Your Retirement of a partner images are ready. Retirement of a partner are a topic that is being searched for and liked by netizens now. You can Download the Retirement of a partner files here. Get all royalty-free vectors.

If you’re searching for retirement of a partner images information linked to the retirement of a partner topic, you have visit the ideal site. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

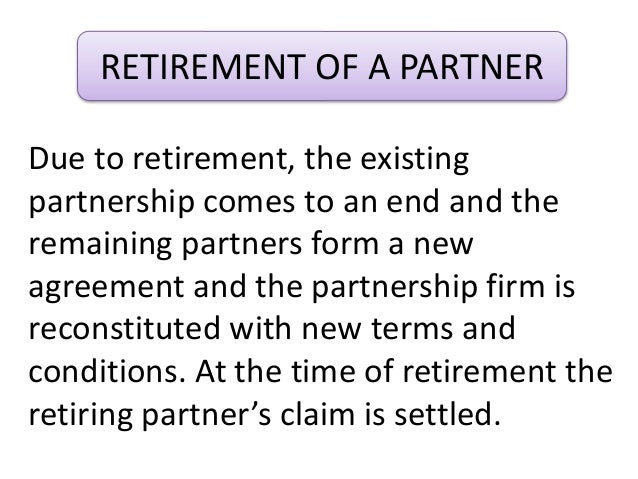

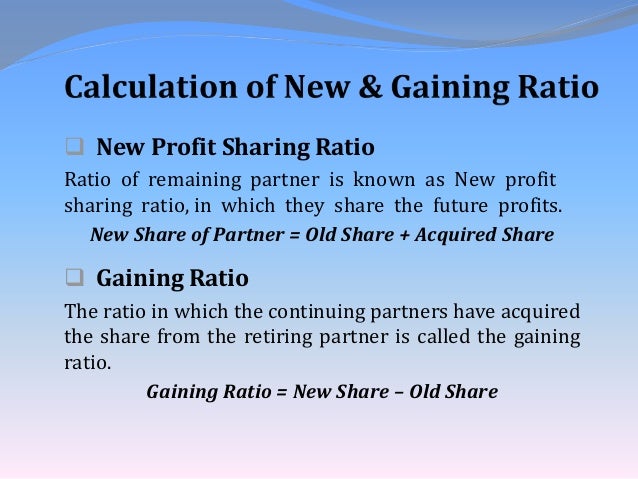

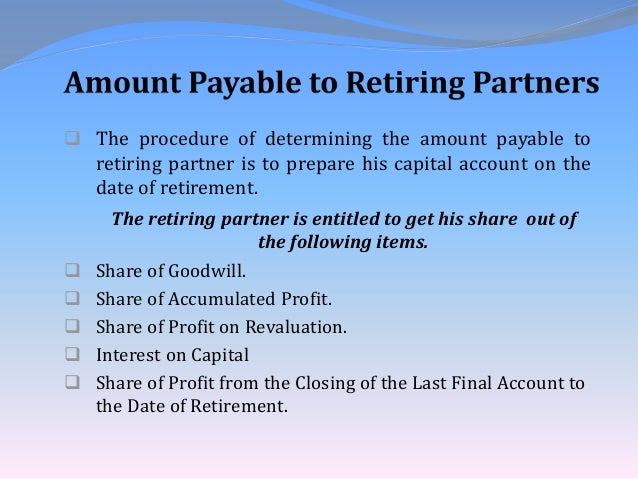

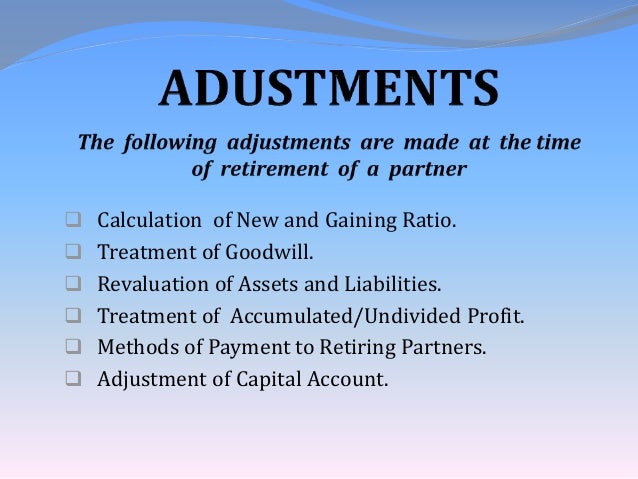

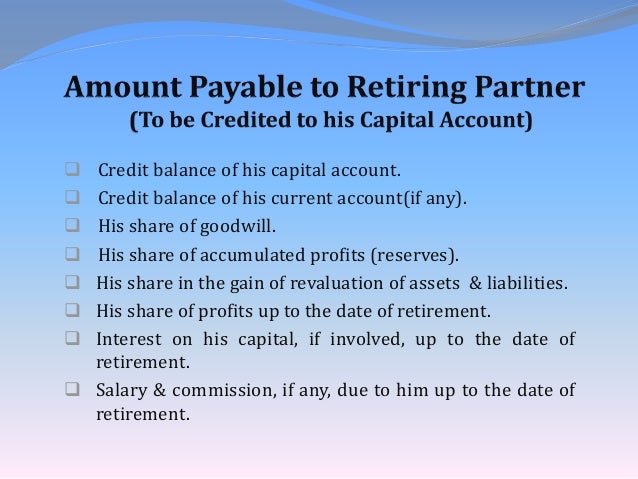

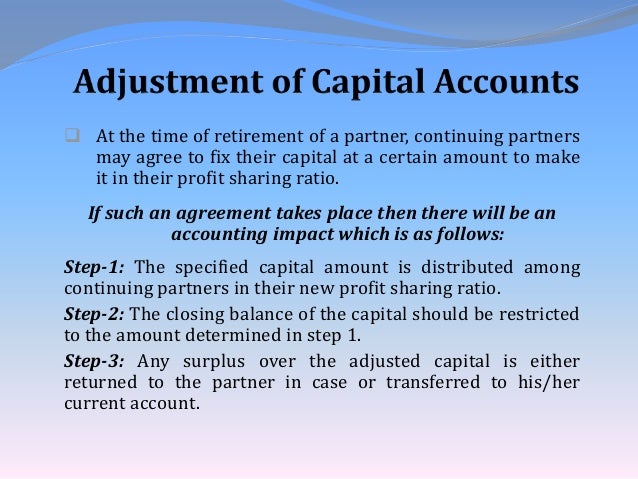

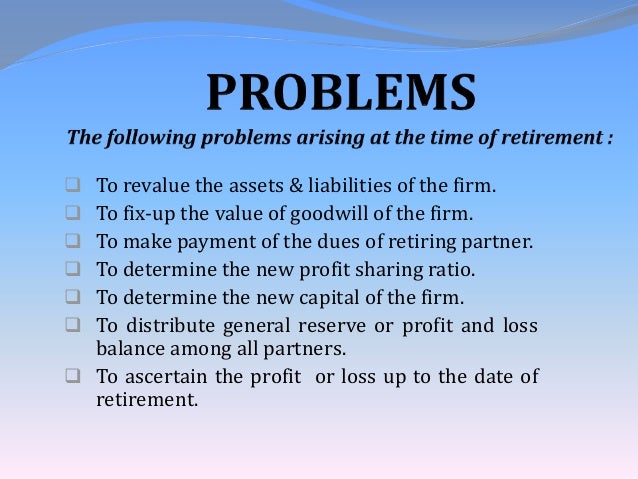

Retirement Of A Partner. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Accountancy 205 get discount coupons for your coaching institute and free study. The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared.

Retirement of Partner 1 (Class 12 Accounts) YouTube From youtube.com

Retirement of Partner 1 (Class 12 Accounts) YouTube From youtube.com

The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. On the amount due from the date of death till the date of final payment. The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared. Accountancy 205 get discount coupons for your coaching institute and free study. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. The payment of the amount of the deceased partner depends on the agreement.

On the amount due from the date of death till the date of final payment.

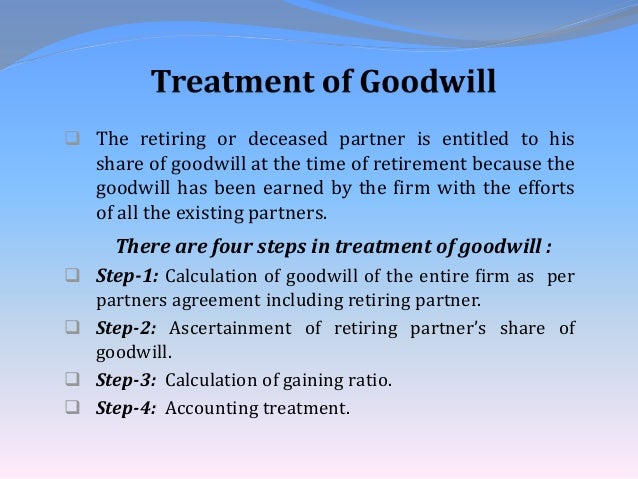

The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. The payment of the amount of the deceased partner depends on the agreement. On the amount due from the date of death till the date of final payment.

Source: slideshare.net

Source: slideshare.net

In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. The payment of the amount of the deceased partner depends on the agreement. The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared.

Source: slideshare.net

Source: slideshare.net

Accountancy 205 get discount coupons for your coaching institute and free study. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. On the amount due from the date of death till the date of final payment. The payment of the amount of the deceased partner depends on the agreement. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner.

Source: slideshare.net

Source: slideshare.net

Let us learn about them. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. Let us learn about them.

Source: slideshare.net

Source: slideshare.net

Let us learn about them. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. On the amount due from the date of death till the date of final payment. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner.

Source: youtube.com

Source: youtube.com

If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Accountancy 205 get discount coupons for your coaching institute and free study. Let us learn about them.

Source: youtube.com

Source: youtube.com

In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Let us learn about them. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Accountancy 205 get discount coupons for your coaching institute and free study.

Source: slideshare.net

Source: slideshare.net

The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. The payment of the amount of the deceased partner depends on the agreement. On the amount due from the date of death till the date of final payment. Let us learn about them.

Source: youtube.com

Source: youtube.com

Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. On the amount due from the date of death till the date of final payment. Let us learn about them. Accountancy 205 get discount coupons for your coaching institute and free study. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner.

Source: youtube.com

Source: youtube.com

Accountancy 205 get discount coupons for your coaching institute and free study. The payment of the amount of the deceased partner depends on the agreement. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. On the amount due from the date of death till the date of final payment.

Source: slideshare.net

Source: slideshare.net

Let us learn about them. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. The payment of the amount of the deceased partner depends on the agreement.

Source: slideshare.net

Source: slideshare.net

In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. Let us learn about them.

Source: slideshare.net

Source: slideshare.net

In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. Accountancy 205 get discount coupons for your coaching institute and free study.

Source: slideshare.net

Source: slideshare.net

Let us learn about them. Let us learn about them. Accountancy 205 get discount coupons for your coaching institute and free study. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business.

Source: youtube.com

Source: youtube.com

On the amount due from the date of death till the date of final payment. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. The payment of the amount of the deceased partner depends on the agreement. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. On the amount due from the date of death till the date of final payment.

Source: youtube.com

Source: youtube.com

The payment of the amount of the deceased partner depends on the agreement. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. Accountancy 205 get discount coupons for your coaching institute and free study. On the amount due from the date of death till the date of final payment.

Source: youtube.com

Source: youtube.com

Let us learn about them. The payment of the amount of the deceased partner depends on the agreement. Accountancy 205 get discount coupons for your coaching institute and free study. If one of the partners decides to leave the firm, the continuing partners can choose to carry on the business. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a.

Source: slideshare.net

Source: slideshare.net

The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. Using this method goodwill is recognized and is recorded either for all partners or alternatively for only the retiring partner. Let us learn about them. The cost of the bonus paid to the retiring partner (15,000) is allocated between the remaining partners. The payment of the amount of the deceased partner depends on the agreement.

Source: tutorstips.com

Source: tutorstips.com

On the amount due from the date of death till the date of final payment. On the amount due from the date of death till the date of final payment. The payment of the amount of the deceased partner depends on the agreement. The retiring partner is paid 90,000 in cash and their capital account of 75,000 is cleared. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement of a partner by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.