Your Retirement distribution code q images are ready in this website. Retirement distribution code q are a topic that is being searched for and liked by netizens today. You can Download the Retirement distribution code q files here. Get all royalty-free images.

If you’re searching for retirement distribution code q images information linked to the retirement distribution code q topic, you have come to the ideal blog. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

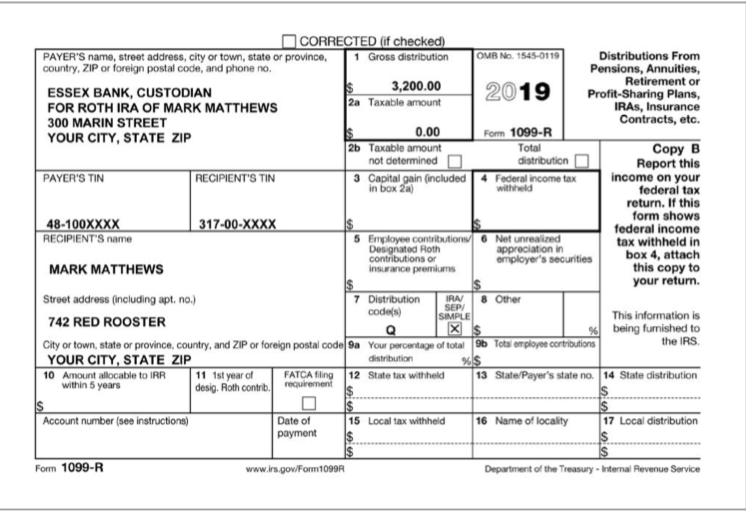

Retirement Distribution Code Q. Get our 401(k) and defined benefits content delivered directly to your. Because the qualified distribution is not included in the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; It will show as nontaxable on your tax return, although it is included in your total income.

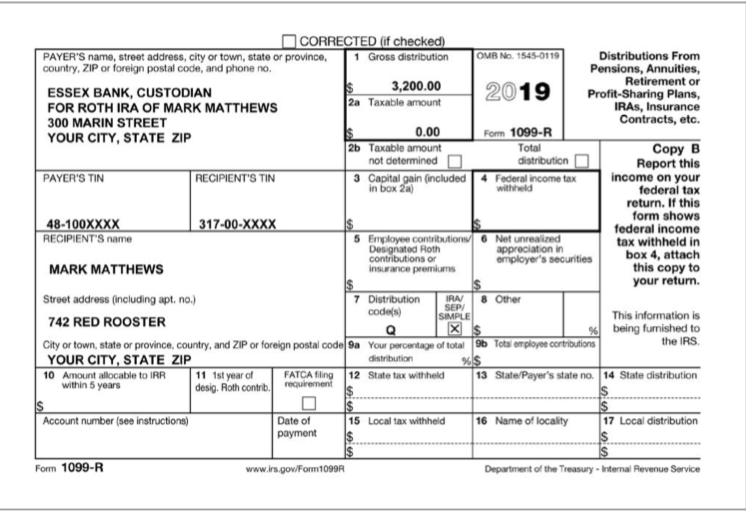

24 . What Is The Taxable Portion Of Mark’s Pension… From chegg.com

24 . What Is The Taxable Portion Of Mark’s Pension… From chegg.com

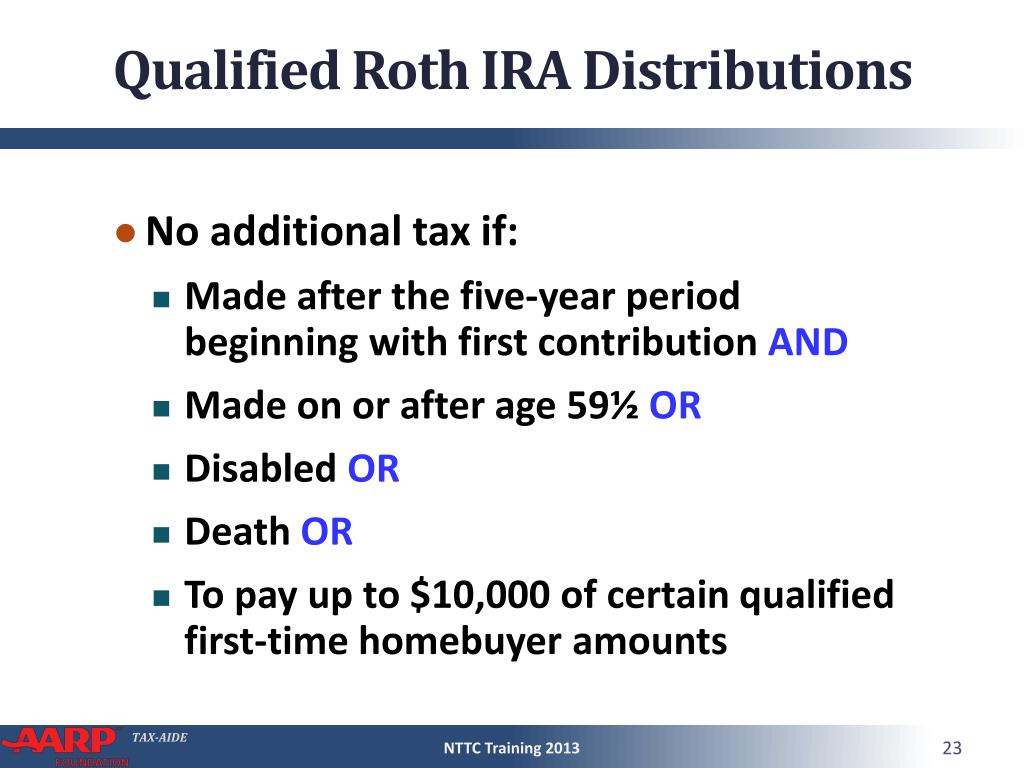

Alternatively, you can take qualified distributions if you are disabled, or because the. It will show as nontaxable on your tax return, although it is included in your total income. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. Get our 401(k) and defined benefits content delivered directly to your. Only the best retirement industry content.

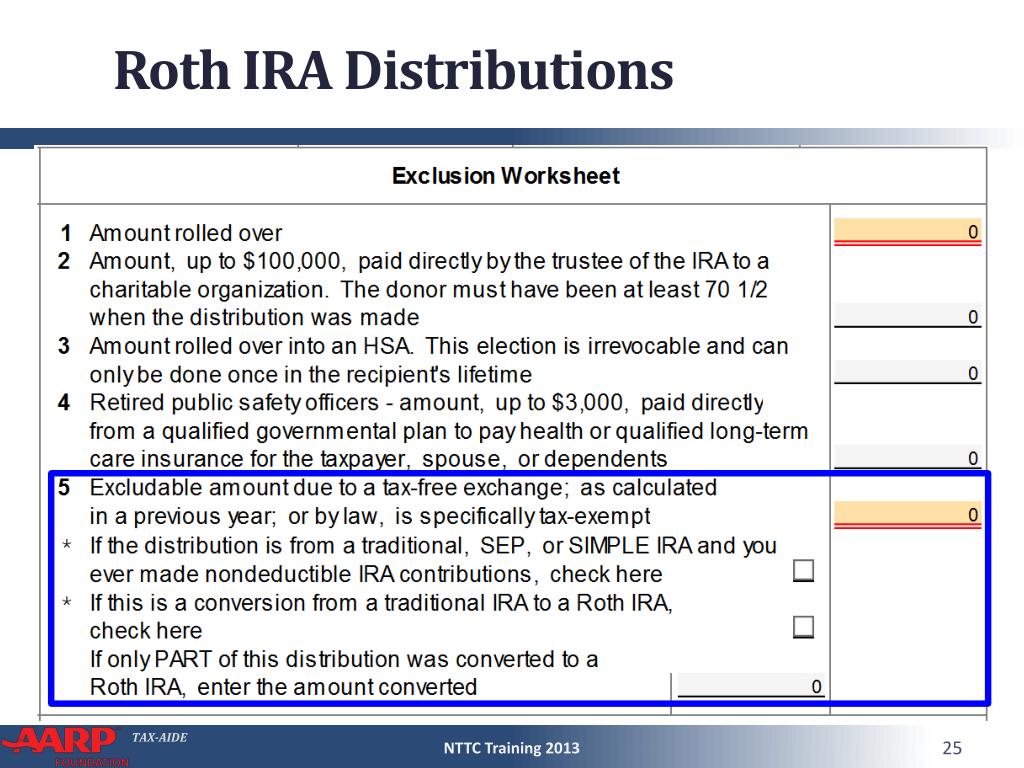

Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions.

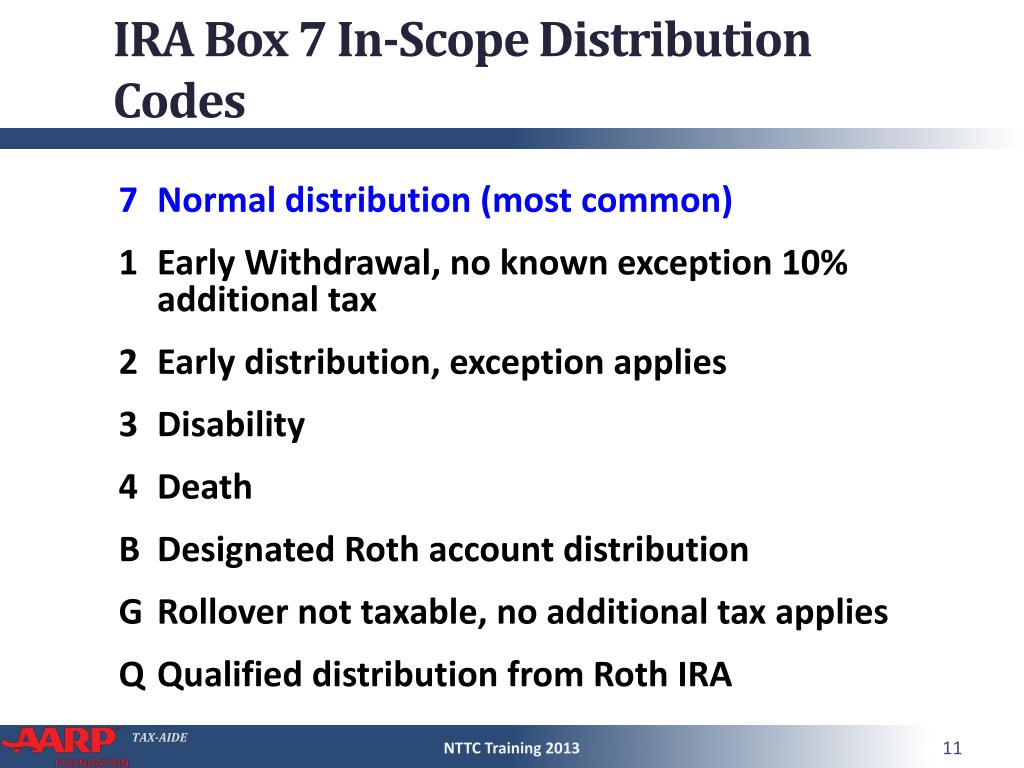

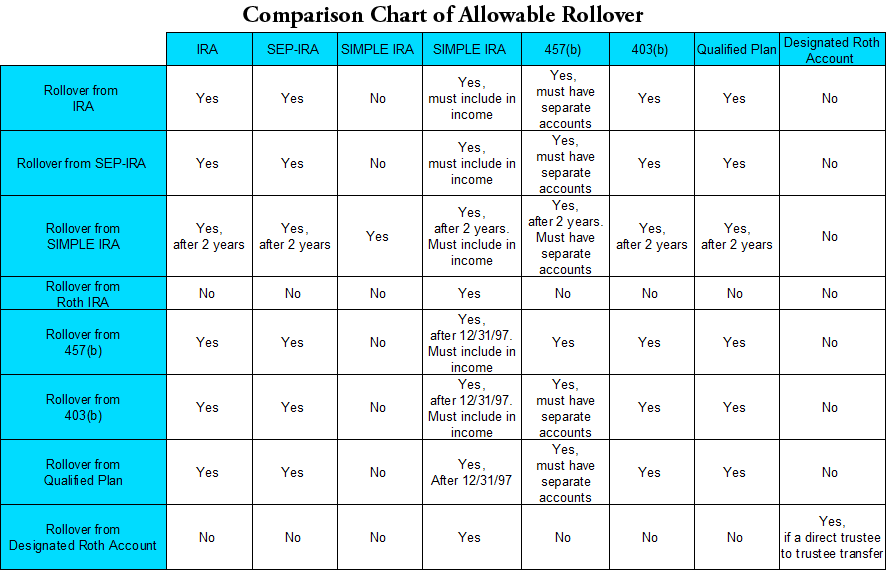

It will show as nontaxable on your tax return, although it is included in your total income. Alternatively, you can take qualified distributions if you are disabled, or because the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; Only the best retirement industry content. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution.

Source: dwc401k.com

It will show as nontaxable on your tax return, although it is included in your total income. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Get our 401(k) and defined benefits content delivered directly to your. Because the qualified distribution is not included in the. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old.

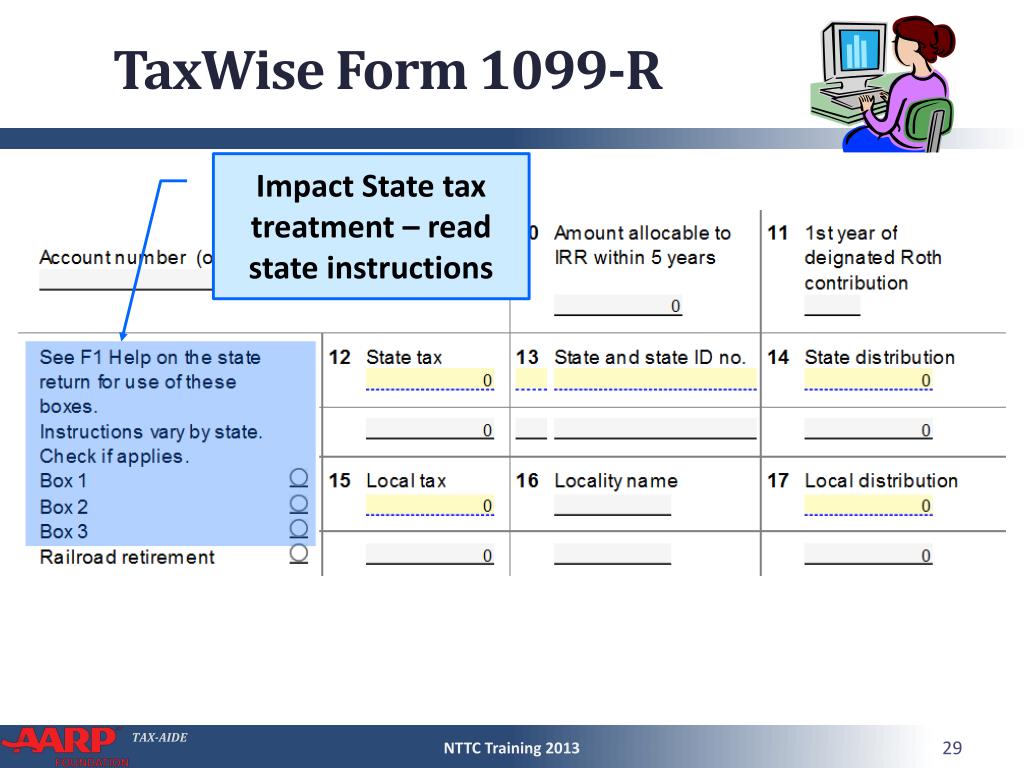

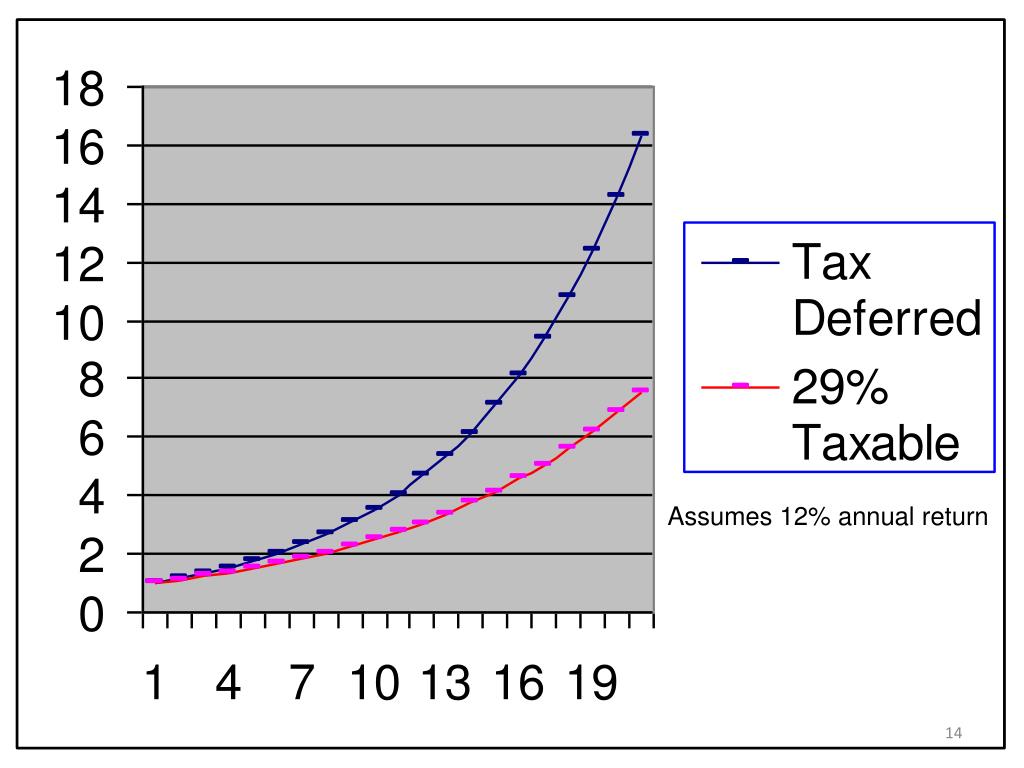

Source: slideserve.com

Source: slideserve.com

It will show as nontaxable on your tax return, although it is included in your total income. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. Because the qualified distribution is not included in the. Only the best retirement industry content.

Source: slideserve.com

Source: slideserve.com

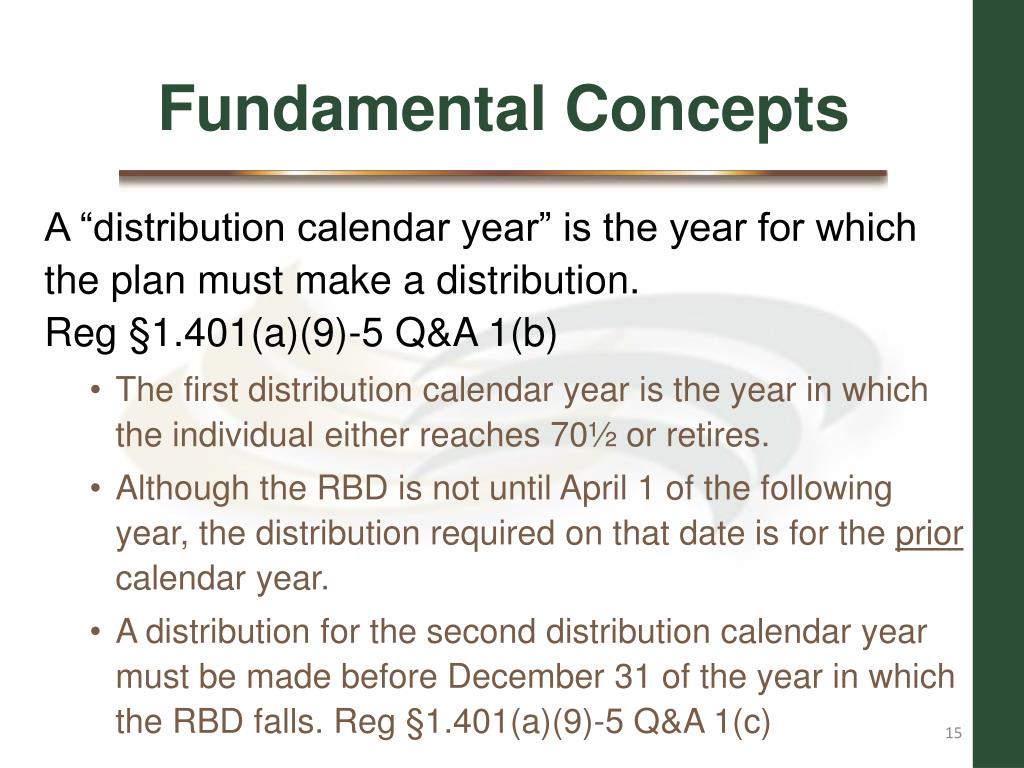

The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Get our 401(k) and defined benefits content delivered directly to your. Alternatively, you can take qualified distributions if you are disabled, or because the. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old.

Source: formsbirds.com

Source: formsbirds.com

Because the qualified distribution is not included in the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; Because the qualified distribution is not included in the. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Alternatively, you can take qualified distributions if you are disabled, or because the.

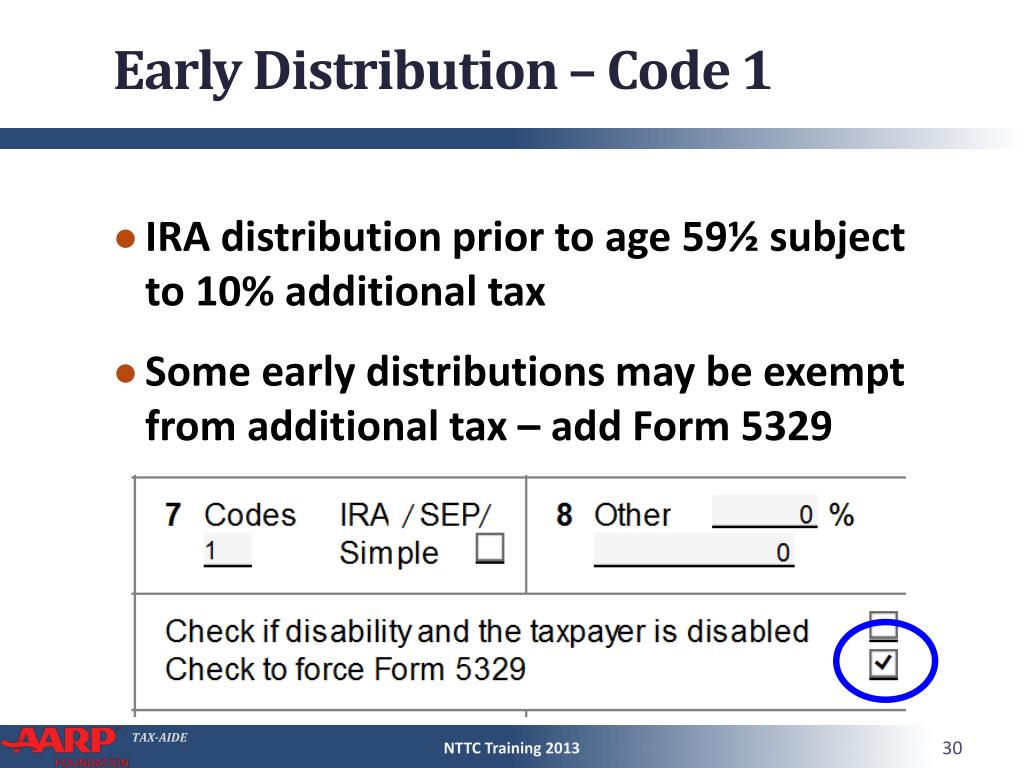

Source: slideserve.com

Source: slideserve.com

Because the qualified distribution is not included in the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Get our 401(k) and defined benefits content delivered directly to your.

Source: slideserve.com

Source: slideserve.com

Only the best retirement industry content. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Get our 401(k) and defined benefits content delivered directly to your. Only the best retirement industry content. Because the qualified distribution is not included in the.

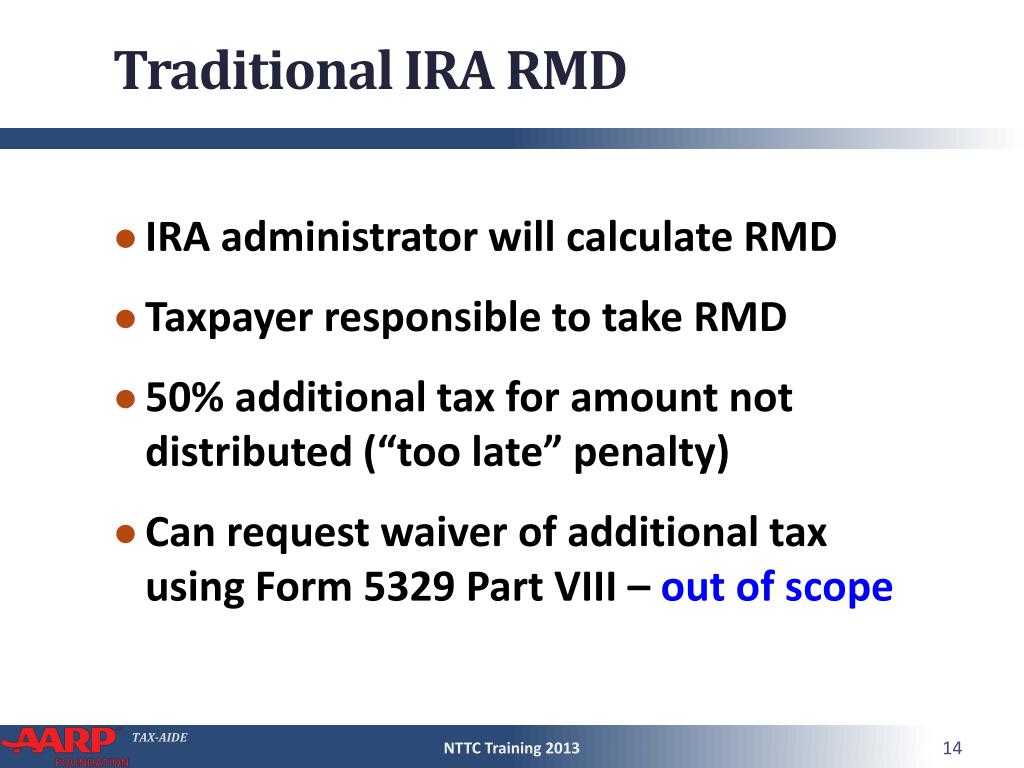

Source: slideserve.com

Source: slideserve.com

Alternatively, you can take qualified distributions if you are disabled, or because the. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. Because the qualified distribution is not included in the.

Source: slideserve.com

Source: slideserve.com

The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Because the qualified distribution is not included in the. Only the best retirement industry content. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old.

Source: slideserve.com

Source: slideserve.com

It will show as nontaxable on your tax return, although it is included in your total income. Because the qualified distribution is not included in the. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank;

Source: oklahoma.gov

Source: oklahoma.gov

The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Get our 401(k) and defined benefits content delivered directly to your. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. It will show as nontaxable on your tax return, although it is included in your total income.

Source: slideserve.com

Source: slideserve.com

This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. It will show as nontaxable on your tax return, although it is included in your total income. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Alternatively, you can take qualified distributions if you are disabled, or because the.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Only the best retirement industry content. Alternatively, you can take qualified distributions if you are disabled, or because the. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank;

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

Only the best retirement industry content. Because the qualified distribution is not included in the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution.

Source: slideserve.com

Source: slideserve.com

You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Because the qualified distribution is not included in the. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Alternatively, you can take qualified distributions if you are disabled, or because the.

Source: slideserve.com

Source: slideserve.com

Alternatively, you can take qualified distributions if you are disabled, or because the. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; Get our 401(k) and defined benefits content delivered directly to your. Alternatively, you can take qualified distributions if you are disabled, or because the.

Source: dwc401k.com

Alternatively, you can take qualified distributions if you are disabled, or because the. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions. Get our 401(k) and defined benefits content delivered directly to your. Only the best retirement industry content.

Source: dwc401k.com

The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. Get our 401(k) and defined benefits content delivered directly to your. The following chart provides the distribution codes for box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. This means that at the time you withdrew money, your roth ira had been open for at least five years, and you were at least 59.5 years old. It will show as nontaxable on your tax return, although it is included in your total income.

Source: chegg.com

Source: chegg.com

Only the best retirement industry content. Alternatively, you can take qualified distributions if you are disabled, or because the. You may look at your form 1040 and verify, line 15a will include distribution, but line 15b will be blank; It will show as nontaxable on your tax return, although it is included in your total income. Therefore, this distribution is not reported on form 8606, which reports nonqualified distributions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement distribution code q by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.