Your Retirement plan requirement california images are available. Retirement plan requirement california are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan requirement california files here. Get all royalty-free photos.

If you’re looking for retirement plan requirement california images information related to the retirement plan requirement california topic, you have visit the ideal site. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

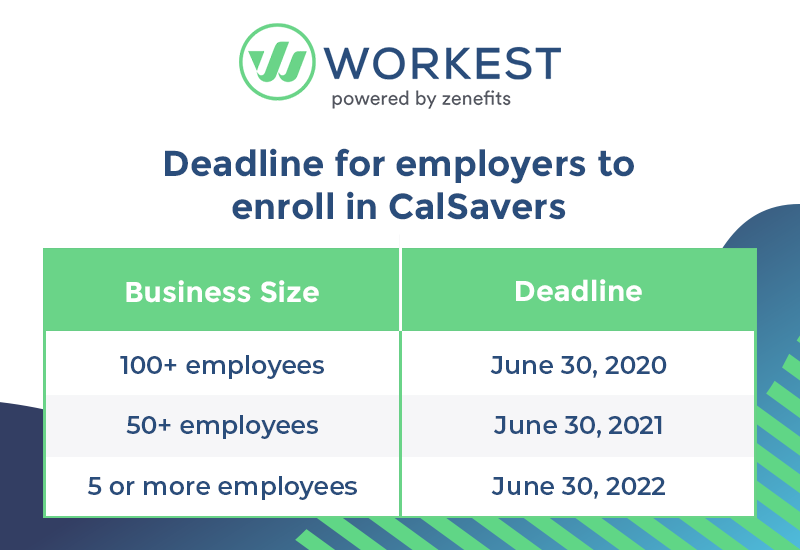

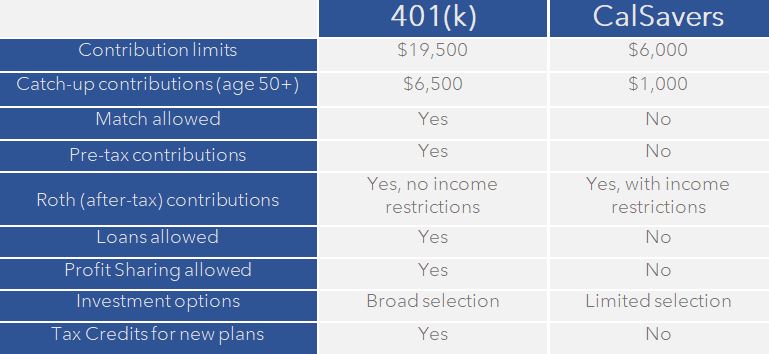

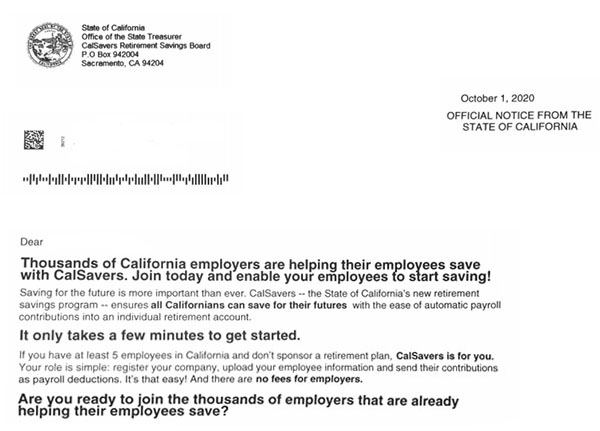

Retirement Plan Requirement California. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. The plan sponsor also has significant opportunities. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply.

Learn About California�s New Law Requiring Businesses to Offer From subscribepage.com

Learn About California�s New Law Requiring Businesses to Offer From subscribepage.com

California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. The plan sponsor also has significant opportunities. The deadline was september 30, 2020. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement.

This year, all california private employers with five or more employees will have to provide their employees with a retirement plan or enroll in calsavers retirement savings program.

The plan sponsor also has significant opportunities. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. The deadline was june 30, 2021. To understand when you were required to. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does.

Source: slideserve.com

Source: slideserve.com

Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. The deadline was june 30, 2021. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021.

Source: cashforclunkers.org

Source: cashforclunkers.org

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. To understand when you were required to. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate.

Source: zenefits.com

Source: zenefits.com

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. The deadline was june 30, 2021. This year, all california private employers with five or more employees will have to provide their employees with a retirement plan or enroll in calsavers retirement savings program. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. For businesses with five or more employees, the deadline to provide a retirement plan by june 30, 2022.

Source: subscribepage.com

Source: subscribepage.com

To understand when you were required to. The deadline was june 30, 2021. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements.

Source: templateroller.com

Source: templateroller.com

On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. This year, all california private employers with five or more employees will have to provide their employees with a retirement plan or enroll in calsavers retirement savings program. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. The plan sponsor also has significant opportunities. For businesses with five or more employees, the deadline to provide a retirement plan by june 30, 2022.

Source: tandvllp.com

Source: tandvllp.com

The plan sponsor also has significant opportunities. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply.

Source: jdsupra.com

Source: jdsupra.com

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. The deadline was june 30, 2021. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate.

Source: trpcweb.com

Source: trpcweb.com

These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. For businesses with five or more employees, the deadline to provide a retirement plan by june 30, 2022. The plan sponsor also has significant opportunities. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply.

Source: trco.com

Source: trco.com

These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. To understand when you were required to. For businesses with five or more employees, the deadline to provide a retirement plan by june 30, 2022. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply.

Source: formsbirds.com

Source: formsbirds.com

The plan sponsor also has significant opportunities. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. The plan sponsor also has significant opportunities. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. This year, all california private employers with five or more employees will have to provide their employees with a retirement plan or enroll in calsavers retirement savings program.

Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021. The deadline was june 30, 2021. To understand when you were required to. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022.

Source: pinterest.com

Source: pinterest.com

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. The plan sponsor also has significant opportunities. To understand when you were required to. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate.

Source: sentrichr.com

Source: sentrichr.com

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. For businesses with five or more employees, the deadline to provide a retirement plan by june 30, 2022. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021.

Source: accountsknowledgehub.in

Source: accountsknowledgehub.in

The deadline was june 30, 2021. The deadline was june 30, 2021. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021.

Source: allstar-wheels.com

Source: allstar-wheels.com

Deadlines have already passed unless you have between 5 and 50 employees, and then you have until june 30, 2022, to comply. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021. The deadline was june 30, 2021. If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022.

Source: guideline.com

Source: guideline.com

401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by june 30, 2022. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. To understand when you were required to.

Source: braeburnwealth.com

Source: braeburnwealth.com

If you’re in either of the latter 2 groups, you should already be complying with california’s retirement plan mandate. These plans require more work and fees for the employer, but they give the employees more opportunities to save for retirement. On may 6, 2021, the ninth circuit upheld california’s retirement plan mandate and confirmed that erisa does. 401 (k) plans, like those we administer at california pensions, are another option for employers looking to comply with the california retirement plan requirements. Previously, businesses with 50 or more employees in california must provide a retirement plan to their employees by june 30, 2021.

Source: pacificpayrollgroup.com

Source: pacificpayrollgroup.com

The deadline was june 30, 2021. This year, all california private employers with five or more employees will have to provide their employees with a retirement plan or enroll in calsavers retirement savings program. To understand when you were required to. The deadline was september 30, 2020. The plan sponsor also has significant opportunities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan requirement california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.