Your Retirement plan tax images are ready in this website. Retirement plan tax are a topic that is being searched for and liked by netizens today. You can Download the Retirement plan tax files here. Find and Download all free images.

If you’re looking for retirement plan tax images information linked to the retirement plan tax topic, you have come to the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Retirement Plan Tax. Can be repaid over 3 years. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Plan loan limits and repayments may be extended. Most likely, you will need more than that to live comfortably during your retirement.

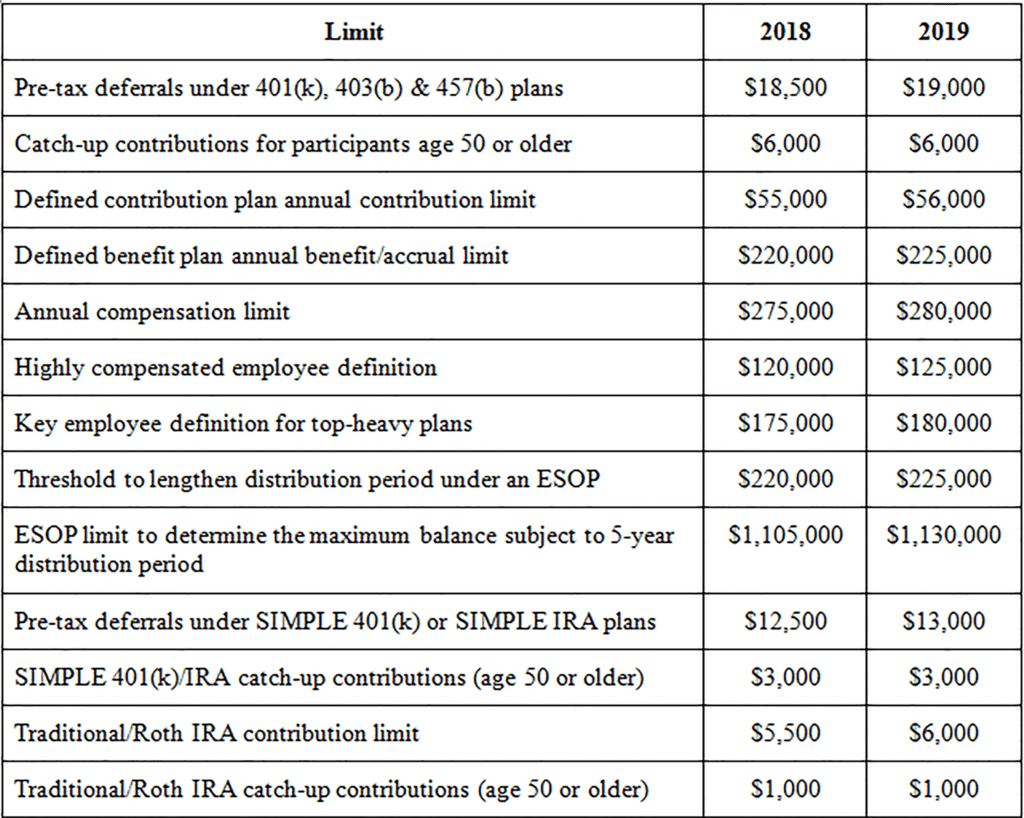

How to Avoid Choosing the Wrong TaxAdvantaged Retirement Plan From providentcpas.com

How to Avoid Choosing the Wrong TaxAdvantaged Retirement Plan From providentcpas.com

Get details on coronavirus relief for retirement plans and iras. As of 2021, the average monthly social security payment is $1,503 for retired workers. Most likely, you will need more than that to live comfortably during your retirement. The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Tax benefits of retirement plans. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing.

Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing.

Tax benefits of retirement plans. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Tax benefits of retirement plans. Most likely, you will need more than that to live comfortably during your retirement. Required minimum distributions are waived in 2020. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income.

Source: moneycrashers.com

Source: moneycrashers.com

Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Required minimum distributions are waived in 2020. Most likely, you will need more than that to live comfortably during your retirement. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Plan loan limits and repayments may be extended.

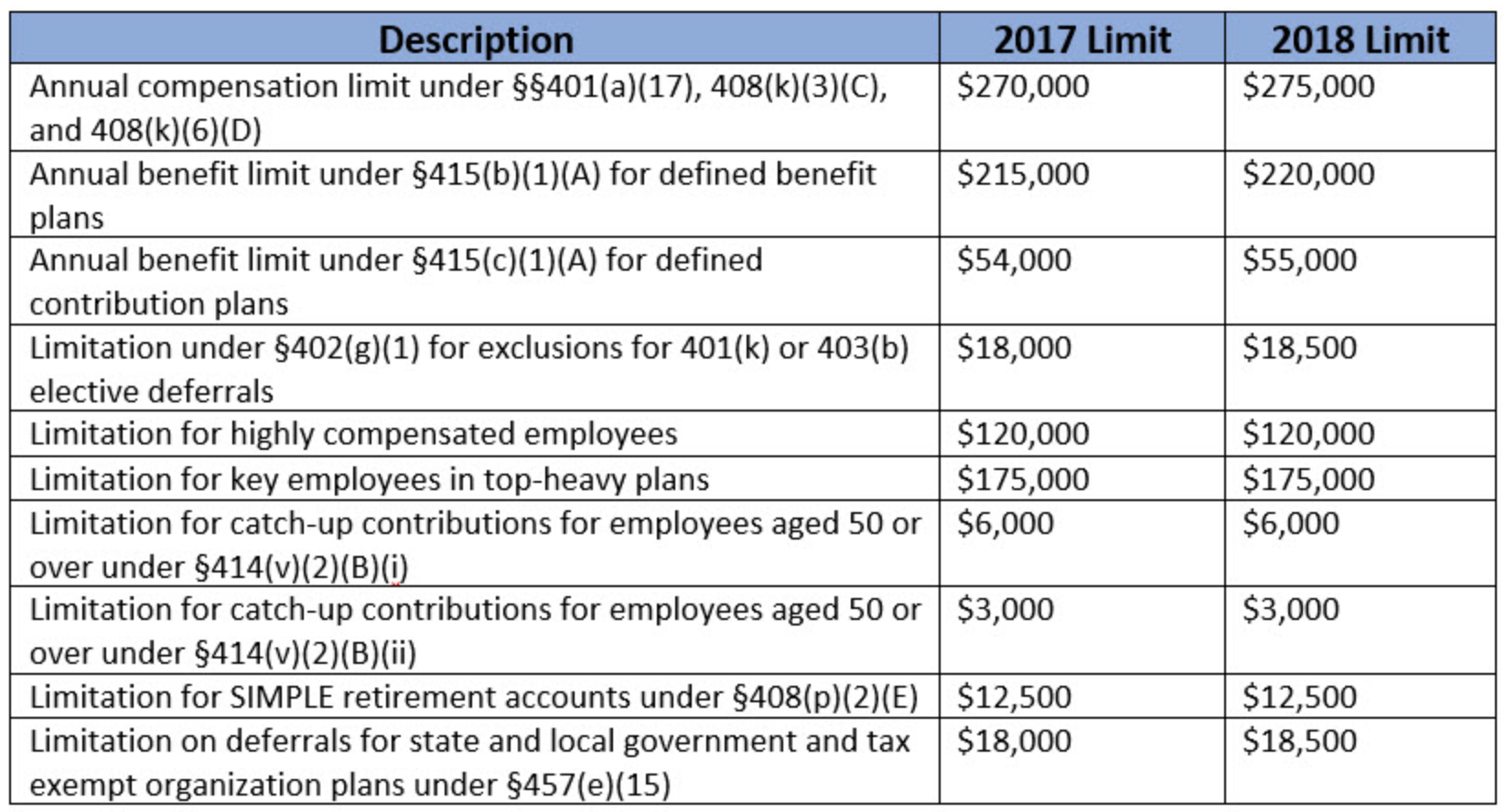

Source: atlaswealthadvisers.com

Source: atlaswealthadvisers.com

The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Can be repaid over 3 years.

Source: dreamstime.com

Source: dreamstime.com

Tax benefits of retirement plans. Required minimum distributions are waived in 2020. Can be repaid over 3 years. Plan loan limits and repayments may be extended. As of 2021, the average monthly social security payment is $1,503 for retired workers.

Source: theannuityconsultants.com

Source: theannuityconsultants.com

As of 2021, the average monthly social security payment is $1,503 for retired workers. The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Can be repaid over 3 years. Required minimum distributions are waived in 2020.

Source: forbes.com

Source: forbes.com

Required minimum distributions are waived in 2020. The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Required minimum distributions are waived in 2020. Plan loan limits and repayments may be extended. Can be repaid over 3 years.

Source: htj.tax

Source: htj.tax

Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Plan loan limits and repayments may be extended. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income.

Source: tomorrowmakers.com

Get details on coronavirus relief for retirement plans and iras. Can be repaid over 3 years. Most likely, you will need more than that to live comfortably during your retirement. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Plan loan limits and repayments may be extended.

Source: getworkforce.com

Source: getworkforce.com

Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Get details on coronavirus relief for retirement plans and iras. Tax benefits of retirement plans. Plan loan limits and repayments may be extended. As of 2021, the average monthly social security payment is $1,503 for retired workers.

Source: demandwealth.com

Source: demandwealth.com

Tax benefits of retirement plans. Plan loan limits and repayments may be extended. Tax benefits of retirement plans. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Most likely, you will need more than that to live comfortably during your retirement.

Source: providentcpas.com

Source: providentcpas.com

Get details on coronavirus relief for retirement plans and iras. Required minimum distributions are waived in 2020. Most likely, you will need more than that to live comfortably during your retirement. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing.

Source: theannuityconsultants.com

Source: theannuityconsultants.com

Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Tax benefits of retirement plans. Required minimum distributions are waived in 2020. Get details on coronavirus relief for retirement plans and iras.

Source: toocoolwebs.com

Source: toocoolwebs.com

Get details on coronavirus relief for retirement plans and iras. Required minimum distributions are waived in 2020. Ira withdrawals, as well as withdrawals from 401(k) plans , 403(b) plans, and 457 plans , are reported on your tax return as ordinary income. Tax benefits of retirement plans. Can be repaid over 3 years.

Source: investingtipsonline.com

Source: investingtipsonline.com

Get details on coronavirus relief for retirement plans and iras. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Most likely, you will need more than that to live comfortably during your retirement. Required minimum distributions are waived in 2020.

The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Can be repaid over 3 years. Plan loan limits and repayments may be extended. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Tax benefits of retirement plans.

Source: reynoldscpafirm.com

Source: reynoldscpafirm.com

As of 2021, the average monthly social security payment is $1,503 for retired workers. The 15% capital gains tax rate is imposed on singles with incomes from $40,401. Plan loan limits and repayments may be extended. Get details on coronavirus relief for retirement plans and iras. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing.

Source: retirewire.com

Source: retirewire.com

Can be repaid over 3 years. As of 2021, the average monthly social security payment is $1,503 for retired workers. Can be repaid over 3 years. Tax benefits of retirement plans. Required minimum distributions are waived in 2020.

Source: youtube.com

Source: youtube.com

As of 2021, the average monthly social security payment is $1,503 for retired workers. You’ll pay ordinary income taxes on your basis (what you paid for the stock), but the remaining nua (the appreciation while the stock was in your retirement plan) will be taxed only when the stock is sold. Get details on coronavirus relief for retirement plans and iras. Keep in mind that retirement can last 30 years or more these days and the costs of living are only increasing. Can be repaid over 3 years.

Source: dreamstime.com

Source: dreamstime.com

Plan loan limits and repayments may be extended. Most likely, you will need more than that to live comfortably during your retirement. Tax benefits of retirement plans. As of 2021, the average monthly social security payment is $1,503 for retired workers. Required minimum distributions are waived in 2020.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.