Your Retirement plan philippines law images are ready in this website. Retirement plan philippines law are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan philippines law files here. Find and Download all royalty-free images.

If you’re searching for retirement plan philippines law images information related to the retirement plan philippines law keyword, you have come to the ideal blog. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

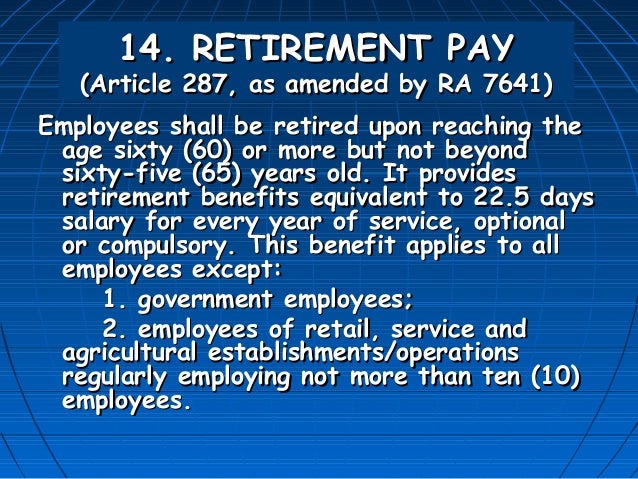

Retirement Plan Philippines Law. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. It does not inhibit these companies from providing more benefits. An act amending article 287 of presidential decree no.

HR Talk How Much Separation Pay Do I Get in the Philippines? Tina in From tinainmanila.com

HR Talk How Much Separation Pay Do I Get in the Philippines? Tina in From tinainmanila.com

Retirement age in the philippines is between 60 and 65. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. It does not inhibit these companies from providing more benefits. The philippines has republic act no. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines.

Retirement age in the philippines is between 60 and 65.

The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. The philippines has republic act no. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. An act amending article 287 of presidential decree no. 442, as amended, otherwise known as the labor code of the philippines, by providing for retirement pay to qualified private sector employees in the absence of any retirement plan in the establishment. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems.

Source: myfinancemd.com

Source: myfinancemd.com

The philippines has republic act no. 7641 (ra 7641), also known as the retirement pay law. 442, as amended, otherwise known as the labor code of the philippines, by providing for retirement pay to qualified private sector employees in the absence of any retirement plan in the establishment. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems.

Source: sowesternpo.blogspot.com

Source: sowesternpo.blogspot.com

Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. The philippines has republic act no. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. Retirement age in the philippines is between 60 and 65.

Source: vdocuments.mx

Source: vdocuments.mx

An act amending article 287 of presidential decree no. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. Retirement age in the philippines is between 60 and 65. Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law.

Source: thebalancesmb.com

Source: thebalancesmb.com

Retirement age in the philippines is between 60 and 65. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. It does not inhibit these companies from providing more benefits.

Source: pra.gov.ph

Source: pra.gov.ph

An act amending article 287 of presidential decree no. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. It does not inhibit these companies from providing more benefits. Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees.

Source: actuarial.zalamea.ph

Source: actuarial.zalamea.ph

Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. It does not inhibit these companies from providing more benefits. 442, as amended, otherwise known as the labor code of the philippines, by providing for retirement pay to qualified private sector employees in the absence of any retirement plan in the establishment.

Source: tinainmanila.com

Source: tinainmanila.com

The philippines has republic act no. Retirement age in the philippines is between 60 and 65. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems.

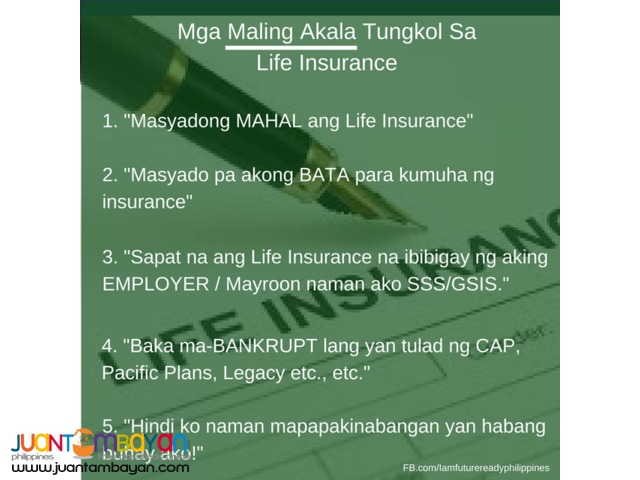

Source: juantambayan.com

Source: juantambayan.com

7641 (ra 7641), also known as the retirement pay law. Retirement age in the philippines is between 60 and 65. 7641 (ra 7641), also known as the retirement pay law. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service.

Source: pra.gov.ph

Source: pra.gov.ph

7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. 7641 (ra 7641), also known as the retirement pay law. An act amending article 287 of presidential decree no. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. It does not inhibit these companies from providing more benefits.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

An act amending article 287 of presidential decree no. 7641 (ra 7641), also known as the retirement pay law. 442, as amended, otherwise known as the labor code of the philippines, by providing for retirement pay to qualified private sector employees in the absence of any retirement plan in the establishment. Retirement age in the philippines is between 60 and 65. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law.

Source: actuarial.zalamea.ph

Source: actuarial.zalamea.ph

Retirement age in the philippines is between 60 and 65. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines. Retirement age in the philippines is between 60 and 65. 7641 (ra 7641), also known as the retirement pay law.

Source: sowesternpo.blogspot.com

Source: sowesternpo.blogspot.com

An act amending article 287 of presidential decree no. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. The philippines� pension system has been ranked second lowest in asia, and 41st out of 43 retirement systems. 7641 (ra 7641), also known as the retirement pay law, came into effect in january 7, 1993 and was made to amend article 287 of the labor code of the philippines.

Source: actuarial.zalamea.ph

Source: actuarial.zalamea.ph

Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees. An act amending article 287 of presidential decree no. 7641 (ra 7641), also known as the retirement pay law. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. The philippines has republic act no.

Source: primer.com.ph

Source: primer.com.ph

This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. Retirement age in the philippines is between 60 and 65. It does not inhibit these companies from providing more benefits. 7641 (ra 7641), also known as the retirement pay law. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees.

Source: binixo.ph

Source: binixo.ph

It does not inhibit these companies from providing more benefits. The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. The philippines has republic act no. Retirement age in the philippines is between 60 and 65. 7641 (ra 7641), also known as the retirement pay law.

Source: isensey.com

Source: isensey.com

It does not inhibit these companies from providing more benefits. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law. 7641 (ra 7641), also known as the retirement pay law. Retirement age in the philippines is between 60 and 65. Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees.

Source: juantambayan.com

Source: juantambayan.com

This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. 442, as amended, otherwise known as the labor code of the philippines, by providing for retirement pay to qualified private sector employees in the absence of any retirement plan in the establishment. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. An act amending article 287 of presidential decree no. Of companies in the philippines do not have a formal retirement plan, fulfilling only the minimum mandated by retirement pay law.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

The government and most private companies allow optional retirement at 60 and mandatory retirement at 65, except in the military service. The philippines has republic act no. Effective since january 7, 1993, this act was an amendment to article 287 of the labor code of the philippines in order to prescribe the minimum retirement benefit which companies are mandated to pay to their eligible employees. This law prescribes minimum retirement benefit that companies must pay eligible retiring employees. An act amending article 287 of presidential decree no.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan philippines law by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.