Your Retirement calculator 401k images are ready. Retirement calculator 401k are a topic that is being searched for and liked by netizens now. You can Get the Retirement calculator 401k files here. Download all free images.

If you’re looking for retirement calculator 401k images information linked to the retirement calculator 401k keyword, you have visit the right site. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

Retirement Calculator 401k. Even without matching, the 401(k) can still make financial sense because of its tax benefits. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching.

Download 401k Calculator Excel Template ExcelDataPro From exceldatapro.com

Download 401k Calculator Excel Template ExcelDataPro From exceldatapro.com

A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. There was a change in regulation in 1978 that affects retirement plans. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since.

The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since.

So if you retire at age 65, your last contribution occurs when you are actually 64. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. So if you retire at age 65, your last contribution occurs when you are actually 64. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. There was a change in regulation in 1978 that affects retirement plans.

Source: db-excel.com

Source: db-excel.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. Even without matching, the 401(k) can still make financial sense because of its tax benefits.

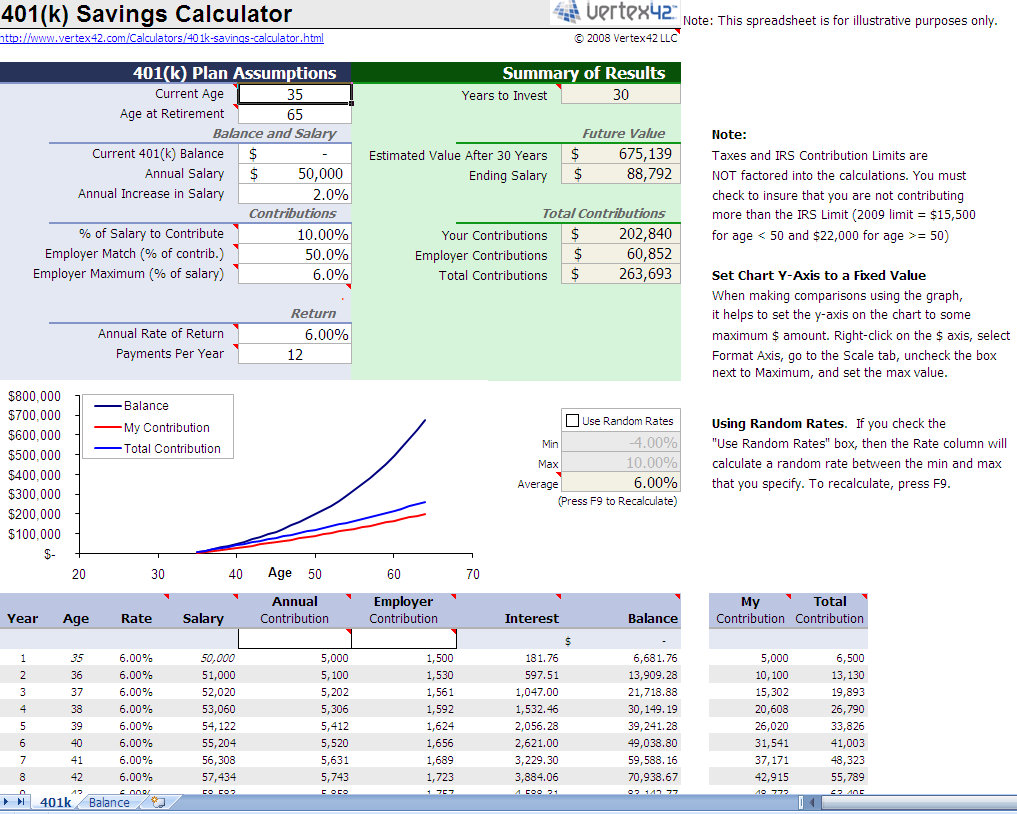

Source: vertex42.com

Source: vertex42.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). So if you retire at age 65, your last contribution occurs when you are actually 64. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. Even without matching, the 401(k) can still make financial sense because of its tax benefits.

Source: ourdebtfreelives.com

Source: ourdebtfreelives.com

Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. There was a change in regulation in 1978 that affects retirement plans. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. So if you retire at age 65, your last contribution occurs when you are actually 64.

Source: myexceltemplates.com

Source: myexceltemplates.com

401k plans have tax benefits and are classified as defined contribution plans. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. Even without matching, the 401(k) can still make financial sense because of its tax benefits. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. So if you retire at age 65, your last contribution occurs when you are actually 64.

Source: formsbirds.com

Source: formsbirds.com

A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. Even without matching, the 401(k) can still make financial sense because of its tax benefits. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. So if you retire at age 65, your last contribution occurs when you are actually 64. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

Source: formsbirds.com

Source: formsbirds.com

Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. Nerdwallet’s 401(k) retirement calculator estimates what. There was a change in regulation in 1978 that affects retirement plans.

Source: exceldatapro.com

Source: exceldatapro.com

To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. So if you retire at age 65, your last contribution occurs when you are actually 64. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). 401k plans have tax benefits and are classified as defined contribution plans. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

Source: sampletemplates.com

Source: sampletemplates.com

Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. 401k plans have tax benefits and are classified as defined contribution plans. There was a change in regulation in 1978 that affects retirement plans. Nerdwallet’s 401(k) retirement calculator estimates what. Even without matching, the 401(k) can still make financial sense because of its tax benefits.

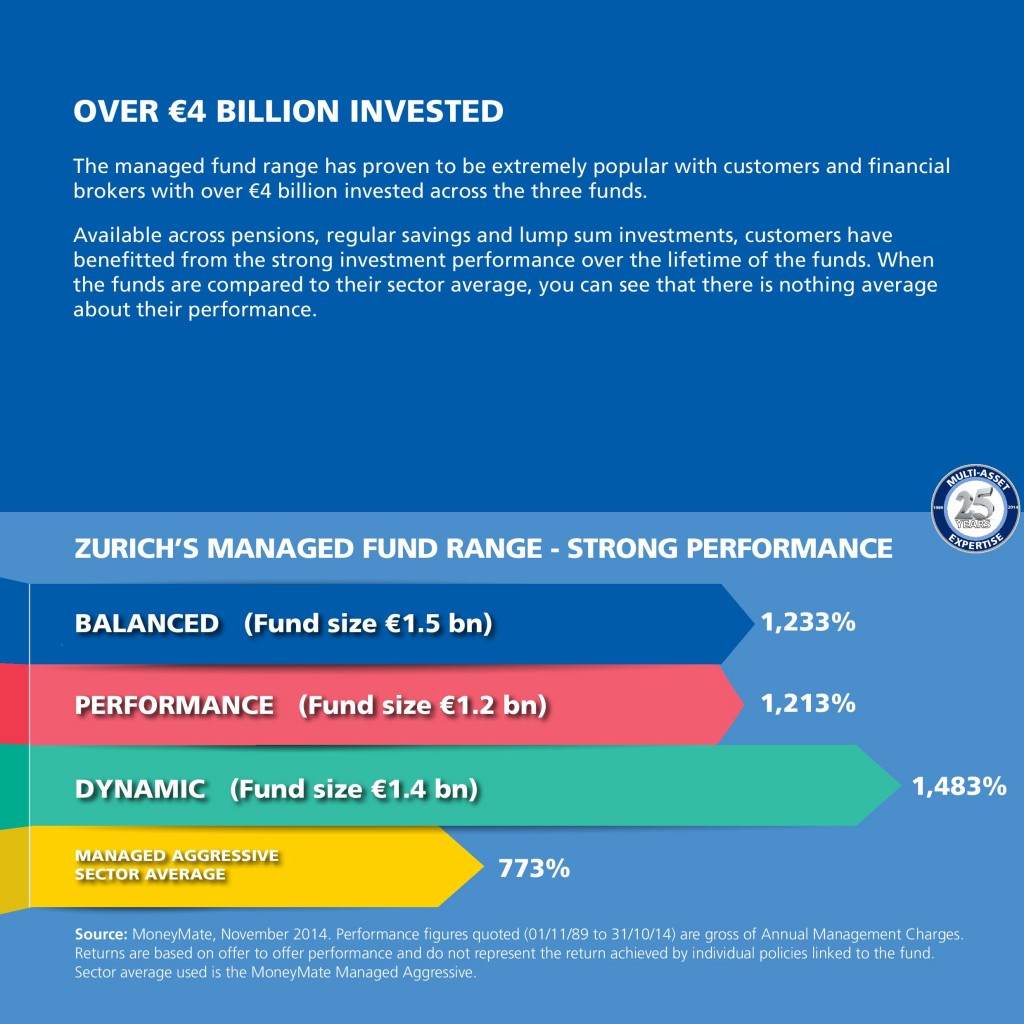

Source: spreadsheet123.com

Source: spreadsheet123.com

A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. So if you retire at age 65, your last contribution occurs when you are actually 64. Nerdwallet’s 401(k) retirement calculator estimates what. There was a change in regulation in 1978 that affects retirement plans. 401k plans have tax benefits and are classified as defined contribution plans.

Source: youtube.com

Source: youtube.com

A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement.

Source: vertex42.com

Source: vertex42.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). There was a change in regulation in 1978 that affects retirement plans. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. Even without matching, the 401(k) can still make financial sense because of its tax benefits. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching.

Source: spreadsheetweb.com

Source: spreadsheetweb.com

There was a change in regulation in 1978 that affects retirement plans. Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. There was a change in regulation in 1978 that affects retirement plans. Nerdwallet’s 401(k) retirement calculator estimates what. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k).

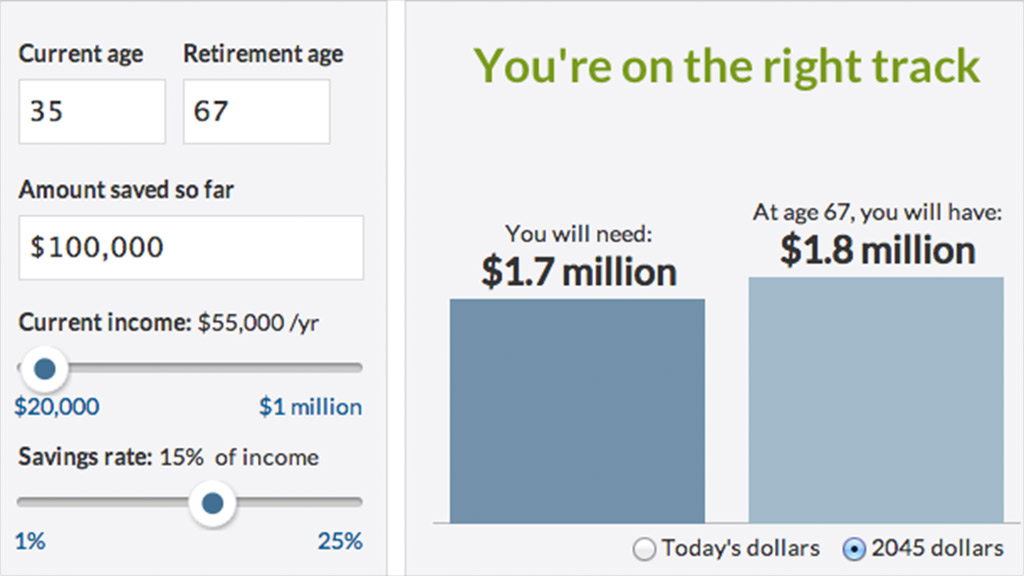

Source: money.cnn.com

Source: money.cnn.com

The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. Even without matching, the 401(k) can still make financial sense because of its tax benefits. 401k plans have tax benefits and are classified as defined contribution plans. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

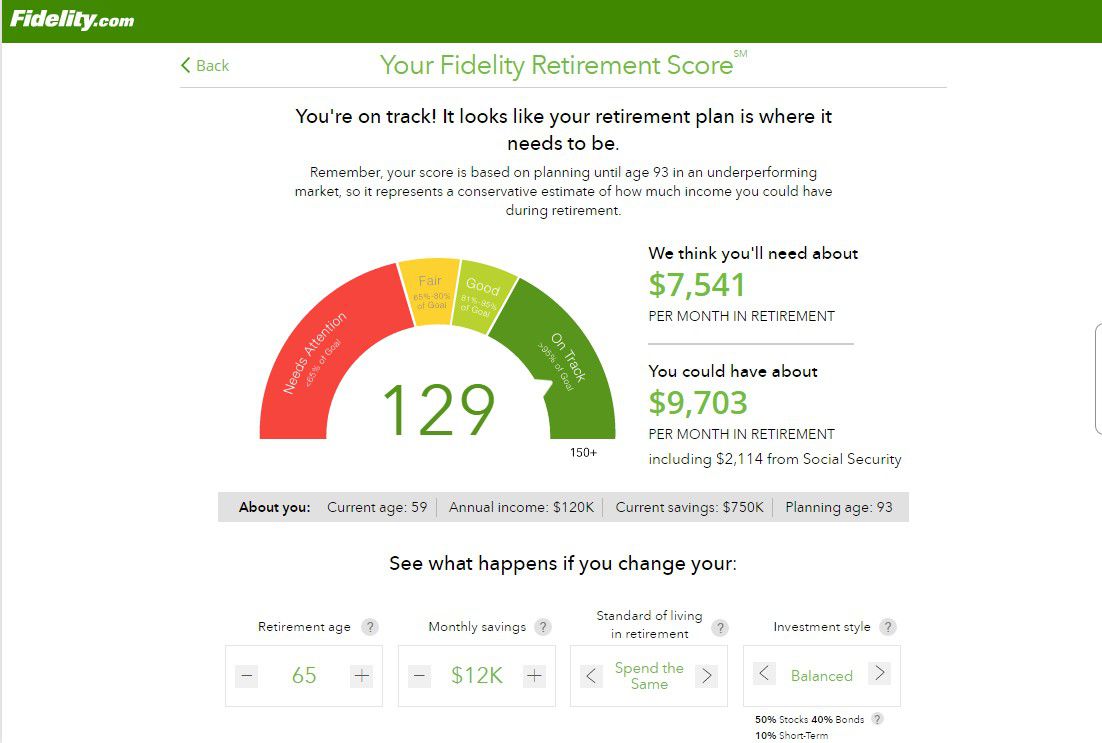

Source: vertex42.com

Source: vertex42.com

Even without matching, the 401(k) can still make financial sense because of its tax benefits. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Even without matching, the 401(k) can still make financial sense because of its tax benefits. 401k plans have tax benefits and are classified as defined contribution plans.

Source: newretirement.com

Source: newretirement.com

Let’s go back to the 401(k) calculator to look at that same example—you make $100,000 and contribute $6,000 annually to your savings—but without any employer matching. So if you retire at age 65, your last contribution occurs when you are actually 64. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Nerdwallet’s 401(k) retirement calculator estimates what. There was a change in regulation in 1978 that affects retirement plans.

Source: homemade.ftempo.com

Source: homemade.ftempo.com

To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. There was a change in regulation in 1978 that affects retirement plans. So if you retire at age 65, your last contribution occurs when you are actually 64. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. A 401(k) account is an easy and effective way to save and earn tax deferred dollars for retirement.

Source: formsbirds.com

Source: formsbirds.com

The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. 401k plans have tax benefits and are classified as defined contribution plans. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). So if you retire at age 65, your last contribution occurs when you are actually 64. There was a change in regulation in 1978 that affects retirement plans.

Source: pinterest.com

Source: pinterest.com

Nerdwallet’s 401(k) retirement calculator estimates what. There was a change in regulation in 1978 that affects retirement plans. The united states congress passed a part of the internal revenue code known as section 401(k) and the name 401k plans has stuck ever since. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). 401k plans have tax benefits and are classified as defined contribution plans.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retirement calculator 401k by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.