Your Retirement 4 rule calculator images are available. Retirement 4 rule calculator are a topic that is being searched for and liked by netizens now. You can Get the Retirement 4 rule calculator files here. Download all free photos and vectors.

If you’re looking for retirement 4 rule calculator images information connected with to the retirement 4 rule calculator keyword, you have visit the right blog. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Retirement 4 Rule Calculator. So, if your annual spending is $40,000, you need $1. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. 4% rule of thumb vs. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t.

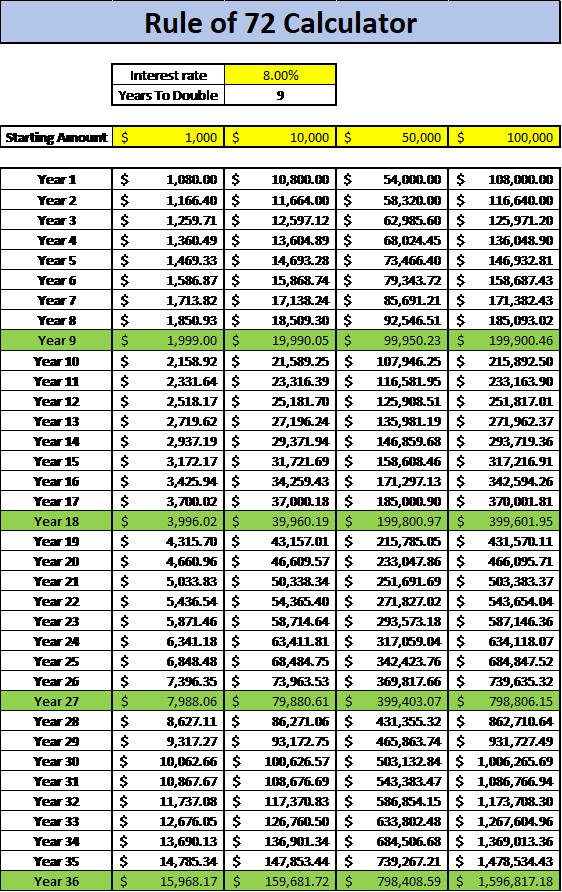

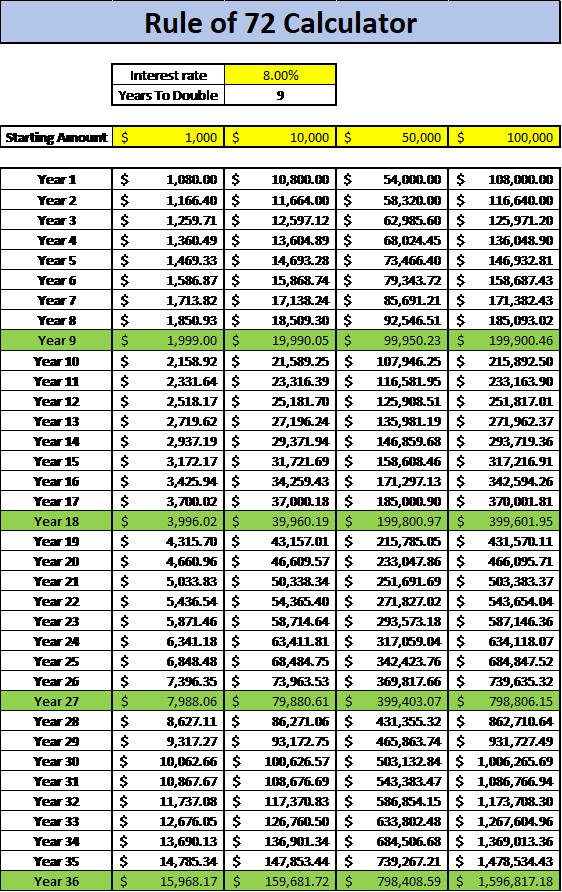

A Convenient Rule of 72 Calculator to Help Investors Plan for Retirement From einvestingforbeginners.com

A Convenient Rule of 72 Calculator to Help Investors Plan for Retirement From einvestingforbeginners.com

If you like this site, email me at stephengower1@gmail.com. 4% rule of thumb vs. The calculations here can be helpful, as can many other retirement calculators out there. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. For this rule, you would either need a low cost of living or additional income to. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement.

Annual expenses x 25 = total retirement portfolio value necessary.

Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. Annual expenses x 25 = total retirement portfolio value necessary. An important note for users (february 2022): If you like this site, email me at stephengower1@gmail.com. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. So, if your annual spending is $40,000, you need $1.

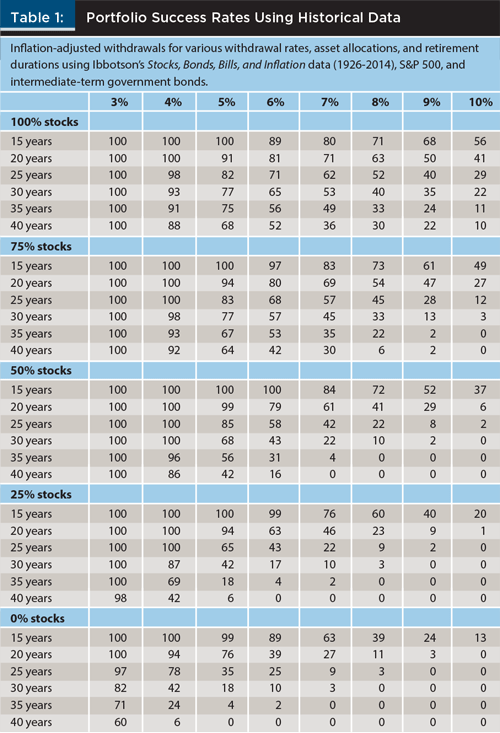

Source: seekingalpha.com

Source: seekingalpha.com

Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. An important note for users (february 2022): For a more robust calculator, use the tool at the bottom of this page. For this rule, you would either need a low cost of living or additional income to.

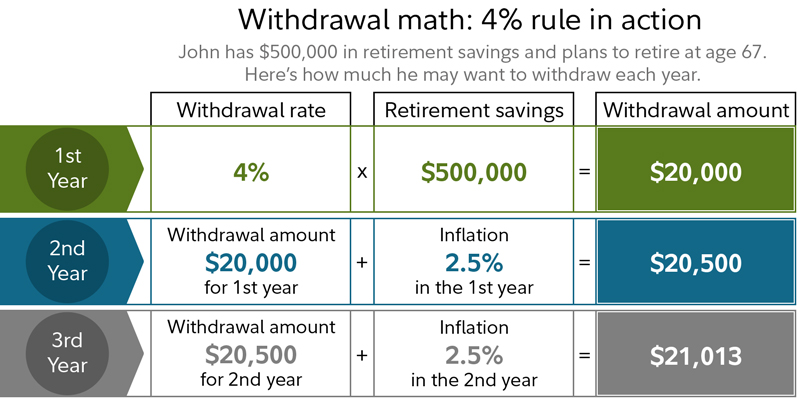

Source: pinterest.com

Source: pinterest.com

The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. I�d love to hear from you. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be.

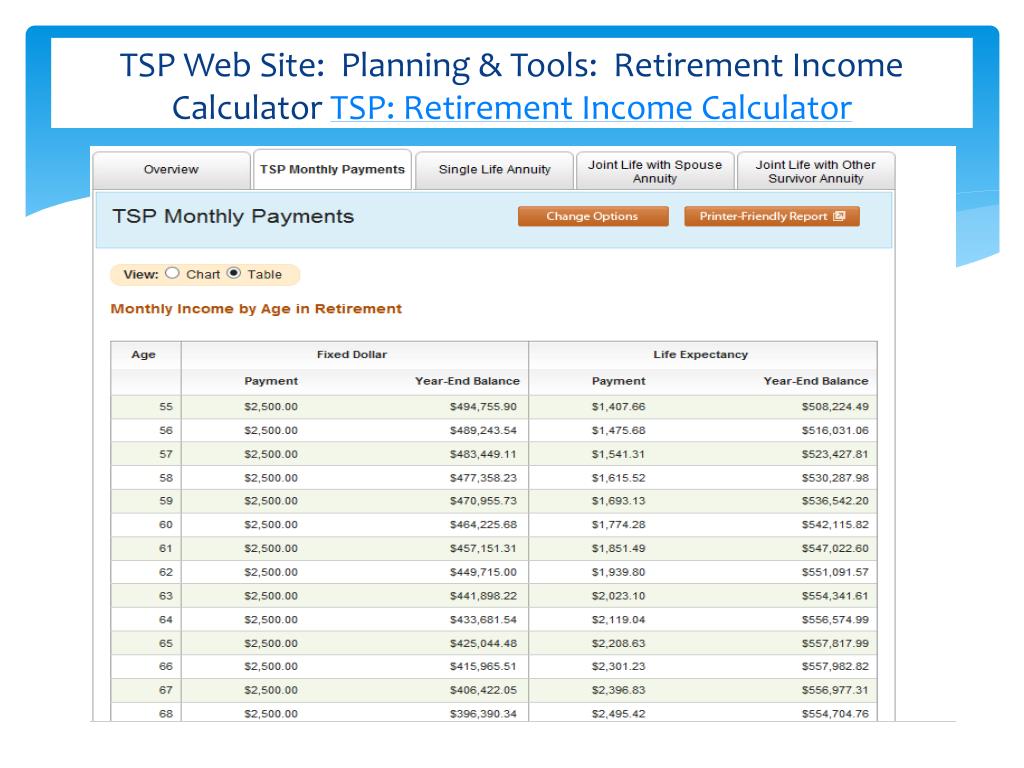

Source: money.cnn.com

Source: money.cnn.com

Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. So, if your annual spending is $40,000, you need $1. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. The calculations here can be helpful, as can many other retirement calculators out there. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month.

Source: hackyourwealth.com

Source: hackyourwealth.com

An important note for users (february 2022): I�d love to hear from you. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. For a more robust calculator, use the tool at the bottom of this page. If you like this site, email me at stephengower1@gmail.com.

Source: wbpay.in

Source: wbpay.in

So, if your annual spending is $40,000, you need $1. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. So, if your annual spending is $40,000, you need $1. I�d love to hear from you.

Source: fidelity.com

Source: fidelity.com

For this rule, you would either need a low cost of living or additional income to. 4% rule of thumb vs. Of course, there are other ways to determine how much to save for retirement. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. An important note for users (february 2022):

Source: weinvestsmart.com

Source: weinvestsmart.com

The calculations here can be helpful, as can many other retirement calculators out there. The calculations here can be helpful, as can many other retirement calculators out there. Of course, there are other ways to determine how much to save for retirement. For this rule, you would either need a low cost of living or additional income to. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule.

Source: seekingalpha.com

Source: seekingalpha.com

Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. I�d love to hear from you. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. Annual expenses x 25 = total retirement portfolio value necessary.

Source: itfdesigncenter.blogspot.com

Source: itfdesigncenter.blogspot.com

I�d love to hear from you. Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement. Of course, there are other ways to determine how much to save for retirement. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement.

Source: theretirementspt.com

Source: theretirementspt.com

Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. For a more robust calculator, use the tool at the bottom of this page. Annual expenses x 25 = total retirement portfolio value necessary. An important note for users (february 2022):

Source: pinterest.com

Source: pinterest.com

With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. An important note for users (february 2022): The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. Annual expenses x 25 = total retirement portfolio value necessary. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t.

Source: theretirementspt.com

Source: theretirementspt.com

Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement. Of course, there are other ways to determine how much to save for retirement. An important note for users (february 2022): With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. Annual expenses x 25 = total retirement portfolio value necessary.

Source: einvestingforbeginners.com

Source: einvestingforbeginners.com

4% rule of thumb vs. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. If you like this site, email me at stephengower1@gmail.com. For a more robust calculator, use the tool at the bottom of this page. So, if your annual spending is $40,000, you need $1.

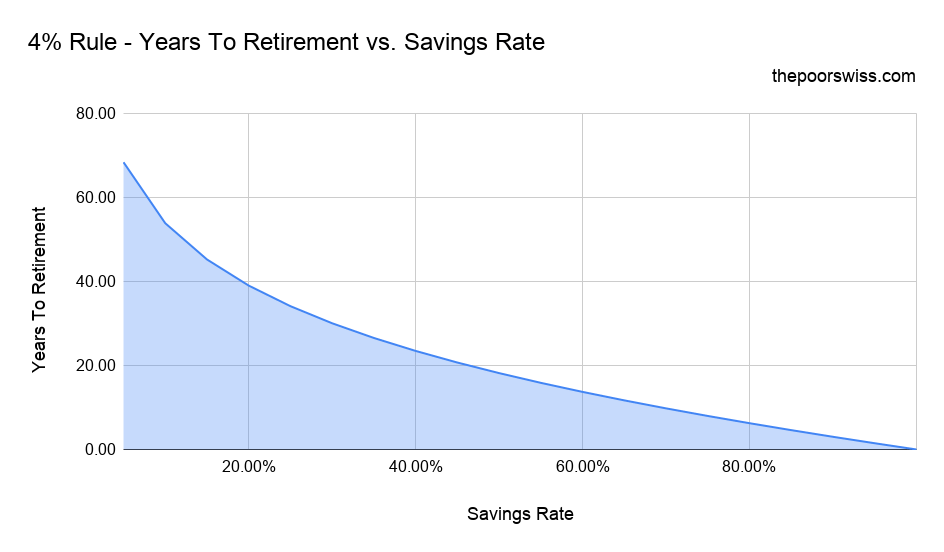

Source: thepoorswiss.com

Source: thepoorswiss.com

Annual expenses x 25 = total retirement portfolio value necessary. If you like this site, email me at stephengower1@gmail.com. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. 4% rule of thumb vs. So, if your annual spending is $40,000, you need $1.

Source: campfirefinance.com

Source: campfirefinance.com

For a more robust calculator, use the tool at the bottom of this page. Annual expenses x 25 = total retirement portfolio value necessary. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement.

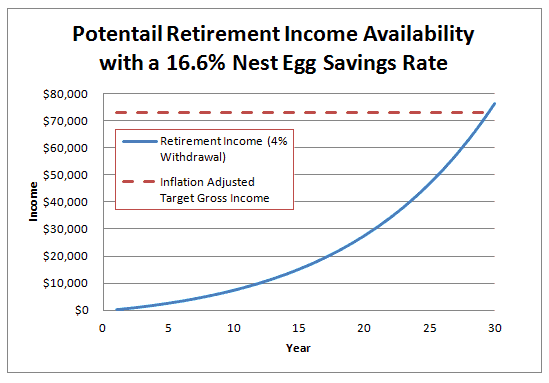

Source: mymoneydesign.com

Source: mymoneydesign.com

If you like this site, email me at stephengower1@gmail.com. For this rule, you would either need a low cost of living or additional income to. If you like this site, email me at stephengower1@gmail.com. Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement. So, if your annual spending is $40,000, you need $1.

Source: pinterest.com

Source: pinterest.com

For this rule, you would either need a low cost of living or additional income to. Or, use this free spreadsheet template in google sheets to see how much money you might withdraw each year in retirement using the 4% rule. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. Perhaps most importantly, the 4% rule is designed to provide an increasing income during retirement. An important note for users (february 2022):

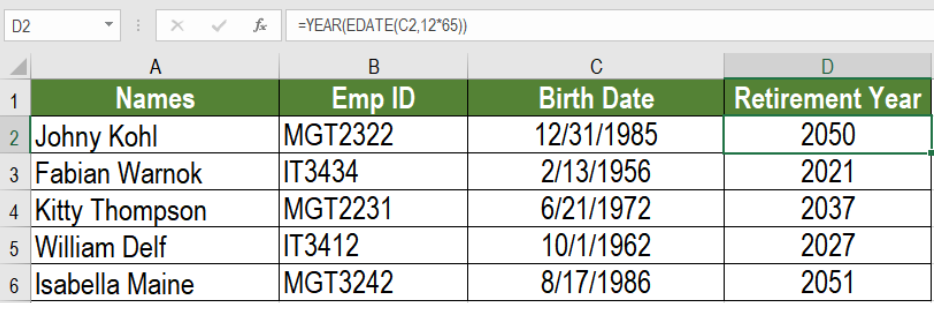

Source: got-it.ai

Source: got-it.ai

With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. 4% rule of thumb vs. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. So, if your annual spending is $40,000, you need $1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement 4 rule calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.