Your Is 55 early retirement images are available in this site. Is 55 early retirement are a topic that is being searched for and liked by netizens today. You can Get the Is 55 early retirement files here. Download all royalty-free images.

If you’re looking for is 55 early retirement pictures information related to the is 55 early retirement topic, you have visit the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Is 55 Early Retirement. 55 may not be too early to retire, but it is too soon for social security. Taking money from your ira or old 401 (k) at age 55. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time.

How the Rule of 55 Impacts Early Retirement Investopedia From investopedia.com

How the Rule of 55 Impacts Early Retirement Investopedia From investopedia.com

If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. 55 may not be too early to retire, but it is too soon for social security. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. Taking money from your ira or old 401 (k) at age 55. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2.

According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1.

With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. Taking money from your ira or old 401 (k) at age 55. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1.

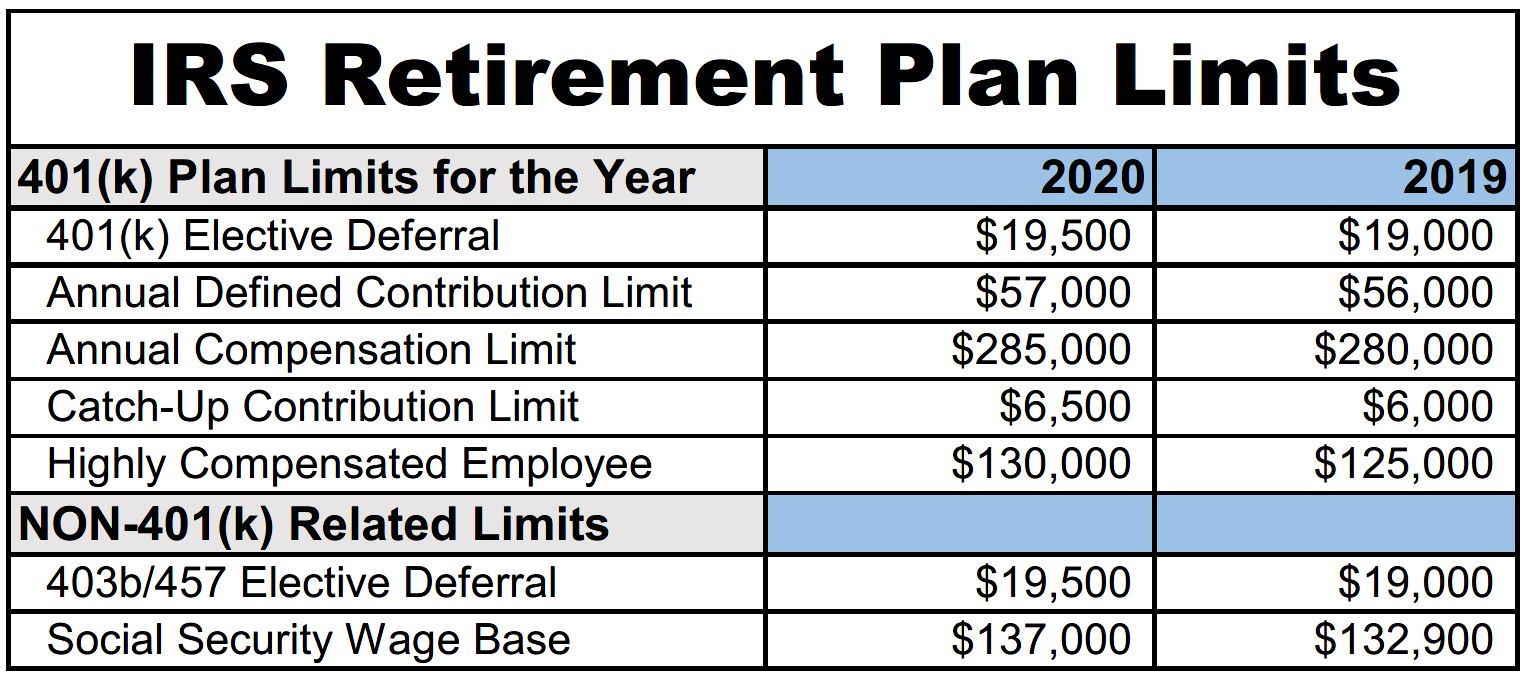

Source: thebalance.com

Source: thebalance.com

Taking money from your ira or old 401 (k) at age 55. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. 55 may not be too early to retire, but it is too soon for social security. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1.

Source: mymoneydesign.com

Source: mymoneydesign.com

Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. 55 may not be too early to retire, but it is too soon for social security. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too.

Source: reversethecrush.com

Source: reversethecrush.com

If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. 55 may not be too early to retire, but it is too soon for social security.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. 55 may not be too early to retire, but it is too soon for social security. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1.

Source: investmentu.com

Source: investmentu.com

According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Taking money from your ira or old 401 (k) at age 55. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time.

Source: latestarterfire.com

Source: latestarterfire.com

Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. Taking money from your ira or old 401 (k) at age 55. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more.

Source: frazerjames.co.uk

Source: frazerjames.co.uk

If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. 55 may not be too early to retire, but it is too soon for social security. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time.

Source: investopedia.com

Source: investopedia.com

Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. Taking money from your ira or old 401 (k) at age 55.

Source: themoneyhour.com

Source: themoneyhour.com

Taking money from your ira or old 401 (k) at age 55. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Taking money from your ira or old 401 (k) at age 55. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. 55 may not be too early to retire, but it is too soon for social security. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2.

Source: forbes.com

Source: forbes.com

55 may not be too early to retire, but it is too soon for social security. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. 55 may not be too early to retire, but it is too soon for social security. Taking money from your ira or old 401 (k) at age 55. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too.

Source: lifeandmyfinances.com

Source: lifeandmyfinances.com

If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more.

Source: mymoneydesign.com

Source: mymoneydesign.com

With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more.

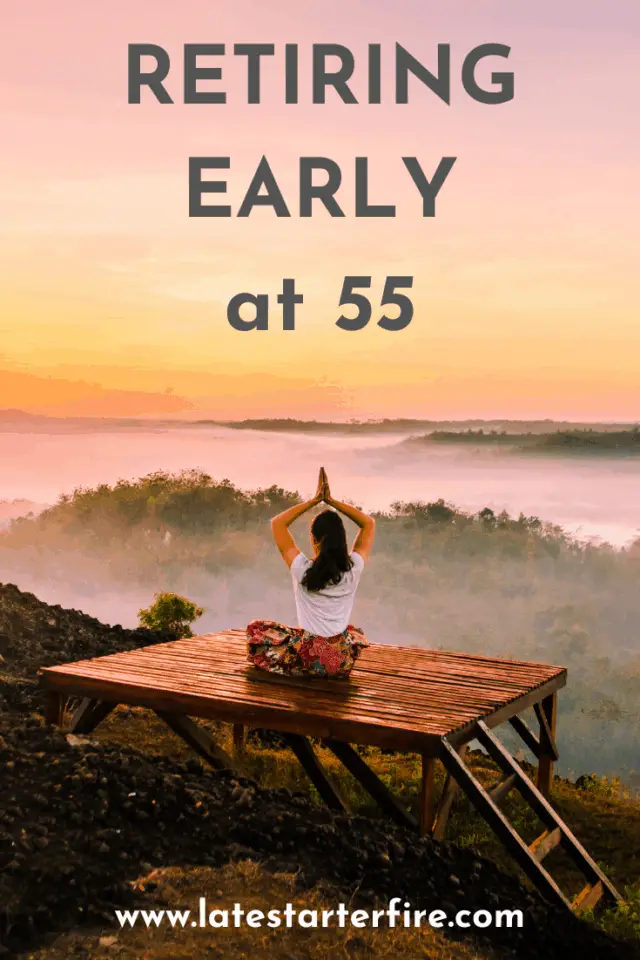

Source: pinterest.com

Source: pinterest.com

55 may not be too early to retire, but it is too soon for social security. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. Taking money from your ira or old 401 (k) at age 55. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. 55 may not be too early to retire, but it is too soon for social security.

Source: pinterest.com

Source: pinterest.com

According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2.

Source: discover.rbcroyalbank.com

Source: discover.rbcroyalbank.com

Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. Essentially, if you have other means of boosting your savings even after you stop working, it is going to last you longer and offer more. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. Taking money from your ira or old 401 (k) at age 55.

Source: consumerismcommentary.com

Source: consumerismcommentary.com

55 may not be too early to retire, but it is too soon for social security. 55 may not be too early to retire, but it is too soon for social security. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. According to the australian bureau of statistics, the average australian retirement age in australia is 55.4 years1.

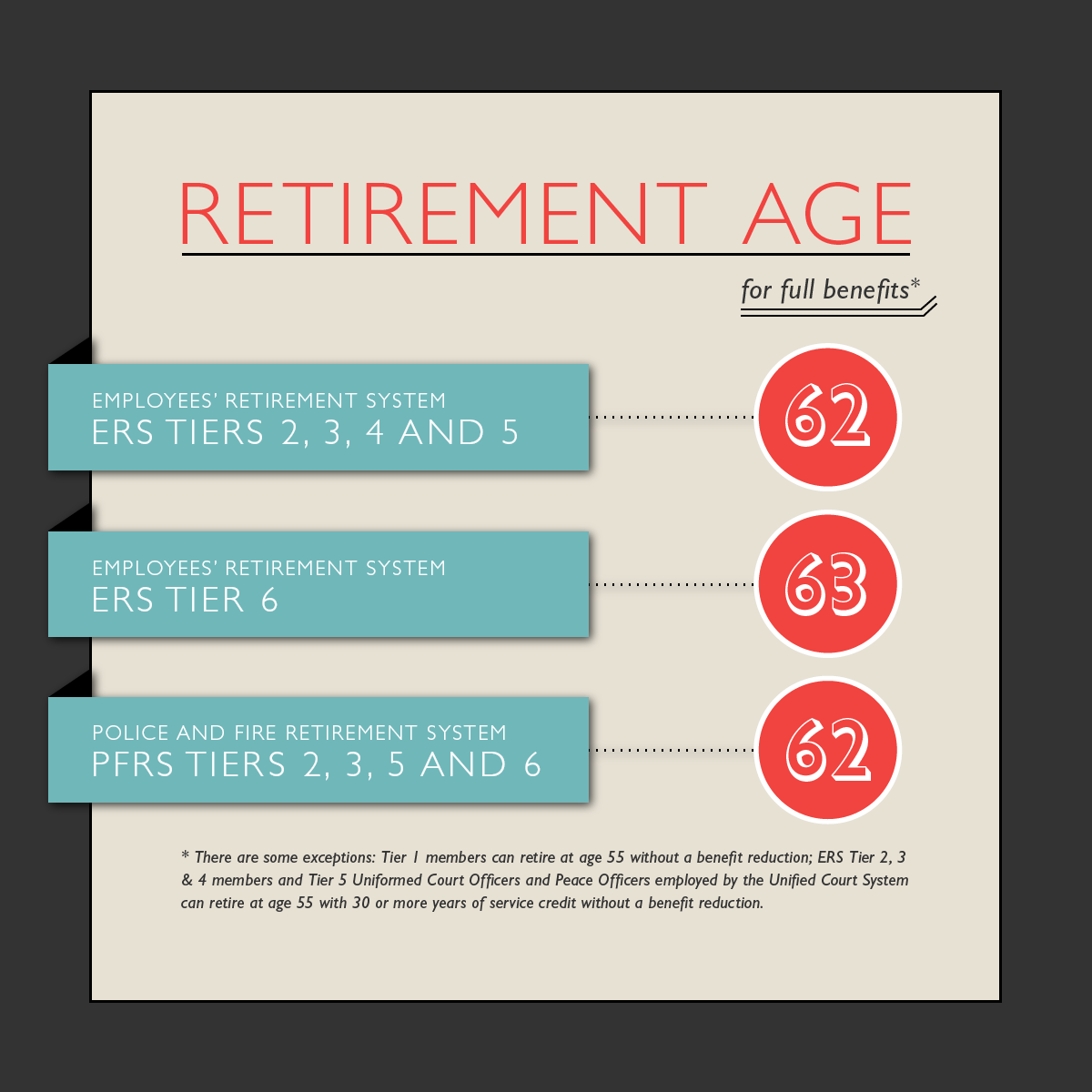

Source: nyretirementnews.com

Source: nyretirementnews.com

With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. Substantially equal periodic payments (sepp) is the option for early retirees to access funds in an ira or old 401 (k) before age 59 1/2. With a life expectancy of 65 people now 654.9 years for men and 87.6 years for women, many of us can expect to be retired for a long time. If 55 is your ideal age for early retirement, someone whose sole income is £250k will be looking to use that money somewhat differently than an individual with money coming in from other sources too. 55 may not be too early to retire, but it is too soon for social security.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title is 55 early retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.