Your G retirement savers credit images are available in this site. G retirement savers credit are a topic that is being searched for and liked by netizens now. You can Find and Download the G retirement savers credit files here. Find and Download all royalty-free vectors.

If you’re looking for g retirement savers credit images information linked to the g retirement savers credit topic, you have visit the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

G Retirement Savers Credit. The percentage ranges from 50 percent and goes down to zero. The credit can range from 10 percent to 50 percent of your. The retirement saver’s credit is nonrefundable. The maximum credit amount is $2,000 as of 2022, or $4,000 if you�re married and filing a joint return.

Pay Credit Card Bill Early And Save From bankrate.com

Pay Credit Card Bill Early And Save From bankrate.com

The retirement saver’s credit is nonrefundable. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. What the saver’s credit is worth. For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The exact amount you can claim will depend on your agi.

The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers.

The retirement saver’s credit is nonrefundable. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. The credit can range from 10 percent to 50 percent of your. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. What the saver’s credit is worth.

Source: thefinancechatter.com

Source: thefinancechatter.com

For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. The retirement saver’s credit is nonrefundable. The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly.

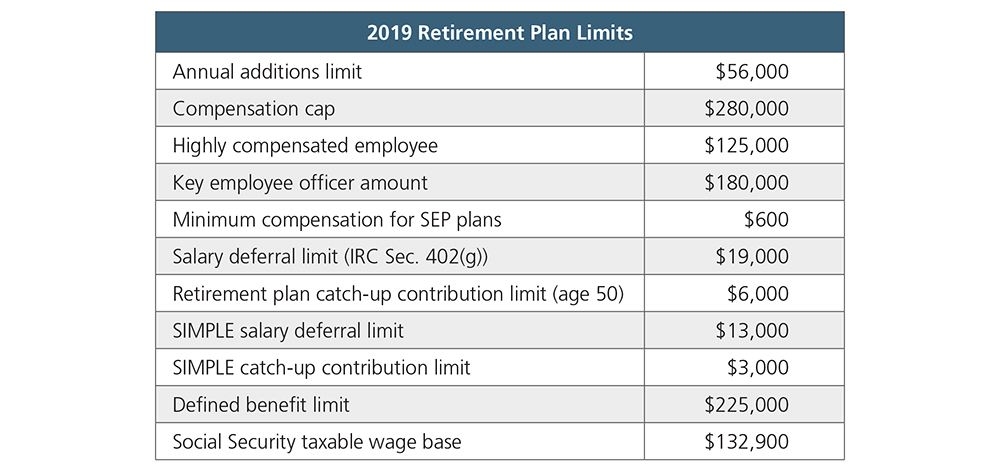

Source: northsave.com

Source: northsave.com

The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The retirement saver’s credit is nonrefundable. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. For that reason, the saver�s credit is most beneficial for taxpayers with low incomes.

The maximum credit amount is $2,000 as of 2022, or $4,000 if you�re married and filing a joint return. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income; The maximum credit amount is $2,000 as of 2022, or $4,000 if you�re married and filing a joint return. The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly.

Source: thelink.ascensus.com

Source: thelink.ascensus.com

It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The exact amount you can claim will depend on your agi. The retirement saver’s credit is nonrefundable. It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income; The percentage ranges from 50 percent and goes down to zero.

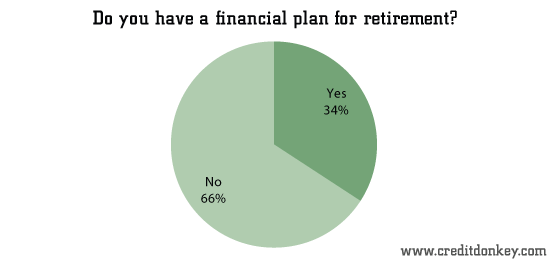

Source: creditdonkey.com

Source: creditdonkey.com

The credit can range from 10 percent to 50 percent of your. The retirement saver’s credit is nonrefundable. The exact amount you can claim will depend on your agi. What the saver’s credit is worth. The table below shows the credit rates for different taxpayers.

Source: pscutt.com

Source: pscutt.com

The exact amount you can claim will depend on your agi. For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The retirement saver’s credit is nonrefundable. The exact amount you can claim will depend on your agi.

Source: legal-forms.laws.com

Source: legal-forms.laws.com

The tax credit is 50%, 20%, or 10% of your retirement plan or ira contributions for the year, depending on your adjusted gross income (agi). The tax credit is 50%, 20%, or 10% of your retirement plan or ira contributions for the year, depending on your adjusted gross income (agi). The exact amount you can claim will depend on your agi. It�s worth up to $1,000, or $2,000 for joint filers. It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income;

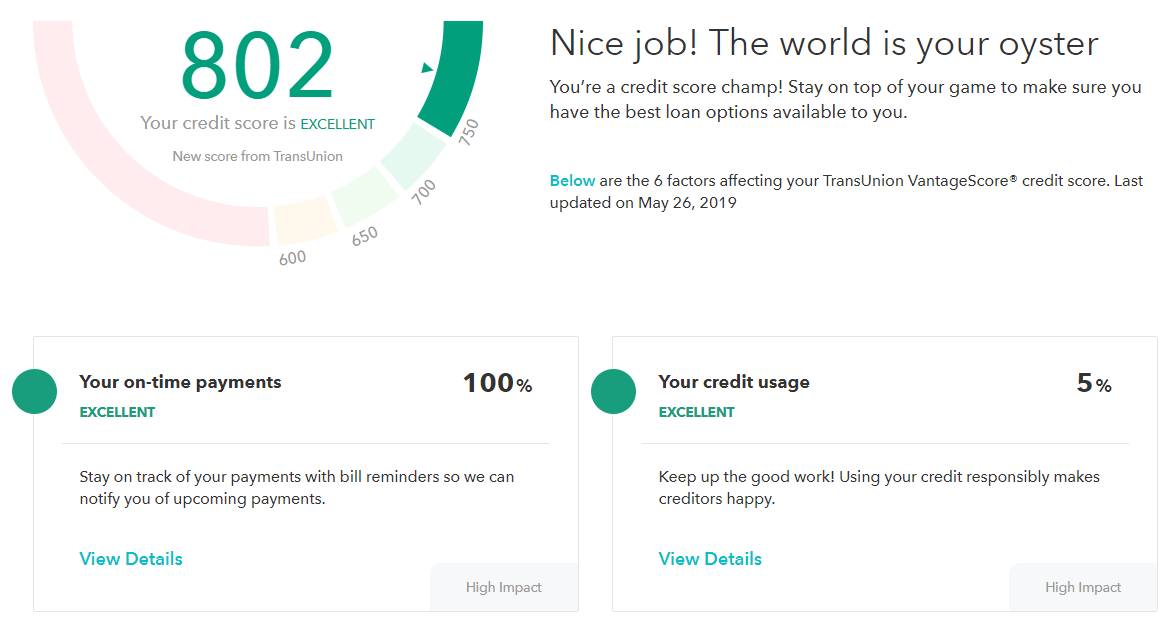

Source: creditdonkey.com

Source: creditdonkey.com

The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. What the saver’s credit is worth. The credit can range from 10 percent to 50 percent of your. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive.

Source: creditdonkey.com

Source: creditdonkey.com

The credit can range from 10 percent to 50 percent of your. The retirement saver’s credit is nonrefundable. The credit can range from 10 percent to 50 percent of your. For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income;

Source: apnaplan.com

Source: apnaplan.com

What the saver’s credit is worth. The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly. The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The tax credit is 50%, 20%, or 10% of your retirement plan or ira contributions for the year, depending on your adjusted gross income (agi).

Source: sites.google.com

For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. The tax credit is 50%, 20%, or 10% of your retirement plan or ira contributions for the year, depending on your adjusted gross income (agi). The maximum credit is $1,000 for singles and heads of household, and $2,000 for married taxpayers filing jointly. The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers. The exact amount you can claim will depend on your agi.

Source: investopedia.com

Source: investopedia.com

It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. It�s worth up to $1,000, or $2,000 for joint filers. The credit can range from 10 percent to 50 percent of your. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The maximum credit amount is $2,000 as of 2022, or $4,000 if you�re married and filing a joint return.

Source: stoploop.com

Source: stoploop.com

The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The tax credit is 50%, 20%, or 10% of your retirement plan or ira contributions for the year, depending on your adjusted gross income (agi). The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The retirement saver’s credit is nonrefundable. The credit can range from 10 percent to 50 percent of your.

Source: vulcanpost.com

Source: vulcanpost.com

The maximum credit amount is $2,000 as of 2022, or $4,000 if you�re married and filing a joint return. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. What the saver’s credit is worth. It�s worth up to $1,000, or $2,000 for joint filers. It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income;

Source: community.personalfinanceclub.com

Source: community.personalfinanceclub.com

It�s limited to a certain percentage of your retirement contributions, depending on your adjusted gross income; The retirement saver’s credit is nonrefundable. The percentage ranges from 50 percent and goes down to zero. The exact amount you can claim will depend on your agi. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive.

Source: pinterest.com

Source: pinterest.com

The exact amount you can claim will depend on your agi. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive. The exact amount you can claim will depend on your agi. The table below shows the credit rates for different taxpayers. The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers.

Source: guardianscu.coop

Source: guardianscu.coop

The saver’s credit is worth 50%, 20% or 10% of your contributions to an eligible retirement account, up to $2,000 for single filers and heads of household or $4,000 for joint filers. What the saver’s credit is worth. The exact amount you can claim will depend on your agi. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The retirement savings contribution credit — the saver�s credit — is a retirement savings incentive.

Source: paychex.com

Source: paychex.com

For that reason, the saver�s credit is most beneficial for taxpayers with low incomes. What the saver’s credit is worth. It can be worth up to $1,000 for an individual and up to $2,000 for married couples filing jointly. The exact amount you can claim will depend on your agi. The credit can range from 10 percent to 50 percent of your.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title g retirement savers credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.