Your Retirement 5 percent rule images are available. Retirement 5 percent rule are a topic that is being searched for and liked by netizens now. You can Get the Retirement 5 percent rule files here. Find and Download all royalty-free images.

If you’re searching for retirement 5 percent rule images information linked to the retirement 5 percent rule keyword, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

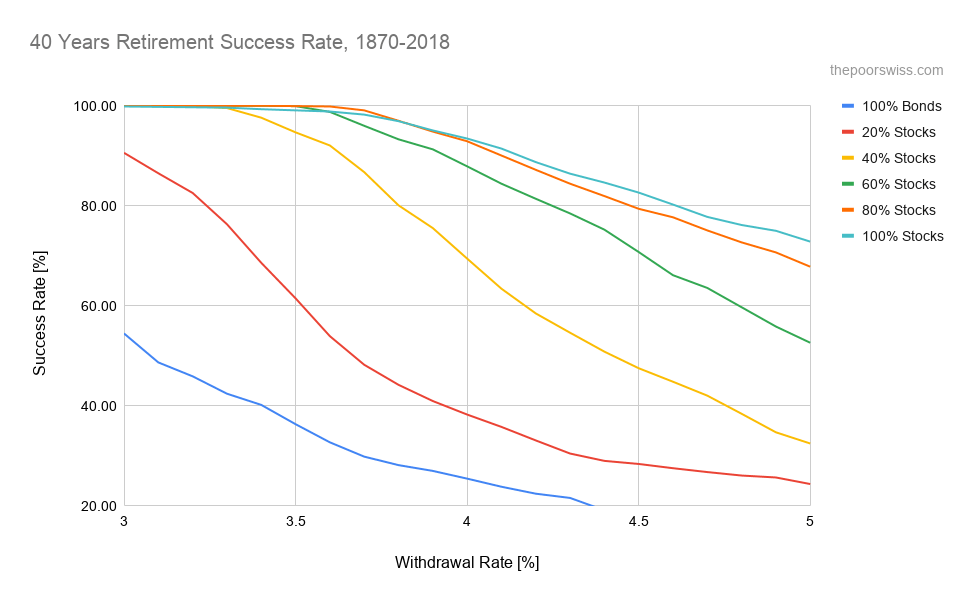

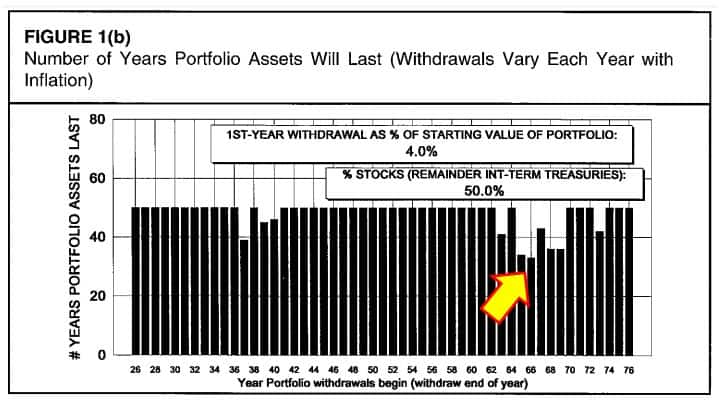

Retirement 5 Percent Rule. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Why did bengen start researching on the 4% withdrawal. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime.

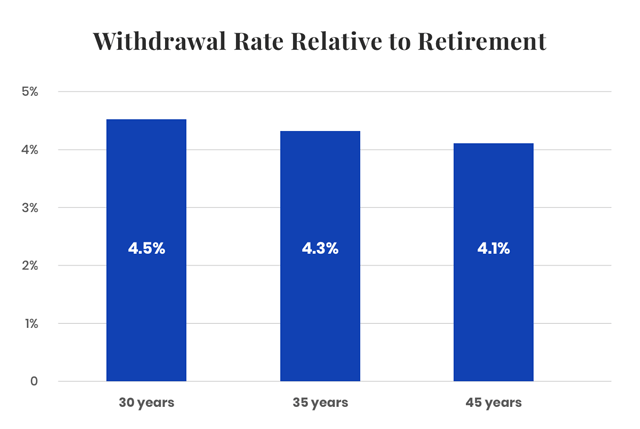

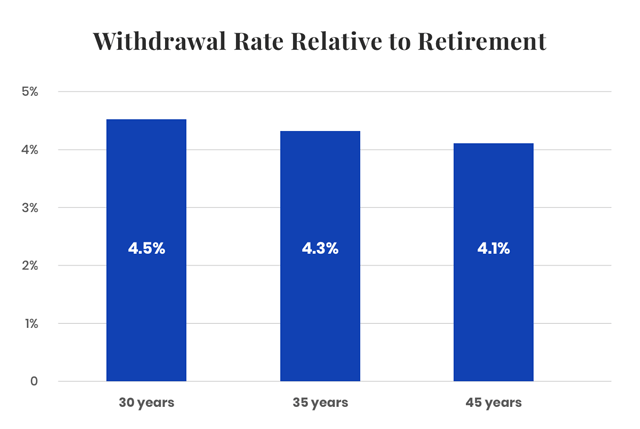

The Four Percent Rule Does It Work or Are There Better Options? From annuity.org

The Four Percent Rule Does It Work or Are There Better Options? From annuity.org

Having an active network in retirement. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years. Retirees often follow what is known as the 4% rule. Why did bengen start researching on the 4% withdrawal. Consider a 5% rule in retirement.

Retirees often follow what is known as the 4% rule.

Retirees often follow what is known as the 4% rule. Why did bengen start researching on the 4% withdrawal. Having an active network in retirement. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player.

An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Retirees often follow what is known as the 4% rule. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective.

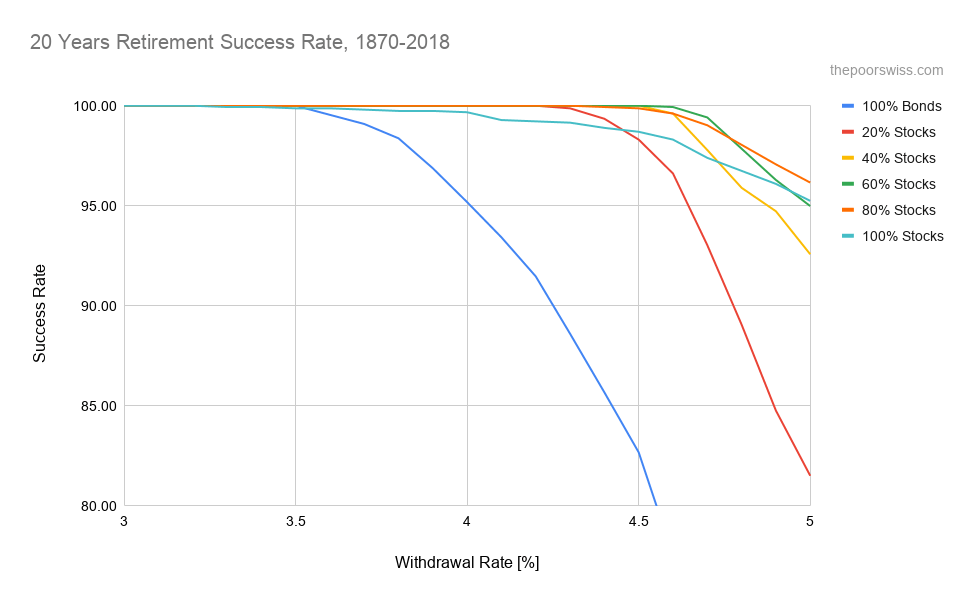

Source: thepoorswiss.com

Source: thepoorswiss.com

Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years.

Source: chicagotribune.com

Source: chicagotribune.com

Having an active network in retirement. An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years. Consider a 5% rule in retirement. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Retirees often follow what is known as the 4% rule.

Source: trustpointinc.com

Source: trustpointinc.com

Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. Consider a 5% rule in retirement. Having an active network in retirement. Retirees often follow what is known as the 4% rule.

Source: annuity.org

Source: annuity.org

How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Having an active network in retirement.

Source: pinterest.com

Source: pinterest.com

Having an active network in retirement. Retirees often follow what is known as the 4% rule. Having an active network in retirement. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years.

Source: retiredinamerica.com

Source: retiredinamerica.com

Retirees often follow what is known as the 4% rule. Retirees often follow what is known as the 4% rule. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully.

Source: pstallworth.com

Source: pstallworth.com

Having an active network in retirement. An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years. Why did bengen start researching on the 4% withdrawal. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. Having an active network in retirement.

Source: moolanomy.com

Source: moolanomy.com

Why did bengen start researching on the 4% withdrawal. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Consider a 5% rule in retirement. Having an active network in retirement. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully.

Source: blog.leveragedgrowth.in

Source: blog.leveragedgrowth.in

Why did bengen start researching on the 4% withdrawal. Retirees often follow what is known as the 4% rule. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective.

Source: blog.moneyfrog.in

Source: blog.moneyfrog.in

Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. Having an active network in retirement. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Consider a 5% rule in retirement.

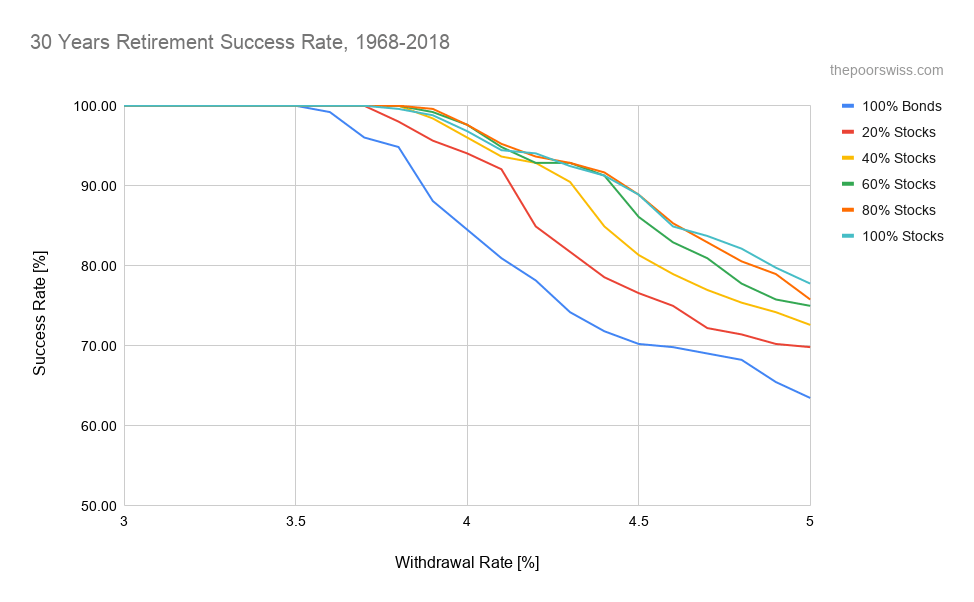

Source: thepoorswiss.com

Source: thepoorswiss.com

Why did bengen start researching on the 4% withdrawal. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Consider a 5% rule in retirement. Having an active network in retirement.

Source: flemingwatson.com

Source: flemingwatson.com

Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Why did bengen start researching on the 4% withdrawal. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. How millennial men and women invest differently if one of those dark scenarios happens but you followed my 5 percent rule, achieving your retirement goals will remain fully. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective.

Source: wesmoss.com

Source: wesmoss.com

An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. Having an active network in retirement. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Retirees often follow what is known as the 4% rule.

Source: thepoorswiss.com

Source: thepoorswiss.com

Why did bengen start researching on the 4% withdrawal. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Why did bengen start researching on the 4% withdrawal. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years.

Source: deguid.blogspot.com

Source: deguid.blogspot.com

Having an active network in retirement. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Why did bengen start researching on the 4% withdrawal. Consider a 5% rule in retirement.

Source: mymoneydesign.com

Source: mymoneydesign.com

Why did bengen start researching on the 4% withdrawal. Retirees often follow what is known as the 4% rule. Having an active network in retirement. Consider a 5% rule in retirement. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player.

Why did bengen start researching on the 4% withdrawal. An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Financial planning throughout your life is required to ensure you have an adequate nest egg and that following the 5% percent rule will be effective. Listen to how the creator of the 4 percent rule applied it for his clients and his own retirement with bill bengen here on player. Established in 1994 by financial advisor william bengen, the rule stipulates that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement 5 percent rule by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.