Your Kentucky retirement system early withdrawal images are available. Kentucky retirement system early withdrawal are a topic that is being searched for and liked by netizens now. You can Download the Kentucky retirement system early withdrawal files here. Download all royalty-free images.

If you’re searching for kentucky retirement system early withdrawal pictures information related to the kentucky retirement system early withdrawal interest, you have come to the right site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Kentucky Retirement System Early Withdrawal. The amount of reduction will depend upon your age or years of service at retirement. The retirement systems kentucky offers for public employees are divided into three groups: Age 55, with at least five (5) years of service credit. Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs).

Calculate Tax Early Retirement Withdrawal QATAX From qatax.blogspot.com

Calculate Tax Early Retirement Withdrawal QATAX From qatax.blogspot.com

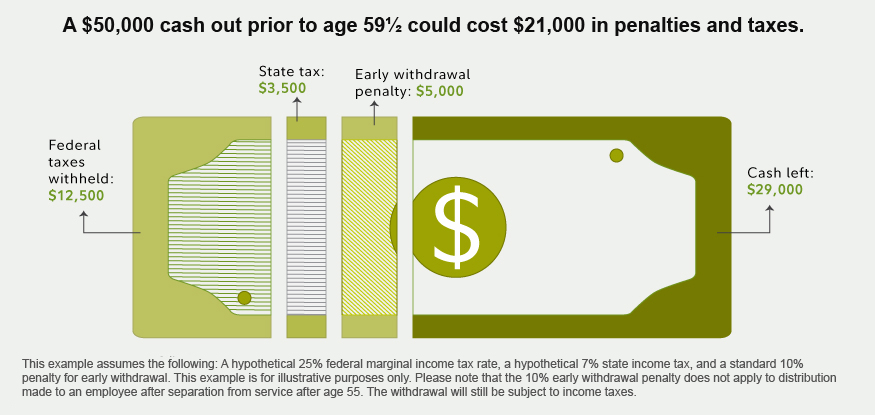

If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. At least 25 years of service credit, up to 27 years of service, at any age. Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). You can receive a reduced benefit at: The amount of reduction will depend upon your age or years of service at retirement. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early.

You can receive a reduced benefit at:

Age 55, with at least five (5) years of service credit. Years from age 65 or 27 years of service (whichever is less) years. The amount of reduction will depend upon your age or years of service at retirement. You can receive a reduced benefit at: Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). Age 55, with at least five (5) years of service credit.

Source: qatax.blogspot.com

Source: qatax.blogspot.com

Age 55, with at least five (5) years of service credit. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. At least 25 years of service credit, up to 27 years of service, at any age. Age 55, with at least five (5) years of service credit. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty.

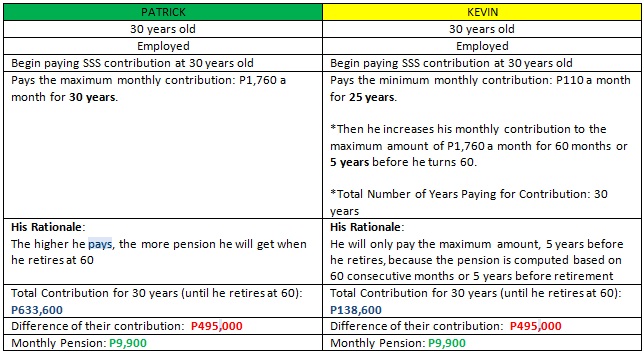

Source: pinterest.com

Source: pinterest.com

If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. Age 55, with at least five (5) years of service credit. At least 25 years of service credit, up to 27 years of service, at any age. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early.

Source: mymoneydesign.com

Source: mymoneydesign.com

In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. The amount of reduction will depend upon your age or years of service at retirement. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. Years from age 65 or 27 years of service (whichever is less) years.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

The retirement systems kentucky offers for public employees are divided into three groups: Age 55, with at least five (5) years of service credit. At least 25 years of service credit, up to 27 years of service, at any age. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. The retirement systems kentucky offers for public employees are divided into three groups:

Source: pinterest.com

Source: pinterest.com

If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. At least 25 years of service credit, up to 27 years of service, at any age. Years from age 65 or 27 years of service (whichever is less) years. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early.

Source: laborcenter.berkeley.edu

Source: laborcenter.berkeley.edu

Years from age 65 or 27 years of service (whichever is less) years. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. The amount of reduction will depend upon your age or years of service at retirement. Years from age 65 or 27 years of service (whichever is less) years. The retirement systems kentucky offers for public employees are divided into three groups:

Source: pages.fidelityinvestments.com

Source: pages.fidelityinvestments.com

The amount of reduction will depend upon your age or years of service at retirement. At least 25 years of service credit, up to 27 years of service, at any age. The amount of reduction will depend upon your age or years of service at retirement. Age 55, with at least five (5) years of service credit. As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2.

Source: ehow.com

Source: ehow.com

Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). Years from age 65 or 27 years of service (whichever is less) years. The retirement systems kentucky offers for public employees are divided into three groups: As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. At least 25 years of service credit, up to 27 years of service, at any age.

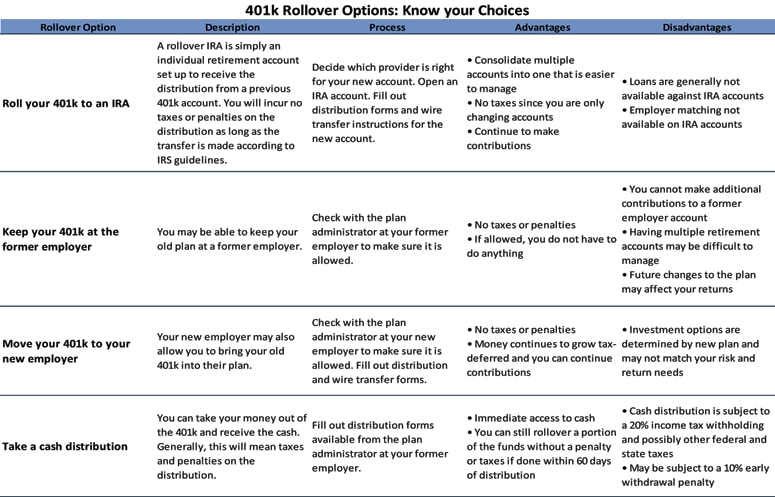

Source: 401krollover.com

Source: 401krollover.com

Age 55, with at least five (5) years of service credit. Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). The retirement systems kentucky offers for public employees are divided into three groups: At least 25 years of service credit, up to 27 years of service, at any age. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early.

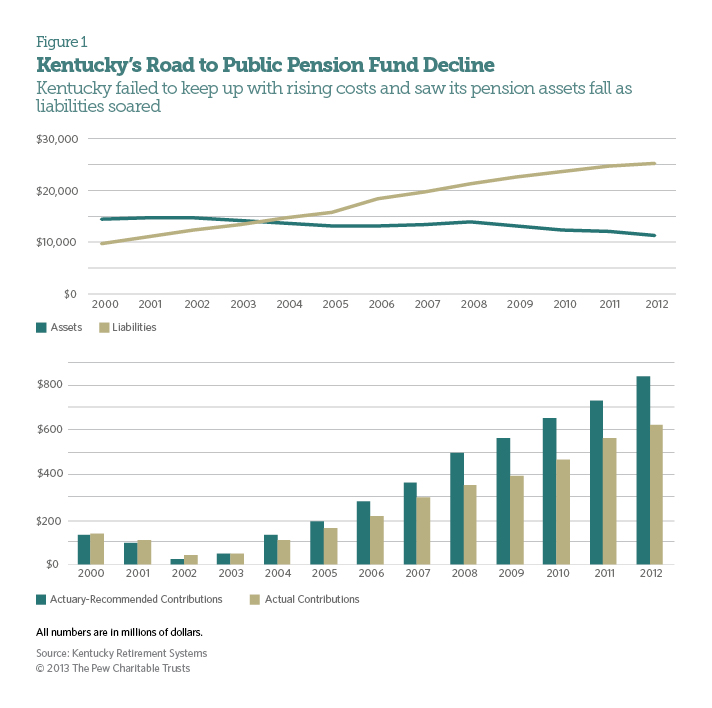

Source: pewtrusts.org

Source: pewtrusts.org

As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. At least 25 years of service credit, up to 27 years of service, at any age. You can receive a reduced benefit at: In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty.

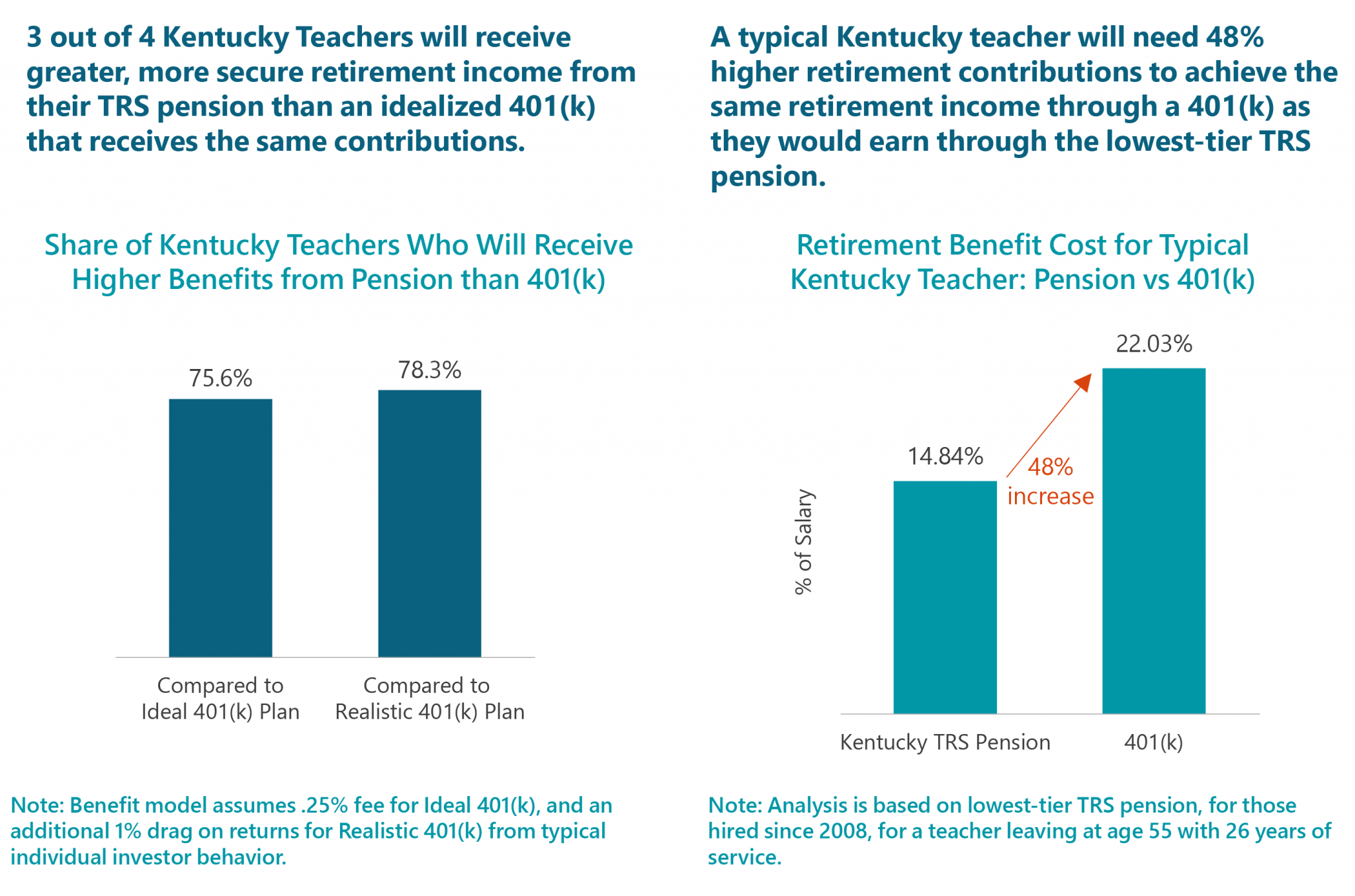

Source: laborcenter.berkeley.edu

Source: laborcenter.berkeley.edu

As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. You can receive a reduced benefit at: As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2. The amount of reduction will depend upon your age or years of service at retirement.

Source: laborcenter.berkeley.edu

Source: laborcenter.berkeley.edu

In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. The amount of reduction will depend upon your age or years of service at retirement. At least 25 years of service credit, up to 27 years of service, at any age. If the refund is paid directly to you, there are federal deadlines by which you must roll your refund into another eligible plan to avoid the irs early withdrawal penalty. Years from age 65 or 27 years of service (whichever is less) years.

Source: financialmentor.com

Source: financialmentor.com

Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). The amount of reduction will depend upon your age or years of service at retirement. At least 25 years of service credit, up to 27 years of service, at any age. The retirement systems kentucky offers for public employees are divided into three groups:

Source: pinterest.com

Source: pinterest.com

The retirement systems kentucky offers for public employees are divided into three groups: Years from age 65 or 27 years of service (whichever is less) years. The amount of reduction will depend upon your age or years of service at retirement. Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs). At least 25 years of service credit, up to 27 years of service, at any age.

Source: teachfrankfort.org

Source: teachfrankfort.org

Years from age 65 or 27 years of service (whichever is less) years. Years from age 65 or 27 years of service (whichever is less) years. The retirement systems kentucky offers for public employees are divided into three groups: At least 25 years of service credit, up to 27 years of service, at any age. Kentucky retirement systems (krs), kentucky judicial form retirement system (kjfrs) and teachers’ retirement system of kentucky (trs).

Source: tristatehomepage.com

Source: tristatehomepage.com

Years from age 65 or 27 years of service (whichever is less) years. Years from age 65 or 27 years of service (whichever is less) years. At least 25 years of service credit, up to 27 years of service, at any age. Age 55, with at least five (5) years of service credit. In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early.

Source: laborcenter.berkeley.edu

Source: laborcenter.berkeley.edu

Years from age 65 or 27 years of service (whichever is less) years. The amount of reduction will depend upon your age or years of service at retirement. At least 25 years of service credit, up to 27 years of service, at any age. Age 55, with at least five (5) years of service credit. As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2.

Source: ecalvinodesigns.blogspot.com

Source: ecalvinodesigns.blogspot.com

You can receive a reduced benefit at: In addition to federal and kentucky state tax, you will owe an additional 10 percent of the amount you withdraw if you take it out too early. The amount of reduction will depend upon your age or years of service at retirement. At least 25 years of service credit, up to 27 years of service, at any age. As retirement money is meant to grow for your retirement, the irs penalizes you for taking your retirement money before you reach age 59 1/2.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kentucky retirement system early withdrawal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.