Your Retirement 3 buckets images are available in this site. Retirement 3 buckets are a topic that is being searched for and liked by netizens now. You can Find and Download the Retirement 3 buckets files here. Find and Download all royalty-free photos and vectors.

If you’re searching for retirement 3 buckets images information related to the retirement 3 buckets topic, you have pay a visit to the right blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

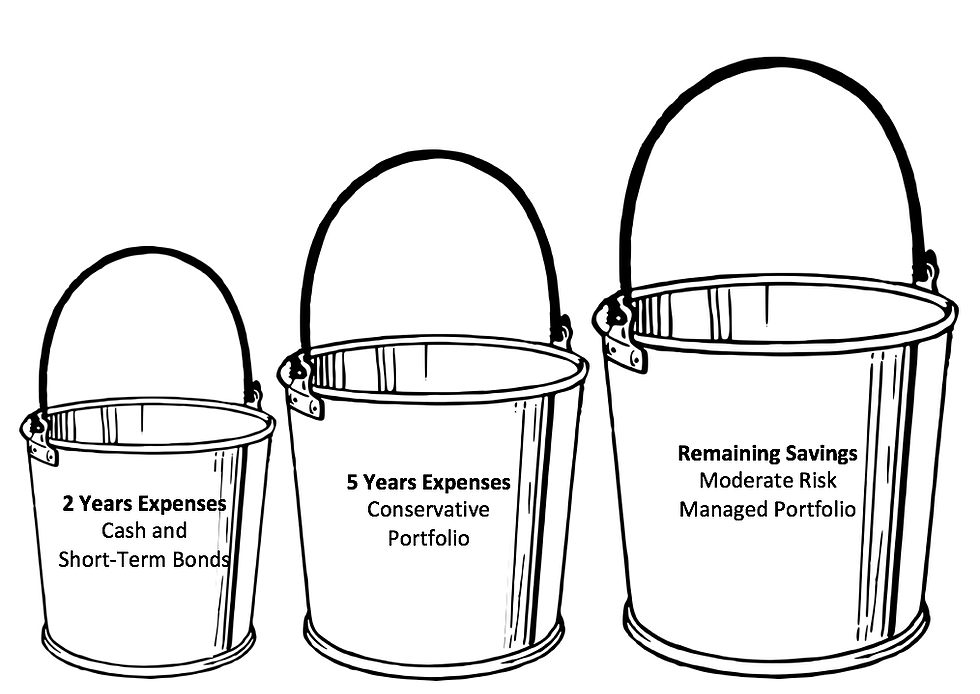

Retirement 3 Buckets. Typically, you’re going to have very low risk assets here. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. 3 buckets of retirement planning.

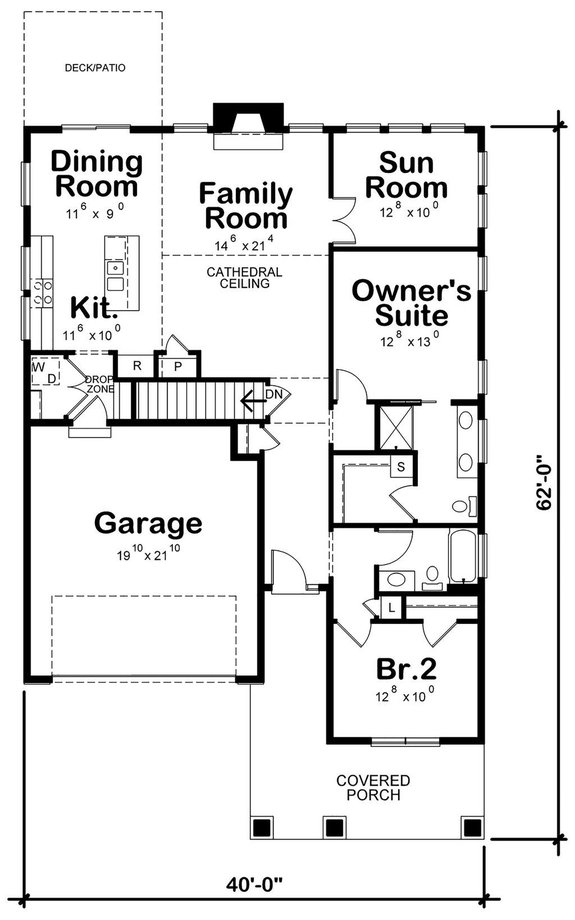

The Three Bucket Concept Jim Smith, Financial Services Professional From jimmsmith.com

The Three Bucket Concept Jim Smith, Financial Services Professional From jimmsmith.com

As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. The 3 buckets strategy is a fairly simple strategy to understand on the surface. For example, you have accumulated $700,000 in savings and then allocated $100,000 for your first 5 years of retirement. As we enter or get closer to retirement, one of the main questions is how should we position our money? The three buckets of money in retirement. 3 buckets of retirement planning.

Typically, you’re going to have very low risk assets here.

I would put $350,000 in bucket 2 and $250,000 in bucket 3. As we enter or get closer to retirement, one of the main questions is how should we position our money? The 3 buckets strategy is a fairly simple strategy to understand on the surface. Let’s say you need $10,000 a month for three years. For example, you have accumulated $700,000 in savings and then allocated $100,000 for your first 5 years of retirement. 3 buckets of retirement planning.

Source: mcbeathfinancialgroup.com

Source: mcbeathfinancialgroup.com

So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. The 3 buckets strategy is a fairly simple strategy to understand on the surface. The three buckets of money in retirement. The bucket 2 is created to be tapped for income when bucket 1 runs out of money. Typically, you’re going to have very low risk assets here.

Source: kiplinger.com

Source: kiplinger.com

The three buckets of money in retirement. As we enter or get closer to retirement, one of the main questions is how should we position our money? When this life change occurs, many people come. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. Typically, you’re going to have very low risk assets here.

Source: mjsfinancialgroup.com

Source: mjsfinancialgroup.com

The 3 buckets strategy is a fairly simple strategy to understand on the surface. As we enter or get closer to retirement, one of the main questions is how should we position our money? 3 buckets of retirement planning. The 3 buckets strategy is a fairly simple strategy to understand on the surface. The three buckets of money in retirement.

Source: braviasfinancial.com

Source: braviasfinancial.com

For example, you have accumulated $700,000 in savings and then allocated $100,000 for your first 5 years of retirement. When this life change occurs, many people come. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. The bucket 2 is created to be tapped for income when bucket 1 runs out of money. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3.

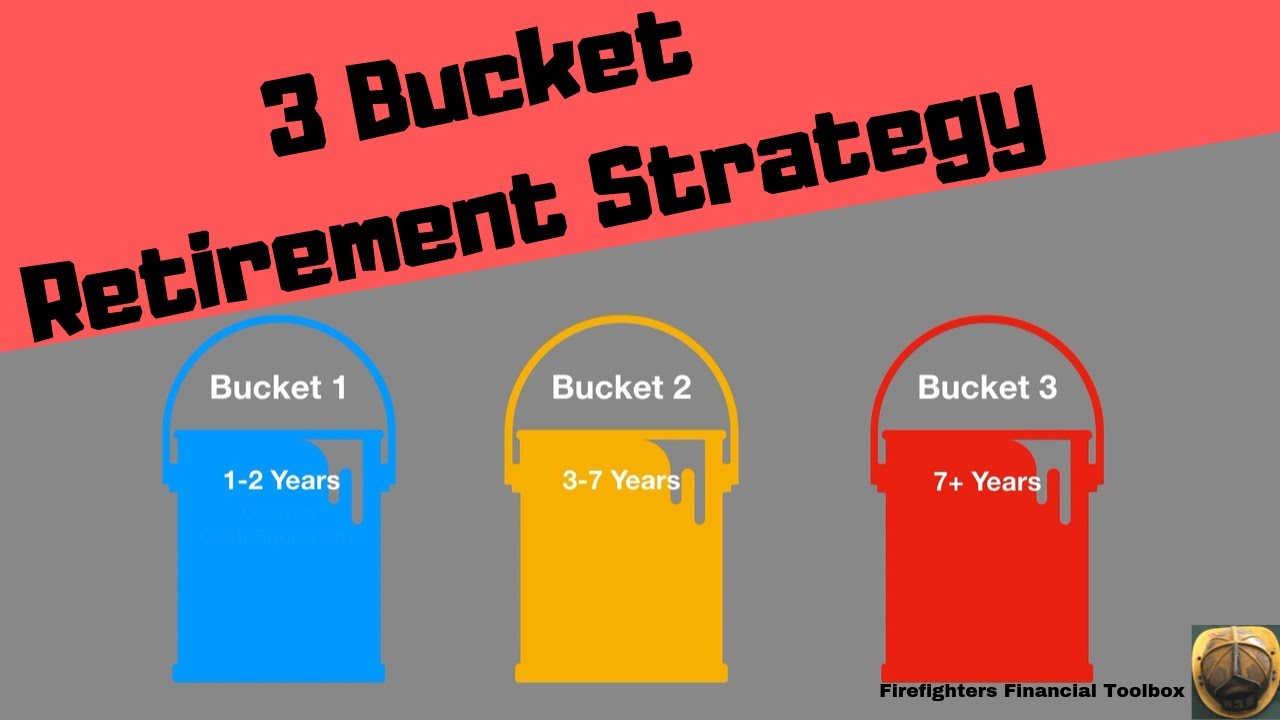

Source: youtube.com

Source: youtube.com

The basic idea is that you divide your retirement nest egg into three buckets with different purposes. As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. Let’s say you need $10,000 a month for three years. When this life change occurs, many people come. I would put $350,000 in bucket 2 and $250,000 in bucket 3.

Source: carsonwealth.com

Source: carsonwealth.com

The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. As we enter or get closer to retirement, one of the main questions is how should we position our money? The three buckets of money in retirement. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. When this life change occurs, many people come.

Source: duncangrp.com

Source: duncangrp.com

The basic idea is that you divide your retirement nest egg into three buckets with different purposes. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned.

Source: mjsfinancialgroup.com

Source: mjsfinancialgroup.com

The three buckets of money in retirement. 3 buckets of retirement planning. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. The three buckets of money in retirement. Typically, you’re going to have very low risk assets here.

Source: davidlukasfinancial.com

Source: davidlukasfinancial.com

The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. When this life change occurs, many people come. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. As we enter or get closer to retirement, one of the main questions is how should we position our money?

Source: advisornews.com

Source: advisornews.com

I would put $350,000 in bucket 2 and $250,000 in bucket 3. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. 3 buckets of retirement planning. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years.

Source: myownadvisor.ca

Source: myownadvisor.ca

The three buckets of money in retirement. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. Typically, you’re going to have very low risk assets here. 3 buckets of retirement planning. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years.

Source: youtube.com

Source: youtube.com

For example, you have accumulated $700,000 in savings and then allocated $100,000 for your first 5 years of retirement. Typically, you’re going to have very low risk assets here. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. 3 buckets of retirement planning. The bucket 2 is created to be tapped for income when bucket 1 runs out of money.

Source: johnsonbrunetti.com

Source: johnsonbrunetti.com

So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. When this life change occurs, many people come. The 3 buckets strategy is a fairly simple strategy to understand on the surface. The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the.

Source: synchronybank.com

As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. The basic idea is that you divide your retirement nest egg into three buckets with different purposes. When this life change occurs, many people come. The bucket 2 is created to be tapped for income when bucket 1 runs out of money.

Source: businessbrokerageblogs.com

Source: businessbrokerageblogs.com

As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned. The 3 buckets strategy is a fairly simple strategy to understand on the surface. The three buckets of money in retirement. Then, divide the remaining $600,000 equally or in any numbers between buckets 2 and 3. As an individual or family, you have spent years saving and saving so you can eventually retire and hopefully have the retirement you always envisioned.

Source: jimmsmith.com

Source: jimmsmith.com

When this life change occurs, many people come. The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. When this life change occurs, many people come. Let’s say you need $10,000 a month for three years.

Source: kiplinger.com

Source: kiplinger.com

When this life change occurs, many people come. The three buckets of money in retirement. I would put $350,000 in bucket 2 and $250,000 in bucket 3. 3 buckets of retirement planning. For example, you have accumulated $700,000 in savings and then allocated $100,000 for your first 5 years of retirement.

Source: archstonefinancial.net

Source: archstonefinancial.net

The 3 buckets strategy is a fairly simple strategy to understand on the surface. I would put $350,000 in bucket 2 and $250,000 in bucket 3. So, in this bucket we’re going to put enough to generate $360,000 of income for the next three years. The first bucket is usually any money that you will need now and in the near future (for the sake of this article let’s say the. As we enter or get closer to retirement, one of the main questions is how should we position our money?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title retirement 3 buckets by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.