Your Retirement plan 2005 images are available. Retirement plan 2005 are a topic that is being searched for and liked by netizens now. You can Download the Retirement plan 2005 files here. Find and Download all free photos and vectors.

If you’re looking for retirement plan 2005 images information related to the retirement plan 2005 keyword, you have come to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Retirement Plan 2005. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from.

Employer Retirement Plan Offerings Download Table From researchgate.net

Employer Retirement Plan Offerings Download Table From researchgate.net

As of january 1, 2005 a. Amended and restated trustee retirement plan. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize.

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees.

Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. As of january 1, 2005 a. Amended and restated trustee retirement plan. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees.

Source: formsbank.com

Source: formsbank.com

This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. Amended and restated trustee retirement plan. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. As of january 1, 2005 a.

Source: researchgate.net

Source: researchgate.net

This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. Amended and restated trustee retirement plan. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize.

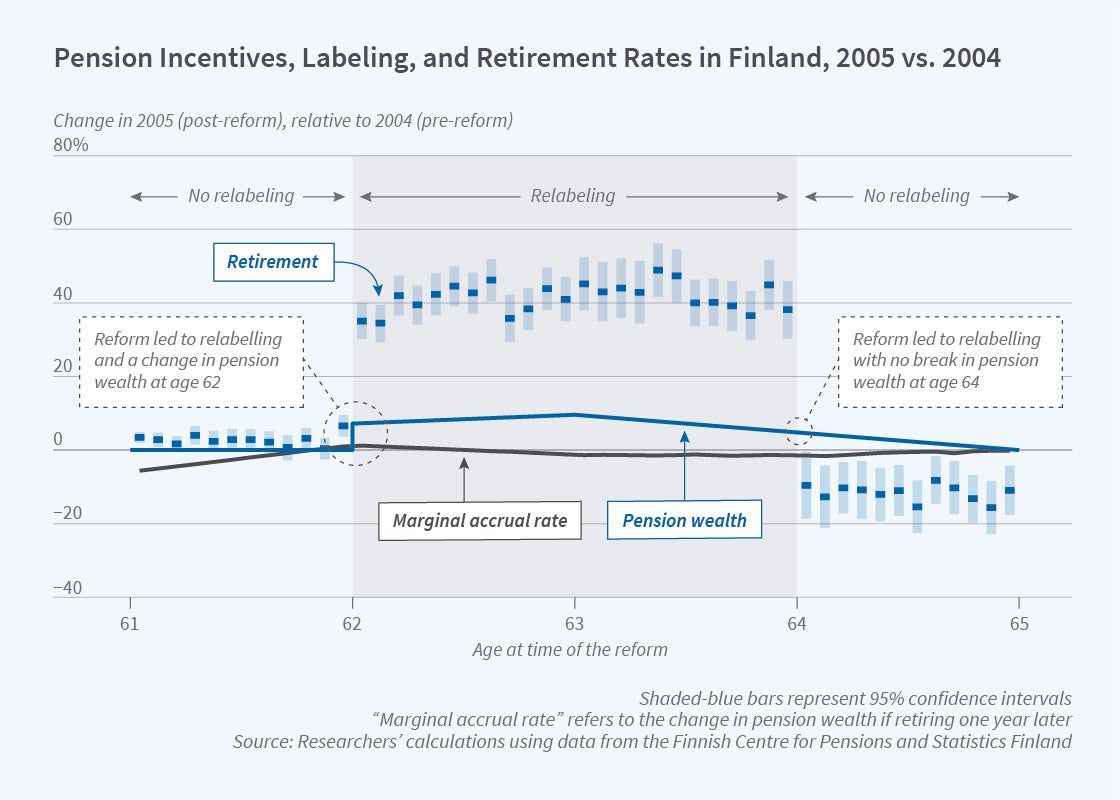

Source: nber.org

Source: nber.org

November 2005 developments 05 january 2006. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from.

Source: slideserve.com

Source: slideserve.com

November 2005 developments 05 january 2006. November 2005 developments 05 january 2006. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. Amended and restated trustee retirement plan. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000.

Source: kenyaplex.com

Source: kenyaplex.com

Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. November 2005 developments 05 january 2006. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. As of january 1, 2005 a.

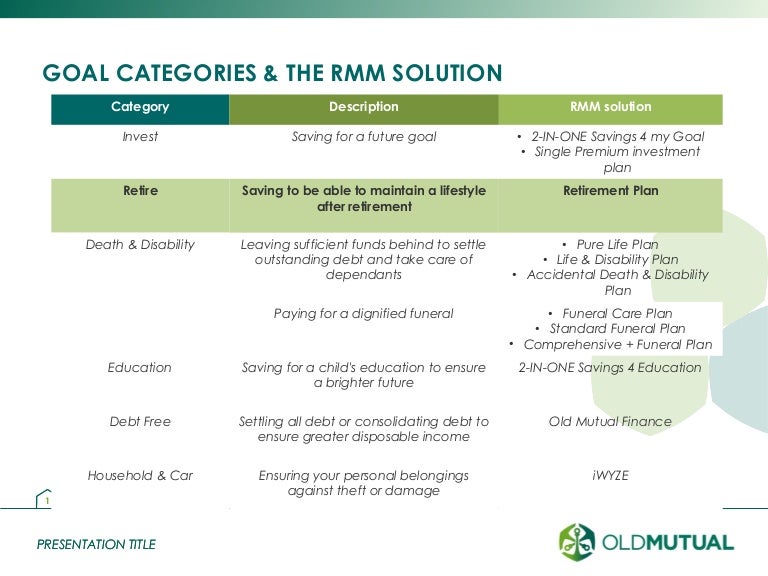

Source: slideshare.net

Source: slideshare.net

November 2005 developments 05 january 2006. Amended and restated trustee retirement plan. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize.

Source: researchgate.net

Source: researchgate.net

Amended and restated trustee retirement plan. November 2005 developments 05 january 2006. As of january 1, 2005 a. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. As of january 1, 2005 a. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from.

Source: slideshare.net

Source: slideshare.net

This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. November 2005 developments 05 january 2006. As of january 1, 2005 a. Amended and restated trustee retirement plan.

Source: researchgate.net

Source: researchgate.net

The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. Amended and restated trustee retirement plan. November 2005 developments 05 january 2006. As of january 1, 2005 a.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. Amended and restated trustee retirement plan. As of january 1, 2005 a. November 2005 developments 05 january 2006.

Source: wealthandfinance.net

Source: wealthandfinance.net

The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. November 2005 developments 05 january 2006. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. Amended and restated trustee retirement plan. As of january 1, 2005 a.

Source: researchgate.net

Source: researchgate.net

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. Amended and restated trustee retirement plan. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees.

Source: clark.com

Source: clark.com

The defined benefit pension world got another blow when international business machines corp., white plains, n.y., announced in december that it was closing its cash balance plan to employees. November 2005 developments 05 january 2006. As of january 1, 2005 a. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. Amended and restated trustee retirement plan.

Source: slideshare.net

Source: slideshare.net

November 2005 developments 05 january 2006. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. Amended and restated trustee retirement plan. November 2005 developments 05 january 2006.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

>the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. >the dollar amount under section 409(o)(1)(c)(ii) for determining the maximum account balance in an employee stock ownership plan subject to a 5 year distribution period is increased from $830,000 to $850,000, while the dollar amount used to determine the lengthening of the 5 year distribution period is increased from $165,000 to $170,000. As of january 1, 2005 a. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. This amended and restated trustee retirement plan (this “plan”) is being adopted by each of the investment companies identified on appendix a hereto (the “trusts”), severally and not jointly, in order to recognize.

Source: researchgate.net

Source: researchgate.net

As of january 1, 2005 a. The limitation on the exclusion for elective deferrals, which applies to 401(k) plans, 403(b) annuities, seps, and the federal government�s thrift savings plan, is increased from. As of january 1, 2005 a. November 2005 developments 05 january 2006. Amended and restated trustee retirement plan.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement plan 2005 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.