Your Retirement plan 3 percent images are available in this site. Retirement plan 3 percent are a topic that is being searched for and liked by netizens today. You can Find and Download the Retirement plan 3 percent files here. Download all free photos.

If you’re looking for retirement plan 3 percent pictures information connected with to the retirement plan 3 percent keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more informative video content and images that match your interests.

Retirement Plan 3 Percent. As an employer, you can contribute up to 25% of your compensation. Choose from six contribution rates. More about plan 3 contribution rates. You select this percentage when you begin employment.

State Guaranteed Retirement Accounts Demos From demos.org

Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service. As an employee, you can contribute up to $20,500 per year ($27,000 if you are 50 or older) in 2022. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. Choose from six contribution rates. That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate.

This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%.

10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. Choose from six contribution rates. 10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. 6% up to age 35 7.5% ages 35 through 44 8.5% age 45 and older. Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older

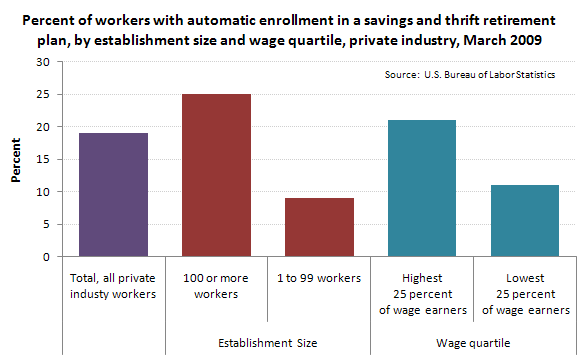

Source: bls.gov

Source: bls.gov

Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older You select this percentage when you begin employment. Teachers’ retirement system (trs) plan 3. That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate. Thus, the 3% works as a multiplier.

Source: demos.org

10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate. Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older 10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%.

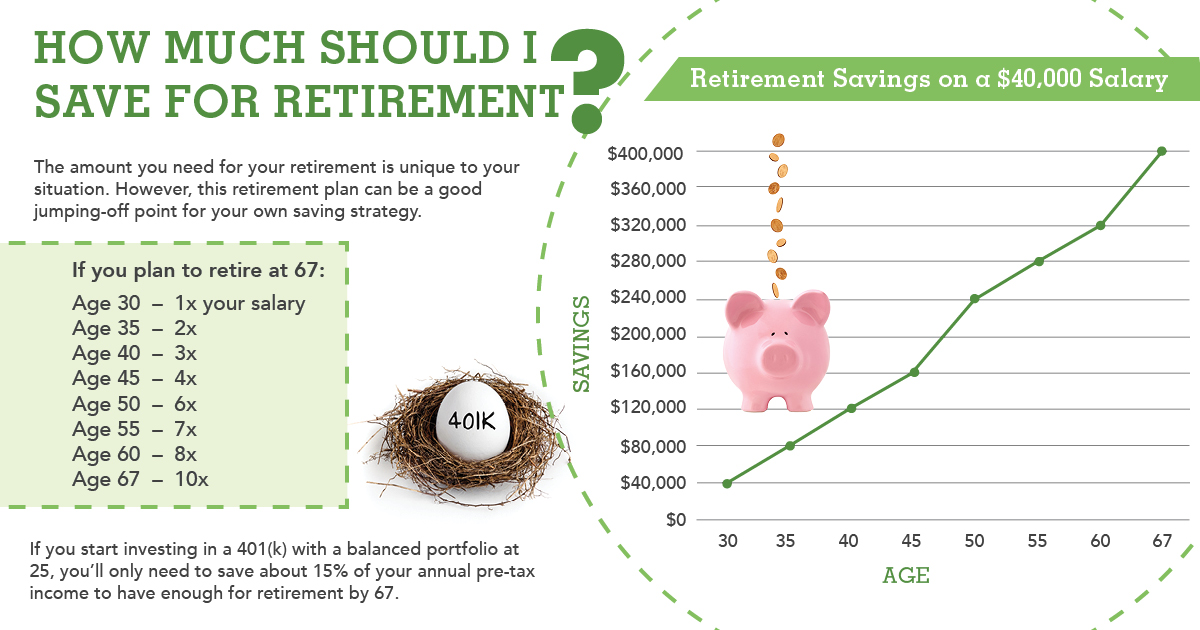

Source: sametcpa.com

Source: sametcpa.com

These next sections discuss your contribution rate options and the investment programs available to you. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. 10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. 5% up to age 35 6% ages 35 through 44 7.5% age 45 and older. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%.

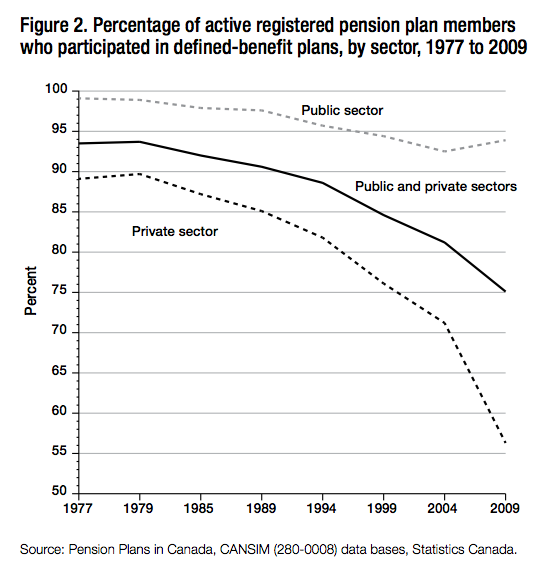

Source: irpp.org

Source: irpp.org

6% up to age 35 7.5% ages 35 through 44 8.5% age 45 and older. As an employer, you can contribute up to 25% of your compensation. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. As an employee, you can contribute up to $20,500 per year ($27,000 if you are 50 or older) in 2022. You select this percentage when you begin employment.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

5% up to age 35 6% ages 35 through 44 7.5% age 45 and older. 10 years of employment would result in a retirement salary percentage of 30% and 30 years of employment would result in. Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service. Teachers’ retirement system (trs) plan 3. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe.

6% up to age 35 7.5% ages 35 through 44 8.5% age 45 and older. Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. What percent of my salary do i need in retirement? If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe.

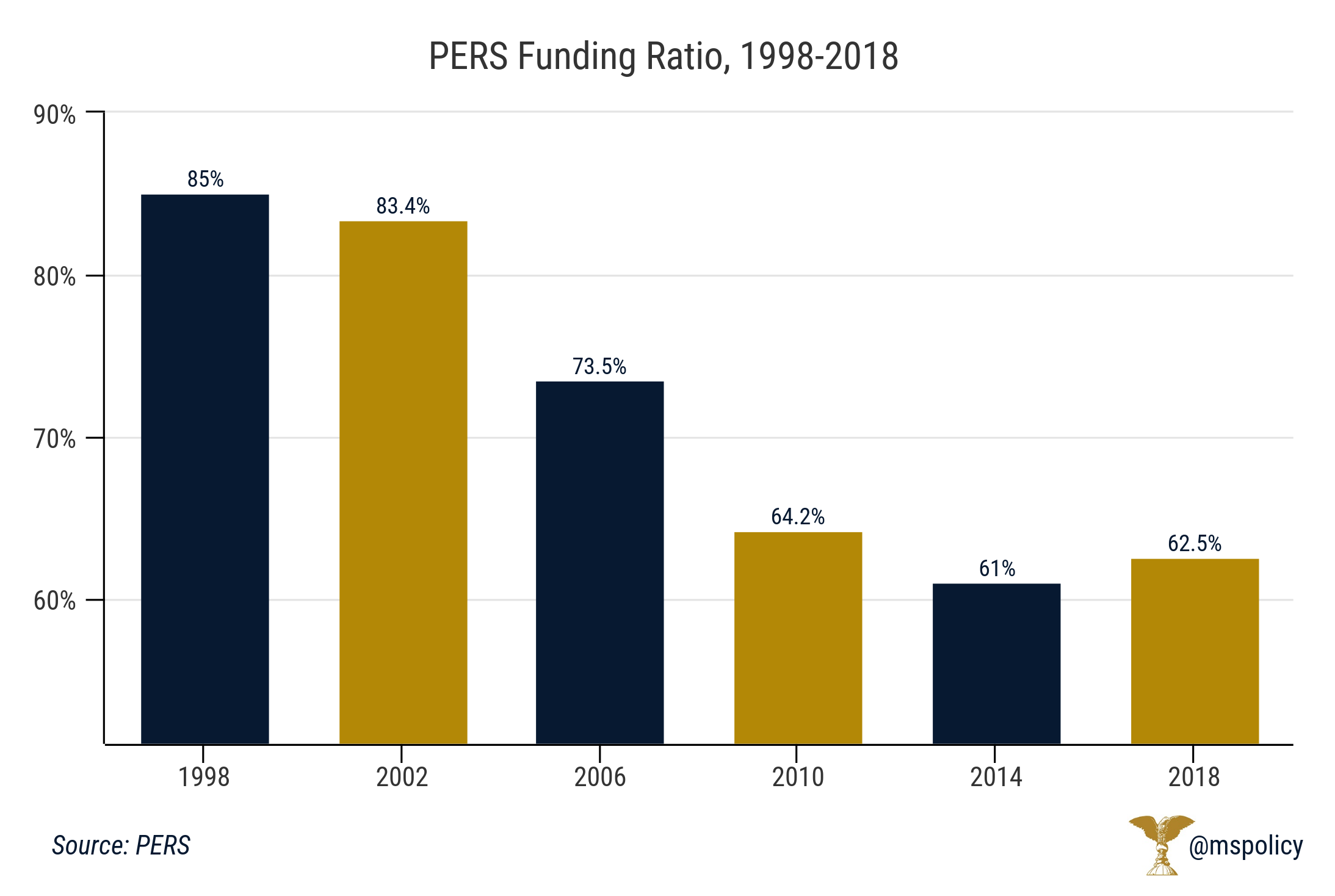

Source: mspolicy.org

Source: mspolicy.org

More about plan 3 contribution rates. 6% up to age 35 7.5% ages 35 through 44 8.5% age 45 and older. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. Thus, the 3% works as a multiplier. More about plan 3 contribution rates.

Source: incomeforlife.org

Source: incomeforlife.org

Choose from six contribution rates. What percent of my salary do i need in retirement? If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. Teachers’ retirement system (trs) plan 3. Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service.

Source: publicintegrity.org

Source: publicintegrity.org

Teachers’ retirement system (trs) plan 3. Thus, the 3% works as a multiplier. As an employee, you can contribute up to $20,500 per year ($27,000 if you are 50 or older) in 2022. Choose from six contribution rates. You select this percentage when you begin employment.

Source: mysolo401k.net

Source: mysolo401k.net

That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate. These next sections discuss your contribution rate options and the investment programs available to you. As an employee, you can contribute up to $20,500 per year ($27,000 if you are 50 or older) in 2022. You select this percentage when you begin employment. This means that the same $1 million portfolio.

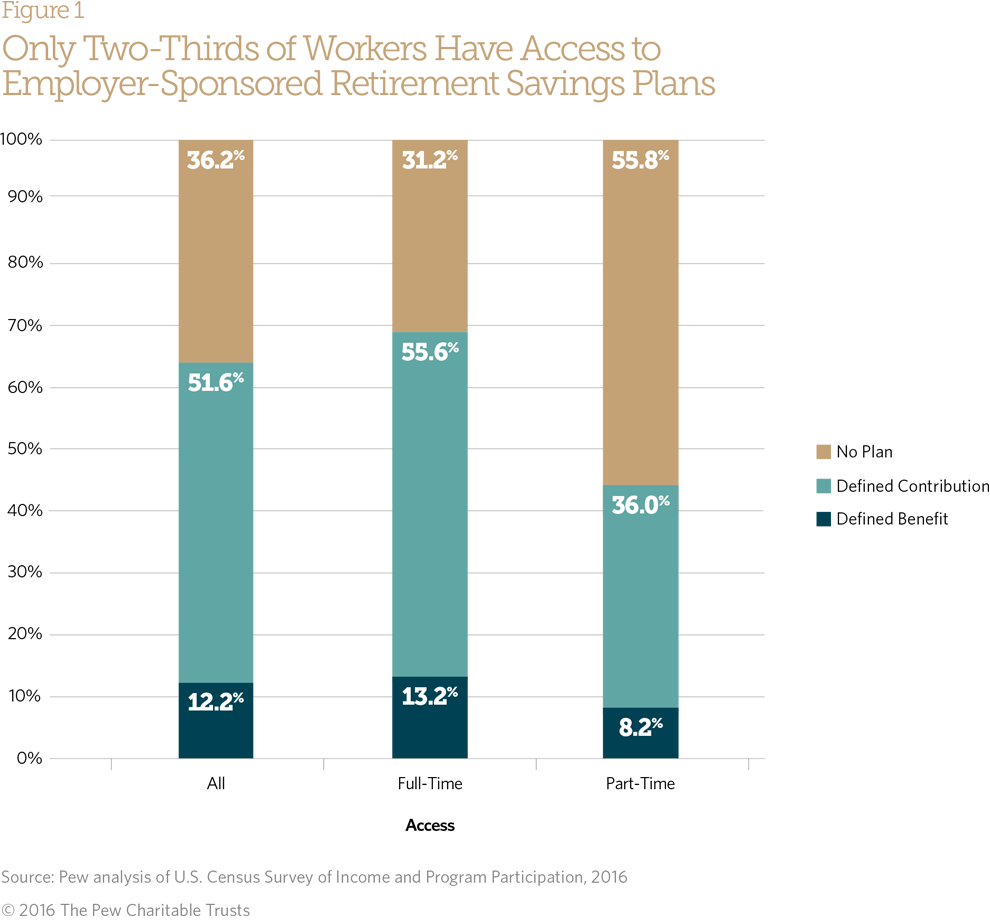

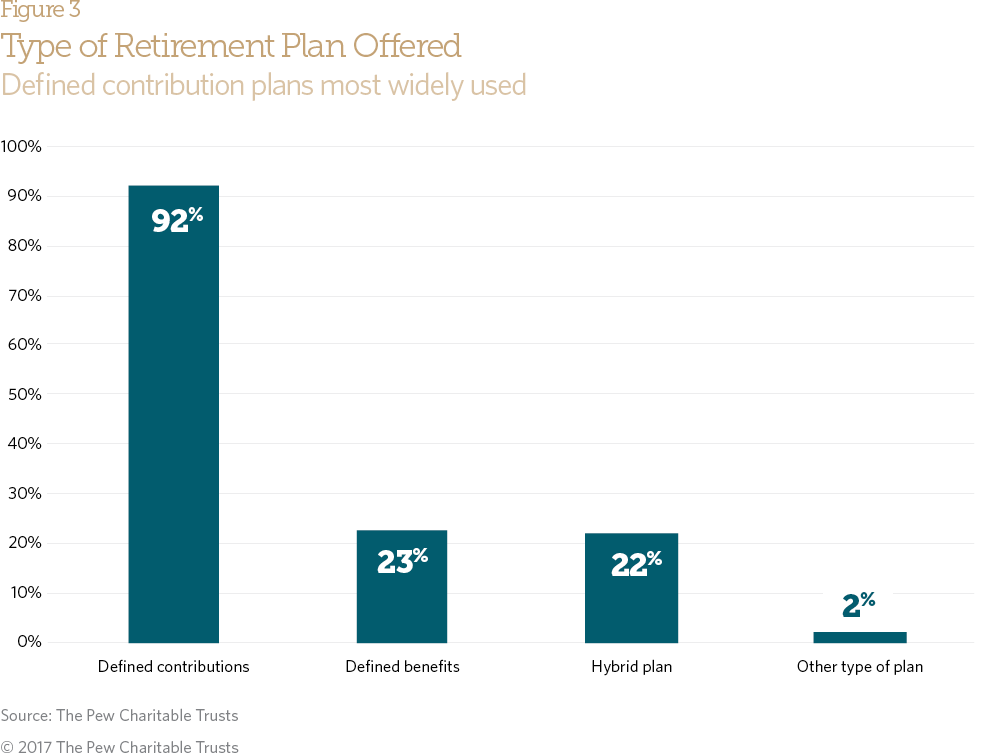

Source: pewtrusts.org

Source: pewtrusts.org

This means that the same $1 million portfolio. This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. Thus, the 3% works as a multiplier. Choose from six contribution rates. Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service.

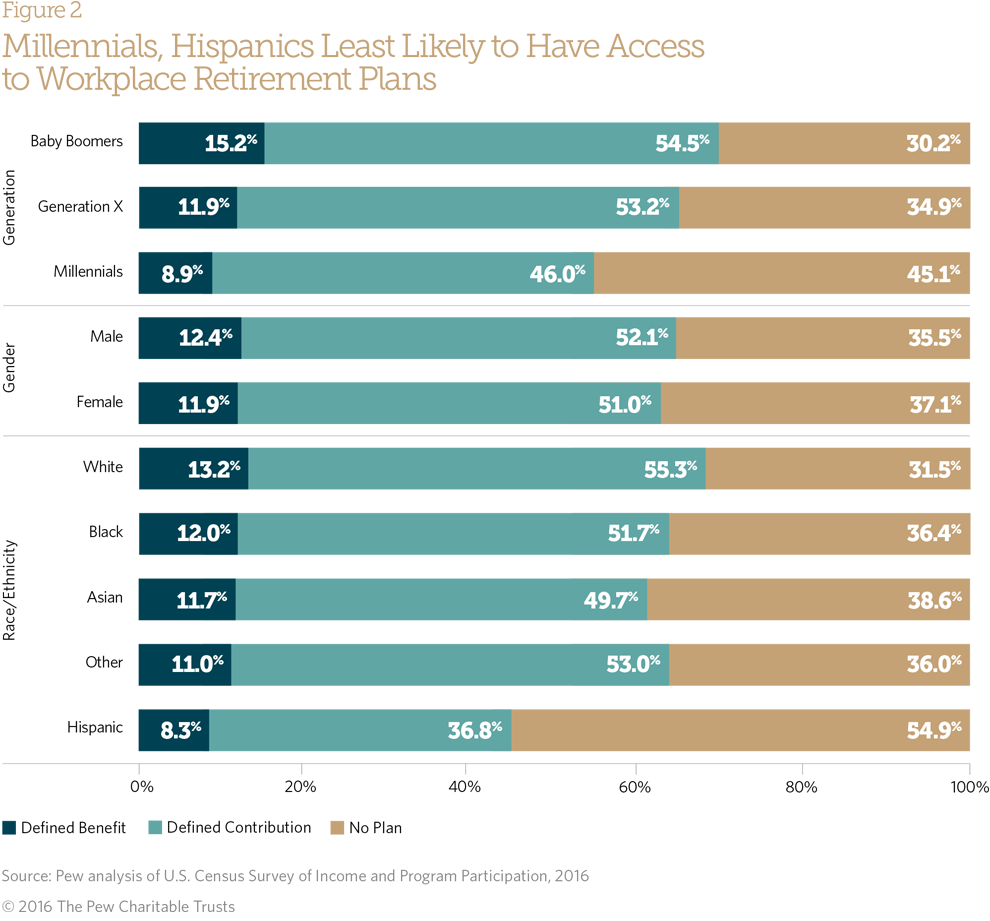

Source: pewtrusts.org

Source: pewtrusts.org

As an employer, you can contribute up to 25% of your compensation. This means that the same $1 million portfolio. What percent of my salary do i need in retirement? That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate. As an employer, you can contribute up to 25% of your compensation.

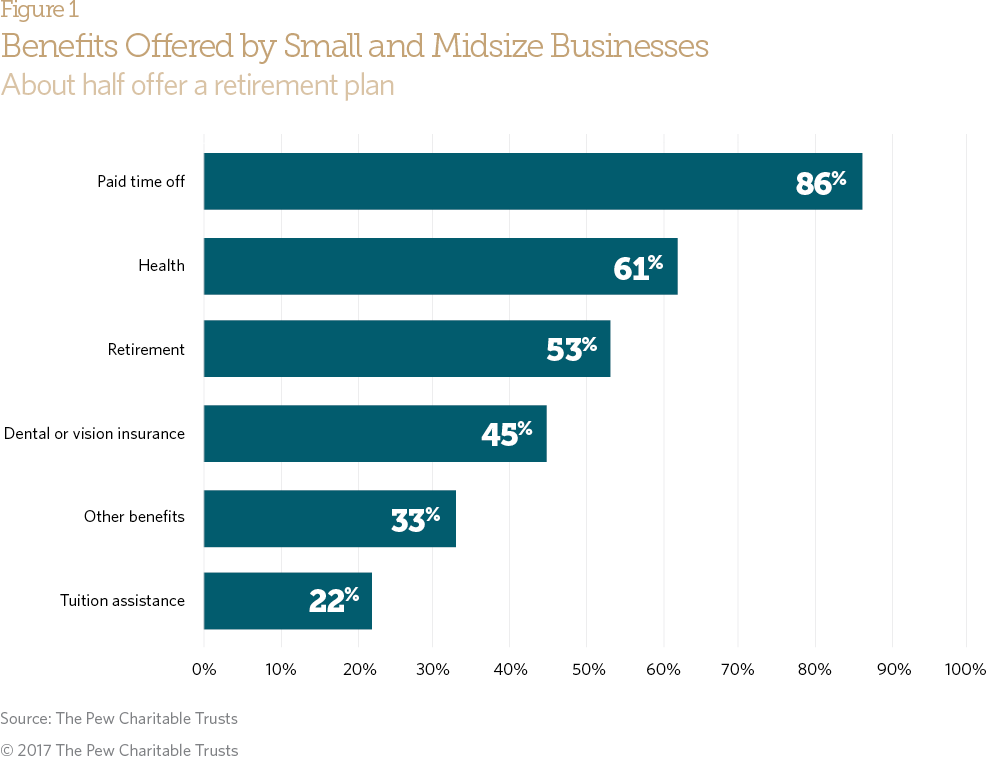

Source: pewtrusts.org

Source: pewtrusts.org

This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. That�s partly why today�s financial advisors are telling people to plan for a 3% withdrawal rate. As an employer, you can contribute up to 25% of your compensation. Choose from six contribution rates. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe.

Source: annuity.org

Source: annuity.org

Teachers’ retirement system (trs) plan 3. Choose from six contribution rates. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. You select this percentage when you begin employment. 6% up to age 35 7.5% ages 35 through 44 8.5% age 45 and older.

Source: oxfordclub.com

Source: oxfordclub.com

If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older Thus, the 3% works as a multiplier. This means that the same $1 million portfolio. Teachers’ retirement system (trs) plan 3.

Source: researchgate.net

Source: researchgate.net

You select this percentage when you begin employment. Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older You select this percentage when you begin employment. Under this plan, the percentage of salary paid to the employee after retirement is determined by the retiree�s number of years of employment increased by 3% for every year of service. These next sections discuss your contribution rate options and the investment programs available to you.

Source: pewtrusts.org

Source: pewtrusts.org

If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. If stocks tumble, and you�re forced to withdraw 4% to cover your bills, you�ll still be safe. These next sections discuss your contribution rate options and the investment programs available to you. 5% up to age 35 6% ages 35 through 44 7.5% age 45 and older. More about plan 3 contribution rates.

Source: pewtrusts.org

Source: pewtrusts.org

This advice follows the idea of hope for the best, plan for the worst. plan your necessary expenses at 3%. More about plan 3 contribution rates. Choose from six contribution rates. Member contribution rate options option a 5% all ages option b 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older These next sections discuss your contribution rate options and the investment programs available to you.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement plan 3 percent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.