Your Early retirement qualify for obamacare images are available. Early retirement qualify for obamacare are a topic that is being searched for and liked by netizens today. You can Get the Early retirement qualify for obamacare files here. Get all royalty-free vectors.

If you’re looking for early retirement qualify for obamacare images information linked to the early retirement qualify for obamacare keyword, you have come to the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

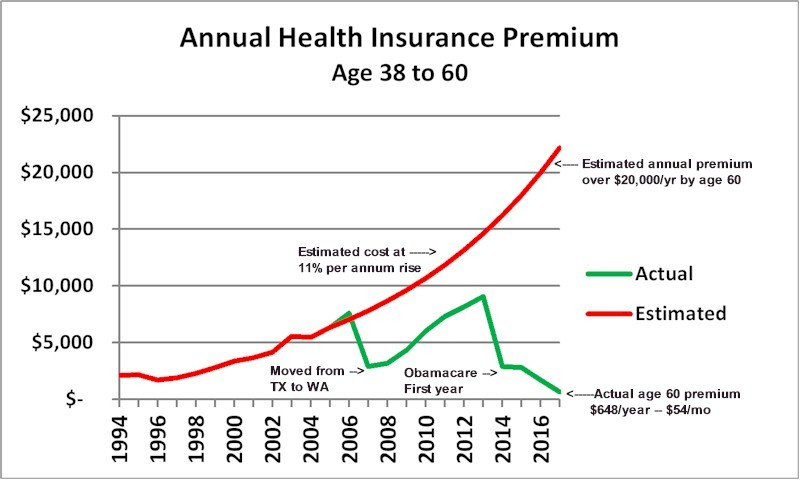

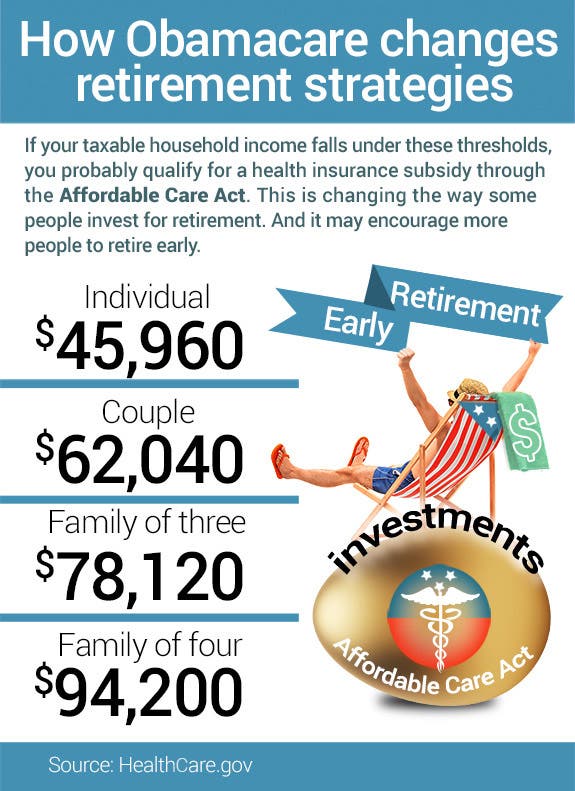

Early Retirement Qualify For Obamacare. Assistance under the affordable care act is based on income. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. 2021 and 2022 federal poverty levels. The total quoted was $354 a month, or $177 per person, per month after subsidies.

Obama Care Health Insurance Cost From fivestarhomehealthcare.blogspot.com

Obama Care Health Insurance Cost From fivestarhomehealthcare.blogspot.com

First, the highest household income that can qualify. To find out if you qualify for cost assistance you�ll look at your income. 2022 obamacare eligibility chart and subsidy calculator; There are two features of obamacare’s premium tax credits that are important for early retirees to understand. 2021 and 2022 federal poverty levels. The total quoted was $354 a month, or $177 per person, per month after subsidies.

To find out if you qualify for cost assistance you�ll look at your income.

If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. 2021 and 2022 federal poverty levels. The marketplace allows families to get lower costs making early retirement easier. The total quoted was $354 a month, or $177 per person, per month after subsidies. Assistance under the affordable care act is based on income. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person.

Source: nl.pinterest.com

Source: nl.pinterest.com

December 30, 2015, 6:58 am. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. To find out if you qualify for cost assistance you�ll look at your income. December 30, 2015, 6:58 am. The marketplace allows families to get lower costs making early retirement easier.

Source: mymoneyblog.com

Source: mymoneyblog.com

Early retirees qualify for obamacare tax credits. Assistance under the affordable care act is based on income. 2022 obamacare eligibility chart and subsidy calculator; There are two features of obamacare’s premium tax credits that are important for early retirees to understand. To find out if you qualify for cost assistance you�ll look at your income.

Source: retireearlyhomepage.com

Source: retireearlyhomepage.com

The total quoted was $354 a month, or $177 per person, per month after subsidies. To find out if you qualify for cost assistance you�ll look at your income. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. The federal poverty level guidelines for 2020 and 2021 coverage; The marketplace allows families to get lower costs making early retirement easier.

Source: gocurrycracker.com

Source: gocurrycracker.com

The marketplace allows families to get lower costs making early retirement easier. The total quoted was $354 a month, or $177 per person, per month after subsidies. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. To find out if you qualify for cost assistance you�ll look at your income. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person.

Source: bankrate.com

Source: bankrate.com

2022 obamacare eligibility chart and subsidy calculator; The total quoted was $354 a month, or $177 per person, per month after subsidies. First, the highest household income that can qualify. The federal poverty level guidelines for 2020 and 2021 coverage; If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person.

Source: gocurrycracker.com

Source: gocurrycracker.com

The federal poverty level guidelines for 2020 and 2021 coverage; The cost of health insurance continues to rise dramatically. First, the highest household income that can qualify. Employers can use the savings to reduce their own health care costs, provide premium relief to their. You should really call healthcare.gov to inquire further so you can better understand your options.

Source: aboutlifeandrunning.blogspot.com

Source: aboutlifeandrunning.blogspot.com

2022 obamacare eligibility chart and subsidy calculator; The marketplace allows families to get lower costs making early retirement easier. Employers can use the savings to reduce their own health care costs, provide premium relief to their. 2022 obamacare eligibility chart and subsidy calculator; Early retirees qualify for obamacare tax credits.

Source: mymoneyblog.com

Source: mymoneyblog.com

The cost of health insurance continues to rise dramatically. You should really call healthcare.gov to inquire further so you can better understand your options. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. 2021 and 2022 federal poverty levels. To find out if you qualify for cost assistance you�ll look at your income.

Source: pinterest.com

Source: pinterest.com

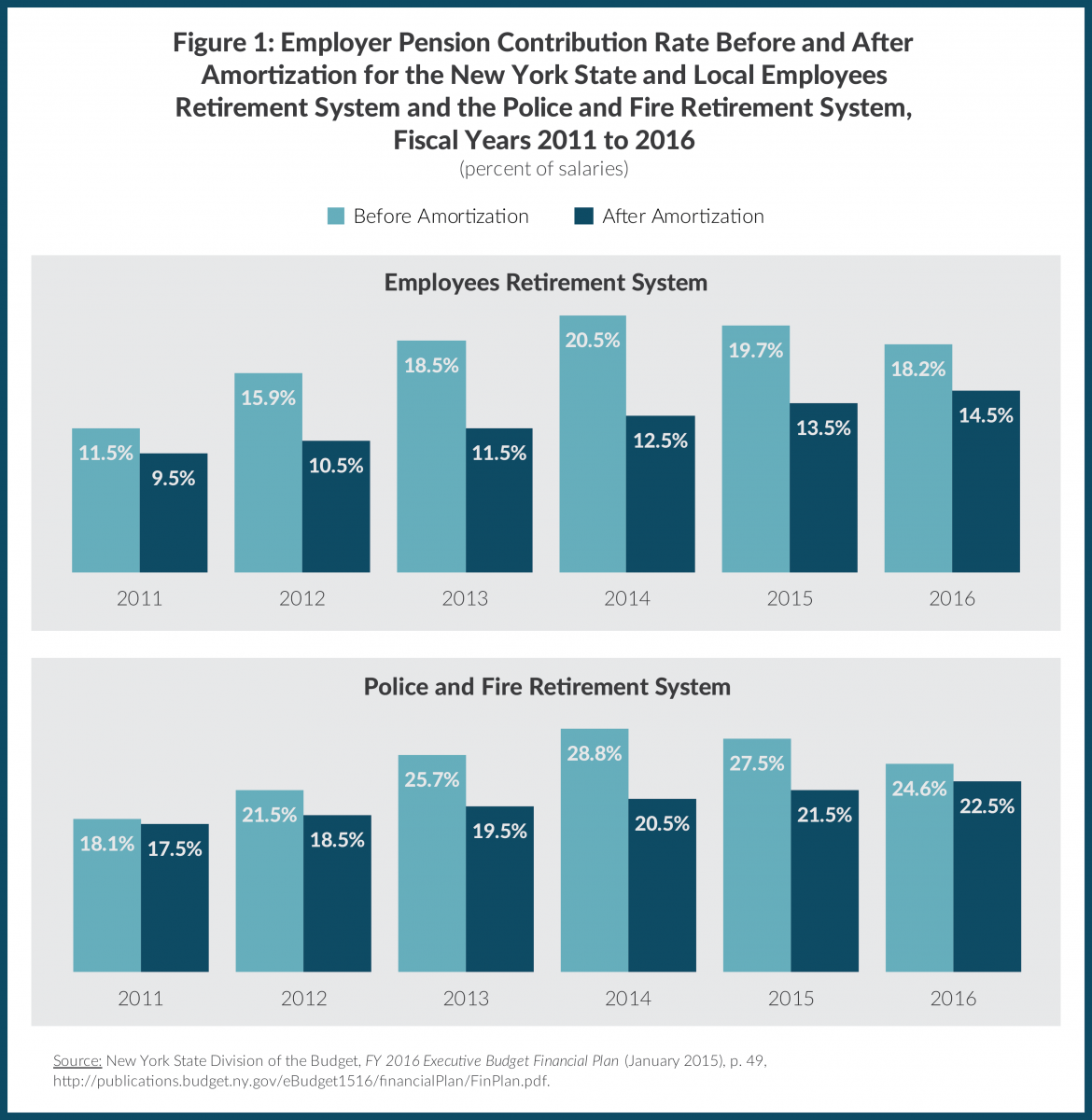

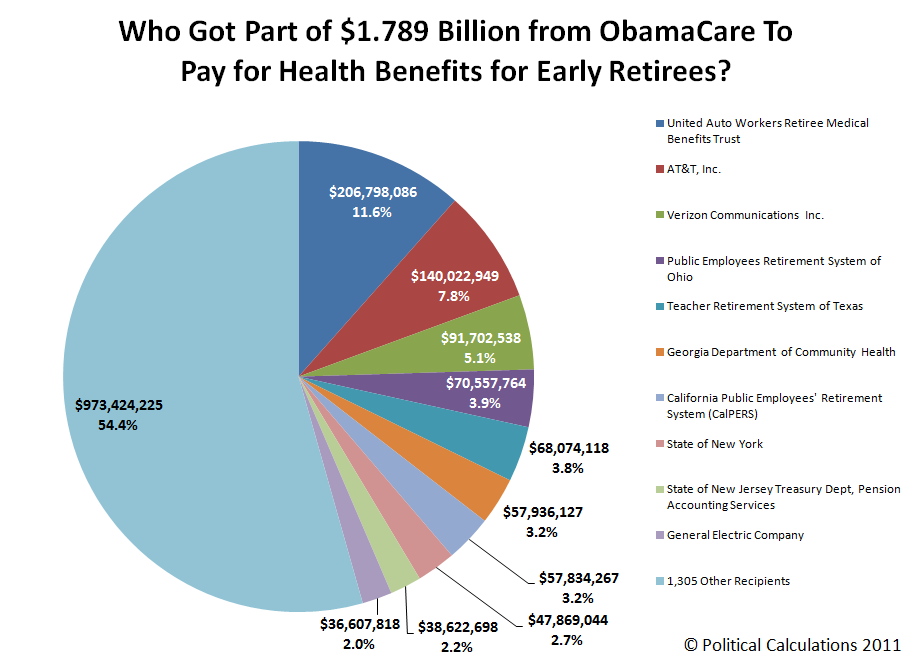

To find out if you qualify for cost assistance you�ll look at your income. Employers can use the savings to reduce their own health care costs, provide premium relief to their. The affordable care act provides $5 billion in financial assistance to employers to help them maintain coverage for early retirees age 55 and older who are not yet eligible for medicare, and their spouses, surviving spouses and dependents. You should really call healthcare.gov to inquire further so you can better understand your options. Assistance under the affordable care act is based on income.

Source: retirementwatch.com

Source: retirementwatch.com

First, the highest household income that can qualify. First, the highest household income that can qualify. Employers can use the savings to reduce their own health care costs, provide premium relief to their. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. The affordable care act provides $5 billion in financial assistance to employers to help them maintain coverage for early retirees age 55 and older who are not yet eligible for medicare, and their spouses, surviving spouses and dependents.

Source: cnbc.com

Source: cnbc.com

Assistance under the affordable care act is based on income. The affordable care act provides $5 billion in financial assistance to employers to help them maintain coverage for early retirees age 55 and older who are not yet eligible for medicare, and their spouses, surviving spouses and dependents. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Early retirees qualify for obamacare tax credits. The cost of health insurance continues to rise dramatically.

Source: pinterest.com

Source: pinterest.com

The total quoted was $354 a month, or $177 per person, per month after subsidies. The total quoted was $354 a month, or $177 per person, per month after subsidies. You should really call healthcare.gov to inquire further so you can better understand your options. The federal poverty level guidelines for 2020 and 2021 coverage; Early retirees qualify for obamacare tax credits.

Source: emeryreddy.com

Source: emeryreddy.com

You should really call healthcare.gov to inquire further so you can better understand your options. Employers can use the savings to reduce their own health care costs, provide premium relief to their. First, the highest household income that can qualify. The affordable care act provides $5 billion in financial assistance to employers to help them maintain coverage for early retirees age 55 and older who are not yet eligible for medicare, and their spouses, surviving spouses and dependents. The federal poverty level guidelines for 2020 and 2021 coverage;

Source: fivestarhomehealthcare.blogspot.com

Source: fivestarhomehealthcare.blogspot.com

December 30, 2015, 6:58 am. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. 2021 and 2022 federal poverty levels. December 30, 2015, 6:58 am.

Source: mygovcost.org

Source: mygovcost.org

The total quoted was $354 a month, or $177 per person, per month after subsidies. The federal poverty level guidelines for 2020 and 2021 coverage; To find out if you qualify for cost assistance you�ll look at your income. Employers can use the savings to reduce their own health care costs, provide premium relief to their. The total quoted was $354 a month, or $177 per person, per month after subsidies.

Source: gocurrycracker.com

Source: gocurrycracker.com

There are two features of obamacare’s premium tax credits that are important for early retirees to understand. You should really call healthcare.gov to inquire further so you can better understand your options. 2022 obamacare eligibility chart and subsidy calculator; There are two features of obamacare’s premium tax credits that are important for early retirees to understand. Early retirees qualify for obamacare tax credits.

Source: pinterest.com

Source: pinterest.com

The affordable care act provides $5 billion in financial assistance to employers to help them maintain coverage for early retirees age 55 and older who are not yet eligible for medicare, and their spouses, surviving spouses and dependents. First, the highest household income that can qualify. You should really call healthcare.gov to inquire further so you can better understand your options. The total quoted was $354 a month, or $177 per person, per month after subsidies. If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person.

Source: youtube.com

Source: youtube.com

If they made $95,000 a year, then they would have no subsidy and be quoted just the flat $340 per month, per person. Assistance under the affordable care act is based on income. 2021 and 2022 federal poverty levels. There are two features of obamacare’s premium tax credits that are important for early retirees to understand. The total quoted was $354 a month, or $177 per person, per month after subsidies.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement qualify for obamacare by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.