Your Early withdrawal 2020 images are ready in this website. Early withdrawal 2020 are a topic that is being searched for and liked by netizens now. You can Find and Download the Early withdrawal 2020 files here. Find and Download all free photos and vectors.

If you’re searching for early withdrawal 2020 pictures information connected with to the early withdrawal 2020 topic, you have pay a visit to the ideal site. Our website always gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Early Withdrawal 2020. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Updated Trinity Study For 2020 More Withdrawal Rates Study, Early From pinterest.com

Updated Trinity Study For 2020 More Withdrawal Rates Study, Early From pinterest.com

Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. The tax software will pick the right tax forms, do the math, and help find tax benefits. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½.

Early withdrawal rules can be complex.

Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The tax software will pick the right tax forms, do the math, and help find tax benefits. Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Source: myscience.org

Source: myscience.org

Early withdrawal rules can be complex. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The tax software will pick the right tax forms, do the math, and help find tax benefits. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Early withdrawal rules can be complex.

Source: thebalance.com

Source: thebalance.com

The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The tax software will pick the right tax forms, do the math, and help find tax benefits. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Early withdrawal rules can be complex.

Source: pinterest.com

Source: pinterest.com

Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½.

Source: pinterest.com

Source: pinterest.com

Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Early withdrawal rules can be complex. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Source: moneypeach.com

Source: moneypeach.com

The tax software will pick the right tax forms, do the math, and help find tax benefits. The tax software will pick the right tax forms, do the math, and help find tax benefits. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions.

Source: a1squad.com

Source: a1squad.com

The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance.

Source: youtube.com

Source: youtube.com

The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The tax software will pick the right tax forms, do the math, and help find tax benefits. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

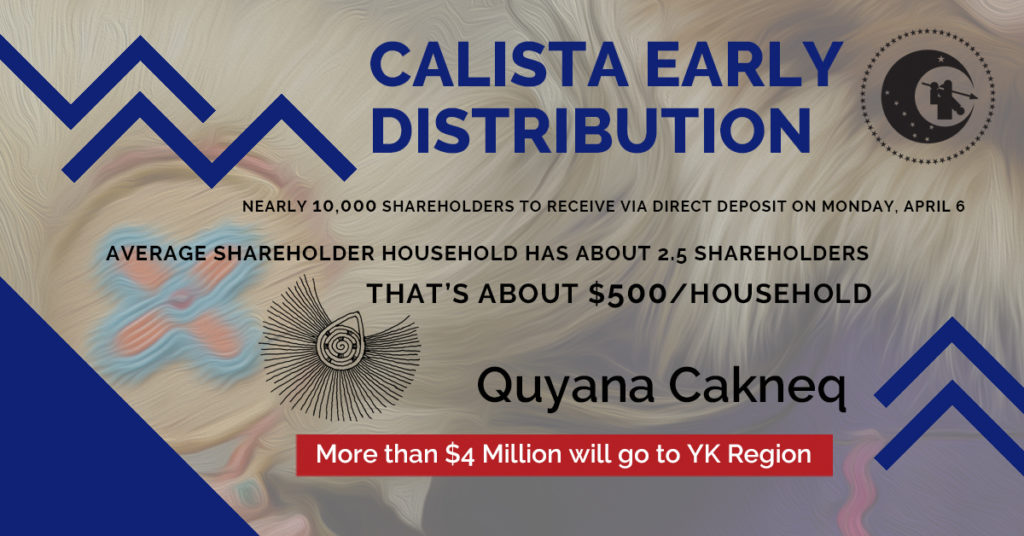

Source: calistacorp.com

Source: calistacorp.com

The tax software will pick the right tax forms, do the math, and help find tax benefits. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions.

Source: 401kspecialistmag.com

Source: 401kspecialistmag.com

Early withdrawal rules can be complex. Early withdrawal rules can be complex. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Source: calistacorp.com

Source: calistacorp.com

The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Early withdrawal rules can be complex. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Source: pinterest.com

Source: pinterest.com

Early withdrawal rules can be complex. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Early withdrawal rules can be complex. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. The tax software will pick the right tax forms, do the math, and help find tax benefits.

Source: youtube.com

Source: youtube.com

The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Early withdrawal rules can be complex. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½.

Source: calistacorp.com

Source: calistacorp.com

Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance.

Source: thebalance.com

Source: thebalance.com

The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return.

Source: phpdistribution.com

Source: phpdistribution.com

Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Early withdrawal rules can be complex. The tax software will pick the right tax forms, do the math, and help find tax benefits. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½.

Source: esloseguido.blogspot.com

Source: esloseguido.blogspot.com

The tax software will pick the right tax forms, do the math, and help find tax benefits. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions.

Source: dknation.draftkings.com

Source: dknation.draftkings.com

The tax software will pick the right tax forms, do the math, and help find tax benefits. Among other things, the cares act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. Early withdrawal rules can be complex. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance.

Source: retirehappy.ca

Source: retirehappy.ca

The tax software will pick the right tax forms, do the math, and help find tax benefits. The tax software will pick the right tax forms, do the math, and help find tax benefits. The cares act exempts crds from the 20% mandatory withholding that normally applies to certain retirement plan distributions. Early withdrawal rules can be complex. The stimulus bill doubled the amount you can borrow from an eligible retirement plan for the next six months, from $50,000 to $100,000 and the loans are now capped at 100% of your vested balance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early withdrawal 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.