Your Retirement plan aditya birla images are available in this site. Retirement plan aditya birla are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan aditya birla files here. Find and Download all royalty-free images.

If you’re looking for retirement plan aditya birla pictures information related to the retirement plan aditya birla topic, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

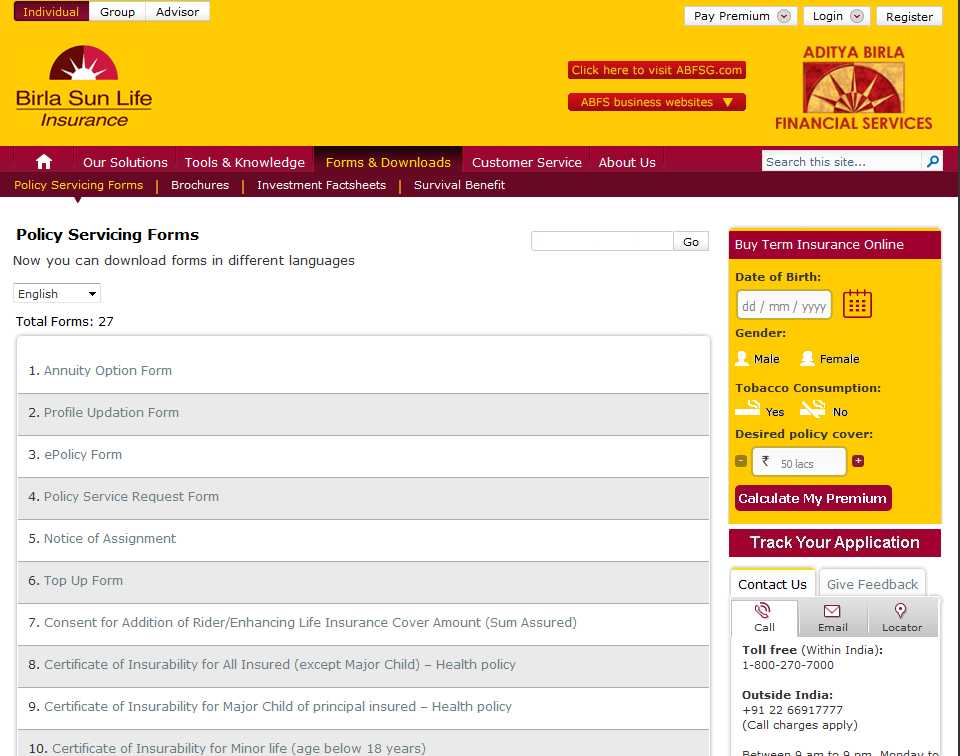

Retirement Plan Aditya Birla. Premiums paid towards the plan are eligible for tax exemption. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s.

हिंदी Aditya Birla Sun Life Retirement Fund NFO Mutual Fund Review From youtube.com

हिंदी Aditya Birla Sun Life Retirement Fund NFO Mutual Fund Review From youtube.com

The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Premiums paid towards the plan are eligible for tax exemption. Annuity certain is a pension plan that provides regular income for a specific period. 03 use the retirement tool to determine the corpus required to accomplish retirement goals. Set his/her retirement goals both short term and long term.

Set his/her retirement goals both short term and long term.

Pursue your desires easily such as going on exotic holidays/pilgrimages, spending time with your. Annuity certain is a pension plan that provides regular income for a specific period. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. Set his/her retirement goals both short term and long term. The need assessment will help him/her to determine systematic.

Source: empower.abslmf.com

Source: empower.abslmf.com

Annuity certain is a pension plan that provides regular income for a specific period. 01 plan for his/her retirement need. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. 5 simple steps to retirement planning. Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or.

Source: dialabank.com

Source: dialabank.com

03 use the retirement tool to determine the corpus required to accomplish retirement goals. Set his/her retirement goals both short term and long term. 03 use the retirement tool to determine the corpus required to accomplish retirement goals. 02 assess their current financial position. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s.

Source: jagoinvestor.com

Source: jagoinvestor.com

03 use the retirement tool to determine the corpus required to accomplish retirement goals. Set his/her retirement goals both short term and long term. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. 02 assess their current financial position. 5 simple steps to retirement planning.

Source: empower.abslmf.com

Pursue your desires easily such as going on exotic holidays/pilgrimages, spending time with your. This policy is underwritten by aditya birla sun life insurance company limited (absli). Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. 02 assess their current financial position. 03 use the retirement tool to determine the corpus required to accomplish retirement goals.

Source: issuu.com

Source: issuu.com

Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Annuity certain is a pension plan that provides regular income for a specific period. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. 03 use the retirement tool to determine the corpus required to accomplish retirement goals.

Annuity certain is a pension plan that provides regular income for a specific period. Premiums paid towards the plan are eligible for tax exemption. This policy is underwritten by aditya birla sun life insurance company limited (absli). Set his/her retirement goals both short term and long term. The need assessment will help him/her to determine systematic.

Source: youtube.com

Source: youtube.com

02 assess their current financial position. This policy is underwritten by aditya birla sun life insurance company limited (absli). Set his/her retirement goals both short term and long term. Annuity certain is a pension plan that provides regular income for a specific period. 01 plan for his/her retirement need.

Source: globalprimenews.com

Source: globalprimenews.com

The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. Premiums paid towards the plan are eligible for tax exemption. This policy is underwritten by aditya birla sun life insurance company limited (absli). The need assessment will help him/her to determine systematic. 01 plan for his/her retirement need.

Source: mohanvamsikrishnachinnam.absliadvisors.com

Source: mohanvamsikrishnachinnam.absliadvisors.com

Annuity certain is a pension plan that provides regular income for a specific period. 5 simple steps to retirement planning. 01 plan for his/her retirement need. 02 assess their current financial position. This policy is underwritten by aditya birla sun life insurance company limited (absli).

Source: myinvestmentideas.com

Source: myinvestmentideas.com

Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. Set his/her retirement goals both short term and long term. 03 use the retirement tool to determine the corpus required to accomplish retirement goals. The need assessment will help him/her to determine systematic.

Source: britneyspearspictyde.blogspot.com

Source: britneyspearspictyde.blogspot.com

Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Set his/her retirement goals both short term and long term. The need assessment will help him/her to determine systematic. Premiums paid towards the plan are eligible for tax exemption.

Source: empower.abslmf.com

Source: empower.abslmf.com

Under this facility, the plan changes from one plan to another when the investor enters another age bracket. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. This policy is underwritten by aditya birla sun life insurance company limited (absli). The need assessment will help him/her to determine systematic.

Source: mywealthpost.com

Source: mywealthpost.com

Premiums paid towards the plan are eligible for tax exemption. 5 simple steps to retirement planning. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Annuity certain is a pension plan that provides regular income for a specific period. 02 assess their current financial position.

Source: keijgoeskorea.blogspot.com

Source: keijgoeskorea.blogspot.com

Set his/her retirement goals both short term and long term. Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. Set his/her retirement goals both short term and long term. Premiums paid towards the plan are eligible for tax exemption. 01 plan for his/her retirement need.

Source: youtube.com

Source: youtube.com

01 plan for his/her retirement need. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. The need assessment will help him/her to determine systematic. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. 03 use the retirement tool to determine the corpus required to accomplish retirement goals.

Source: empower.abslmf.com

Source: empower.abslmf.com

So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s. Annuity certain is a pension plan that provides regular income for a specific period. 03 use the retirement tool to determine the corpus required to accomplish retirement goals. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s.

Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Aditya birla sun life insurance and absli empower pension plan are only the names of the company and policy respectively and do not in any way indicate their quality, future prospects or. 5 simple steps to retirement planning. So, when the investor crosses 40 years and enters in the 40s age, the plan changes to aditya birla sun life retirement fund’s 40s plan which has another investment strategy suitable for investors in their 40s. Premiums paid towards the plan are eligible for tax exemption.

Source: youtube.com

Source: youtube.com

Under this facility, the plan changes from one plan to another when the investor enters another age bracket. The sponsors of aditya birla sun life mutual fund are aditya birla capital limited, a part of the aditya birla group, which is a premier conglomerate of businesses in. The need assessment will help him/her to determine systematic. Under this facility, the plan changes from one plan to another when the investor enters another age bracket. Set his/her retirement goals both short term and long term.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan aditya birla by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.