Your Retirement plan pru life images are available. Retirement plan pru life are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement plan pru life files here. Download all free photos and vectors.

If you’re looking for retirement plan pru life images information linked to the retirement plan pru life interest, you have visit the right site. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

Retirement Plan Pru Life. Retire the way you want. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. The choice of payout period is: You would want to maintain the same lifestyle post retirement.

ICICI Pru Easy Retirement Single Premium Plan Wishpolicy From wishpolicy.com

ICICI Pru Easy Retirement Single Premium Plan Wishpolicy From wishpolicy.com

One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. A monthly income after retirement will ensure that your loved ones live the life you have planned for them. Such plans help you set aside some amount towards your retirement while you are still working. 10, 15, 20, 25 or 30 years. You would want to maintain the same lifestyle post retirement. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier.

The choice of payout period is:

Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. 10, 15, 20, 25 or 30 years. You would want to maintain the same lifestyle post retirement. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement.

Source: projects4mba.com

Source: projects4mba.com

If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. A monthly income after retirement will ensure that your loved ones live the life you have planned for them. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to.

Source: pinoydeal.ph

Source: pinoydeal.ph

One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. You would want to maintain the same lifestyle post retirement. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. 10, 15, 20, 25 or 30 years. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier.

Source: udaipurkiran.com

Source: udaipurkiran.com

Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. Retire the way you want. The choice of payout period is: Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. A monthly income after retirement will ensure that your loved ones live the life you have planned for them.

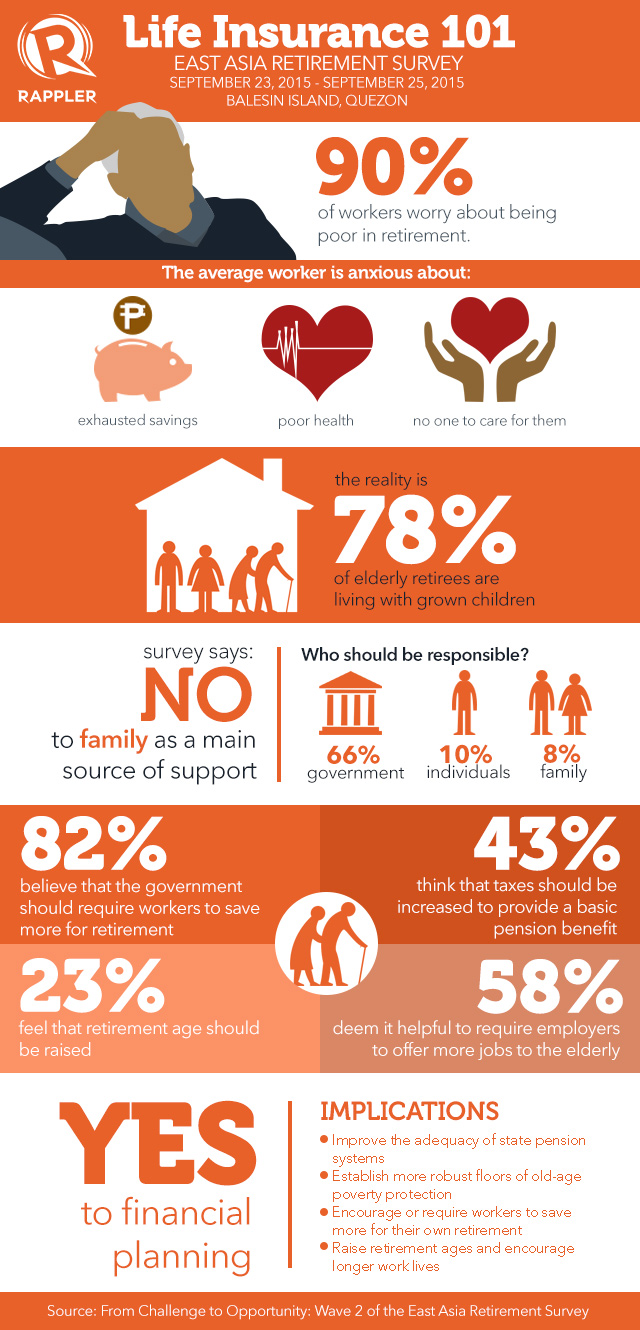

Source: rappler.com

Source: rappler.com

The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. You work very hard to provide the best lifestyle and security for your family. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and.

Source: english.lokmat.com

Source: english.lokmat.com

A monthly income after retirement will ensure that your loved ones live the life you have planned for them. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. 10, 15, 20, 25 or 30 years.

Source: riskquoter.com

Source: riskquoter.com

You work very hard to provide the best lifestyle and security for your family. You work very hard to provide the best lifestyle and security for your family. The choice of payout period is: 10, 15, 20, 25 or 30 years. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and.

Source: ipruconnect2protect.com

Source: ipruconnect2protect.com

The choice of payout period is: The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. You would want to maintain the same lifestyle post retirement.

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

10, 15, 20, 25 or 30 years. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life.

Source: edirmacedo.blogspot.com

Source: edirmacedo.blogspot.com

4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement. You work very hard to provide the best lifestyle and security for your family. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and.

Source: suchetadalal.com

Source: suchetadalal.com

Such plans help you set aside some amount towards your retirement while you are still working. Retire the way you want. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. You would want to maintain the same lifestyle post retirement.

Source: ipruconnect2protect.com

Source: ipruconnect2protect.com

The choice of payout period is: Such plans help you set aside some amount towards your retirement while you are still working. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. You work very hard to provide the best lifestyle and security for your family. 10, 15, 20, 25 or 30 years.

Source: pinterest.com

Source: pinterest.com

10, 15, 20, 25 or 30 years. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. You work very hard to provide the best lifestyle and security for your family. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement. Retire the way you want.

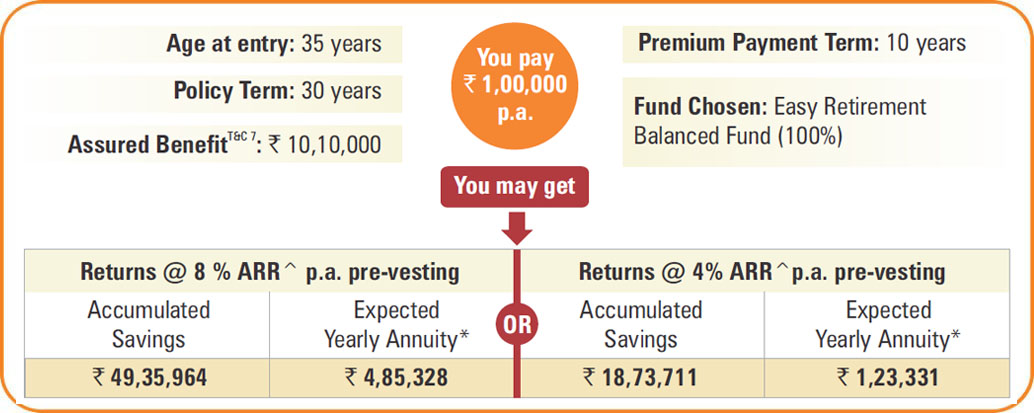

Source: blog.iciciprulife.com

Source: blog.iciciprulife.com

You would want to maintain the same lifestyle post retirement. You work very hard to provide the best lifestyle and security for your family. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. Retire the way you want. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant.

Source: news.shoppersvila.com

Source: news.shoppersvila.com

Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. You work very hard to provide the best lifestyle and security for your family. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and.

Source: ap7am.com

Source: ap7am.com

You would want to maintain the same lifestyle post retirement. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. You would want to maintain the same lifestyle post retirement. Such plans help you set aside some amount towards your retirement while you are still working. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement.

Source: dixonwells.com

Source: dixonwells.com

You work very hard to provide the best lifestyle and security for your family. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. 4 pru active retirement ii provides coverage against total and permanent disability of the life assured because of an accident during the term of the policy, or before the policy anniversary prior to the life assured attaining age 70, whichever is earlier. Icici pru saral pension plan 1 under joint life option the secondary annuitant shall be the spouse of the primary annuitant. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement.

Source: holisticinvestment.in

Source: holisticinvestment.in

The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. A monthly income after retirement will ensure that your loved ones live the life you have planned for them. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement. You would want to maintain the same lifestyle post retirement.

Source: indusind.com

Source: indusind.com

Retire the way you want. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and. Pru retirement growth guarantees you income and income growth according to your plans for a fulfilling retirement. If you are disabled or unfortunately pass away due to illness, this plan pays your loved ones up to. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan pru life by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.