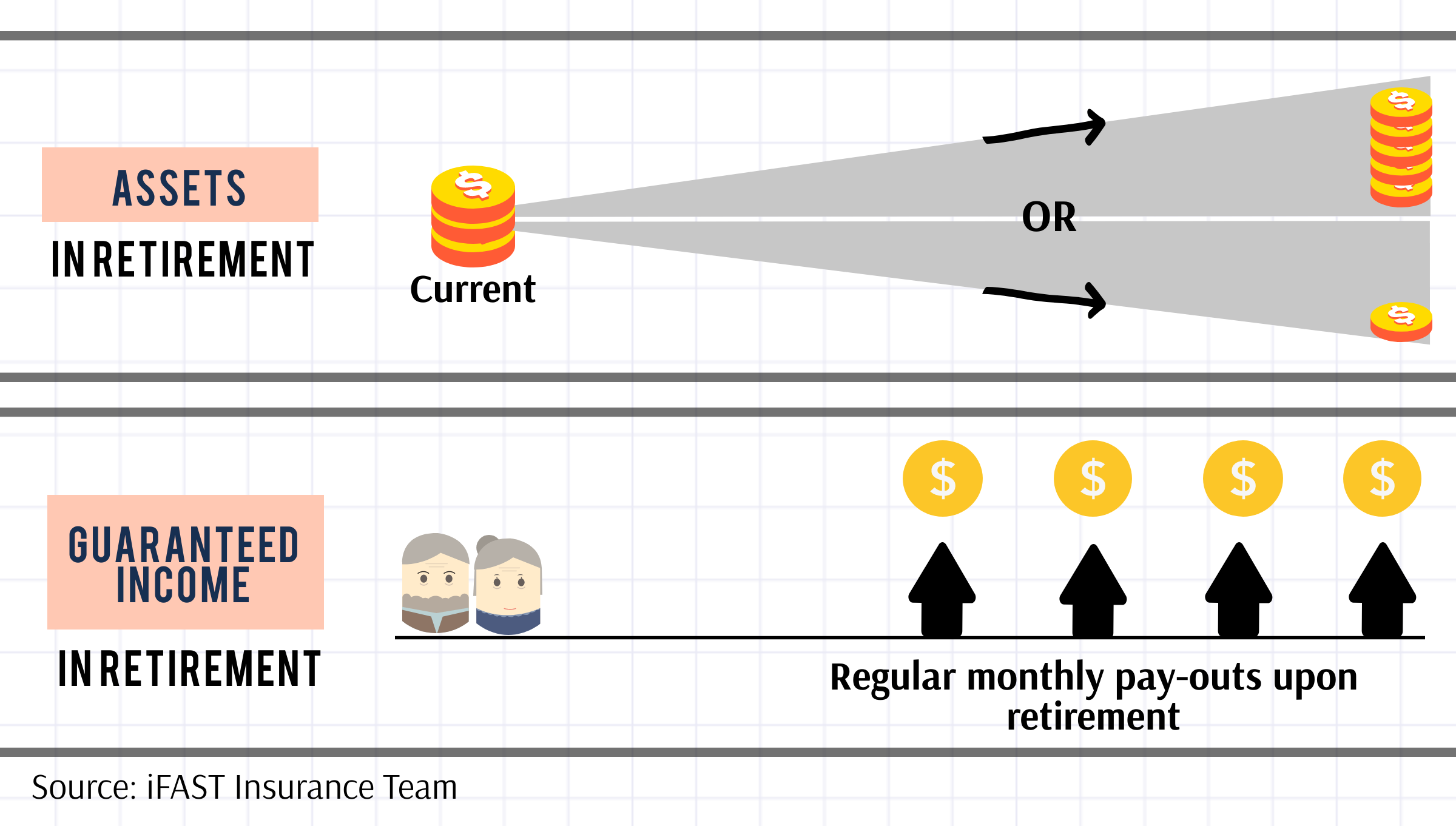

Source: secure.fundsupermart.com

Source: secure.fundsupermart.com

A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). Unlike pensions, an annuity is not insured. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. Still, it’s worth remembering as you shop around.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Unlike pensions, an annuity is not insured. Unlike other retirement account, such as a 401(k), you cannot withdraw funds. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. Still, it’s worth remembering as you shop around. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k).

Source: nairaland.com

Still, it’s worth remembering as you shop around. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). Unlike pensions, an annuity is not insured. The biggest drawcard for a living annuity is the fact that you’ve got the flexibility of being able to draw money according to your needs and in line with the living annuity withdrawal regiment of 2.5% to 17.5% per annum. You contribute money before taxes are taken out, or transfer an old ira or 401(k.

Source: youtube.com

Source: youtube.com

Unlike pensions, an annuity is not insured. A living annuity is an investment vehicle that puts you in the drivers’ seat, with a variety of investments to choose from. A retirement savings plan that has been authorized by the irs is known as a qualified annuity and is funded by an ira and 401(k). Still, it’s worth remembering as you shop around. Unlike pensions, an annuity is not insured.

Source: friedmanllp.com

Source: friedmanllp.com

You contribute money before taxes are taken out, or transfer an old ira or 401(k. Unlike pensions, an annuity is not insured. A pension becomes an annuity if a retiree elects the payment option (instead of the lump sum option). Annuity owners can fund retirement annuities with funds from an ira, 401(k), or cash. Unlike other retirement account, such as a 401(k), you cannot withdraw funds.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan vs annuity by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.