Your Nys 89p early retirement option images are available in this site. Nys 89p early retirement option are a topic that is being searched for and liked by netizens now. You can Find and Download the Nys 89p early retirement option files here. Find and Download all royalty-free images.

If you’re looking for nys 89p early retirement option pictures information related to the nys 89p early retirement option interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

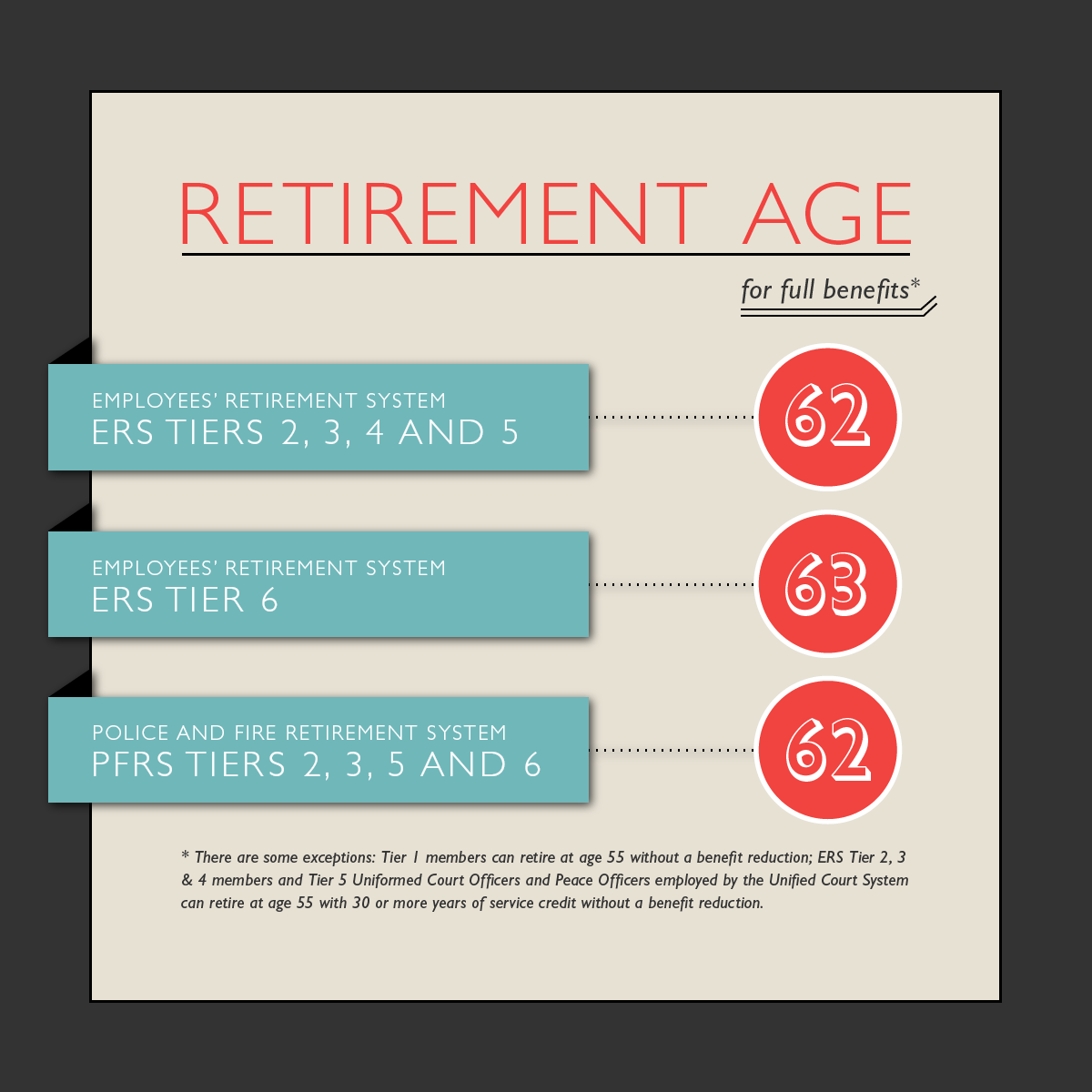

Nys 89p Early Retirement Option. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. Laws article 2, new york state employees� retirement system; When you turn 62, the early retirement benefit is reduced by 50 percent of your. Your total benefit cannot exceed 50 percent of your fas.

Early Retirement Archives New York Retirement News From nyretirementnews.com

Early Retirement Archives New York Retirement News From nyretirementnews.com

Current as of january 01, 2021 | updated by findlaw staff. Laws article 2, new york state employees� retirement system; If your beneficiary is your spouse at the time of your death, he or. Retirement and social security law. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary.

Your total benefit cannot exceed 50 percent of your fas.

Title 9, special retirement plans applicable to specified classes of members; The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth. If your beneficiary is your spouse at the time of your death, he or. Joint allowance — partial (tiers 3 and 4)*.

Source: dehashidofu.tistory.com

Source: dehashidofu.tistory.com

This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth. If your beneficiary is your spouse at the time of your death, he or. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. Current as of january 01, 2021 | updated by findlaw staff. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary.

Source: nyretirementnews.com

Source: nyretirementnews.com

The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. If your beneficiary is your spouse at the time of your death, he or. Title 9, special retirement plans applicable to specified classes of members; Joint allowance — partial (tiers 3 and 4)*.

Source: ketuba-art.com

Source: ketuba-art.com

When you turn 62, the early retirement benefit is reduced by 50 percent of your. Title 9, special retirement plans applicable to specified classes of members; The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. Laws article 2, new york state employees� retirement system; Your total benefit cannot exceed 50 percent of your fas.

Source: nydailynews.com

Source: nydailynews.com

Laws article 2, new york state employees� retirement system; This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. If your beneficiary is your spouse at the time of your death, he or. Current as of january 01, 2021 | updated by findlaw staff. Retirement and social security law.

Source: nydailynews.com

Source: nydailynews.com

After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. Laws article 2, new york state employees� retirement system; Current as of january 01, 2021 | updated by findlaw staff. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. Joint allowance — partial (tiers 3 and 4)*.

Source: nypost.com

Source: nypost.com

The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. Retirement and social security law. Your total benefit cannot exceed 50 percent of your fas. Current as of january 01, 2021 | updated by findlaw staff.

Source: pinterest.com

Source: pinterest.com

The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. Retirement and social security law. Your total benefit cannot exceed 50 percent of your fas.

Source: nyretirementnews.com

Source: nyretirementnews.com

Joint allowance — partial (tiers 3 and 4)*. The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. Your total benefit cannot exceed 50 percent of your fas. This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth. When you turn 62, the early retirement benefit is reduced by 50 percent of your.

Source: cbcny.org

Source: cbcny.org

The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. Title 9, special retirement plans applicable to specified classes of members; Retirement and social security law. Your total benefit cannot exceed 50 percent of your fas.

Source: cseany.org

Source: cseany.org

If your beneficiary is your spouse at the time of your death, he or. When you turn 62, the early retirement benefit is reduced by 50 percent of your. If your beneficiary is your spouse at the time of your death, he or. The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. Retirement and social security law.

Source: nyretirementnews.com

Source: nyretirementnews.com

Retirement and social security law. Your total benefit cannot exceed 50 percent of your fas. Joint allowance — partial (tiers 3 and 4)*. Title 9, special retirement plans applicable to specified classes of members; If your beneficiary is your spouse at the time of your death, he or.

Source: nysretirementnews.com

Source: nysretirementnews.com

Current as of january 01, 2021 | updated by findlaw staff. This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. Title 9, special retirement plans applicable to specified classes of members; The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary.

Source: nysretirementnews.com

Source: nysretirementnews.com

Retirement and social security law. Your total benefit cannot exceed 50 percent of your fas. Joint allowance — partial (tiers 3 and 4)*. If your beneficiary is your spouse at the time of your death, he or. This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth.

Source: nyretirementnews.com

Source: nyretirementnews.com

Your total benefit cannot exceed 50 percent of your fas. Your total benefit cannot exceed 50 percent of your fas. If your beneficiary is your spouse at the time of your death, he or. Current as of january 01, 2021 | updated by findlaw staff. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life.

Source: timesunion.com

Source: timesunion.com

Joint allowance — partial (tiers 3 and 4)*. If your beneficiary is your spouse at the time of your death, he or. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years.

Source: syracuse.com

Source: syracuse.com

When you turn 62, the early retirement benefit is reduced by 50 percent of your. The participant must elect the continuance of 75, 50 or 25 percent of the retirement benefit payable to the option beneficiary. This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. Laws article 2, new york state employees� retirement system;

Joint allowance — partial (tiers 3 and 4). This option provides the participant with a reduced lifetime benefit based on the participant’s and the option beneficiary’s dates of birth. The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years. Joint allowance — partial (tiers 3 and 4). Current as of january 01, 2021 | updated by findlaw staff.

Source: newslocker.com

Source: newslocker.com

This option will provide you with a reduced monthly benefit for your lifetime, and is based on your birth date and that of your beneficiary. When you turn 62, the early retirement benefit is reduced by 50 percent of your. After your death, your beneficiary will receive a specific percentage of your benefit which you select (75, 50, or 25 percent) for life. Retirement and social security law. The early retirement benefit equals 42 percent of your fas for 20 years of service credit plus an additional 4 percent of your fas for each year of service (or prorated portion thereof) beyond 20 years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title nys 89p early retirement option by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.