Your Retirement plan contribution limits 2021 images are ready. Retirement plan contribution limits 2021 are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan contribution limits 2021 files here. Get all free images.

If you’re looking for retirement plan contribution limits 2021 pictures information connected with to the retirement plan contribution limits 2021 topic, you have visit the ideal blog. Our site always gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

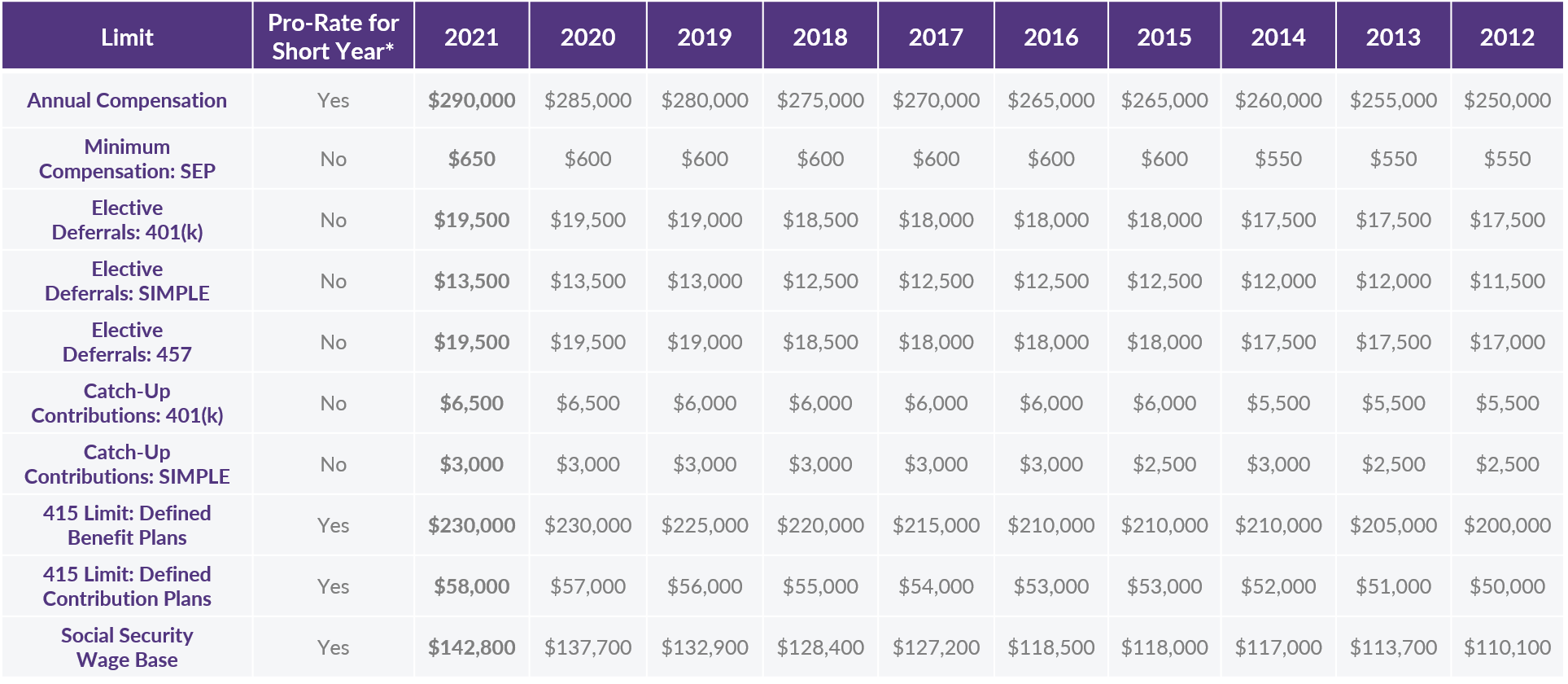

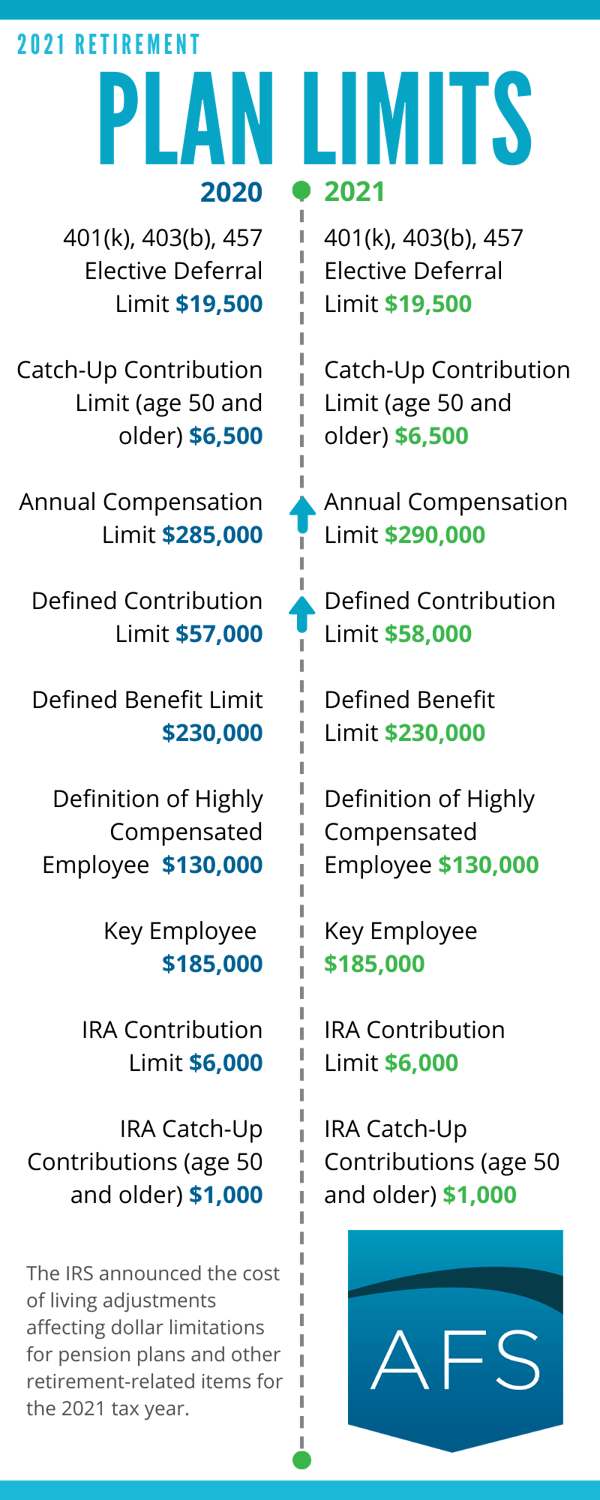

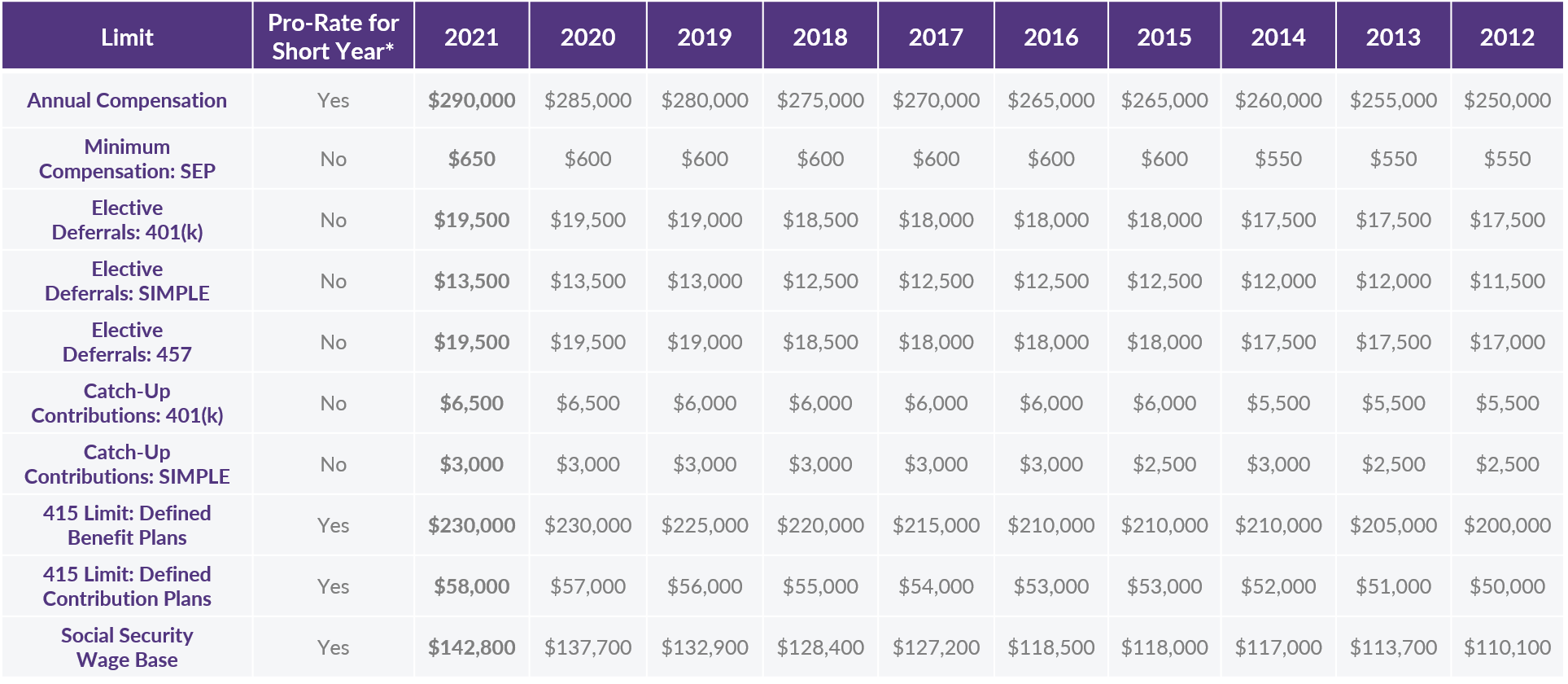

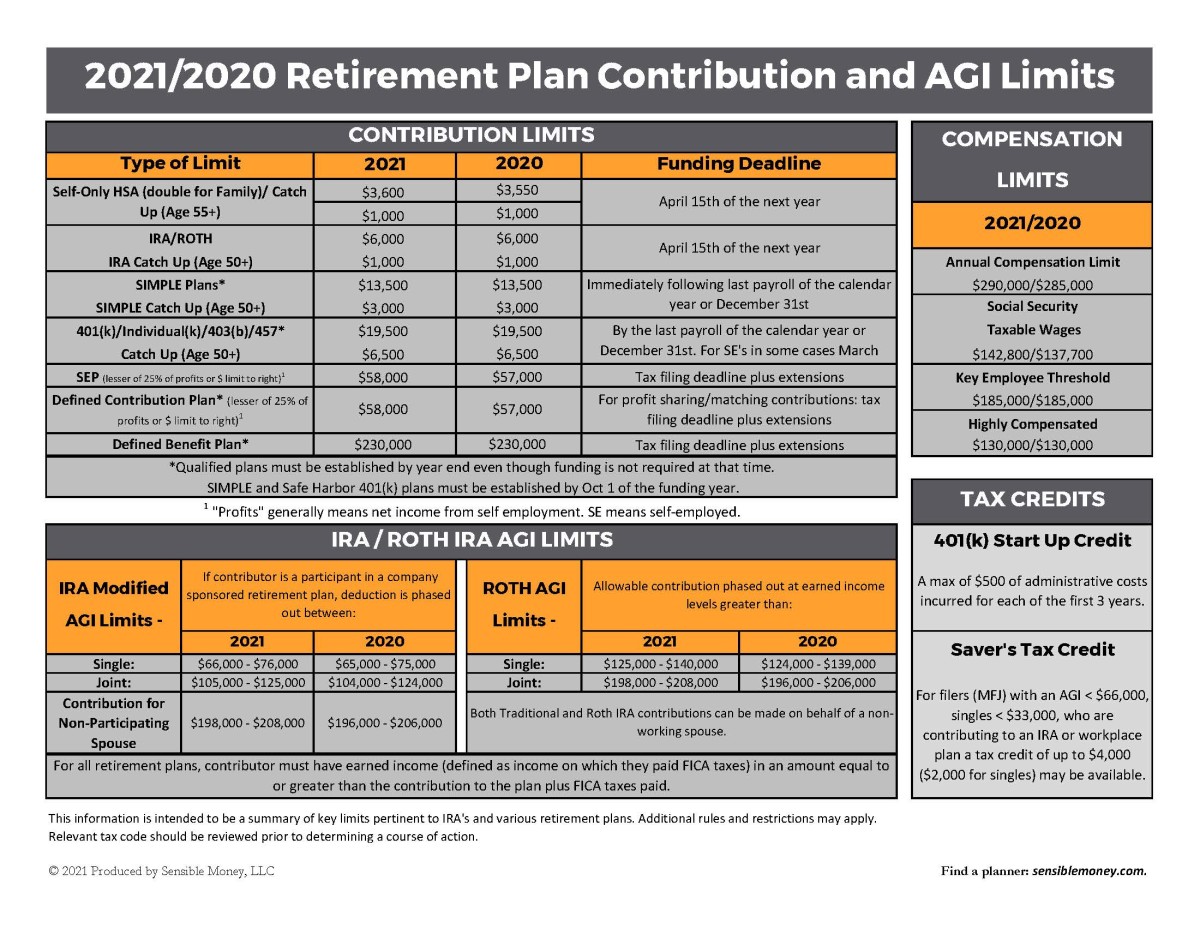

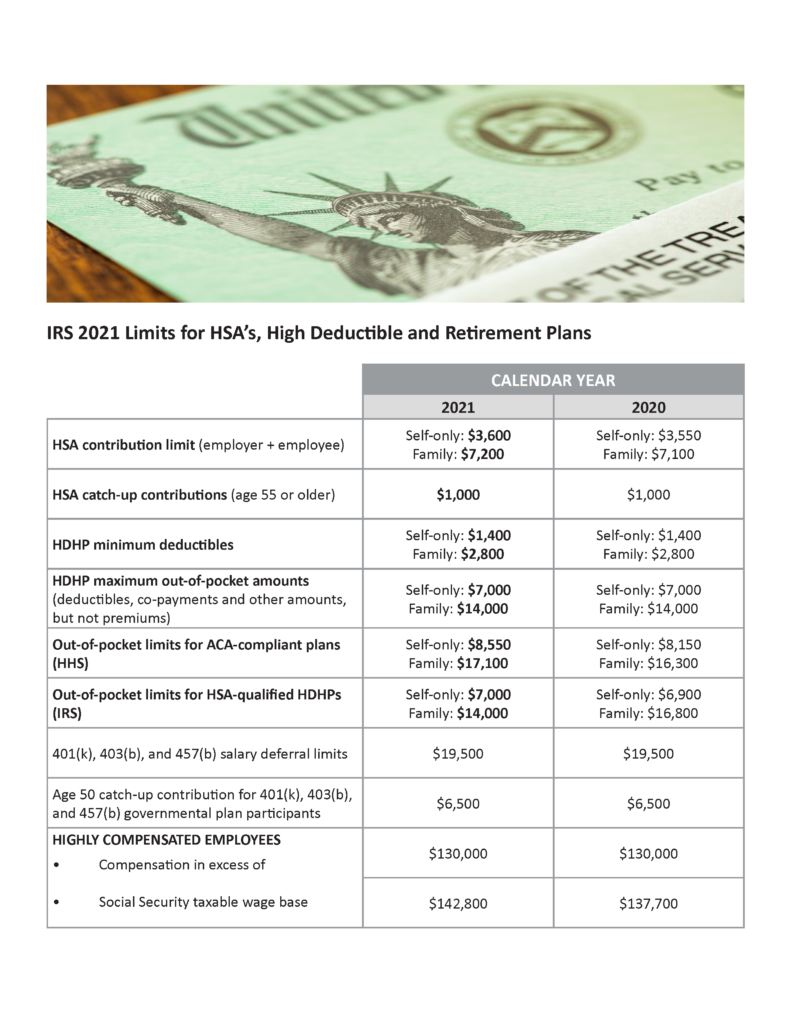

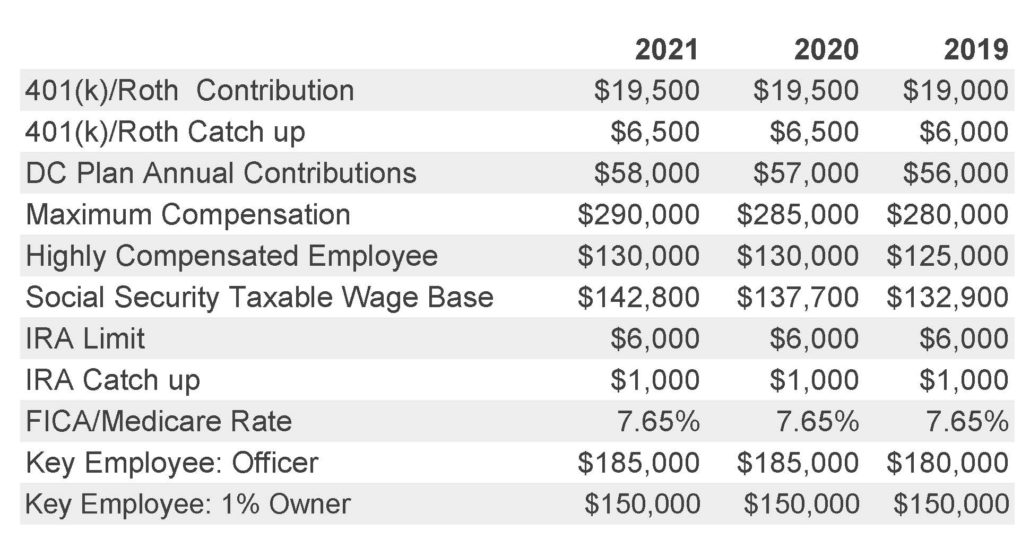

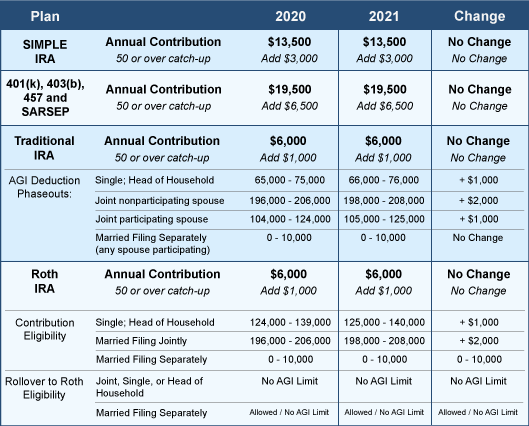

Retirement Plan Contribution Limits 2021. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The contribution limits are broken into two categories; 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,.

2021 Max Simple Ira Contribution Limits NEWREAY From newreay.blogspot.com

The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. $6,000 ($7,000 age 50 or over) $1,000. $6,000 ($7,000 age 50 or over) $1,000. You may contribute additional elective salary deferrals of: The contribution limits are broken into two categories; Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000.

The esop maximum balance limit also increased.

The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The contribution limits are broken into two categories; The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. The esop maximum balance limit also increased. There are limits to how much employers and employees can contribute to a plan (or.

Source: pcscapital.com

Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000. $6,000 ($7,000 age 50 or over) $1,000. Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. $6,000 ($7,000 age 50 or over) $1,000.

Source: atlas401kplans.com

Source: atlas401kplans.com

The esop maximum balance limit also increased. $6,000 ($7,000 age 50 or over) $1,000. There are limits to how much employers and employees can contribute to a plan (or. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The amount the employer can contribute increased by $1,000 in 2021.

Source: northwestbank.com

Source: northwestbank.com

The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. $6,000 ($7,000 age 50 or over) $1,000. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. You may contribute additional elective salary deferrals of: The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,.

Source: afs401k.com

The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. $6,000 ($7,000 age 50 or over) $1,000. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. The amount the employer can contribute increased by $1,000 in 2021. You may contribute additional elective salary deferrals of:

Source: walshandassociates.com

Source: walshandassociates.com

The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. The esop maximum balance limit also increased. $6,000 ($7,000 age 50 or over) $1,000. Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000.

Source: newreay.blogspot.com

The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. You may contribute additional elective salary deferrals of: The amount the employer can contribute increased by $1,000 in 2021. The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. $6,000 ($7,000 age 50 or over) $1,000.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide] 2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2021_Retirement_401k_IRS_Contribution_Limits.jpg?width=1267&name=2021_Retirement_401k_IRS_Contribution_Limits.jpg) Source: griffinbenefits.com

Source: griffinbenefits.com

$6,000 ($7,000 age 50 or over) $1,000. The contribution limits are broken into two categories; You may contribute additional elective salary deferrals of: $6,000 ($7,000 age 50 or over) $1,000. There are limits to how much employers and employees can contribute to a plan (or.

Source: fyi.nwcm.com

Source: fyi.nwcm.com

The amount the employer can contribute increased by $1,000 in 2021. The contribution limits are broken into two categories; The esop maximum balance limit also increased. The amount the employer can contribute increased by $1,000 in 2021. $6,000 ($7,000 age 50 or over) $1,000.

Source: washfinancial.com

Source: washfinancial.com

The contribution limits are broken into two categories; The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The esop maximum balance limit also increased. The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. You may contribute additional elective salary deferrals of:

Source: thestreet.com

Source: thestreet.com

$6,000 ($7,000 age 50 or over) $1,000. Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000. $6,000 ($7,000 age 50 or over) $1,000. The amount the employer can contribute increased by $1,000 in 2021. You may contribute additional elective salary deferrals of:

Source: authorstream.com

Source: authorstream.com

There are limits to how much employers and employees can contribute to a plan (or. The contribution limits are broken into two categories; The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan.

Source: integritybenefitpartners.com

Source: integritybenefitpartners.com

The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. $6,000 ($7,000 age 50 or over) $1,000. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. $6,000 ($7,000 age 50 or over) $1,000.

Source: fosterthomas.com

Source: fosterthomas.com

There are limits to how much employers and employees can contribute to a plan (or. You may contribute additional elective salary deferrals of: The ira contribution limit is the same from 2021, for 2022 at $6,000 for the year. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. $6,000 ($7,000 age 50 or over) $1,000.

Source: theastuteadvisor.com

Source: theastuteadvisor.com

$6,000 ($7,000 age 50 or over) $1,000. $6,000 ($7,000 age 50 or over) $1,000. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. The amount the employer can contribute increased by $1,000 in 2021. $6,000 ($7,000 age 50 or over) $1,000.

Source: marinerwealthadvisors.com

Source: marinerwealthadvisors.com

$6,000 ($7,000 age 50 or over) $1,000. There are limits to how much employers and employees can contribute to a plan (or. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. $6,000 ($7,000 age 50 or over) $1,000. The esop maximum balance limit also increased.

Source: trustok.com

Source: trustok.com

The amount the employer can contribute increased by $1,000 in 2021. The amount the employer can contribute increased by $1,000 in 2021. You may contribute additional elective salary deferrals of: 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. The contribution limits are broken into two categories;

Source: comperiorc.com

Source: comperiorc.com

The contribution limits are broken into two categories; The basic limit on elective deferrals is $20,500 in 2022, $19,500 in 2020 and 2021,. The basic salary deferral amount for 401 (k) and similar workplace plans remains flat at. You may contribute additional elective salary deferrals of: Most of the key plan limits remain unchanged for 2021 from 2020 levels with the notable exception of the combined dc annual contribution limit, which increased to $58,000, and the annual compensation limit increase to $290,000.

Source: gsdfinancially.com

Source: gsdfinancially.com

$6,000 ($7,000 age 50 or over) $1,000. 2 rows on october 26, 2020, the irs announced the various adjustments applicable to retirement plan. $6,000 ($7,000 age 50 or over) $1,000. You may contribute additional elective salary deferrals of: There are limits to how much employers and employees can contribute to a plan (or.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan contribution limits 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.