Your Fidelity retirement calculator images are available in this site. Fidelity retirement calculator are a topic that is being searched for and liked by netizens today. You can Download the Fidelity retirement calculator files here. Get all royalty-free images.

If you’re searching for fidelity retirement calculator images information connected with to the fidelity retirement calculator interest, you have visit the ideal blog. Our website always provides you with hints for seeking the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

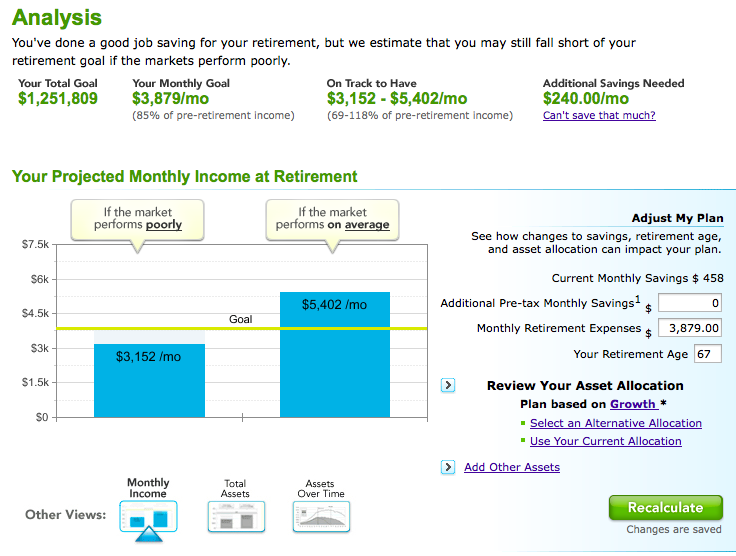

Fidelity Retirement Calculator. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in. The default planning age used in the calculator is 93. You can choose an age from 85 to 100 as the end of your retirement. How the retirement calculator works.

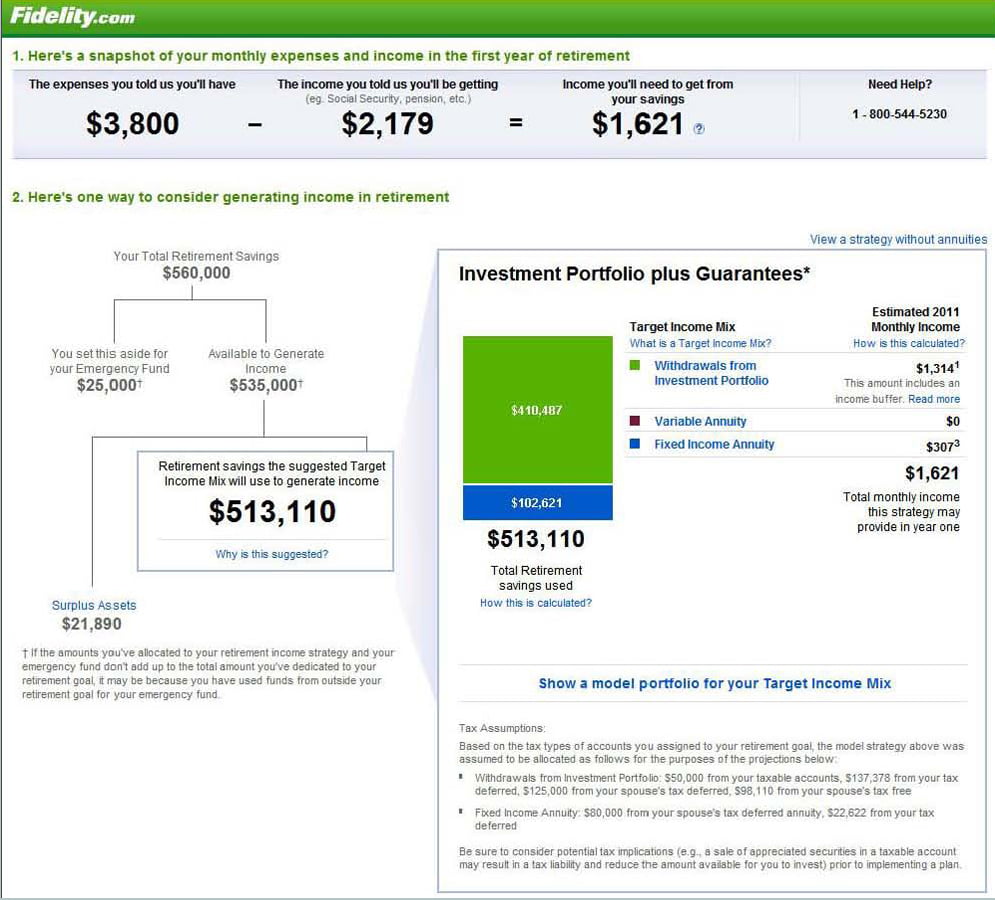

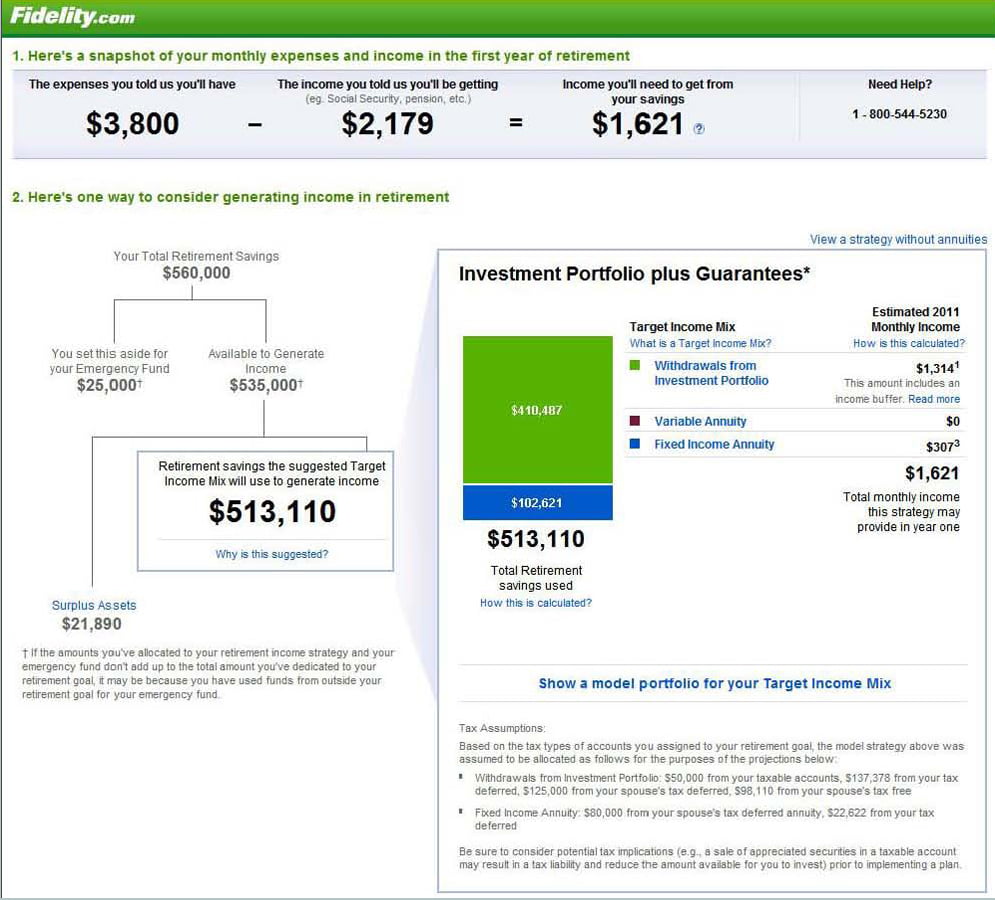

Online Calculator Takes On Annuities Squared Away Blog From squaredawayblog.bc.edu

Online Calculator Takes On Annuities Squared Away Blog From squaredawayblog.bc.edu

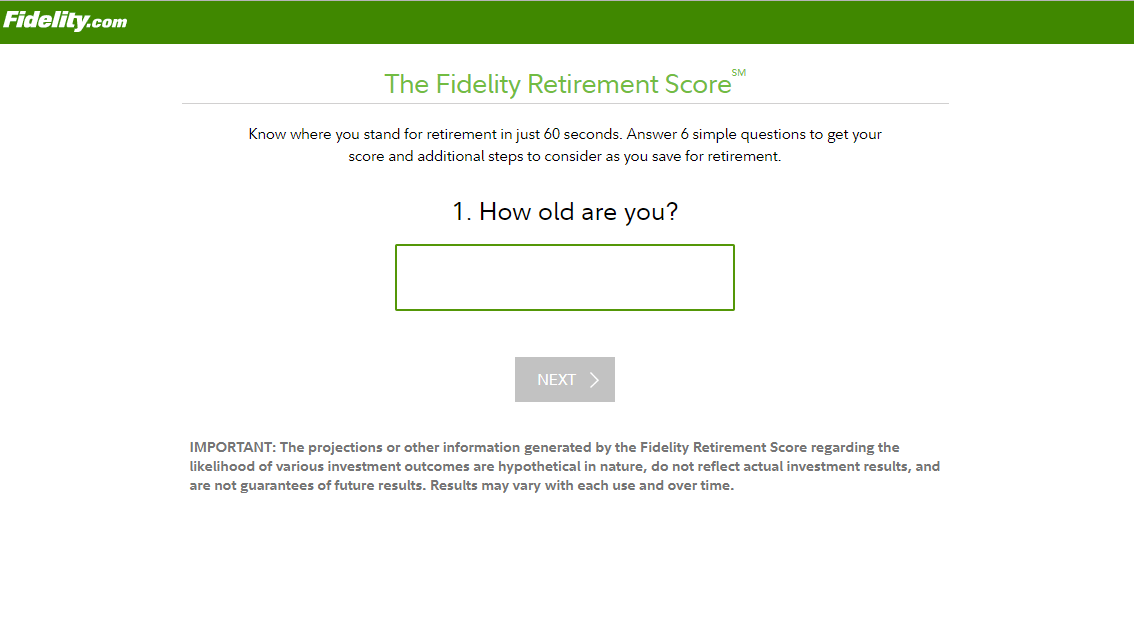

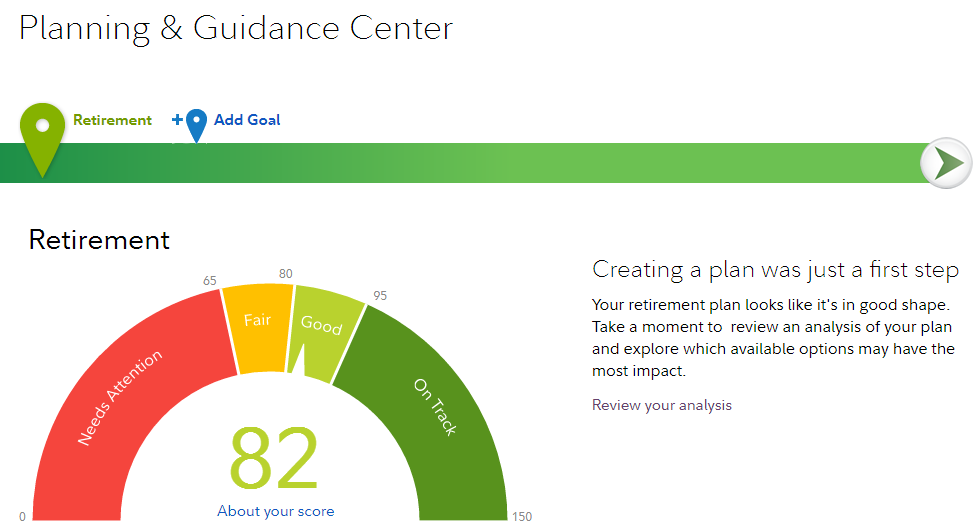

Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. This will affect how much you will have, and consequently change your score. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in. The calculator uses this age to figure out how many years your retirement plan needs to generate income. This includes a minimal amount required for travelling and transport, social and cultural activities and clothing.

This will affect how much you will have, and consequently change your score.

The default planning age used in the calculator is 93. How the retirement calculator works. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. As a first step the retirement calculator assumes a basic cost of living amount. You can choose an age from 85 to 100 as the end of your retirement. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward.

Source: thebalance.com

Source: thebalance.com

Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. You can choose an age from 85 to 100 as the end of your retirement. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals.

Source: cheatsheet.com

Source: cheatsheet.com

This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions. The calculator uses this age to figure out how many years your retirement plan needs to generate income. You can choose an age from 85 to 100 as the end of your retirement. How the retirement calculator works. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both.

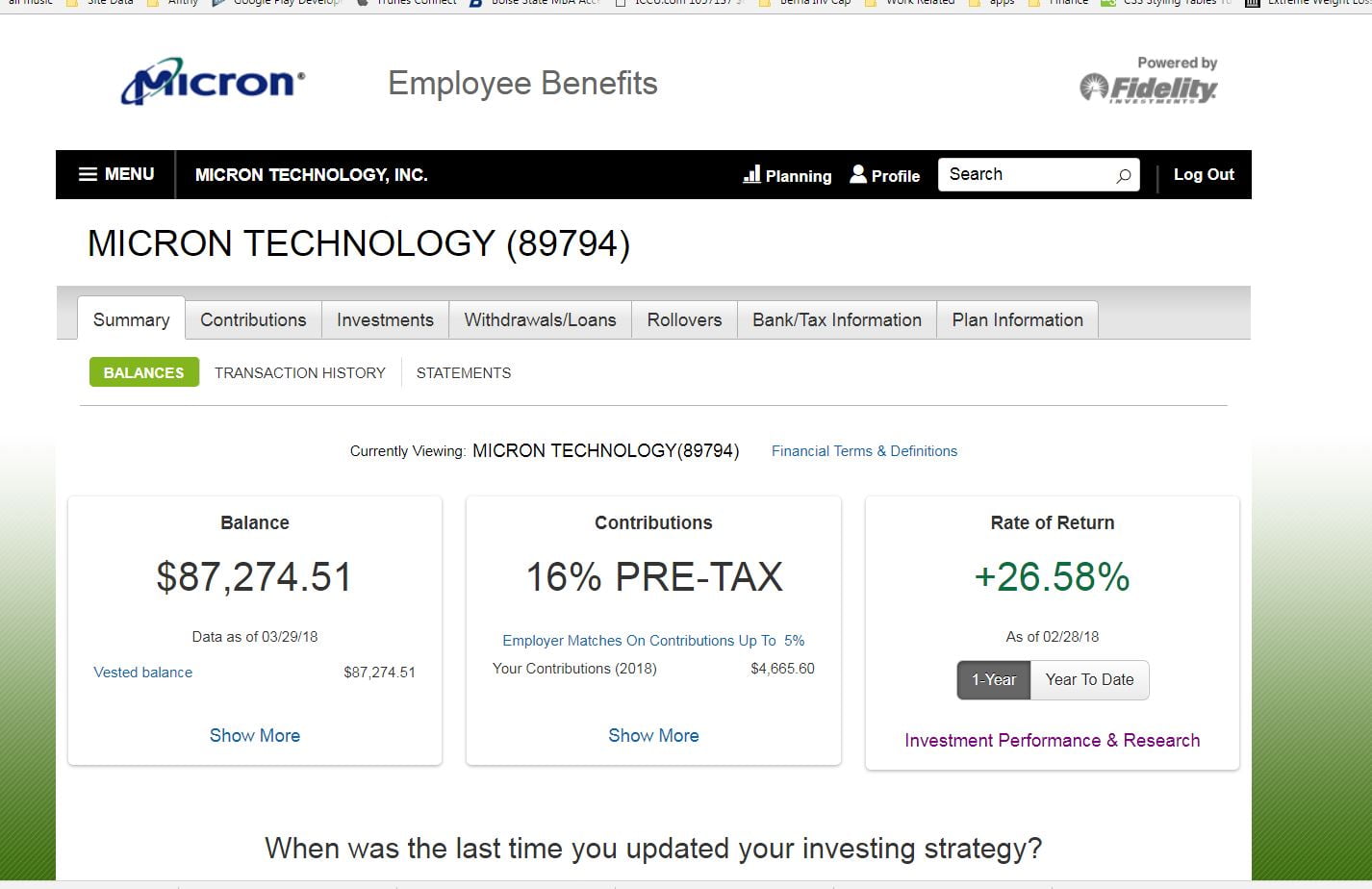

Source: ira-reviews.com

Source: ira-reviews.com

The default planning age used in the calculator is 93. Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. The calculator uses this age to figure out how many years your retirement plan needs to generate income. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in.

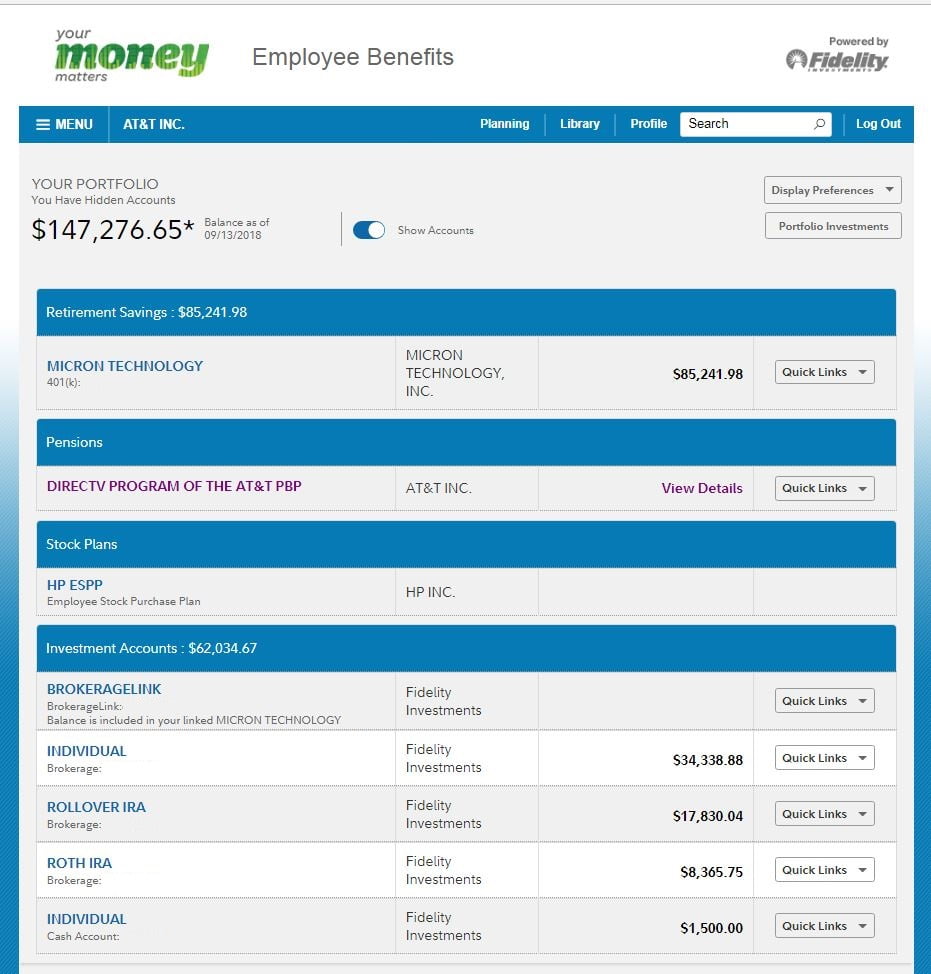

Source: ira-reviews.com

Source: ira-reviews.com

How the retirement calculator works. Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions. This will affect how much you will have, and consequently change your score. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward.

Fees”) Source: employeefiduciary.com

You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. The default planning age used in the calculator is 93. How the retirement calculator works. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward.

As a first step the retirement calculator assumes a basic cost of living amount. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. You can choose an age from 85 to 100 as the end of your retirement. How the retirement calculator works. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in.

Source: uk.stockbrokers.com

Source: uk.stockbrokers.com

This will affect how much you will have, and consequently change your score. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. As a first step the retirement calculator assumes a basic cost of living amount. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in. This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions.

Source: stockbrokers.com

Source: stockbrokers.com

The calculator uses this age to figure out how many years your retirement plan needs to generate income. This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions. The default planning age used in the calculator is 93. The calculator uses this age to figure out how many years your retirement plan needs to generate income. This includes a minimal amount required for travelling and transport, social and cultural activities and clothing.

Source: consiglidesign.com

Source: consiglidesign.com

Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. This includes a minimal amount required for travelling and transport, social and cultural activities and clothing. Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward.

Source: forbes.com

Source: forbes.com

Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. You can choose an age from 85 to 100 as the end of your retirement. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. As a first step the retirement calculator assumes a basic cost of living amount. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals.

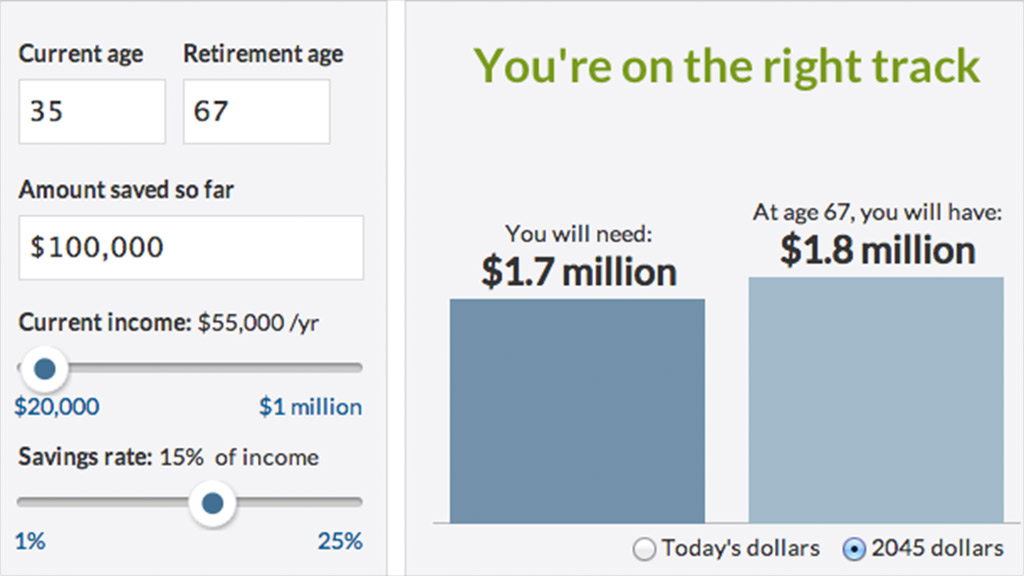

Source: money.cnn.com

Source: money.cnn.com

As a first step the retirement calculator assumes a basic cost of living amount. This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions. The calculator uses this age to figure out how many years your retirement plan needs to generate income. The default planning age used in the calculator is 93. You can choose an age from 85 to 100 as the end of your retirement.

Source: doughroller.net

Source: doughroller.net

You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in. The calculator uses this age to figure out how many years your retirement plan needs to generate income. How the retirement calculator works. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

As a first step the retirement calculator assumes a basic cost of living amount. This will affect how much you will have, and consequently change your score. The calculator uses this age to figure out how many years your retirement plan needs to generate income. Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. This includes a minimal amount required for travelling and transport, social and cultural activities and clothing.

Source: squaredawayblog.bc.edu

Source: squaredawayblog.bc.edu

Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. The calculator uses this age to figure out how many years your retirement plan needs to generate income. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. As a first step the retirement calculator assumes a basic cost of living amount. This includes a minimal amount required for travelling and transport, social and cultural activities and clothing.

Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions. You can choose an age from 85 to 100 as the end of your retirement. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. How the retirement calculator works.

Source: investmentmanias.blogspot.com

Source: investmentmanias.blogspot.com

As a first step the retirement calculator assumes a basic cost of living amount. The calculator uses this age to figure out how many years your retirement plan needs to generate income. Pension allowances and tax overview tax relief lifetime allowance annual allowance money purchase annual allowance tapered annual allowance carry forward. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. You can choose an age from 85 to 100 as the end of your retirement.

Source: best-retirement-calculators.com

Source: best-retirement-calculators.com

How the retirement calculator works. You can choose an age from 85 to 100 as the end of your retirement. This will affect how much you will have, and consequently change your score. Fidelity has handy calculators designed to help you work out all aspects of your retirement, from planning your goals & savings to working out withdrawals. You can increase this cost to a more realistic figure that suits your lifestyle by using the plus key option (in.

Source: brokegirlrich.com

Source: brokegirlrich.com

This includes a minimal amount required for travelling and transport, social and cultural activities and clothing. The calculator uses this age to figure out how many years your retirement plan needs to generate income. Tell us what you expect your pension pot to be at retirement, and we’ll estimate the income you could receive using drawdown, an annuity, or both. As a first step the retirement calculator assumes a basic cost of living amount. You can choose an age from 85 to 100 as the end of your retirement.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fidelity retirement calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.