Your Early retirement strategies and roth conversion images are available. Early retirement strategies and roth conversion are a topic that is being searched for and liked by netizens now. You can Get the Early retirement strategies and roth conversion files here. Find and Download all free images.

If you’re searching for early retirement strategies and roth conversion images information connected with to the early retirement strategies and roth conversion keyword, you have come to the right site. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

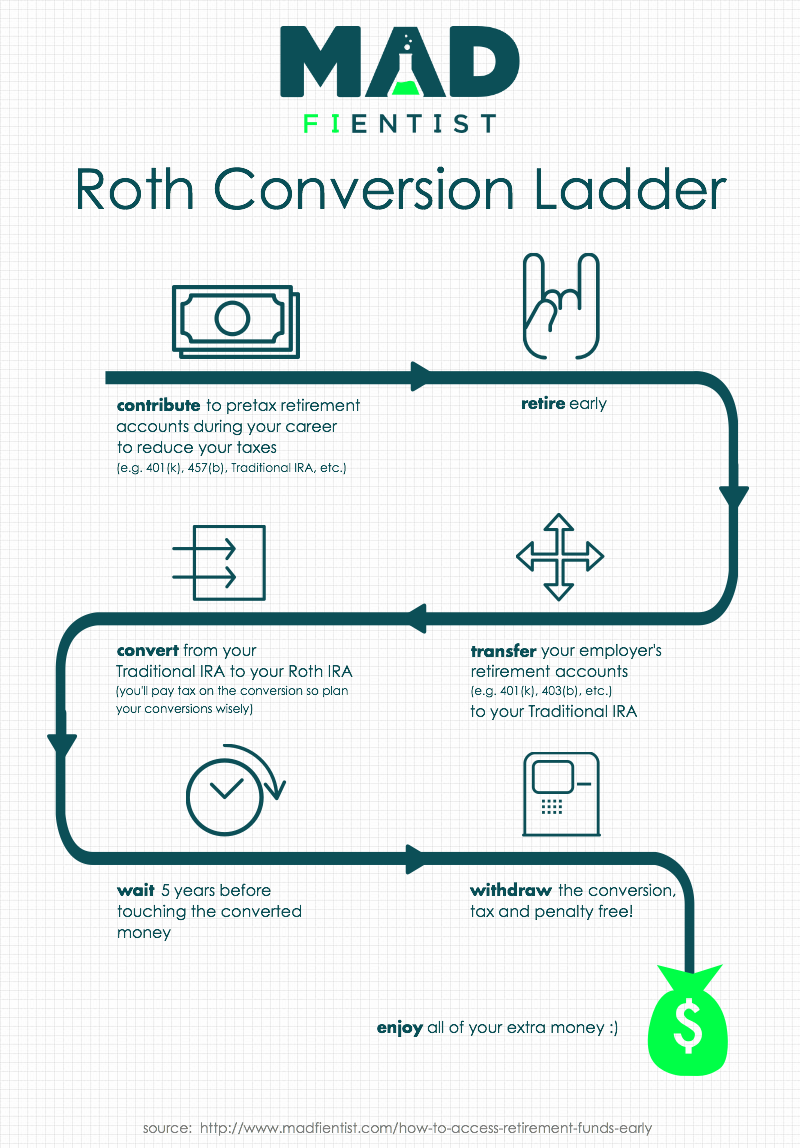

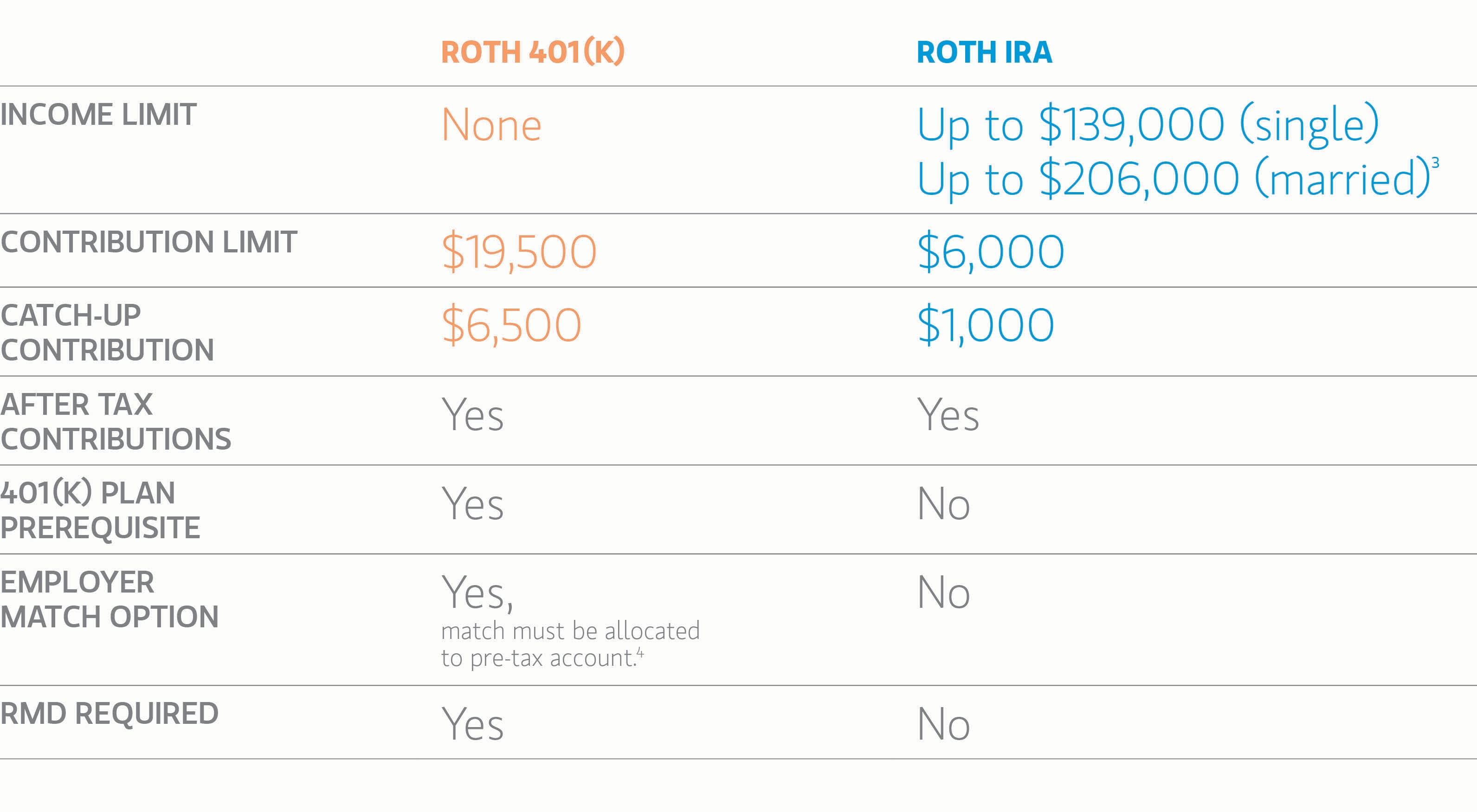

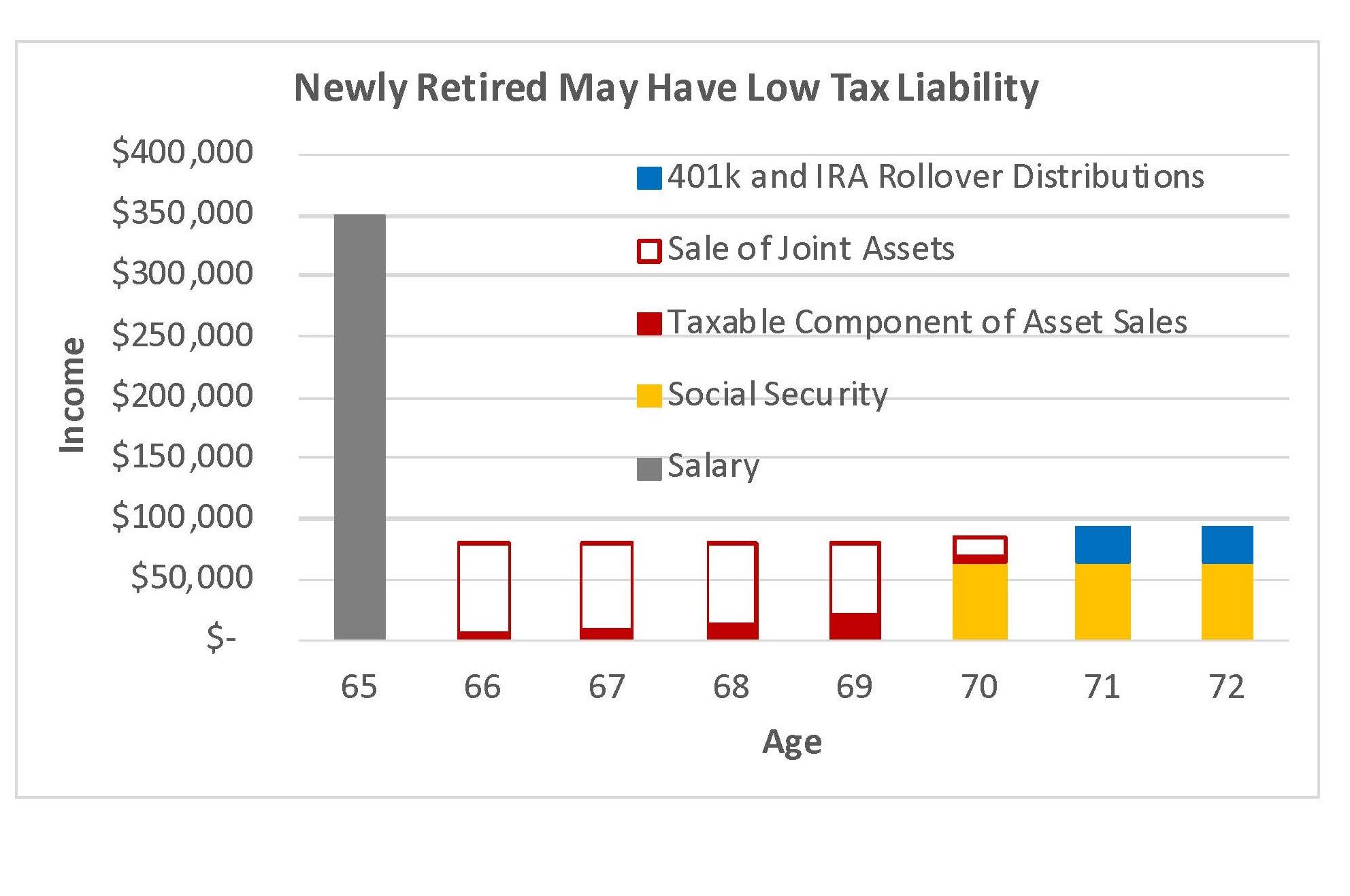

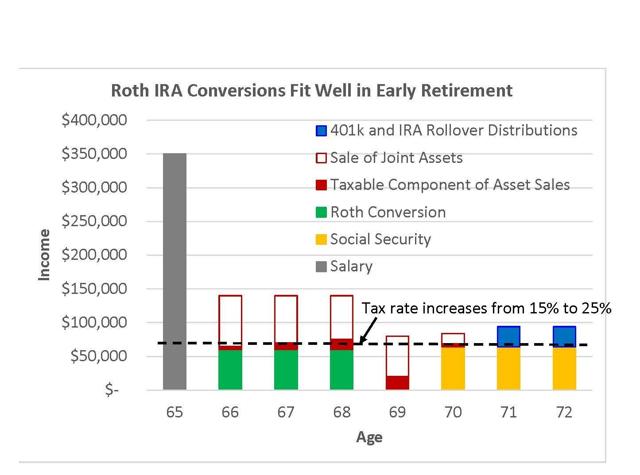

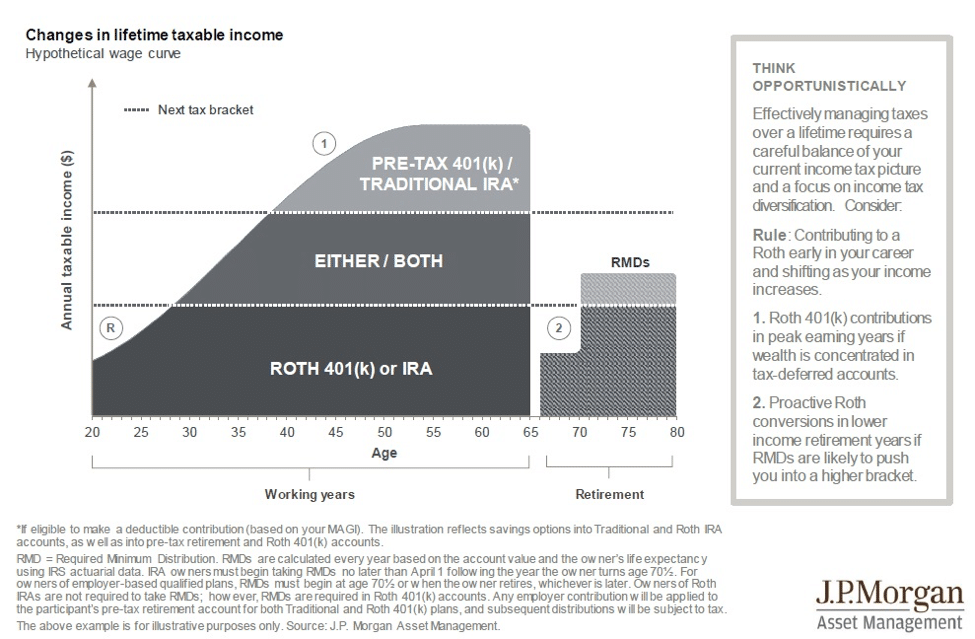

Early Retirement Strategies And Roth Conversion. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. A married couple filing jointly pays tax at. Transfer 401k funds to a traditional ira. As you prepare for early retirement, you will be saving a.

The Benefit and Suitability of Roth Conversions From wsfsbank.com

The Benefit and Suitability of Roth Conversions From wsfsbank.com

A married couple filing jointly pays tax at. One of the most important steps is to determine how much money you’ll need to. One can exercise this option regardless of. Roth ira conversion ladder step 1: Transfer 401k funds to a traditional ira. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax.

As soon as you quit your job, you’ll want to transfer the money that’s.

One of the most important steps is to determine how much money you’ll need to. One of the most important steps is to determine how much money you’ll need to. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. Transfer 401k funds to a traditional ira. Roth ira conversion ladder step 1: How to create a roth ira conversion ladder step 1:

Source: madfientist.com

Source: madfientist.com

As you prepare for early retirement, you will be saving a. As soon as you quit your job, you’ll want to transfer the money that’s. Transfer 401k funds to a traditional ira. One can exercise this option regardless of. Once you have built your net worth to your fi number, then you’re ready to retire early!

Source: sensiblefinancial.com

Source: sensiblefinancial.com

Once you have built your net worth to your fi number, then you’re ready to retire early! Once you have built your net worth to your fi number, then you’re ready to retire early! Transfer 401k funds to a traditional ira. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. Roth ira conversion ladder step 1:

Source: putnam.com

Source: putnam.com

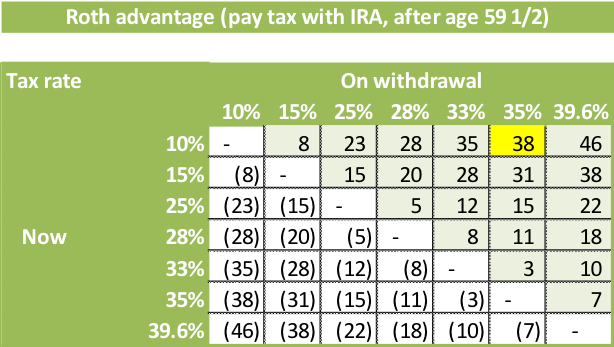

A married couple filing jointly pays tax at. As soon as you quit your job, you’ll want to transfer the money that’s. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value.

Source: fishbowlapp.com

Source: fishbowlapp.com

As you prepare for early retirement, you will be saving a. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. As soon as you quit your job, you’ll want to transfer the money that’s. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. One can exercise this option regardless of.

Source: morganstanley.com

Source: morganstanley.com

Transfer 401k funds to a traditional ira. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. A married couple filing jointly pays tax at. How to create a roth ira conversion ladder step 1: As soon as you quit your job, you’ll want to transfer the money that’s.

Source: truewealthdesign.com

Source: truewealthdesign.com

Roth ira conversion ladder step 1: One can exercise this option regardless of. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. As soon as you quit your job, you’ll want to transfer the money that’s. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value.

Source: seekingalpha.com

Source: seekingalpha.com

As soon as you quit your job, you’ll want to transfer the money that’s. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. A married couple filing jointly pays tax at. Once you have built your net worth to your fi number, then you’re ready to retire early! One of the most important steps is to determine how much money you’ll need to.

Source: financialdesignstudio.com

Source: financialdesignstudio.com

The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. A married couple filing jointly pays tax at. One can exercise this option regardless of. One of the most important steps is to determine how much money you’ll need to.

Source: providencefinancialinc.com

Source: providencefinancialinc.com

The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. Transfer 401k funds to a traditional ira. A married couple filing jointly pays tax at. As soon as you quit your job, you’ll want to transfer the money that’s. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax.

Source: iscfinancialadvisors.com

Source: iscfinancialadvisors.com

Transfer 401k funds to a traditional ira. A married couple filing jointly pays tax at. One can exercise this option regardless of. Once you have built your net worth to your fi number, then you’re ready to retire early! One of the most important steps is to determine how much money you’ll need to.

Source: putnam.com

Source: putnam.com

One of the most important steps is to determine how much money you’ll need to. As you prepare for early retirement, you will be saving a. One can exercise this option regardless of. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax.

Source: seekingalpha.com

Source: seekingalpha.com

How to create a roth ira conversion ladder step 1: With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. As you prepare for early retirement, you will be saving a. Transfer 401k funds to a traditional ira. The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value.

Source: usatoday.com

Source: usatoday.com

The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. One can exercise this option regardless of. How to create a roth ira conversion ladder step 1: As you prepare for early retirement, you will be saving a. As soon as you quit your job, you’ll want to transfer the money that’s.

Source: pinterest.com

Source: pinterest.com

The dearth of taxable income in early retirement suggests that a roth conversion strategy during those years can add substantial value. How to create a roth ira conversion ladder step 1: The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. One of the most important steps is to determine how much money you’ll need to. As soon as you quit your job, you’ll want to transfer the money that’s.

Source: usatoday.com

Source: usatoday.com

A married couple filing jointly pays tax at. One of the most important steps is to determine how much money you’ll need to. As soon as you quit your job, you’ll want to transfer the money that’s. As you prepare for early retirement, you will be saving a. One can exercise this option regardless of.

Source: wsfsbank.com

Source: wsfsbank.com

One can exercise this option regardless of. Transfer 401k funds to a traditional ira. As you prepare for early retirement, you will be saving a. One of the most important steps is to determine how much money you’ll need to. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account.

Source: virtuswealth.com

Source: virtuswealth.com

Once you have built your net worth to your fi number, then you’re ready to retire early! The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. One can exercise this option regardless of. Transfer 401k funds to a traditional ira. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax.

Source: financialdesignstudio.com

Source: financialdesignstudio.com

With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. The roth conversion option allows an individual to distribute pretax dollars set aside in a traditional ira or 401k directly to a roth ira account. One can exercise this option regardless of. With conversions of $15k, he will pay a lower tax on the amount converted at 22% compared to the 25% tax rate he’d pay during early retirement by paying the penalty plus 15% tax. Roth ira conversion ladder step 1:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement strategies and roth conversion by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.