Your Early retirement planner images are available in this site. Early retirement planner are a topic that is being searched for and liked by netizens now. You can Download the Early retirement planner files here. Find and Download all royalty-free photos.

If you’re searching for early retirement planner images information linked to the early retirement planner keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Early Retirement Planner. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. Set guidelines for your spending. When your annual return on investments cover 100% of your expenses you are financially independent. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s.

7 Benefits of Early Retirement Planning in India 2021 From canarahsbclife.com

7 Benefits of Early Retirement Planning in India 2021 From canarahsbclife.com

Set guidelines for your spending. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. When your annual return on investments cover 100% of your expenses you are financially independent. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. “the most critical variable in financial planning, and the. Retirement planning & how to retire early.

“the most critical variable in financial planning, and the.

Many people are concerned about their retirement planning but put it aside for far too long. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. Many people are concerned about their retirement planning but put it aside for far too long. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. “the most critical variable in financial planning, and the. Retirement planning & how to retire early.

Source: moneycrashers.com

Source: moneycrashers.com

Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Set guidelines for your spending. To retire early, you need to know how much cash you need to maintain the lifestyle you envision.

Source: expensivity.com

Source: expensivity.com

Set guidelines for your spending. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. When your annual return on investments cover 100% of your expenses you are financially independent. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500.

Source: canarahsbclife.com

Source: canarahsbclife.com

Many people are concerned about their retirement planning but put it aside for far too long. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. Many people are concerned about their retirement planning but put it aside for far too long. Set guidelines for your spending.

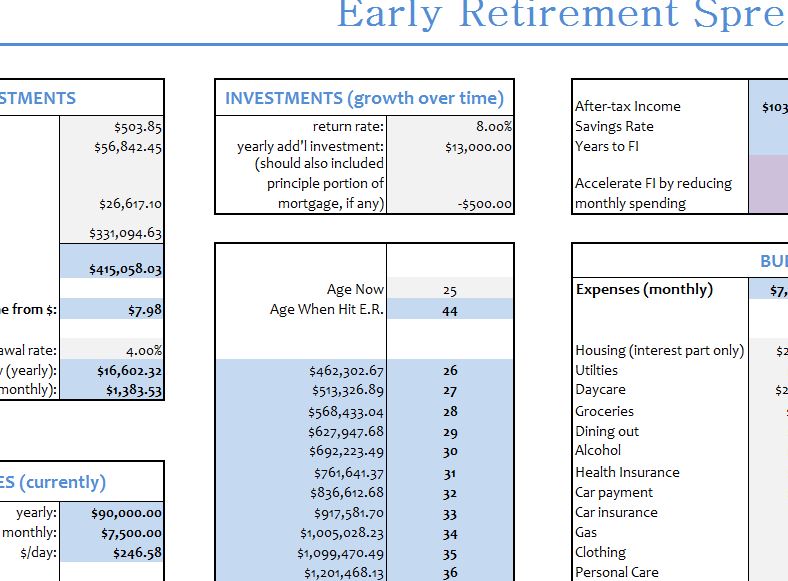

Source: exceltemplates.net

Source: exceltemplates.net

When your annual return on investments cover 100% of your expenses you are financially independent. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. “the most critical variable in financial planning, and the. Retirement planning & how to retire early. Set guidelines for your spending.

Source: crediful.com

Source: crediful.com

You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. “the most critical variable in financial planning, and the. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. Set guidelines for your spending.

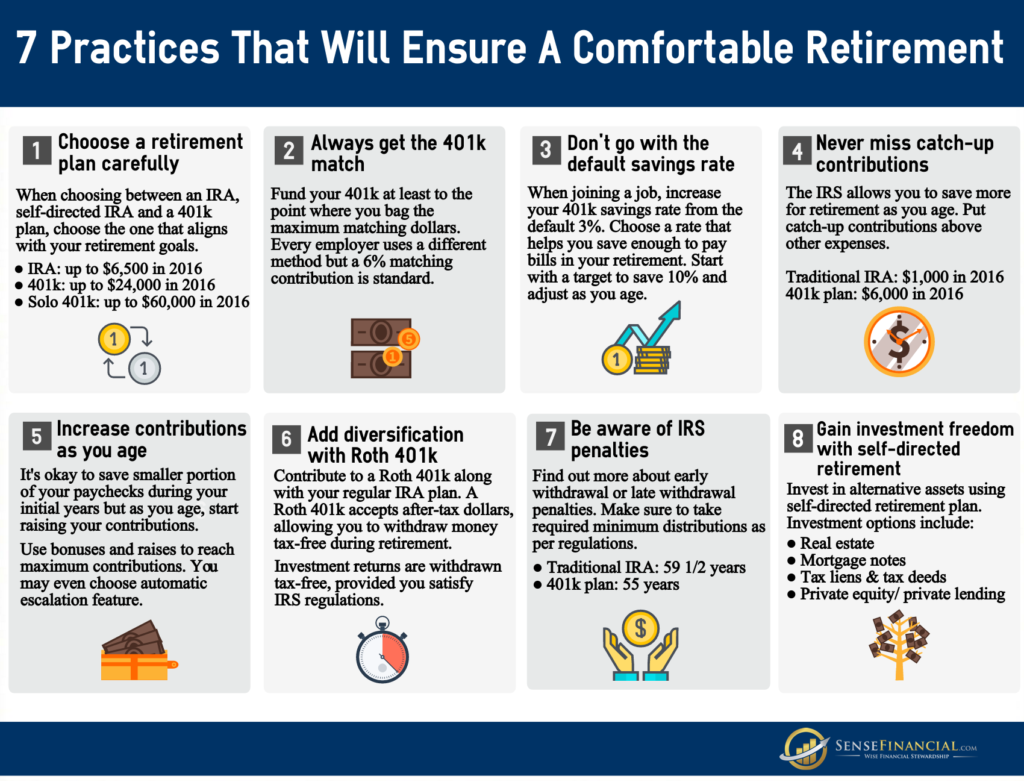

Source: sensefinancial.com

Source: sensefinancial.com

Set guidelines for your spending. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money.

Source: newretirement.com

Source: newretirement.com

Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. “the most critical variable in financial planning, and the. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money.

Source: pinterest.com

Source: pinterest.com

Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. “the most critical variable in financial planning, and the. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Many people are concerned about their retirement planning but put it aside for far too long.

Source: thriftymommastips.com

Source: thriftymommastips.com

When your annual return on investments cover 100% of your expenses you are financially independent. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. When your annual return on investments cover 100% of your expenses you are financially independent. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. To retire early, you need to know how much cash you need to maintain the lifestyle you envision.

Source: pinterest.com

Source: pinterest.com

To retire early, you need to know how much cash you need to maintain the lifestyle you envision. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. When your annual return on investments cover 100% of your expenses you are financially independent. Many people are concerned about their retirement planning but put it aside for far too long. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your.

Source: pinterest.com

Source: pinterest.com

Set guidelines for your spending. When your annual return on investments cover 100% of your expenses you are financially independent. Set guidelines for your spending. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s.

Source: jmbfinmgrs.com

Source: jmbfinmgrs.com

Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Retirement planning & how to retire early. Many people are concerned about their retirement planning but put it aside for far too long. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money.

Source: listenmoneymatters.com

Source: listenmoneymatters.com

Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. Many people are concerned about their retirement planning but put it aside for far too long. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. Unfortunately, this often leads to a retirement you settle for versus a retirement you want.

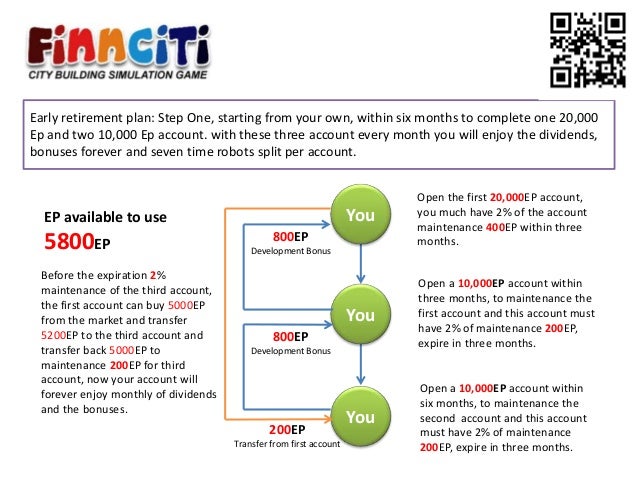

Source: slideshare.net

Source: slideshare.net

“the most critical variable in financial planning, and the. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Retirement planning & how to retire early. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your.

Source: thechinfamily.hk

Source: thechinfamily.hk

Retirement planning & how to retire early. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Many people are concerned about their retirement planning but put it aside for far too long. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s. Set guidelines for your spending.

Source: in.pinterest.com

Source: in.pinterest.com

Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Retirement planning & how to retire early. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. Set guidelines for your spending.

Source: zricks.com

Set guidelines for your spending. “the most critical variable in financial planning, and the. Set guidelines for your spending. Millennial investors who engage in early retirement planning and take advantage of a 401k plan in their twenties give themselves a great opportunity to retire at a younger age and with a large sum of money. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500.

![3 Reasons To Retire Early [INFOGRAPHIC] Early retirement, Retirement 3 Reasons To Retire Early [INFOGRAPHIC] Early retirement, Retirement](https://i.pinimg.com/originals/a6/ea/b2/a6eab2d3a164bdcb11496ca777a501ed.png) Source: pinterest.com

Source: pinterest.com

Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Retirement planning is a process you put in place to manage your finances after you leave the workforce or sell your. Set guidelines for your spending. Unfortunately, this often leads to a retirement you settle for versus a retirement you want. Early retirement planning for millennial investing is one of the wisest decisions you can do in your 20s.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement planner by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.