Your Fire early retirement images are ready in this website. Fire early retirement are a topic that is being searched for and liked by netizens today. You can Download the Fire early retirement files here. Download all free photos.

If you’re looking for fire early retirement images information linked to the fire early retirement topic, you have pay a visit to the right blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Fire Early Retirement. Fire stands for financial independence, retire early. Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment.

The FIRE Movement Movement, Early retirement, Sarcastic From pinterest.com

The FIRE Movement Movement, Early retirement, Sarcastic From pinterest.com

If you want to retire at 55, you need to save £6,000 a year from the age of 21. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. It�s been gaining popularity since, as fire proponents share their stories in. Under the fire movement, a number of people have begun working towards a single goal. The acronym fire stands for ‘financially independent to retire early’. The early retirement calculator is a helpful tool for the fire (financial independence retire early) community to use.

The acronym fire stands for ‘financially independent to retire early’.

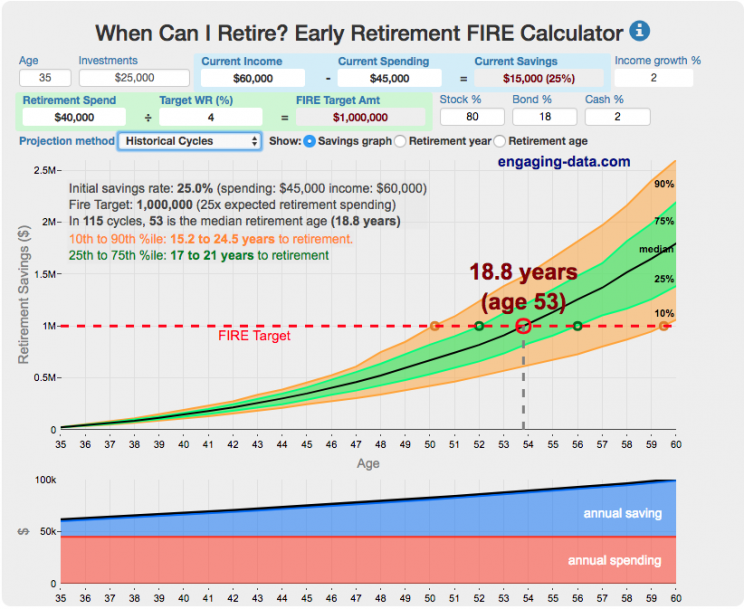

The early retirement calculator is a helpful tool for the fire (financial independence retire early) community to use. The early retirement calculator is a helpful tool for the fire (financial independence retire early) community to use. Fire stands for financial independence, retire early. Under the fire movement, a number of people have begun working towards a single goal. The acronym fire stands for ‘financially independent to retire early’. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age.

Source: pinterest.com

Source: pinterest.com

It�s been gaining popularity since, as fire proponents share their stories in. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. This movement brings with it the. The fire movement calculator is designed to take the manual calculations away from those destined to be. It provides fire community members with impactful analyses designed to make the journey to early retirement easier.

Source: wallethacks.com

Source: wallethacks.com

Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. Fire stands for financial independence, retire early. If you have an annual salary of £30,000, you would need 20%. The fire movement calculator is designed to take the manual calculations away from those destined to be. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age.

Source: pinterest.com

Source: pinterest.com

This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. Fire stands for financial independence, retire early. It�s been gaining popularity since, as fire proponents share their stories in. It provides fire community members with impactful analyses designed to make the journey to early retirement easier. With that logic, here are the savings levels required for early retirement at a handful of expense points, thanks to the college investor.

Source: pinterest.com

Source: pinterest.com

If you have an annual salary of £30,000, you would need 20%. If you want to retire at 55, you need to save £6,000 a year from the age of 21. If you have an annual salary of £30,000, you would need 20%. It�s been gaining popularity since, as fire proponents share their stories in. The movement first appeared in the late 2000s.

Source: pinterest.com

Source: pinterest.com

With that logic, here are the savings levels required for early retirement at a handful of expense points, thanks to the college investor. The fire movement calculator is designed to take the manual calculations away from those destined to be. The movement first appeared in the late 2000s. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. It�s been gaining popularity since, as fire proponents share their stories in.

Source: legacybuildersfinancial.com

Source: legacybuildersfinancial.com

With that logic, here are the savings levels required for early retirement at a handful of expense points, thanks to the college investor. This movement brings with it the. Under the fire movement, a number of people have begun working towards a single goal. The movement first appeared in the late 2000s. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age.

![House FIRE [Financial Independence, Retire Early] Buy House FIRE House FIRE [Financial Independence, Retire Early] Buy House FIRE](https://rukminim1.flixcart.com/image/832/832/krp94sw0/book/9/d/s/house-fire-financial-independence-retire-early-original-imag5fkmjka3psgm.jpeg?q=70) Source: flipkart.com

Source: flipkart.com

Fire stands for financial independence, retire early. Under the fire movement, a number of people have begun working towards a single goal. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. It provides fire community members with impactful analyses designed to make the journey to early retirement easier. The acronym fire stands for ‘financially independent to retire early’.

Source: hollanderlone.com

Source: hollanderlone.com

If you want to retire at 55, you need to save £6,000 a year from the age of 21. The fire movement calculator is designed to take the manual calculations away from those destined to be. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. If you want to retire at 55, you need to save £6,000 a year from the age of 21. It provides fire community members with impactful analyses designed to make the journey to early retirement easier.

Source: pinterest.com

Source: pinterest.com

Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds. It provides fire community members with impactful analyses designed to make the journey to early retirement easier. With that logic, here are the savings levels required for early retirement at a handful of expense points, thanks to the college investor.

Source: debt.ca

Source: debt.ca

This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. The acronym fire stands for ‘financially independent to retire early’. Fire stands for financial independence, retire early. If you want to retire at 55, you need to save £6,000 a year from the age of 21. It�s been gaining popularity since, as fire proponents share their stories in.

Source: pinterest.com

Source: pinterest.com

The movement first appeared in the late 2000s. This movement brings with it the. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. The early retirement calculator is a helpful tool for the fire (financial independence retire early) community to use. Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds.

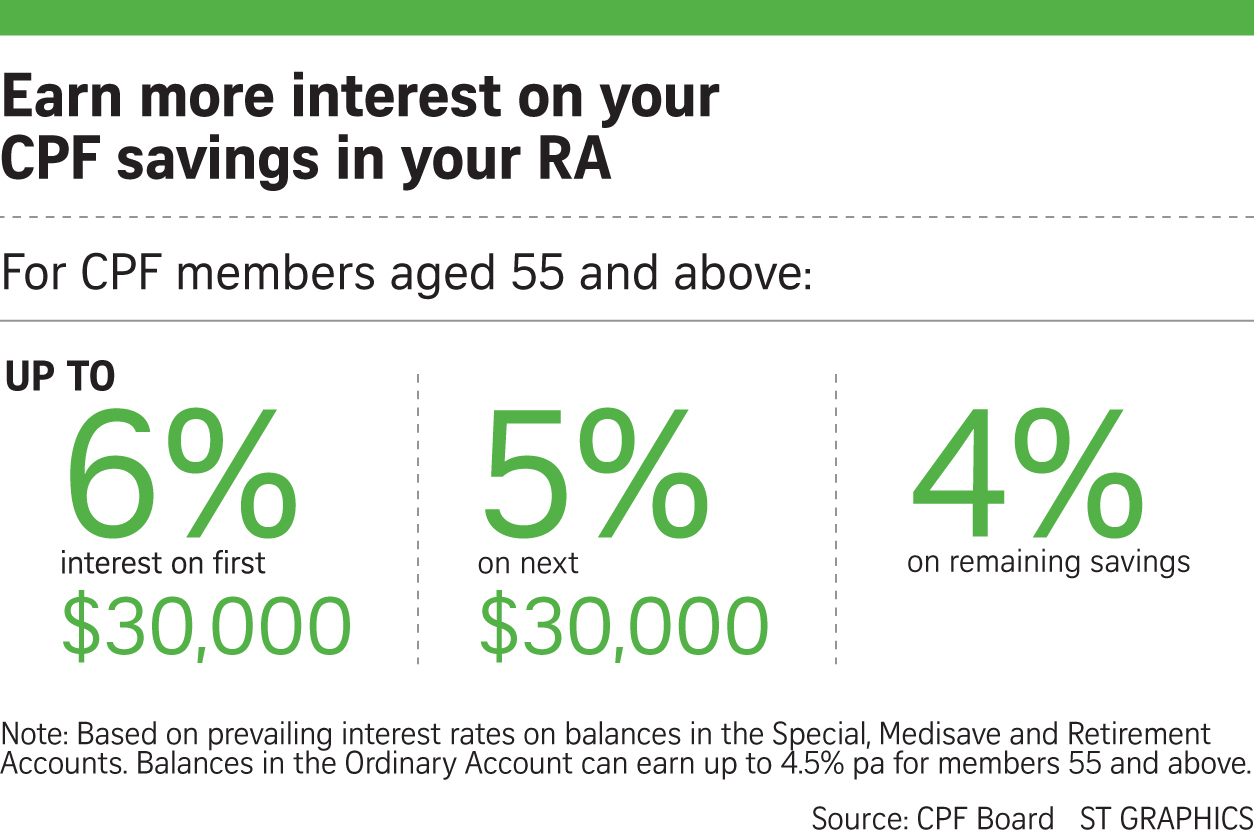

Source: dollarsandsense.sg

Source: dollarsandsense.sg

If you want to retire at 55, you need to save £6,000 a year from the age of 21. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. Fire stands for financial independence, retire early. With that logic, here are the savings levels required for early retirement at a handful of expense points, thanks to the college investor. This movement brings with it the.

Source: pinterest.com

Source: pinterest.com

This movement brings with it the. It provides fire community members with impactful analyses designed to make the journey to early retirement easier. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. Under the fire movement, a number of people have begun working towards a single goal. The fire movement calculator is designed to take the manual calculations away from those destined to be.

Source: pinterest.com

Source: pinterest.com

The movement first appeared in the late 2000s. Under the fire movement, a number of people have begun working towards a single goal. The movement first appeared in the late 2000s. The fire movement calculator is designed to take the manual calculations away from those destined to be. It provides fire community members with impactful analyses designed to make the journey to early retirement easier.

Source: engaging-data.com

Source: engaging-data.com

This movement brings with it the. This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. The acronym fire stands for ‘financially independent to retire early’. Under the fire movement, a number of people have begun working towards a single goal. Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds.

Source: pinterest.com

Source: pinterest.com

It�s been gaining popularity since, as fire proponents share their stories in. The acronym fire stands for ‘financially independent to retire early’. Under the fire movement, a number of people have begun working towards a single goal. If you have an annual salary of £30,000, you would need 20%. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment.

Source: pinterest.com

Source: pinterest.com

The movement first appeared in the late 2000s. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. Fire stands for financial independence, retire early. It�s been gaining popularity since, as fire proponents share their stories in. If you want to retire at 55, you need to save £6,000 a year from the age of 21.

Source: realinvestmentadvice.com

Source: realinvestmentadvice.com

This goal sees them saving enough money to retire several decades (while they’re in their 30s, 40s or even 50s) before the usual retirement age. Financial independence, retire early (fire) is a financial movement defined by frugality and extreme savings and investment. Many in the fire community use the 4% withdrawal rule to decide what they can safely afford to take from savings each year without running out of funds. The fire movement calculator is designed to take the manual calculations away from those destined to be. Fire stands for financial independence, retire early.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fire early retirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.