Your Retirement plan 50 images are ready in this website. Retirement plan 50 are a topic that is being searched for and liked by netizens today. You can Get the Retirement plan 50 files here. Find and Download all royalty-free images.

If you’re looking for retirement plan 50 images information connected with to the retirement plan 50 interest, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

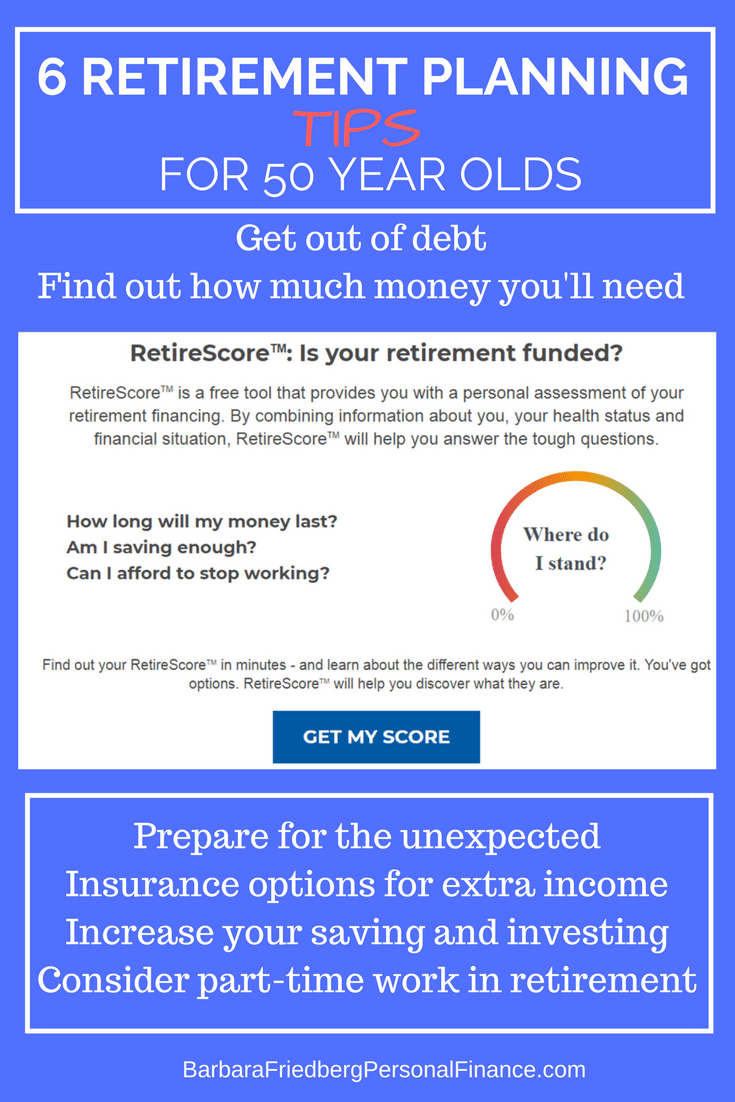

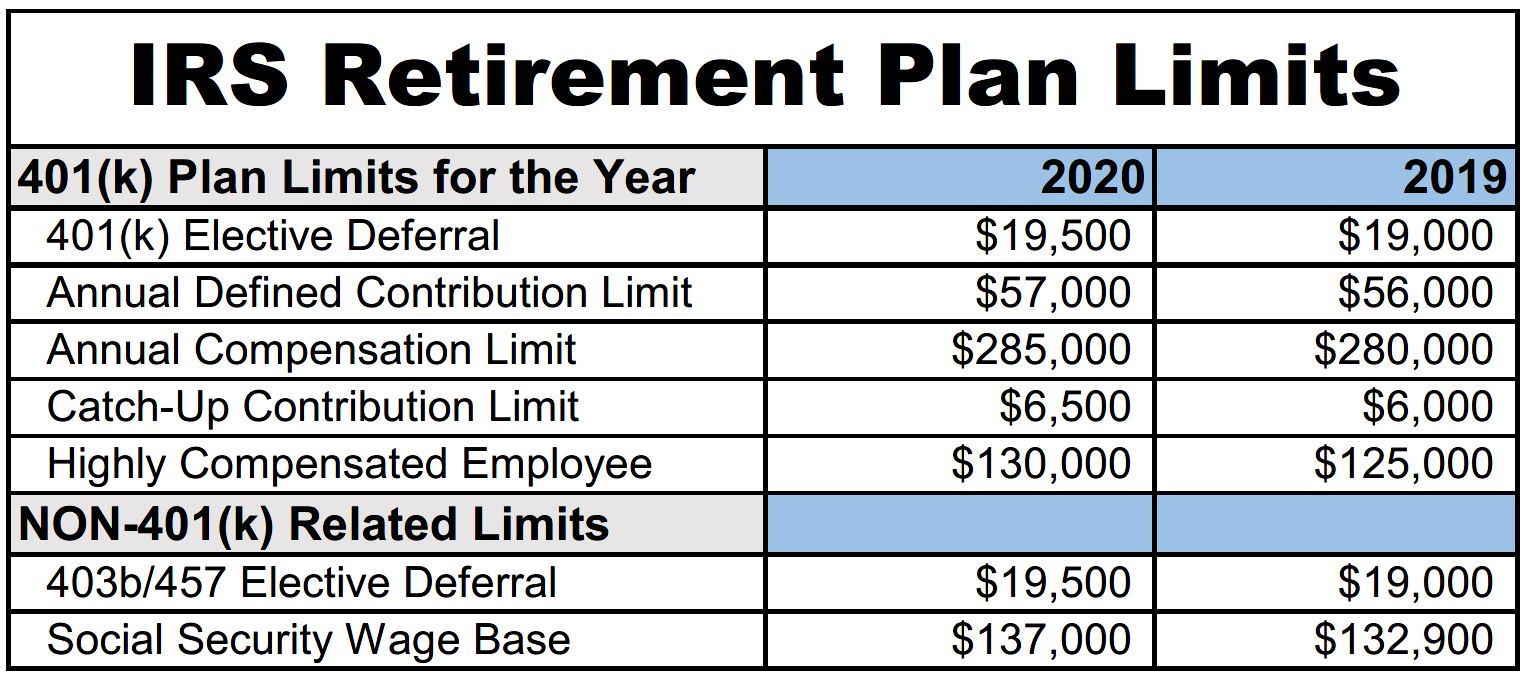

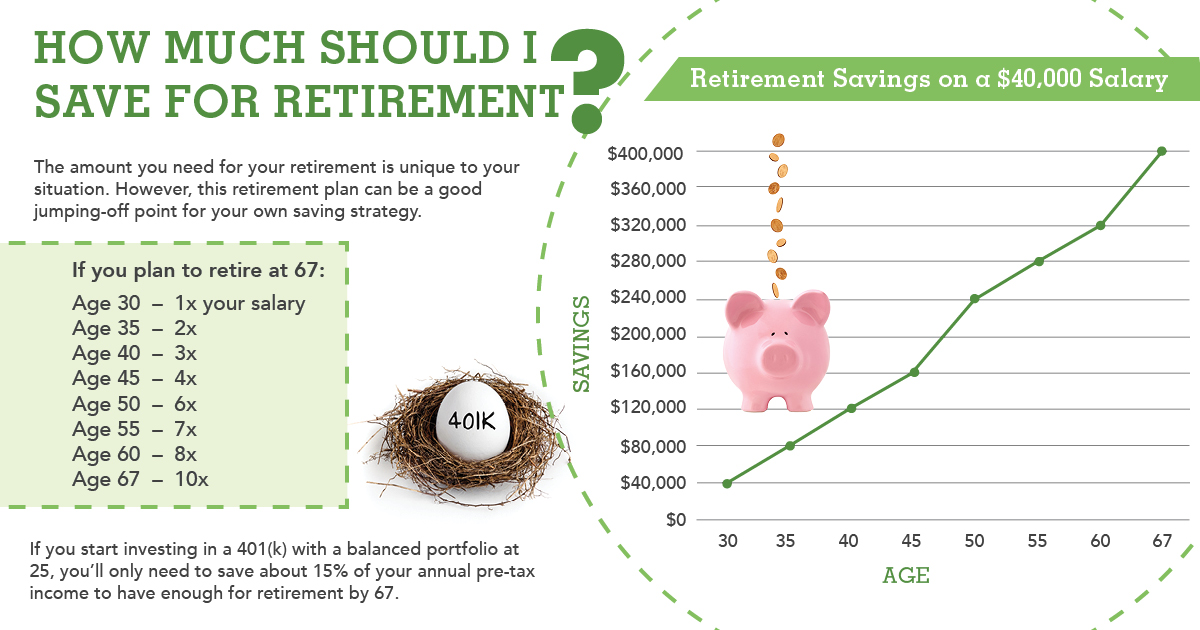

Retirement Plan 50. If you want to retire early, it’s important to first define what retirement means for you. Make sure to find out if your company provides a match for 401(k) donations. If you have the means to do it, try to max out your 401(k) contributions. In 2022, employees can normally contribute $20,500 per year to their retirement plan.

Retirement Planning JamaPunji From jamapunji.pk

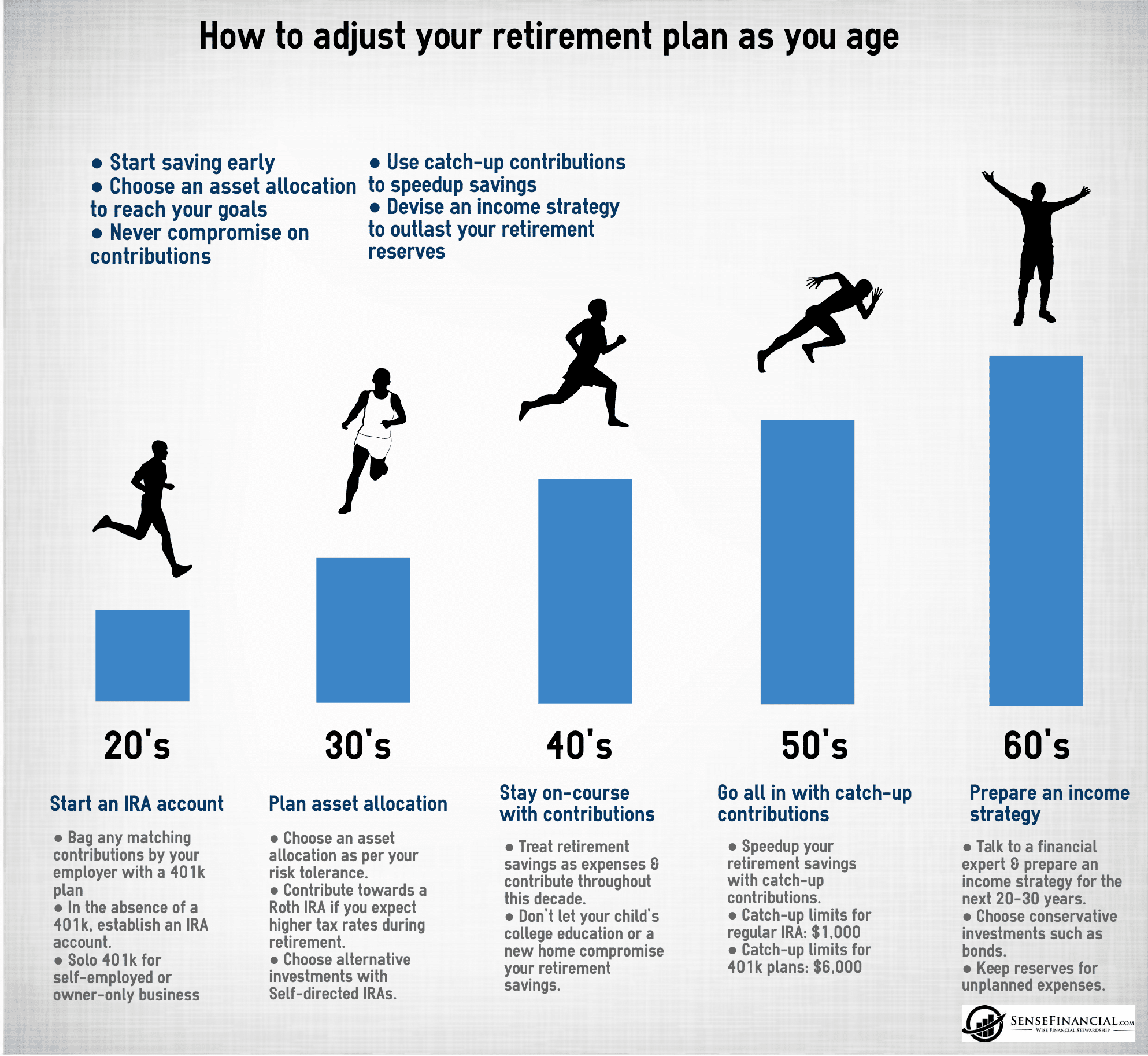

If you want to retire early, it’s important to first define what retirement means for you. In 2022, employees can normally contribute $20,500 per year to their retirement plan. You don�t want to head into retirement dragging a boatload of. Make sure to find out if your company provides a match for 401(k) donations. Once you hit 50, you are allowed to. Nobody likes to hear it, but the fastest way to save more is to spend less.

Tips for retirement planning in your 50s get a handle on spending.

Make sure to find out if your company provides a match for 401(k) donations. If you want to retire early, it’s important to first define what retirement means for you. Nobody likes to hear it, but the fastest way to save more is to spend less. Start with your retirement vision. Put as much as you can into your 401 (k), if you have one, advises lassus. You don�t want to head into retirement dragging a boatload of.

Source: redtea.com

Source: redtea.com

If you’re over 50, though, you can contribute up to $6,500 more on top of that. Make sure to find out if your company provides a match for 401(k) donations. If you have the means to do it, try to max out your 401(k) contributions. Start with your retirement vision. Tips for retirement planning in your 50s get a handle on spending.

Source: youtube.com

Source: youtube.com

Tips for retirement planning in your 50s get a handle on spending. If you’re over 50, though, you can contribute up to $6,500 more on top of that. If you have the means to do it, try to max out your 401(k) contributions. Tips for retirement planning in your 50s get a handle on spending. The more you plan ahead, the smoother the transition to an early retirement can be.

Source: pacesconnection.com

Make sure to find out if your company provides a match for 401(k) donations. If you have the means to do it, try to max out your 401(k) contributions. Put as much as you can into your 401 (k), if you have one, advises lassus. Once you hit 50, you are allowed to. The more you plan ahead, the smoother the transition to an early retirement can be.

Source: dontinvestandforget.com

Source: dontinvestandforget.com

If you want to retire early, it’s important to first define what retirement means for you. You don�t want to head into retirement dragging a boatload of. Put as much as you can into your 401 (k), if you have one, advises lassus. Tips for retirement planning in your 50s get a handle on spending. Make sure to find out if your company provides a match for 401(k) donations.

Source: pewtrusts.org

Source: pewtrusts.org

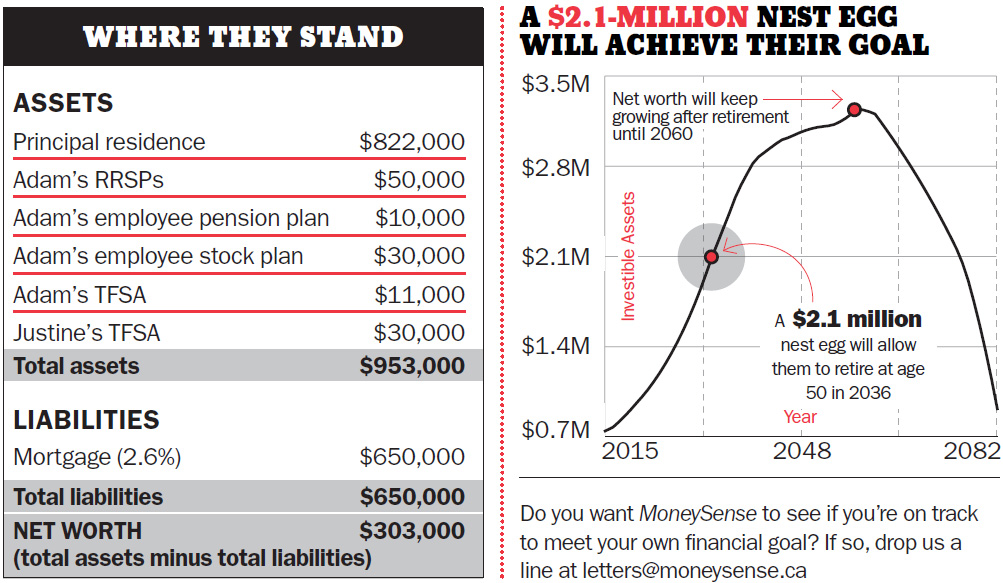

How to retire at 50: The more you plan ahead, the smoother the transition to an early retirement can be. If you have the means to do it, try to max out your 401(k) contributions. Make sure to find out if your company provides a match for 401(k) donations. How to retire at 50:

Source: wfn1.com

Source: wfn1.com

Once you hit 50, you are allowed to. The more you plan ahead, the smoother the transition to an early retirement can be. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. Nobody likes to hear it, but the fastest way to save more is to spend less. Put as much as you can into your 401 (k), if you have one, advises lassus.

Source: jamapunji.pk

If you’re over 50, though, you can contribute up to $6,500 more on top of that. If you’re over 50, though, you can contribute up to $6,500 more on top of that. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. Once you hit 50, you are allowed to. You don�t want to head into retirement dragging a boatload of.

Source: barnardfinancialplanning.com

Source: barnardfinancialplanning.com

Once you hit 50, you are allowed to. Make sure to find out if your company provides a match for 401(k) donations. You don�t want to head into retirement dragging a boatload of. If you want to retire early, it’s important to first define what retirement means for you. Start with your retirement vision.

Source: pinterest.com

Source: pinterest.com

The more you plan ahead, the smoother the transition to an early retirement can be. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. You don�t want to head into retirement dragging a boatload of. The more you plan ahead, the smoother the transition to an early retirement can be. Make sure to find out if your company provides a match for 401(k) donations.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Start with your retirement vision. If you have the means to do it, try to max out your 401(k) contributions. Tips for retirement planning in your 50s get a handle on spending. How to retire at 50: Once you hit 50, you are allowed to.

Source: pinterest.com

Source: pinterest.com

You don�t want to head into retirement dragging a boatload of. In 2022, employees can normally contribute $20,500 per year to their retirement plan. Start with your retirement vision. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. If you have the means to do it, try to max out your 401(k) contributions.

Source: listenmoneymatters.com

Source: listenmoneymatters.com

One of the smartest moves in planning for an early retirement is consulting with a financial advisor. Start with your retirement vision. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. Make sure to find out if your company provides a match for 401(k) donations. Put as much as you can into your 401 (k), if you have one, advises lassus.

Source: moneysense.ca

Source: moneysense.ca

Start with your retirement vision. Start with your retirement vision. One of the smartest moves in planning for an early retirement is consulting with a financial advisor. If you want to retire early, it’s important to first define what retirement means for you. If you’re over 50, though, you can contribute up to $6,500 more on top of that.

Source: bollinwealth.com

Source: bollinwealth.com

One of the smartest moves in planning for an early retirement is consulting with a financial advisor. If you’re over 50, though, you can contribute up to $6,500 more on top of that. Once you hit 50, you are allowed to. Nobody likes to hear it, but the fastest way to save more is to spend less. Make sure to find out if your company provides a match for 401(k) donations.

Source: pinterest.com

Source: pinterest.com

One of the smartest moves in planning for an early retirement is consulting with a financial advisor. Nobody likes to hear it, but the fastest way to save more is to spend less. In 2022, employees can normally contribute $20,500 per year to their retirement plan. Once you hit 50, you are allowed to. One of the smartest moves in planning for an early retirement is consulting with a financial advisor.

Source: m-rpa.com

Source: m-rpa.com

If you’re over 50, though, you can contribute up to $6,500 more on top of that. You don�t want to head into retirement dragging a boatload of. Tips for retirement planning in your 50s get a handle on spending. If you want to retire early, it’s important to first define what retirement means for you. Nobody likes to hear it, but the fastest way to save more is to spend less.

Source: johnjaicks.com

Source: johnjaicks.com

If you have the means to do it, try to max out your 401(k) contributions. If you want to retire early, it’s important to first define what retirement means for you. Make sure to find out if your company provides a match for 401(k) donations. If you’re over 50, though, you can contribute up to $6,500 more on top of that. Nobody likes to hear it, but the fastest way to save more is to spend less.

Source: myfinancemd.com

Source: myfinancemd.com

In 2022, employees can normally contribute $20,500 per year to their retirement plan. In 2022, employees can normally contribute $20,500 per year to their retirement plan. Put as much as you can into your 401 (k), if you have one, advises lassus. How to retire at 50: If you have the means to do it, try to max out your 401(k) contributions.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan 50 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.