Your Retirement plan hong kong images are available in this site. Retirement plan hong kong are a topic that is being searched for and liked by netizens now. You can Get the Retirement plan hong kong files here. Get all free photos and vectors.

If you’re searching for retirement plan hong kong images information connected with to the retirement plan hong kong keyword, you have come to the ideal site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Retirement Plan Hong Kong. There is a wide gap in retirement planning in hong kong. Throw in other aspirations you want to. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for.

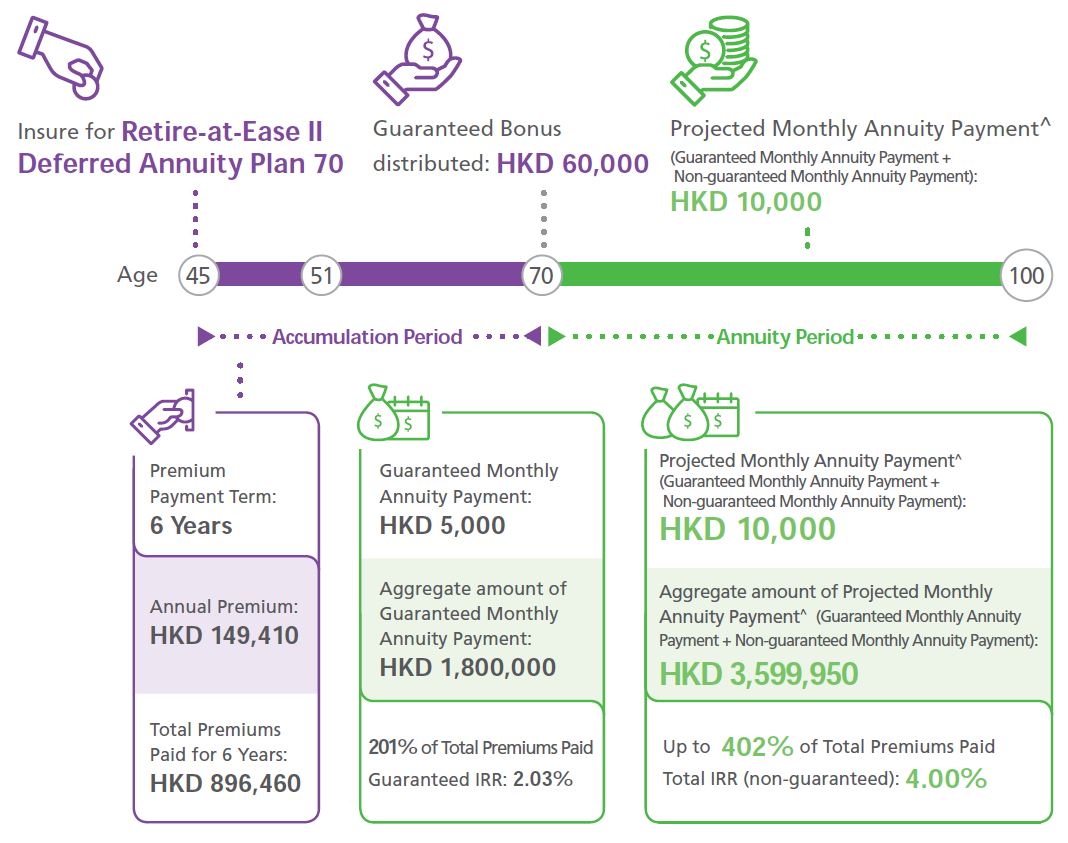

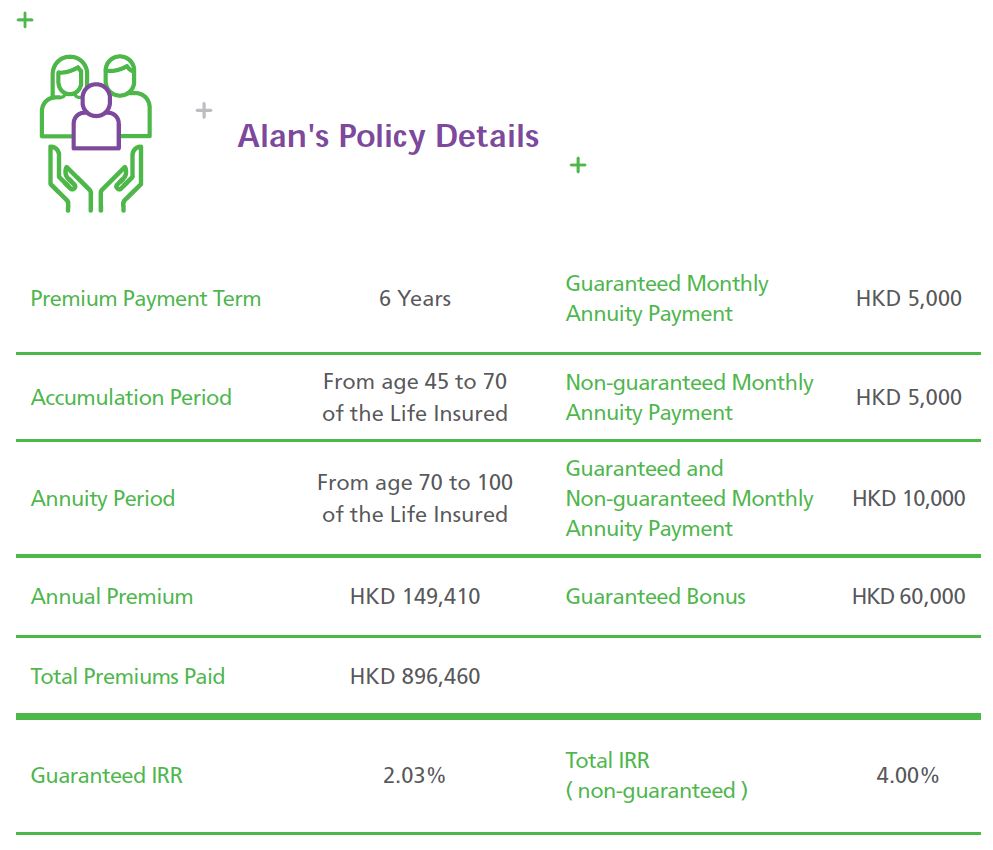

Hong kong people are living longer. If based on the data, the average retirement age will last 17 years, that means. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end. According to the data provided in the article, a comfortable retirement in hong kong is expected to cost around hk$436,000 each year.

67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4.

According to the data provided in the article, a comfortable retirement in hong kong is expected to cost around hk$436,000 each year. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. Hong kong people are living longer. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end.

Source: hklife.com.hk

Source: hklife.com.hk

According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. There is a wide gap in retirement planning in hong kong. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end.

Source: fruugo.us

Source: fruugo.us

With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. There is a wide gap in retirement planning in hong kong. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2.

1.jpg “RetireatEase II Deferred Annuity Plan Retirement Plan Hong Kong”) Source: hklife.com.hk

Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. If based on the data, the average retirement age will last 17 years, that means. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream.

Source: hklife.com.hk

Throw in other aspirations you want to. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. According to the data provided in the article, a comfortable retirement in hong kong is expected to cost around hk$436,000 each year.

Throw in other aspirations you want to. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4.

Source: hklife.com.hk

Source: hklife.com.hk

Throw in other aspirations you want to. Throw in other aspirations you want to. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end.

Source: 3ecpa.com.hk

Source: 3ecpa.com.hk

Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium.

If based on the data, the average retirement age will last 17 years, that means. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. If based on the data, the average retirement age will last 17 years, that means. According to the data provided in the article, a comfortable retirement in hong kong is expected to cost around hk$436,000 each year. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4.

Source: planyourfinances.com

Source: planyourfinances.com

There is a wide gap in retirement planning in hong kong. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. Hong kong people are living longer.

With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. If based on the data, the average retirement age will last 17 years, that means. There is a wide gap in retirement planning in hong kong.

Source: scmp.com

Source: scmp.com

According to the data provided in the article, a comfortable retirement in hong kong is expected to cost around hk$436,000 each year. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2.

Source: researchgate.net

Source: researchgate.net

67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. Hong kong people are living longer.

Source: hklife.com.hk

Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. There is a wide gap in retirement planning in hong kong.

Source: apps-uat.principal.com.hk

Source: apps-uat.principal.com.hk

A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. There is a wide gap in retirement planning in hong kong. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4.

Source: deckerretirementplanning.com

Source: deckerretirementplanning.com

There is a wide gap in retirement planning in hong kong. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. With the cost of living in hong kong rising year on year, it�s crucial you manage your retirement savings intelligently. There is a wide gap in retirement planning in hong kong. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong.

Source: asiaadvisersnetwork.com

Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4. There is a wide gap in retirement planning in hong kong. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. Hong kong people are living longer.

Source: scmp.com

Source: scmp.com

Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end. The hsbc finfit survey estimates that an average person will need hkd4.7 million to retire comfortably in hong kong. A retirement plan supported by all three pillars provides comprehensive protection for your future, but putting together your ideal retirement plan takes time and you may want to prioritize one or two of the pillars for. 67% of survey respondents would face a shortfall in their retirement reserves for the extended golden years 3,4.

According to estimates, by 2041 the average life expectancy of local men and women will reach 84 and 90 respectively 2. Hkmc annuity plan is underwritten by hkmc annuity limited and designed to provide you, as the annuitant, with a steady stream of guaranteed monthly annuity payments after paying a single premium. Throw in other aspirations you want to. With this special feature, you can better plan your retirement life by turning your lump sum cash into a stable lifelong income stream. Apparently, people in hong kong are living longer and their savings plans are not enough to pay for their needs until the very end.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan hong kong by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.