Your Early retirement rule of 70 images are ready in this website. Early retirement rule of 70 are a topic that is being searched for and liked by netizens now. You can Get the Early retirement rule of 70 files here. Get all royalty-free photos.

If you’re searching for early retirement rule of 70 pictures information connected with to the early retirement rule of 70 keyword, you have come to the right blog. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Early Retirement Rule Of 70. The rule of 70 is a way to estimate the number of years it takes for a certain variable to double. If you use the rule of 69.3, you will get 10.828125 years. If you use the rule of 70, you will get 10.9375. The rule of 70 and the rule of 72 are nearly the.

The Ultimate Guide to Safe Withdrawal Rates Part 22 Can the “Simple From earlyretirementnow.com

The Ultimate Guide to Safe Withdrawal Rates Part 22 Can the “Simple From earlyretirementnow.com

If you use the rule of 70, you will get 10.9375. The rule of 70 vs. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. The rule of 70 is a way to estimate the number of years it takes for a certain variable to double. These investments could be stocks, bonds or a group of investments within a retirement portfolio.

If you miss these, there is a hefty penalty, so make sure you start them on time.

From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. If you use the rule of 69.3, you will get 10.828125 years. The rule of 70 vs. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. These investments could be stocks, bonds or a group of investments within a retirement portfolio. If you miss these, there is a hefty penalty, so make sure you start them on time.

Source: truewealthdesign.com

Source: truewealthdesign.com

If you use the rule of 69.3, you will get 10.828125 years. To estimate the number of years for a variable to double, take the number 70 and. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. If you use the rule of 70, you will get 10.9375. The rule of 70 is a way to estimate the number of years it takes for a certain variable to double.

Source: lordabbett.com

Source: lordabbett.com

The rule of 70 vs. Even though there is a difference between these three results, it translates to only a few months difference when. From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. If you miss these, there is a hefty penalty, so make sure you start them on time. To estimate the number of years for a variable to double, take the number 70 and.

Source: northwestern.edu

Source: northwestern.edu

For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. These investments could be stocks, bonds or a group of investments within a retirement portfolio. You can obtain the number 11.25 when you use 72 instead, which is a lot easier to work with when doing your calculations. The rule of 70 and the rule of 72 are nearly the. If you miss these, there is a hefty penalty, so make sure you start them on time.

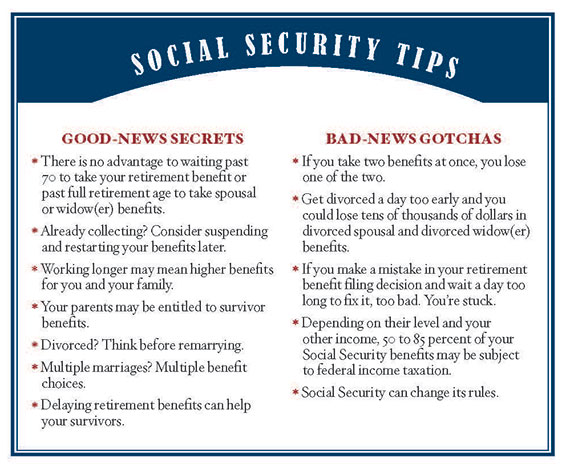

Source: simplywise.com

Source: simplywise.com

If you use the rule of 69.3, you will get 10.828125 years. Even though there is a difference between these three results, it translates to only a few months difference when. If you miss these, there is a hefty penalty, so make sure you start them on time. You can obtain the number 11.25 when you use 72 instead, which is a lot easier to work with when doing your calculations. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster.

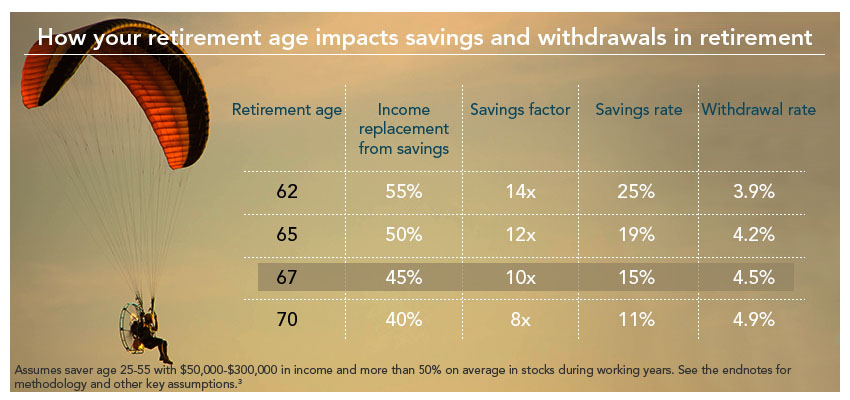

Source: retirement.fidelity.com.hk

Source: retirement.fidelity.com.hk

The rule of 70 is a way to estimate the number of years it takes for a certain variable to double. The rule of 70 and the rule of 72 are nearly the. If you use the rule of 69.3, you will get 10.828125 years. The rule of 70 vs. If you miss these, there is a hefty penalty, so make sure you start them on time.

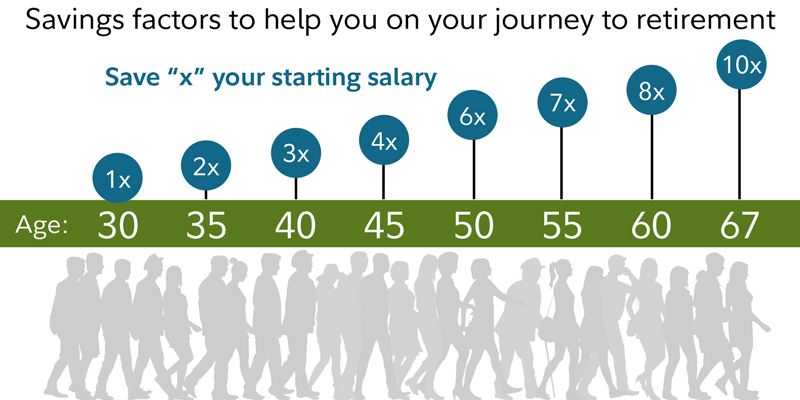

Source: fidelity.com

Source: fidelity.com

If you use the rule of 70, you will get 10.9375. These investments could be stocks, bonds or a group of investments within a retirement portfolio. If you miss these, there is a hefty penalty, so make sure you start them on time. If you use the rule of 70, you will get 10.9375. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019.

Source: fidelity.com

Source: fidelity.com

If you use the rule of 69.3, you will get 10.828125 years. From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. These investments could be stocks, bonds or a group of investments within a retirement portfolio. Lastly, although it applies to people of all ages, when you�re.

If you miss these, there is a hefty penalty, so make sure you start them on time. To estimate the number of years for a variable to double, take the number 70 and. If you use the rule of 70, you will get 10.9375. Even though there is a difference between these three results, it translates to only a few months difference when. These investments could be stocks, bonds or a group of investments within a retirement portfolio.

Source: br.pinterest.com

Source: br.pinterest.com

For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. If you miss these, there is a hefty penalty, so make sure you start them on time. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. These investments could be stocks, bonds or a group of investments within a retirement portfolio. From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts.

Source: lordabbett.com

Source: lordabbett.com

The rule of 70 and the rule of 72 are nearly the. From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. You can obtain the number 11.25 when you use 72 instead, which is a lot easier to work with when doing your calculations. If you use the rule of 69.3, you will get 10.828125 years. These investments could be stocks, bonds or a group of investments within a retirement portfolio.

Source: myseniorhealthplan.com

Source: myseniorhealthplan.com

For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. The rule of 70 is a way to estimate the number of years it takes for a certain variable to double. The rule of 70 vs. If you miss these, there is a hefty penalty, so make sure you start them on time. The rule of 70 and the rule of 72 are nearly the.

Source: wctpension.org

Source: wctpension.org

Even though there is a difference between these three results, it translates to only a few months difference when. To estimate the number of years for a variable to double, take the number 70 and. If you miss these, there is a hefty penalty, so make sure you start them on time. If you use the rule of 70, you will get 10.9375. Even though there is a difference between these three results, it translates to only a few months difference when.

Source: edrempel.com

Source: edrempel.com

From age 70, you�ll also need to keep in mind the minimum distribution limits on your retirement accounts. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. The rule of 70 and the rule of 72 are nearly the. If you use the rule of 70, you will get 10.9375. The rule of 70 is a way to estimate the number of years it takes for a certain variable to double.

Source: gocurrycracker.com

Source: gocurrycracker.com

If you miss these, there is a hefty penalty, so make sure you start them on time. The rule of 70 vs. If you use the rule of 70, you will get 10.9375. To estimate the number of years for a variable to double, take the number 70 and. You can obtain the number 11.25 when you use 72 instead, which is a lot easier to work with when doing your calculations.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

The rule of 70 is a way to estimate the number of years it takes for a certain variable to double. Lastly, although it applies to people of all ages, when you�re. If you use the rule of 69.3, you will get 10.828125 years. The rule of 70 and the rule of 72 are nearly the. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster.

Source: addishill.com

Source: addishill.com

Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. If you use the rule of 70, you will get 10.9375. To estimate the number of years for a variable to double, take the number 70 and. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019.

Source: fool.com

Source: fool.com

These investments could be stocks, bonds or a group of investments within a retirement portfolio. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. You can obtain the number 11.25 when you use 72 instead, which is a lot easier to work with when doing your calculations. For instance, an investor might use the rule of 70 to determine what new types of investments to add to a portfolio in order to get it to grow even faster. Lastly, although it applies to people of all ages, when you�re.

Source: urban.org

Source: urban.org

The rule of 70 and the rule of 72 are nearly the. Many plans require withdrawals by 72 for those who turned 70 1/2 after december 31, 2019. If you use the rule of 70, you will get 10.9375. Even though there is a difference between these three results, it translates to only a few months difference when. These investments could be stocks, bonds or a group of investments within a retirement portfolio.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement rule of 70 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.