Your How to prepare for retirement in 10 years images are ready in this website. How to prepare for retirement in 10 years are a topic that is being searched for and liked by netizens today. You can Download the How to prepare for retirement in 10 years files here. Find and Download all free photos.

If you’re searching for how to prepare for retirement in 10 years images information connected with to the how to prepare for retirement in 10 years keyword, you have visit the ideal blog. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

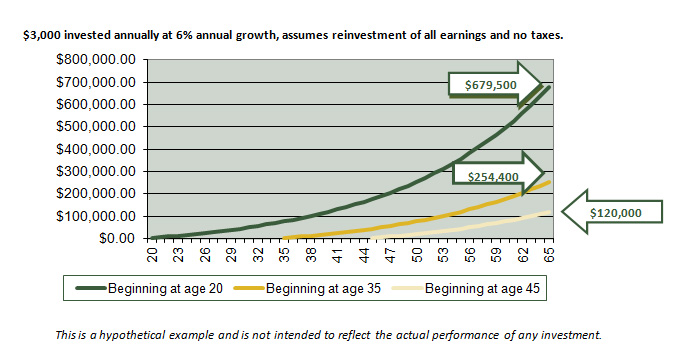

How To Prepare For Retirement In 10 Years. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Don’t despair you have 10 years to act, by earning more, trimming. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away.

IRA vs. 401(k) Differences Which Retirement Plan Is Better? From moneycrashers.com

IRA vs. 401(k) Differences Which Retirement Plan Is Better? From moneycrashers.com

Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Don’t despair you have 10 years to act, by earning more, trimming.

Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away.

Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Don’t despair you have 10 years to act, by earning more, trimming. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point.

Source: fortunebuilders.com

Source: fortunebuilders.com

Don’t despair you have 10 years to act, by earning more, trimming. Learn more about financial growth, and continue to earn and save. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Don’t despair you have 10 years to act, by earning more, trimming.

Source: pinterest.com

Source: pinterest.com

Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income.

Source: pinterest.com

Source: pinterest.com

Learn more about financial growth, and continue to earn and save. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Don’t despair you have 10 years to act, by earning more, trimming. Learn more about financial growth, and continue to earn and save.

Source: ilafp.com

Source: ilafp.com

Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Learn more about financial growth, and continue to earn and save. Don’t despair you have 10 years to act, by earning more, trimming.

Source: thebalance.com

Source: thebalance.com

Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Don’t despair you have 10 years to act, by earning more, trimming. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point.

Source: moneycrashers.com

Source: moneycrashers.com

Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away.

Source: moneycrashers.com

Source: moneycrashers.com

Learn more about financial growth, and continue to earn and save. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Learn more about financial growth, and continue to earn and save. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in.

Source: employeebenefitadviser.com

Source: employeebenefitadviser.com

Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Learn more about financial growth, and continue to earn and save. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month.

Source: pinterest.com

Source: pinterest.com

Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Don’t despair you have 10 years to act, by earning more, trimming. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Learn more about financial growth, and continue to earn and save.

Source: ramseysolutions.com

Source: ramseysolutions.com

Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income.

Source: pinterest.com

Source: pinterest.com

Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in.

Source: moneycrashers.com

Source: moneycrashers.com

Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Don’t despair you have 10 years to act, by earning more, trimming. Learn more about financial growth, and continue to earn and save. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away.

Source: fvpholdings.com

Source: fvpholdings.com

Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Learn more about financial growth, and continue to earn and save. Don’t despair you have 10 years to act, by earning more, trimming. Do a deeper dive plug your current numbers (such as earnings, savings and future pensions) into an online calculator to estimate your retirement income.

Source: cnbc.com

Source: cnbc.com

Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save.

Source: tradearcadepro.com

Source: tradearcadepro.com

Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point. Don’t despair you have 10 years to act, by earning more, trimming. Learn more about financial growth, and continue to earn and save. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away.

Source: hl.co.uk

Source: hl.co.uk

Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Experts say you’ll need 75 to 80 percent of preretirement income to live well — debatable but a good starting point.

Source: theepinvestor.com

Source: theepinvestor.com

Learn more about financial growth, and continue to earn and save. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Learn more about financial growth, and continue to earn and save. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in.

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

Learn more about financial growth, and continue to earn and save. Key takeaways if you�re 10 years away from retirement, you still have time to tuck some money away. Once you find a second property to purchase and move in, the first house is now being rented out for $1,300 per month. Set yourself up by reducing expenses and then developing a plan to save the amount you need to cover monthly expenses in. Don’t despair you have 10 years to act, by earning more, trimming.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to prepare for retirement in 10 years by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.