Your Fers early retirement calculator images are available. Fers early retirement calculator are a topic that is being searched for and liked by netizens now. You can Download the Fers early retirement calculator files here. Find and Download all free vectors.

If you’re looking for fers early retirement calculator images information connected with to the fers early retirement calculator interest, you have pay a visit to the right site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Fers Early Retirement Calculator. Before joining fers, former federal employees could opt to join the csrs offset plan. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency.

10 Financial Benefits for Federal Pharmacists You Wish You Had From yourfinancialpharmacist.com

10 Financial Benefits for Federal Pharmacists You Wish You Had From yourfinancialpharmacist.com

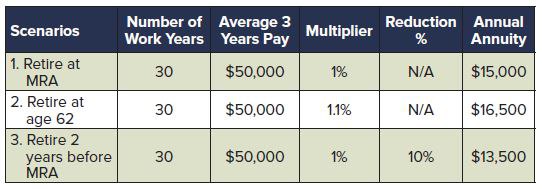

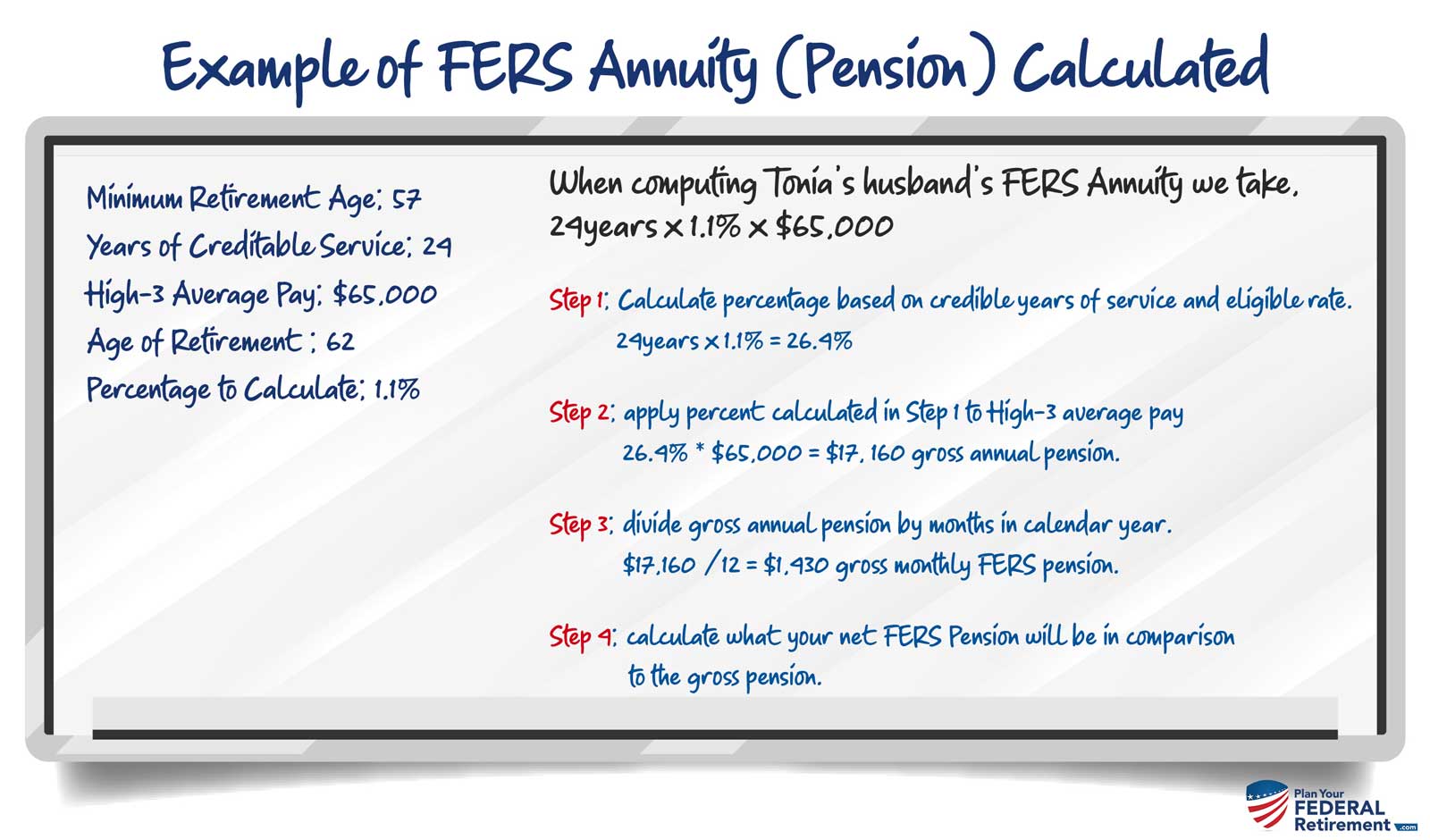

The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Example of early out retirement pension calculation. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Your multiplier is the easy part of the equation. Let’s say you have 20 years of service, and you’re 51.

Your retirement date is based on your mra (minimum retirement age), which is determined by your age and years of creditable service in the civilian federal workforce.

Your retirement date is based on your mra (minimum retirement age), which is determined by your age and years of creditable service in the civilian federal workforce. Your multiplier is the easy part of the equation. Employees also have to pay 6.2 percent of their pay into the social security trust fund. This bump in pension is often the incentive that many feds need to work just a bit longer. This calculator also accounts for military time that you may be eligible to. Find out more about taking a fers early out.

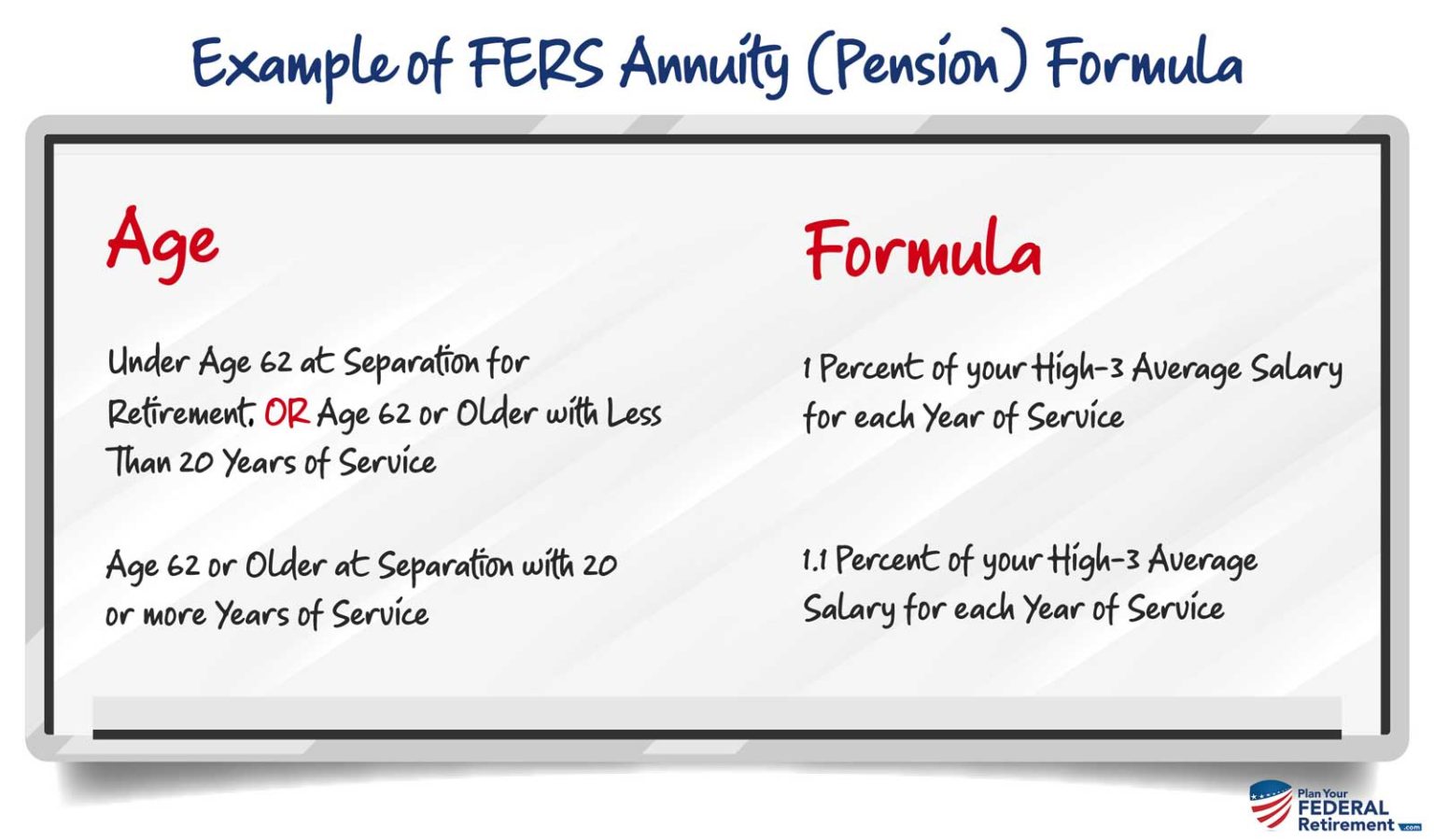

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

This bump in pension is often the incentive that many feds need to work just a bit longer. Employees also have to pay 6.2 percent of their pay into the social security trust fund. Example of early out retirement pension calculation. Before joining fers, former federal employees could opt to join the csrs offset plan. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons.

Source: blog.acadviser.com

This calculator also accounts for military time that you may be eligible to. Let’s say you have 20 years of service, and you’re 51. Employees also have to pay 6.2 percent of their pay into the social security trust fund. Before joining fers, former federal employees could opt to join the csrs offset plan. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency.

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

This calculator also accounts for military time that you may be eligible to. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Example of early out retirement pension calculation. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. This bump in pension is often the incentive that many feds need to work just a bit longer.

Source: youtube.com

Source: youtube.com

This calculator also accounts for military time that you may be eligible to. Employees also have to pay 6.2 percent of their pay into the social security trust fund. This calculator also accounts for military time that you may be eligible to. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Your multiplier is the easy part of the equation.

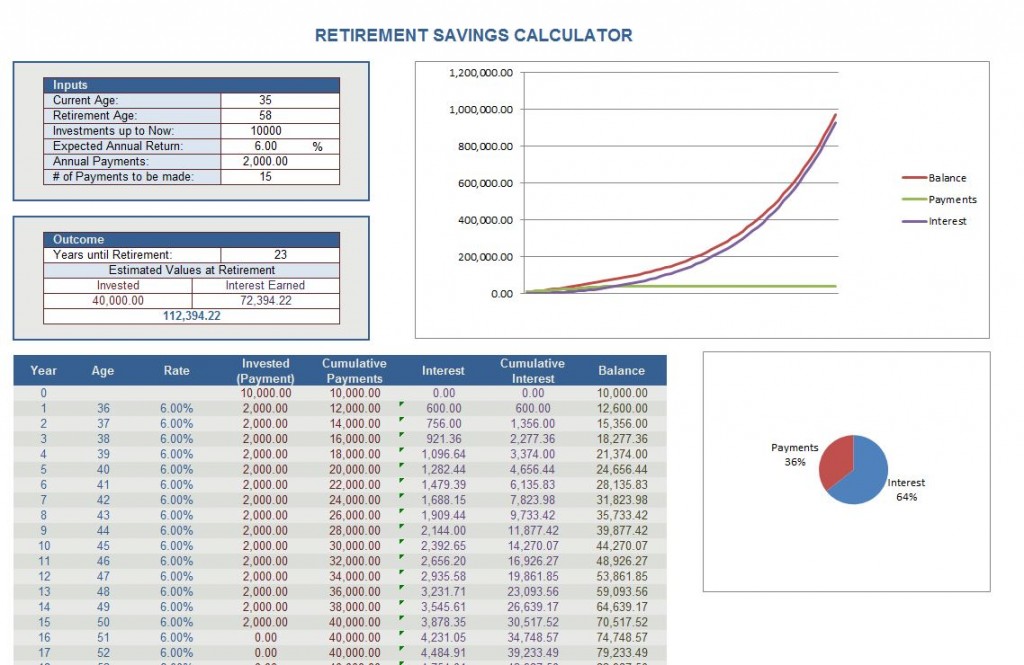

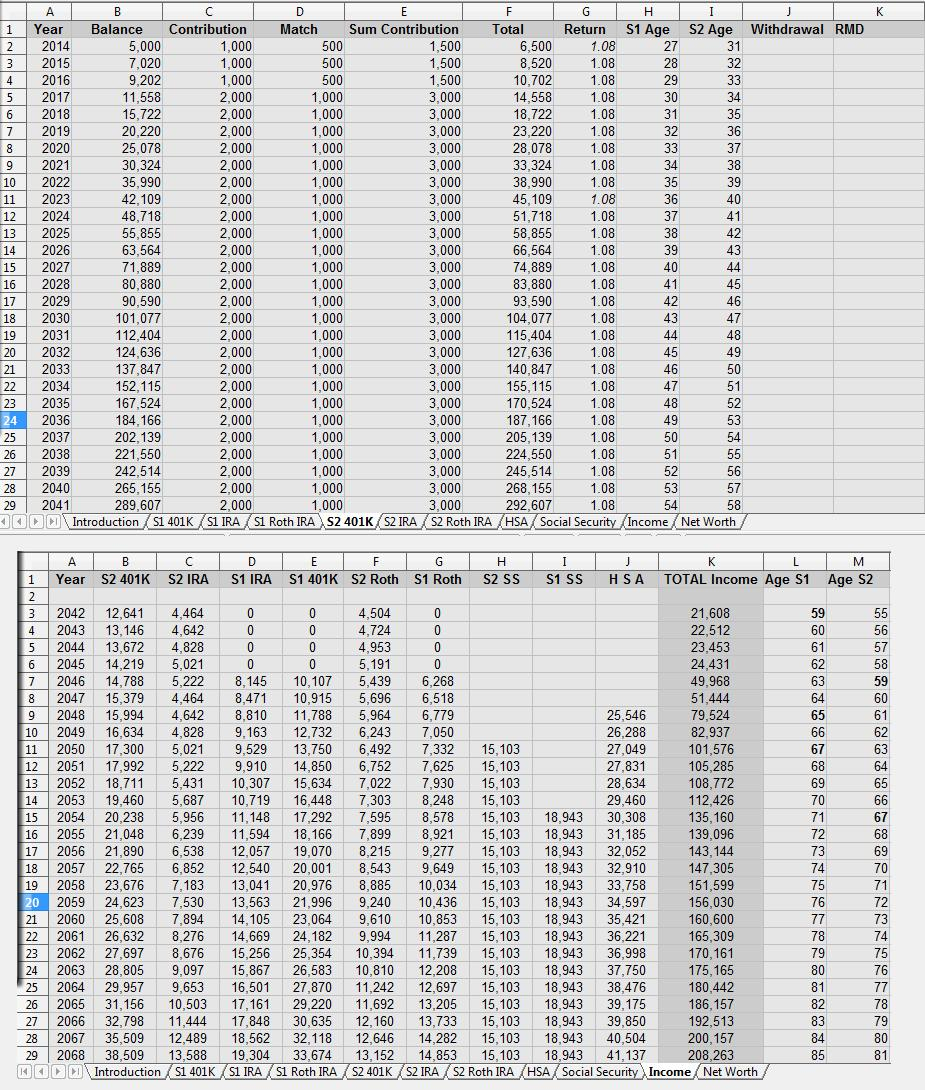

Source: db-excel.com

Source: db-excel.com

Find out more about taking a fers early out. Your multiplier is the easy part of the equation. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. This bump in pension is often the incentive that many feds need to work just a bit longer.

Source: culato.blogspot.com

Source: culato.blogspot.com

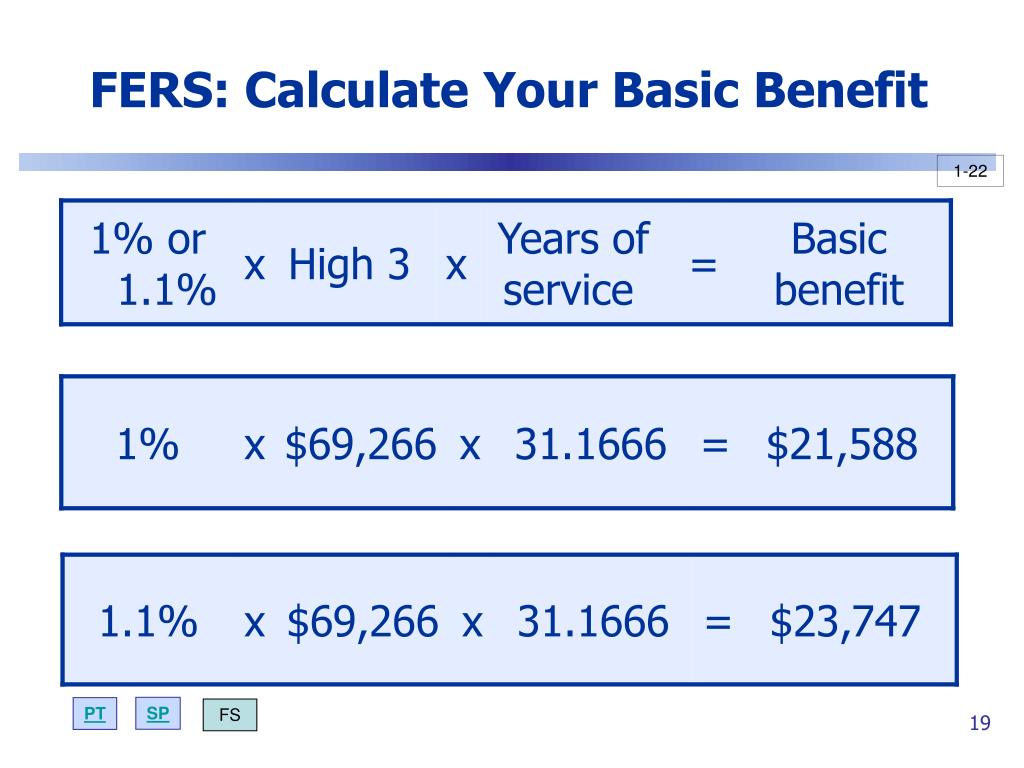

Your retirement date is based on your mra (minimum retirement age), which is determined by your age and years of creditable service in the civilian federal workforce. Example of early out retirement pension calculation. Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!). Let’s say you have 20 years of service, and you’re 51. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee.

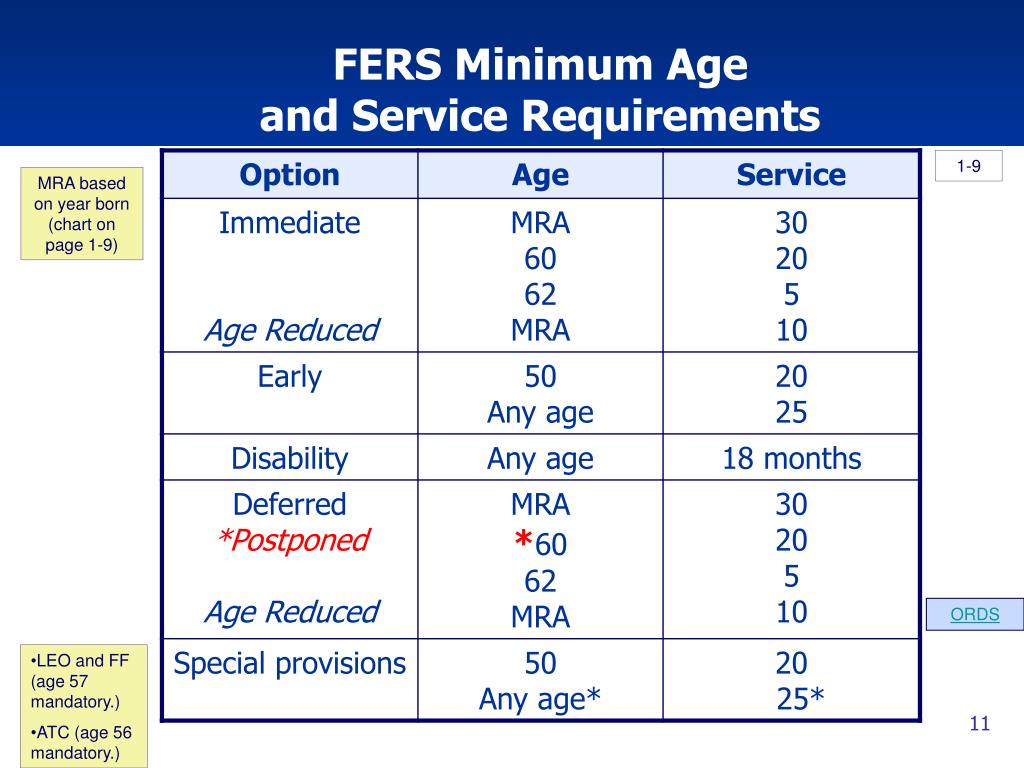

Source: slideserve.com

Source: slideserve.com

This calculator also accounts for military time that you may be eligible to. Before joining fers, former federal employees could opt to join the csrs offset plan. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. This calculator also accounts for military time that you may be eligible to. Your multiplier is the easy part of the equation.

Source: slideserve.com

Source: slideserve.com

You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Let’s say you have 20 years of service, and you’re 51. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Employees also have to pay 6.2 percent of their pay into the social security trust fund. Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!).

Source: retireinstitute.com

Source: retireinstitute.com

This calculator also accounts for military time that you may be eligible to. This calculator also accounts for military time that you may be eligible to. Let’s say you have 20 years of service, and you’re 51. Your retirement date is based on your mra (minimum retirement age), which is determined by your age and years of creditable service in the civilian federal workforce. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency.

Source: kidaltemon.blogspot.com

Source: kidaltemon.blogspot.com

Example of early out retirement pension calculation. This calculator also accounts for military time that you may be eligible to. Before joining fers, former federal employees could opt to join the csrs offset plan. Let’s say you have 20 years of service, and you’re 51. Employees also have to pay 6.2 percent of their pay into the social security trust fund.

Source: fabtemplatez.com

Source: fabtemplatez.com

Your multiplier is the easy part of the equation. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Your multiplier is the easy part of the equation. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons.

Source: calucul.blogspot.com

Source: calucul.blogspot.com

Find out more about taking a fers early out. Your retirement date is based on your mra (minimum retirement age), which is determined by your age and years of creditable service in the civilian federal workforce. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Let’s say you have 20 years of service, and you’re 51. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency.

Source: wealthynickel.com

Source: wealthynickel.com

This calculator also accounts for military time that you may be eligible to. Your multiplier is the easy part of the equation. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. Let’s say you have 20 years of service, and you’re 51. Before joining fers, former federal employees could opt to join the csrs offset plan.

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

Before joining fers, former federal employees could opt to join the csrs offset plan. Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!). You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Use our fers retirement date calculator to find the earliest date you can retire as a federal employee. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons.

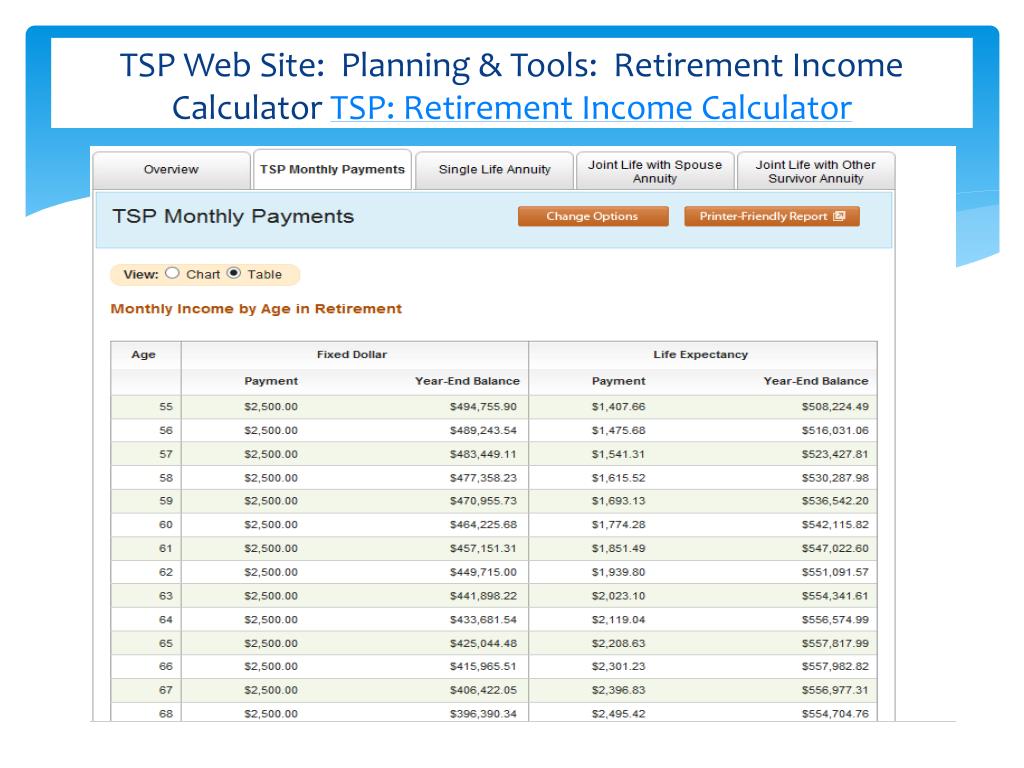

Source: slideserve.com

Source: slideserve.com

This bump in pension is often the incentive that many feds need to work just a bit longer. Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!). You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. This bump in pension is often the incentive that many feds need to work just a bit longer. Find out more about taking a fers early out.

Source: in.pinterest.com

Source: in.pinterest.com

This bump in pension is often the incentive that many feds need to work just a bit longer. Your multiplier is the easy part of the equation. Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!). Employees also have to pay 6.2 percent of their pay into the social security trust fund. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons.

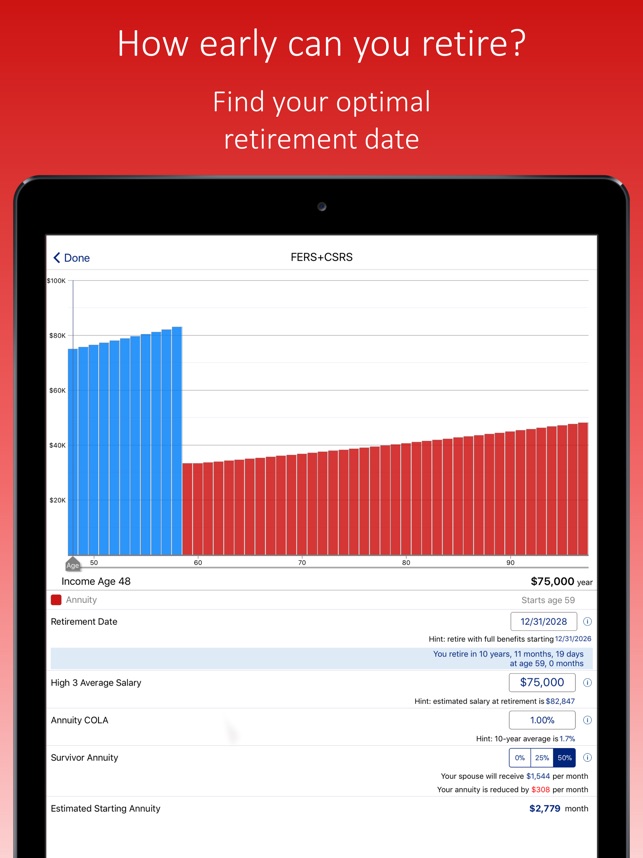

Source: fers-csrs-retirement-estimator-ios.soft112.com

Source: fers-csrs-retirement-estimator-ios.soft112.com

Let’s say you have 20 years of service, and you’re 51. The federal employees’ retirement system (fers) covers federal employees who were hired after january 1, 1984, and who switched from the csrs during open seasons. This bump in pension is often the incentive that many feds need to work just a bit longer. Your multiplier is the easy part of the equation. Before joining fers, former federal employees could opt to join the csrs offset plan.

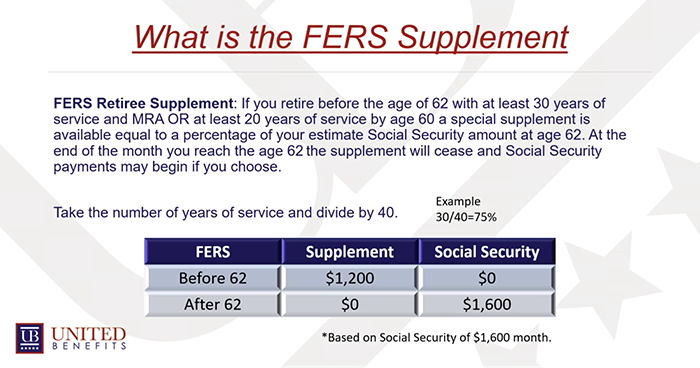

Source: unitedbenefits.com

Source: unitedbenefits.com

Find out more about taking a fers early out. Let’s say you have 20 years of service, and you’re 51. Employees also have to pay 6.2 percent of their pay into the social security trust fund. You can only take a fers early out retirement if you meet the requirements and it’s offered by your agency. Example of early out retirement pension calculation.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fers early retirement calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.