Your Retirement plan box on w2 images are ready in this website. Retirement plan box on w2 are a topic that is being searched for and liked by netizens now. You can Download the Retirement plan box on w2 files here. Find and Download all free photos and vectors.

If you’re looking for retirement plan box on w2 images information linked to the retirement plan box on w2 keyword, you have come to the ideal site. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

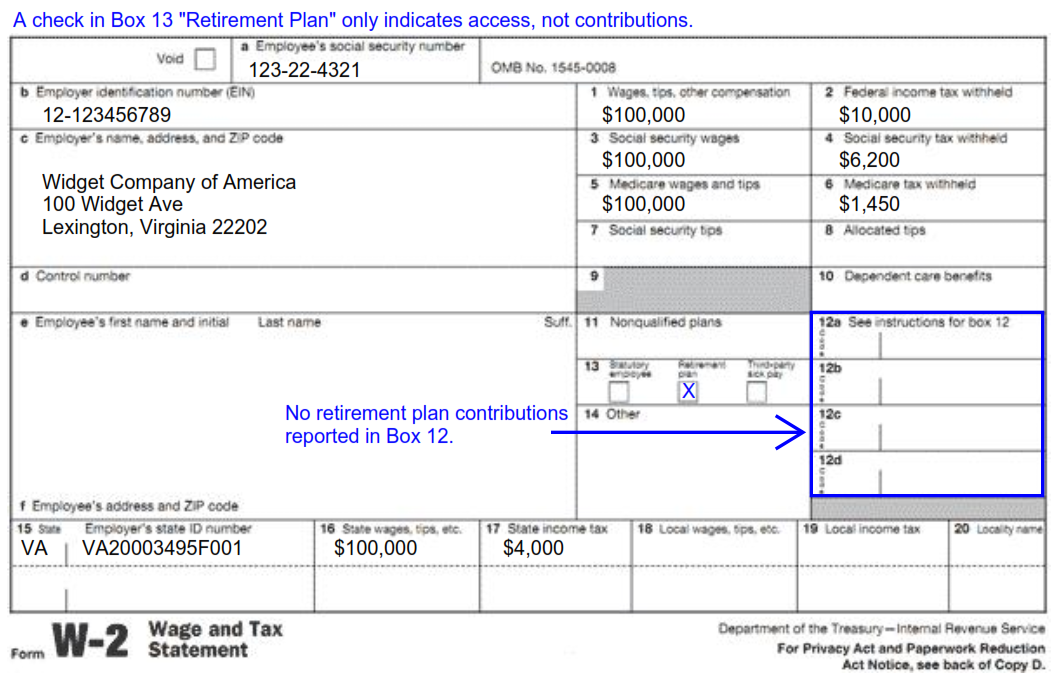

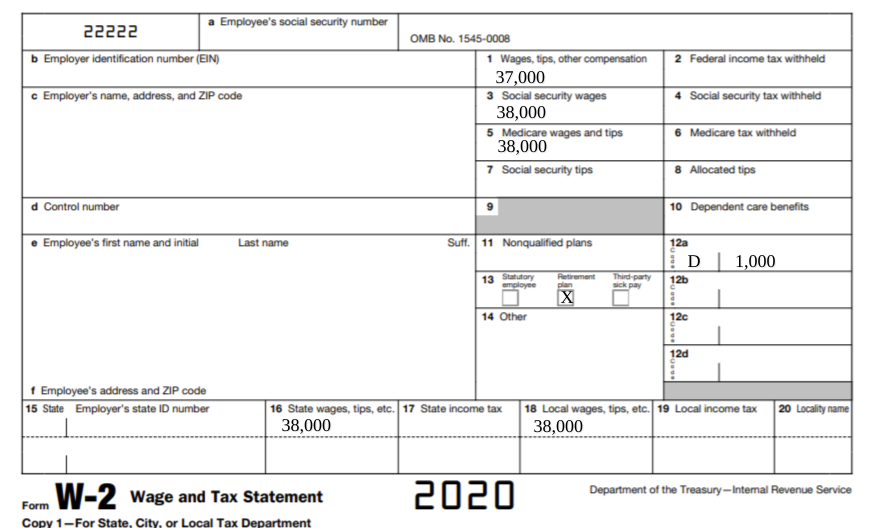

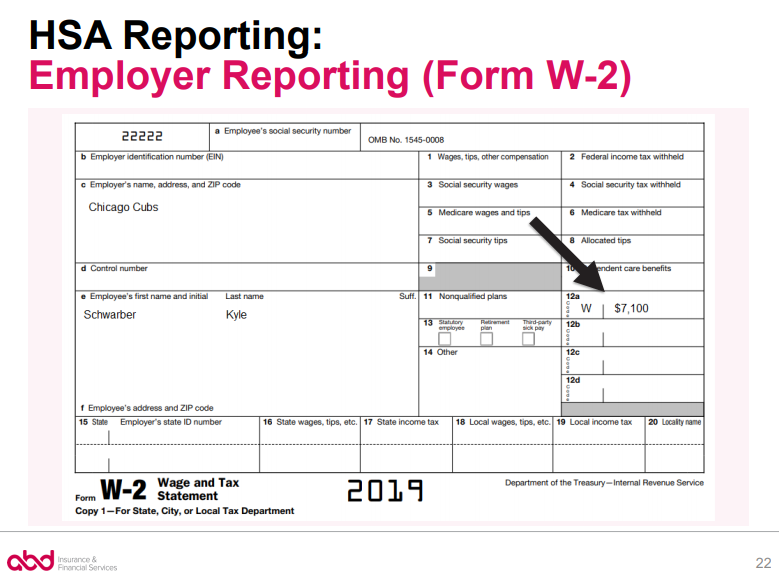

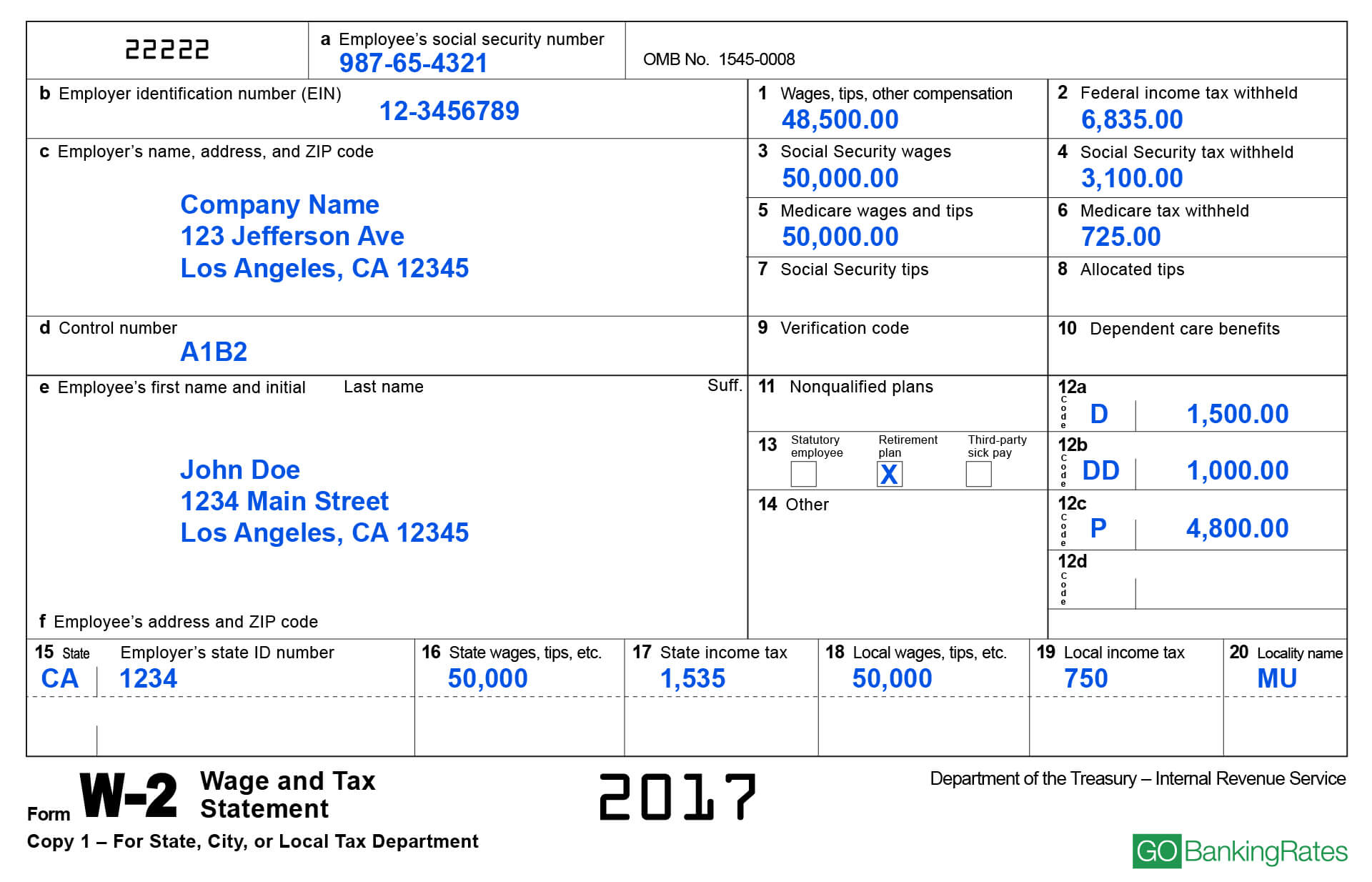

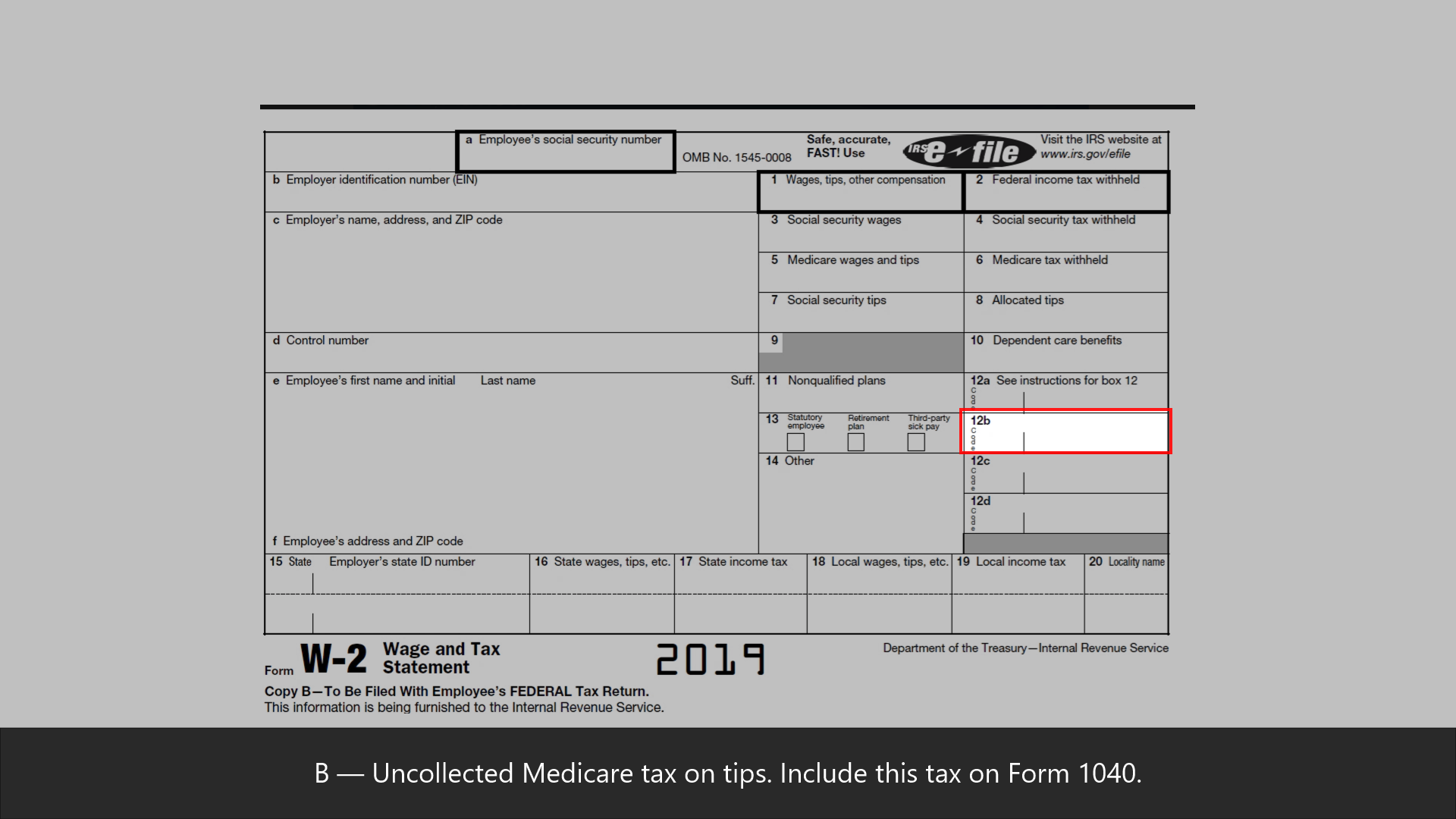

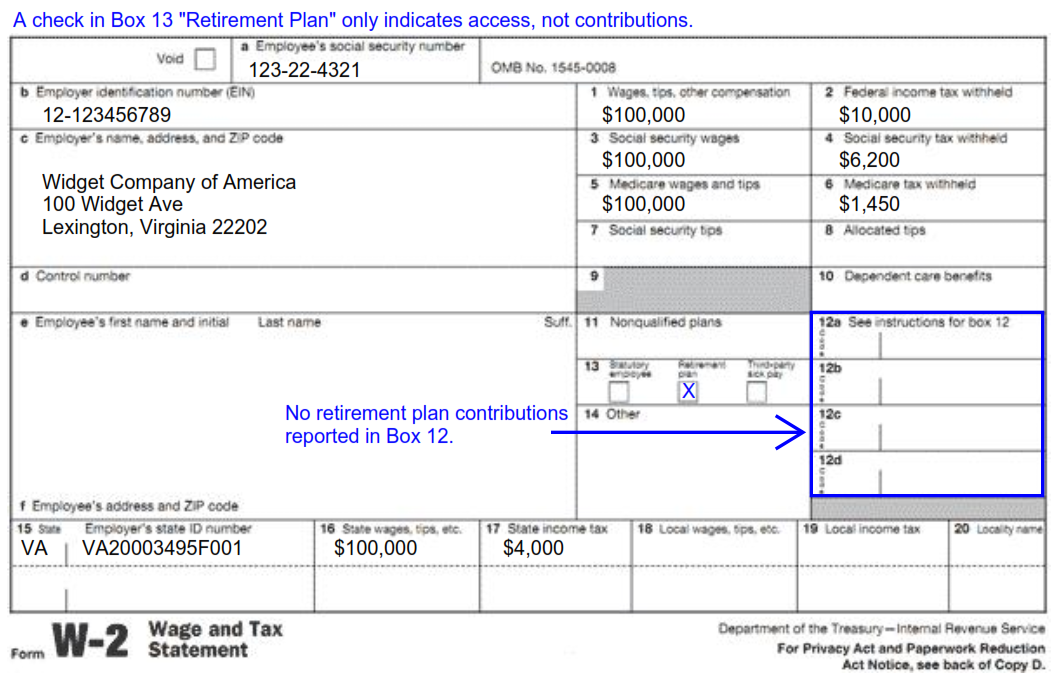

Retirement Plan Box On W2. Code h to incorrectly report health benefits; If you are still not certain. It shouldn�t make a difference unless you contributed to a. The only purpose of that box is determining if your ira contributions are deductible.

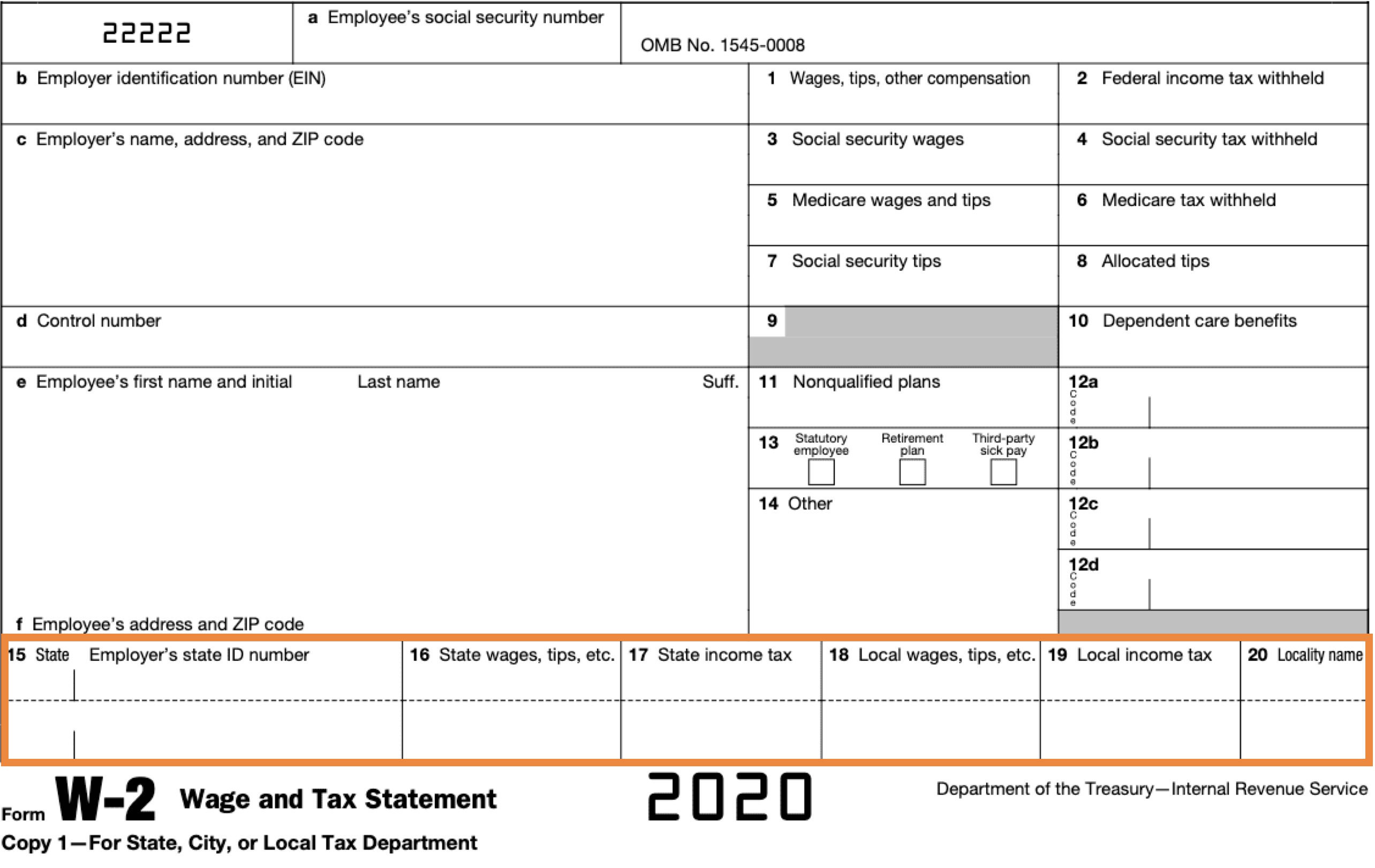

Understanding Tax Season Form W2 Remote Financial Planner From remotefinancialplanner.com

Understanding Tax Season Form W2 Remote Financial Planner From remotefinancialplanner.com

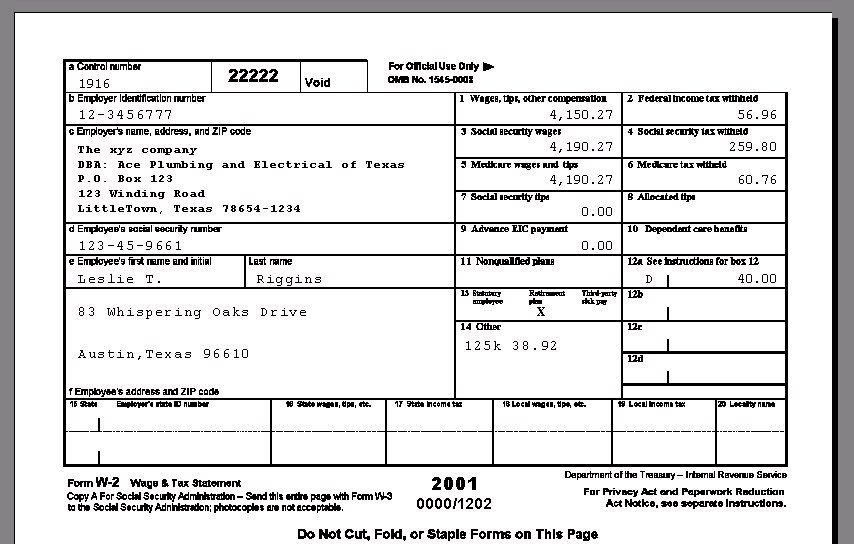

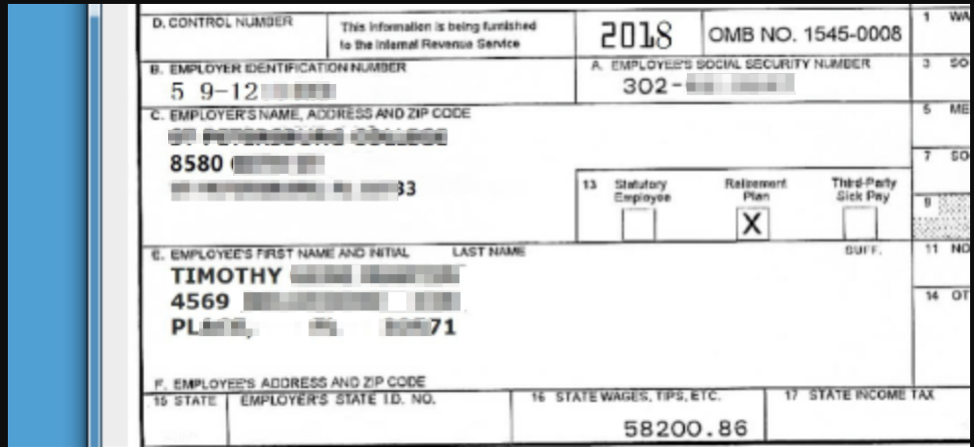

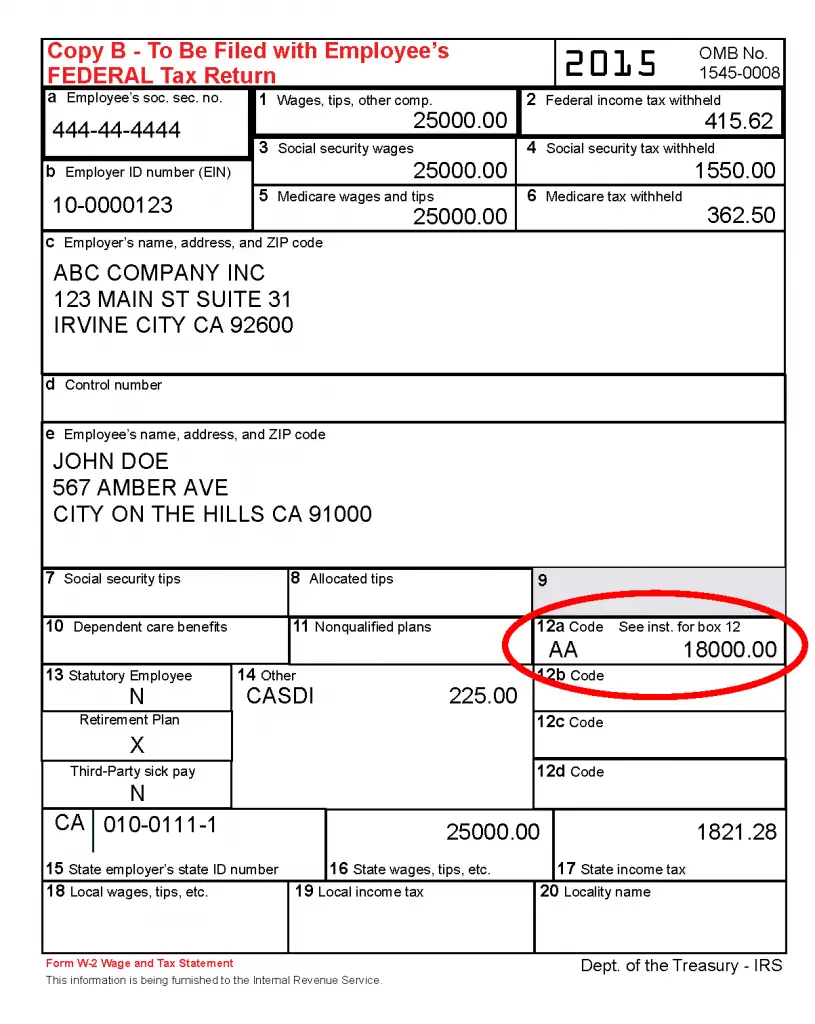

If you are still not certain. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. The only purpose of that box is determining if your ira contributions are deductible. This information is used for a few different things, mostly to determine eligibility and contribution limits to. Code e for 403 (b) contributions but did not have a 403 (b) plan. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer.

This information is used for a few different things, mostly to determine eligibility and contribution limits to.

Code h to incorrectly report health benefits; Stick with the imported data (box is checked). The only purpose of that box is determining if your ira contributions are deductible. Type of plan conditions check the retirement box? Code e for 403 (b) contributions but did not have a 403 (b) plan. Code h to incorrectly report health benefits;

Source: forbes.com

Source: forbes.com

Stick with the imported data (box is checked). It shouldn�t make a difference unless you contributed to a. If you are still not certain. Code e for 403 (b) contributions but did not have a 403 (b) plan. The only purpose of that box is determining if your ira contributions are deductible.

Source: ccssoftware.com

Source: ccssoftware.com

Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. The only purpose of that box is determining if your ira contributions are deductible. Type of plan conditions check the retirement box? It shouldn�t make a difference unless you contributed to a. If you are still not certain.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer. If you are still not certain. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer. This information is used for a few different things, mostly to determine eligibility and contribution limits to. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year.

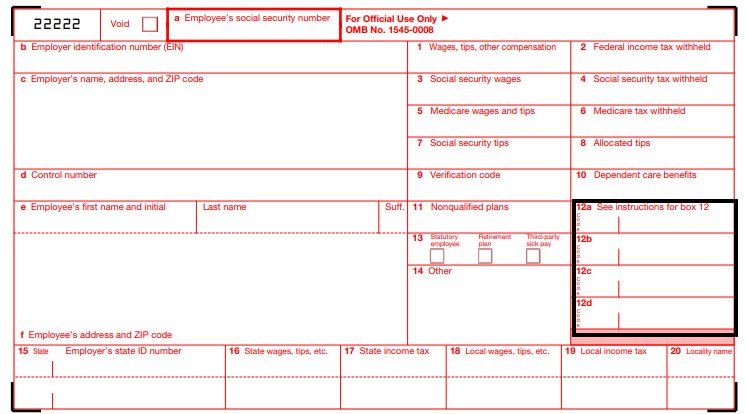

Source: gusto.com

Source: gusto.com

The only purpose of that box is determining if your ira contributions are deductible. Type of plan conditions check the retirement box? Code e for 403 (b) contributions but did not have a 403 (b) plan. It shouldn�t make a difference unless you contributed to a. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year.

Source: patriotsoftware.com

Source: patriotsoftware.com

Stick with the imported data (box is checked). If you are still not certain. It shouldn�t make a difference unless you contributed to a. The only purpose of that box is determining if your ira contributions are deductible. This information is used for a few different things, mostly to determine eligibility and contribution limits to.

Source: taxirin.blogspot.com

Source: taxirin.blogspot.com

If you are still not certain. Code h to incorrectly report health benefits; It shouldn�t make a difference unless you contributed to a. Stick with the imported data (box is checked). Code e for 403 (b) contributions but did not have a 403 (b) plan.

Source: gobankingrates.com

Source: gobankingrates.com

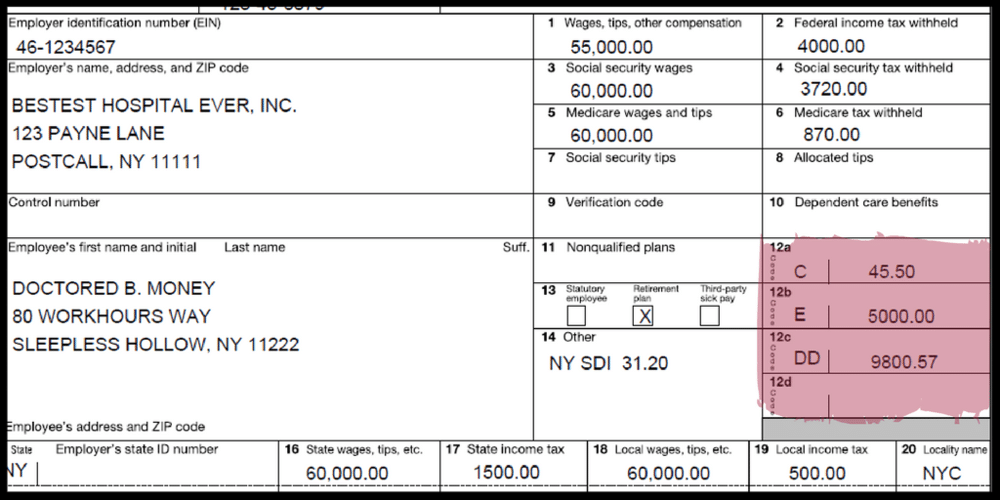

Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. Stick with the imported data (box is checked). Code e for 403 (b) contributions but did not have a 403 (b) plan. It shouldn�t make a difference unless you contributed to a. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer.

Source: library.myguide.org

Source: library.myguide.org

This information is used for a few different things, mostly to determine eligibility and contribution limits to. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer. Code e for 403 (b) contributions but did not have a 403 (b) plan. Type of plan conditions check the retirement box?

Source: help.onpay.com

Source: help.onpay.com

Stick with the imported data (box is checked). Code h to incorrectly report health benefits; Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. Code e for 403 (b) contributions but did not have a 403 (b) plan. Type of plan conditions check the retirement box?

Source: avocadoughtoast.com

Source: avocadoughtoast.com

Stick with the imported data (box is checked). Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer. The only purpose of that box is determining if your ira contributions are deductible. This information is used for a few different things, mostly to determine eligibility and contribution limits to. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year.

![]() Source: excelcapmanagement.com

Source: excelcapmanagement.com

If you are still not certain. Stick with the imported data (box is checked). Code h to incorrectly report health benefits; Type of plan conditions check the retirement box? This information is used for a few different things, mostly to determine eligibility and contribution limits to.

Source: studentaid.gov

Source: studentaid.gov

Code e for 403 (b) contributions but did not have a 403 (b) plan. Code h to incorrectly report health benefits; Stick with the imported data (box is checked). The only purpose of that box is determining if your ira contributions are deductible. If you are still not certain.

Source: divadesignsinunion.blogspot.com

Source: divadesignsinunion.blogspot.com

Code h to incorrectly report health benefits; Type of plan conditions check the retirement box? Code h to incorrectly report health benefits; This information is used for a few different things, mostly to determine eligibility and contribution limits to. The only purpose of that box is determining if your ira contributions are deductible.

Source: forbes.com

Source: forbes.com

Stick with the imported data (box is checked). The only purpose of that box is determining if your ira contributions are deductible. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. It shouldn�t make a difference unless you contributed to a. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer.

Source: remotefinancialplanner.com

Source: remotefinancialplanner.com

Code e for 403 (b) contributions but did not have a 403 (b) plan. If you are still not certain. The only purpose of that box is determining if your ira contributions are deductible. It shouldn�t make a difference unless you contributed to a. Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer.

Source: journeypayroll.com

Source: journeypayroll.com

The only purpose of that box is determining if your ira contributions are deductible. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. It shouldn�t make a difference unless you contributed to a. Stick with the imported data (box is checked). If you are still not certain.

![]() Source: excelcapmanagement.com

Source: excelcapmanagement.com

Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer. Code e for 403 (b) contributions but did not have a 403 (b) plan. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. If you are still not certain. Code h to incorrectly report health benefits;

Source: investopedia.com

Source: investopedia.com

If you are still not certain. It shouldn�t make a difference unless you contributed to a. Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year. Code h to incorrectly report health benefits; Yes, you should at least check for the retirement savings credit if box 13 is checked (though you may not be eligible for the credit when you go through the questions).box 13 will indicate if you are enrolled or offered a retirement plan by your employer.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan box on w2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.