Your How to plan for retirement images are ready in this website. How to plan for retirement are a topic that is being searched for and liked by netizens now. You can Find and Download the How to plan for retirement files here. Get all free photos.

If you’re looking for how to plan for retirement pictures information related to the how to plan for retirement interest, you have come to the ideal site. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

How To Plan For Retirement. Contribute to your employer’s retirement savings plan. (see back panel to order a copy.) 3. To lead a secure, independent and peaceful life post retirement you need to plan now. Retirement planning has five steps:

How to Figure out How Much You Need to Save for Retirement From benlefort.com

How to Figure out How Much You Need to Save for Retirement From benlefort.com

And, for those near retirement, taking the mystery out of retirement planning. Ad learn what you need to know about retirement today & be prepared for tomorrow. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Retirement planning has five steps: And the key is to start early to take advantage of power of compounding.

And, for those near retirement, taking the mystery out of retirement planning.

A guide to your money and your financial future. If your employer offers a retirement. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. Retirement planning has five steps: (see back panel to order a copy.) 3.

Source: castle-bank.co.uk

Source: castle-bank.co.uk

(see back panel to order a copy.) 3. Ad learn what you need to know about retirement today & be prepared for tomorrow. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. (see back panel to order a copy.) 3.

Source: fyi.extension.wisc.edu

Source: fyi.extension.wisc.edu

Ad learn what you need to know about retirement today & be prepared for tomorrow. And the key is to start early to take advantage of power of compounding. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Ad learn what you need to know about retirement today & be prepared for tomorrow. And, for those near retirement, taking the mystery out of retirement planning.

Source: housebuyers4u.co.uk

Source: housebuyers4u.co.uk

Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Ad learn what you need to know about retirement today & be prepared for tomorrow. Retirement planning has five steps: To define an asset allocation and investment plan to reach that goal. And the key is to start early to take advantage of power of compounding.

Source: sensefinancial.com

Source: sensefinancial.com

Retirement planning has five steps: Retirement planning is the process you put in place to maintain your finances after you leave the workforce. To lead a secure, independent and peaceful life post retirement you need to plan now. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. Ad learn what you need to know about retirement today & be prepared for tomorrow.

Source: pinterest.com

Source: pinterest.com

To define an asset allocation and investment plan to reach that goal. The key to a secure retirement is to plan ahead. If your employer offers a retirement. Retirement planning has five steps: And the key is to start early to take advantage of power of compounding.

Source: pinterest.com

Source: pinterest.com

And, for those near retirement, taking the mystery out of retirement planning. Ad learn what you need to know about retirement today & be prepared for tomorrow. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. To lead a secure, independent and peaceful life post retirement you need to plan now.

A guide to your money and your financial future. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. A guide to your money and your financial future.

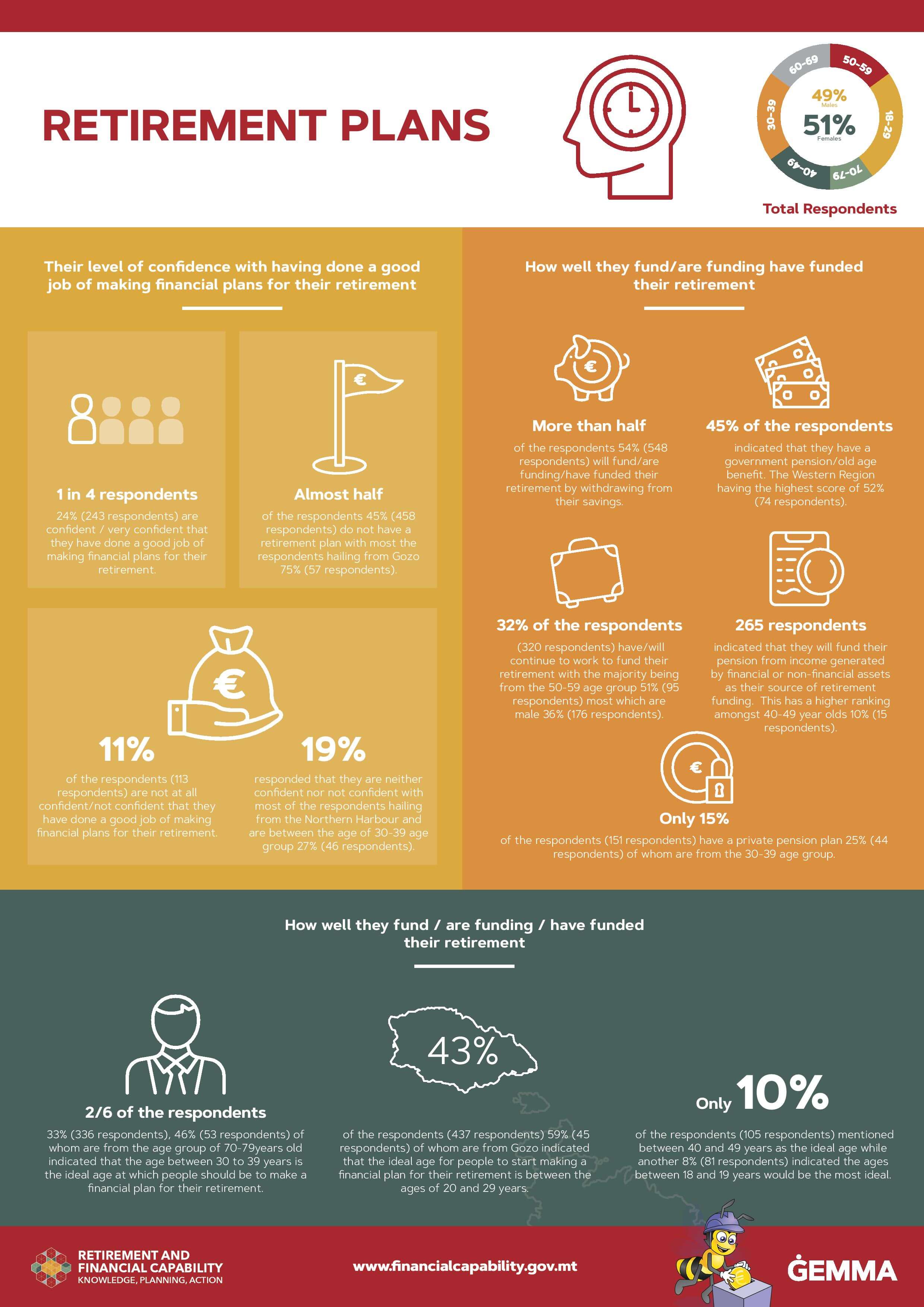

Source: gemma.gov.mt

Source: gemma.gov.mt

Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. The key to a secure retirement is to plan ahead. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. To define an asset allocation and investment plan to reach that goal. (see back panel to order a copy.) 3.

Source: nyretirementnews.com

Source: nyretirementnews.com

Ad learn what you need to know about retirement today & be prepared for tomorrow. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Ad learn what you need to know about retirement today & be prepared for tomorrow. And, for those near retirement, taking the mystery out of retirement planning. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier.

Source: pinterest.com

Source: pinterest.com

Contribute to your employer’s retirement savings plan. And, for those near retirement, taking the mystery out of retirement planning. To lead a secure, independent and peaceful life post retirement you need to plan now. The key to a secure retirement is to plan ahead. And the key is to start early to take advantage of power of compounding.

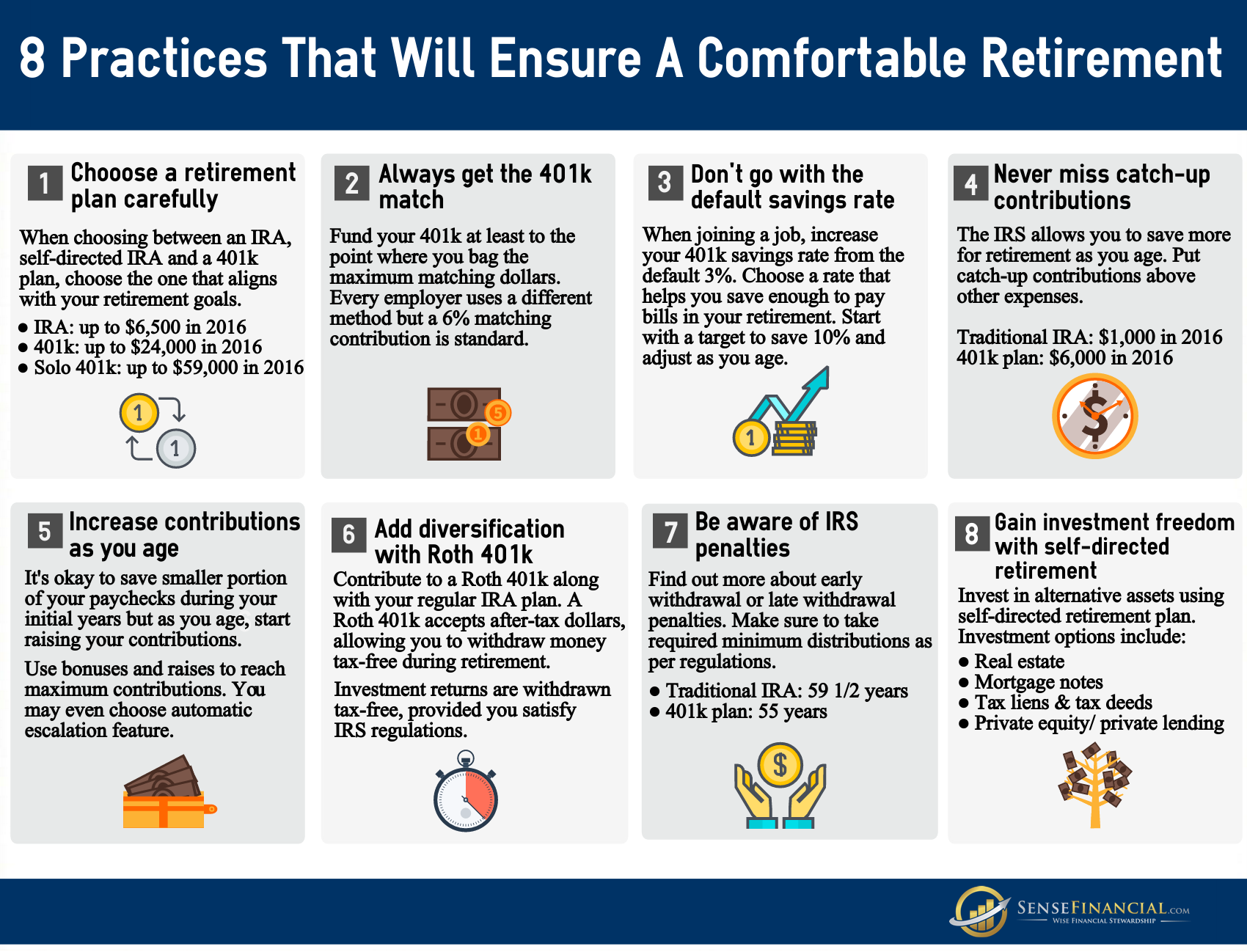

Source: sensefinancial.com

Source: sensefinancial.com

Ad learn what you need to know about retirement today & be prepared for tomorrow. And, for those near retirement, taking the mystery out of retirement planning. If your employer offers a retirement. Ad learn what you need to know about retirement today & be prepared for tomorrow. That’s why we recommend developing your retirement plan as an essential part of your overall financial plan.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

(see back panel to order a copy.) 3. A guide to your money and your financial future. (see back panel to order a copy.) 3. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier. Ad learn what you need to know about retirement today & be prepared for tomorrow.

Source: benlefort.com

Source: benlefort.com

Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. If your employer offers a retirement. Ad learn what you need to know about retirement today & be prepared for tomorrow. Ad learn what you need to know about retirement today & be prepared for tomorrow.

Source: visual.ly

Source: visual.ly

Ad learn what you need to know about retirement today & be prepared for tomorrow. And, for those near retirement, taking the mystery out of retirement planning. Retirement planning is the process you put in place to maintain your finances after you leave the workforce. Retirement planning has five steps: Contribute to your employer’s retirement savings plan.

Source: myconfidence.com

Source: myconfidence.com

That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. Contribute to your employer’s retirement savings plan. Retirement planning has five steps: And the key is to start early to take advantage of power of compounding. Knowing where you stand financially and the goals you would like to achieve in your life will make planning for life after work much easier.

Source: jamapunji.pk

That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. The key to a secure retirement is to plan ahead. Retirement planning has five steps: That’s why we recommend developing your retirement plan as an essential part of your overall financial plan. If your employer offers a retirement.

Source: sensefinancial.com

Source: sensefinancial.com

Ad learn what you need to know about retirement today & be prepared for tomorrow. To define an asset allocation and investment plan to reach that goal. Ad learn what you need to know about retirement today & be prepared for tomorrow. A guide to your money and your financial future. If your employer offers a retirement.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](http://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

And the key is to start early to take advantage of power of compounding. Retirement planning has five steps: Ad learn what you need to know about retirement today & be prepared for tomorrow. And the key is to start early to take advantage of power of compounding. (see back panel to order a copy.) 3.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to plan for retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.