Your Retirement plan no beneficiary designation images are ready. Retirement plan no beneficiary designation are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan no beneficiary designation files here. Get all royalty-free photos.

If you’re looking for retirement plan no beneficiary designation pictures information connected with to the retirement plan no beneficiary designation topic, you have visit the right site. Our site always gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

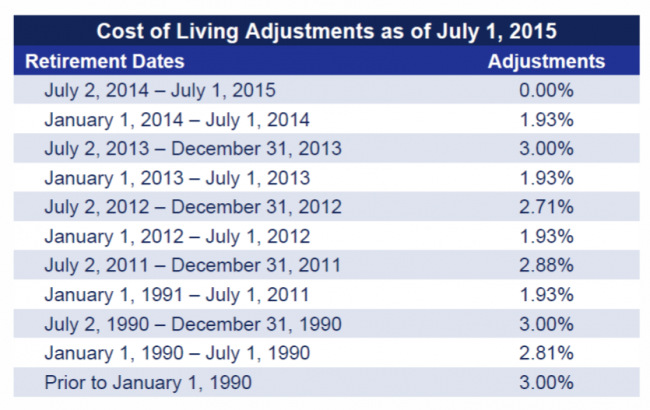

Retirement Plan No Beneficiary Designation. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. Deferred compensation plan of a state or local government (section 457(b) plan), or; Qualified employee annuity plan (section 403(a) plan), c.

Retirement Account Beneficiary Designations Fleming and Curti, PLC From elder-law.com

Retirement Account Beneficiary Designations Fleming and Curti, PLC From elder-law.com

Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. The plan participant and his wife subsequently divorced. Under the terms of the divorce decree, the participant’s spouse surrendered her claim to any portion of the benefits under the participant’s retirement plan. The facts in kennedy are straightforward: Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have.

The primary beneficiary (or beneficiaries) inherit first.

Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Qualified employee annuity plan (section 403(a) plan), c. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the.

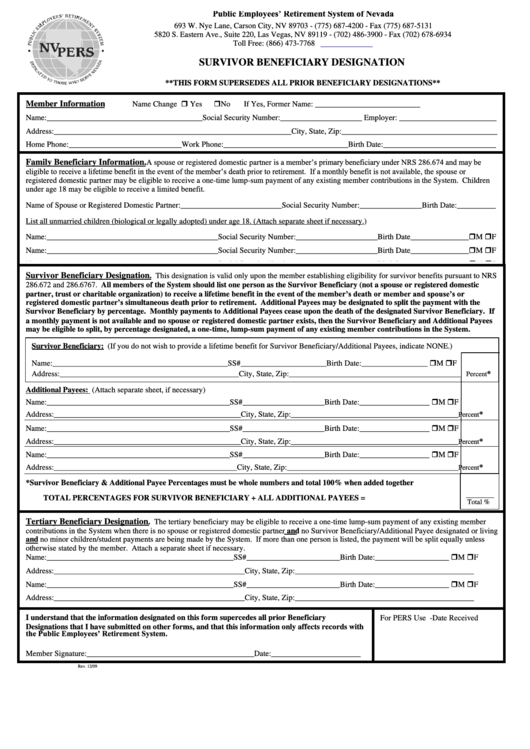

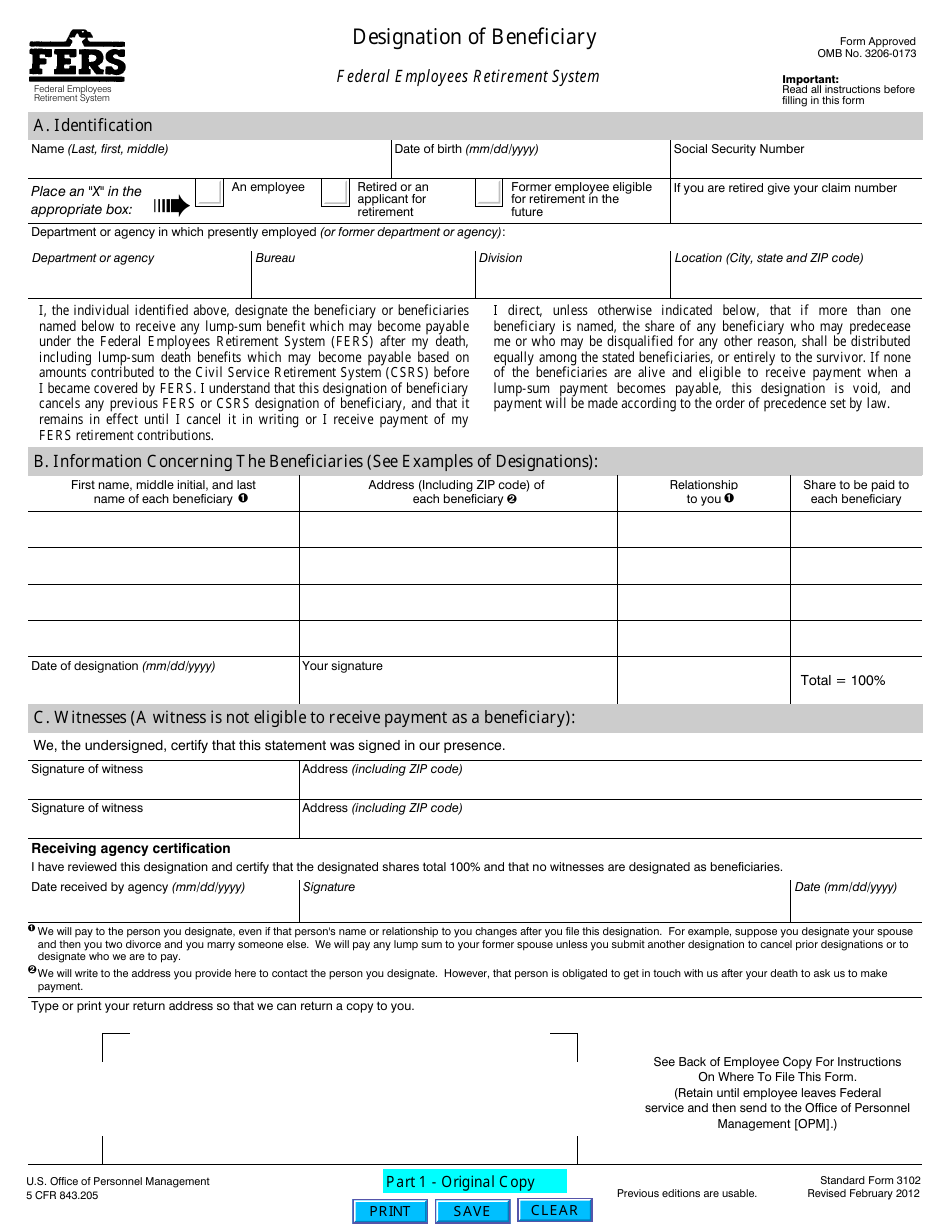

Source: formsbank.com

Source: formsbank.com

Qualified employee annuity plan (section 403(a) plan), c. It is important for plan fiduciaries of qualified retirement plans to understand their role regarding beneficiary designations and the regulations that dictate. The primary beneficiary (or beneficiaries) inherit first. The facts in kennedy are straightforward: The plan participant and his wife subsequently divorced.

Source: flagship-advisors.com

Source: flagship-advisors.com

Deferred compensation plan of a state or local government (section 457(b) plan), or; Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. A plan participant married and designated his wife as his beneficiary. Treat himself or herself as the beneficiary rather than treating the ira as his or her own.

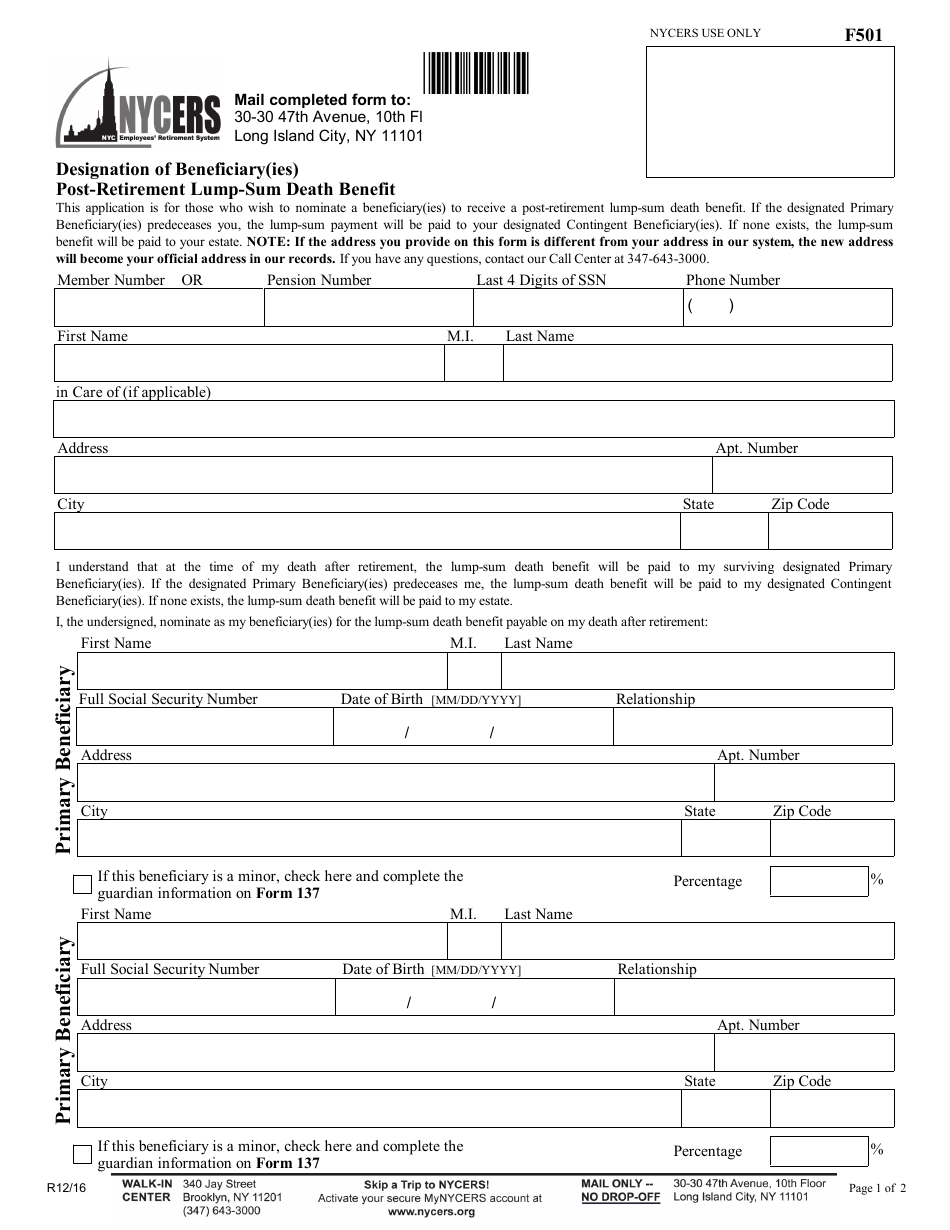

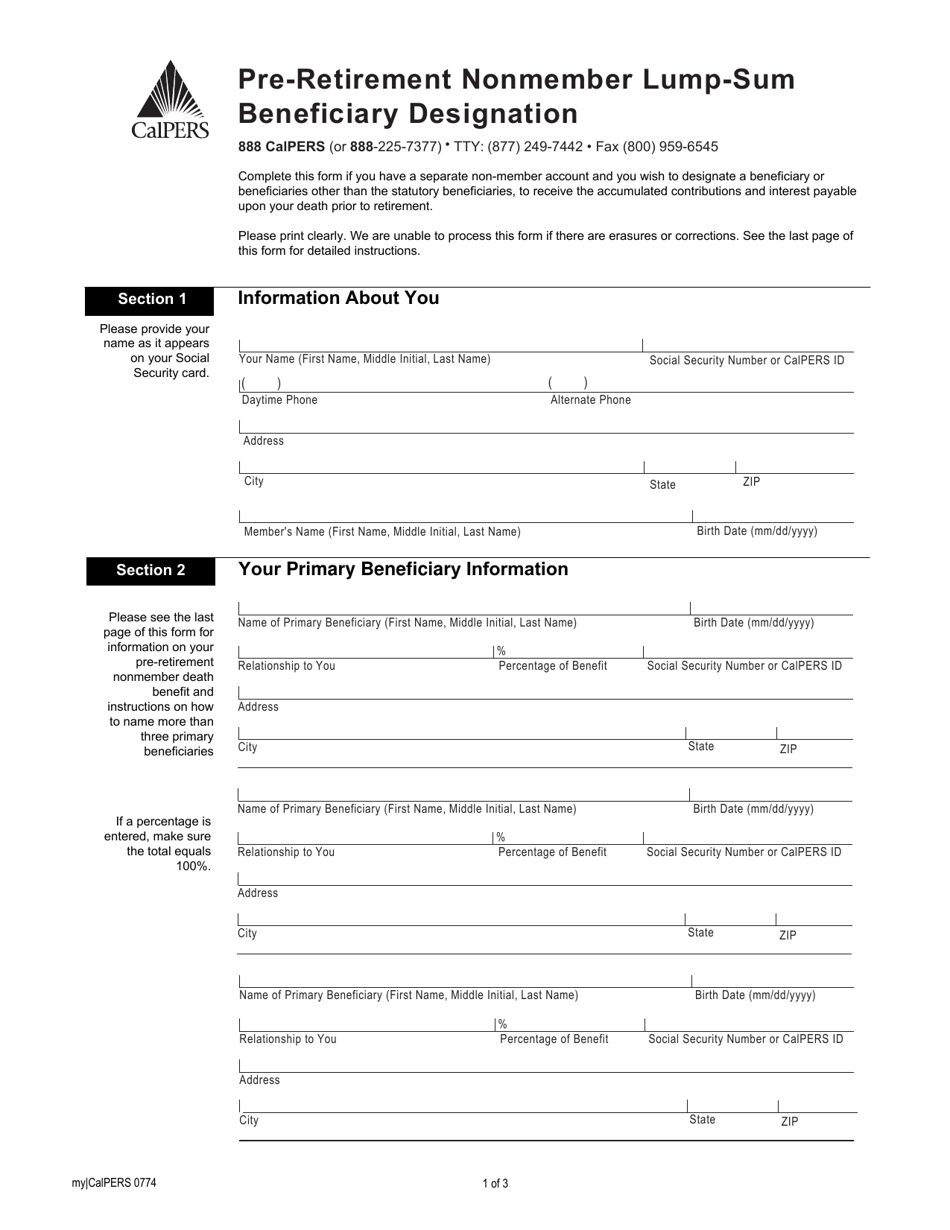

Source: fill.io

Source: fill.io

According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. The primary beneficiary (or beneficiaries) inherit first. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. Deferred compensation plan of a state or local government (section 457(b) plan), or;

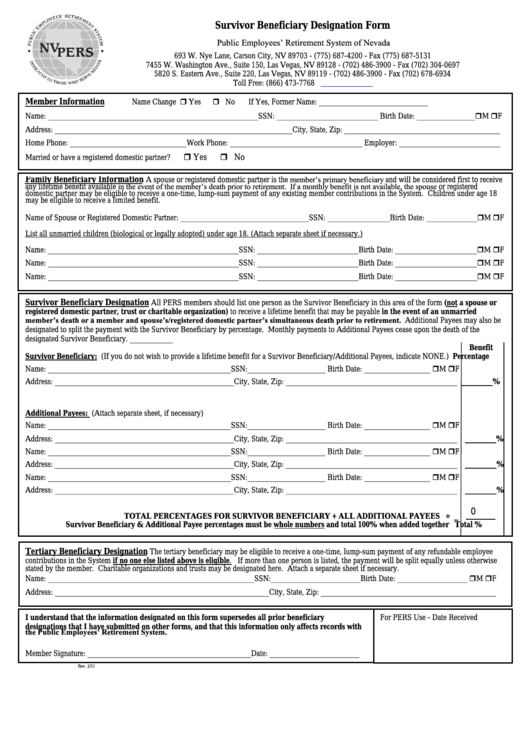

Source: uslegalforms.com

Source: uslegalforms.com

If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. A plan participant married and designated his wife as his beneficiary. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s.

Source: elder-law.com

Source: elder-law.com

The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. The plan participant and his wife subsequently divorced. Treat himself or herself as the beneficiary rather than treating the ira as his or her own. Deferred compensation plan of a state or local government (section 457(b) plan), or; The primary beneficiary (or beneficiaries) inherit first.

Source: templateroller.com

Source: templateroller.com

It is important for plan fiduciaries of qualified retirement plans to understand their role regarding beneficiary designations and the regulations that dictate. The plan participant and his wife subsequently divorced. Treat himself or herself as the beneficiary rather than treating the ira as his or her own. The primary beneficiary (or beneficiaries) inherit first. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce.

Source: planyourlegacy.berkeley.edu

Deferred compensation plan of a state or local government (section 457(b) plan), or; Qualified employee annuity plan (section 403(a) plan), c. If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have. A plan participant married and designated his wife as his beneficiary. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce.

Source: cchalaw.com

Source: cchalaw.com

According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. The facts in kennedy are straightforward: Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the. Qualified employee annuity plan (section 403(a) plan), c.

Source: legalyaar.com

Source: legalyaar.com

According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Qualified employee annuity plan (section 403(a) plan), c. Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s.

Source: elder-law.com

Source: elder-law.com

Deferred compensation plan of a state or local government (section 457(b) plan), or; Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. The plan participant and his wife subsequently divorced. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s.

Source: retirementincomecenter.com

Source: retirementincomecenter.com

The plan participant and his wife subsequently divorced. A plan participant married and designated his wife as his beneficiary. Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. The primary beneficiary (or beneficiaries) inherit first. Treat himself or herself as the beneficiary rather than treating the ira as his or her own.

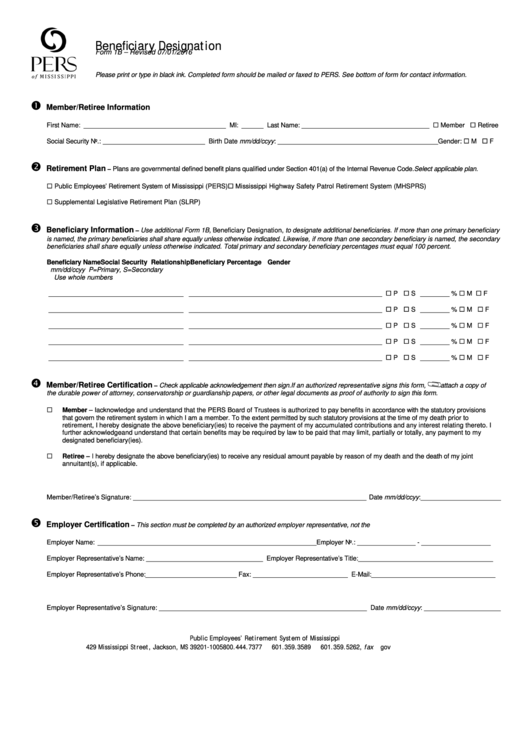

Source: formsbank.com

Source: formsbank.com

Qualified employee annuity plan (section 403(a) plan), c. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the. If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce.

Source: dsigntb.blogspot.com

Source: dsigntb.blogspot.com

The facts in kennedy are straightforward: The plan participant and his wife subsequently divorced. The primary beneficiary (or beneficiaries) inherit first. The facts in kennedy are straightforward: Treat himself or herself as the beneficiary rather than treating the ira as his or her own.

Source: templateroller.com

Source: templateroller.com

According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Under the terms of the divorce decree, the participant’s spouse surrendered her claim to any portion of the benefits under the participant’s retirement plan. Qualified employee annuity plan (section 403(a) plan), c. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce. The facts in kennedy are straightforward:

Source: navianhawaii.org

Source: navianhawaii.org

Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. The primary beneficiary (or beneficiaries) inherit first. Most retirement plans, annuities, and life insurance policies ask you to designate beneficiaries to let you decide what should become of your assets in the event of your demise. Under the terms of the divorce decree, the participant’s spouse surrendered her claim to any portion of the benefits under the participant’s retirement plan. The plan participant and his wife subsequently divorced.

Source: formsbank.com

Source: formsbank.com

According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Households investing at least $100,000.¹ both state and federal laws govern the disposition of these assets, and the results can be complicated, especially when the owner of the account has been divorced and remarried. Treat himself or herself as the beneficiary rather than treating the ira as his or her own. A plan participant married and designated his wife as his beneficiary. The participant neglected to change his beneficiary designation under the plan to reflect the terms of the divorce.

Source: probatestars.com

Source: probatestars.com

Qualified employee annuity plan (section 403(a) plan), c. A plan participant married and designated his wife as his beneficiary. If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have. It is important for plan fiduciaries of qualified retirement plans to understand their role regarding beneficiary designations and the regulations that dictate. The plan participant and his wife subsequently divorced.

Source: templateroller.com

Source: templateroller.com

The primary beneficiary (or beneficiaries) inherit first. If they pass away before or with you, your assets would instead go to any secondary beneficiaries you have. Treat himself or herself as the beneficiary rather than treating the ira as his or her own. According to a recent wall street journal article, retirement plans and iras account for about 60 percent of the assets of u.s. Under the terms of the divorce decree, the participant’s spouse surrendered her claim to any portion of the benefits under the participant’s retirement plan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan no beneficiary designation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.