Your Early retirement penalty images are available. Early retirement penalty are a topic that is being searched for and liked by netizens today. You can Download the Early retirement penalty files here. Find and Download all free photos and vectors.

If you’re looking for early retirement penalty pictures information linked to the early retirement penalty keyword, you have visit the ideal site. Our website always gives you hints for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

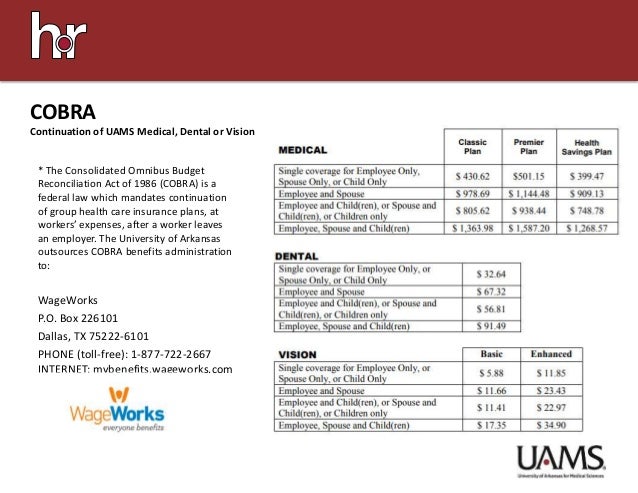

Early Retirement Penalty. For those born between 1943 and 1954, the full retirement age is 66. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. Anyone born after that date in the 1950s has several months tacked on for full. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus.

72(t) Distributions Early Withdrawals From Retirement Accounts for Ta From trustgroupfinancial.com

72(t) Distributions Early Withdrawals From Retirement Accounts for Ta From trustgroupfinancial.com

The distribution was made because you are totally and permanently disabled. You have reached age 59 1/2. 401k and other retirement plans. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: If you return the cash to your ira within 3 years you will not owe the tax payment. Anyone born after that date in the 1950s has several months tacked on for full.

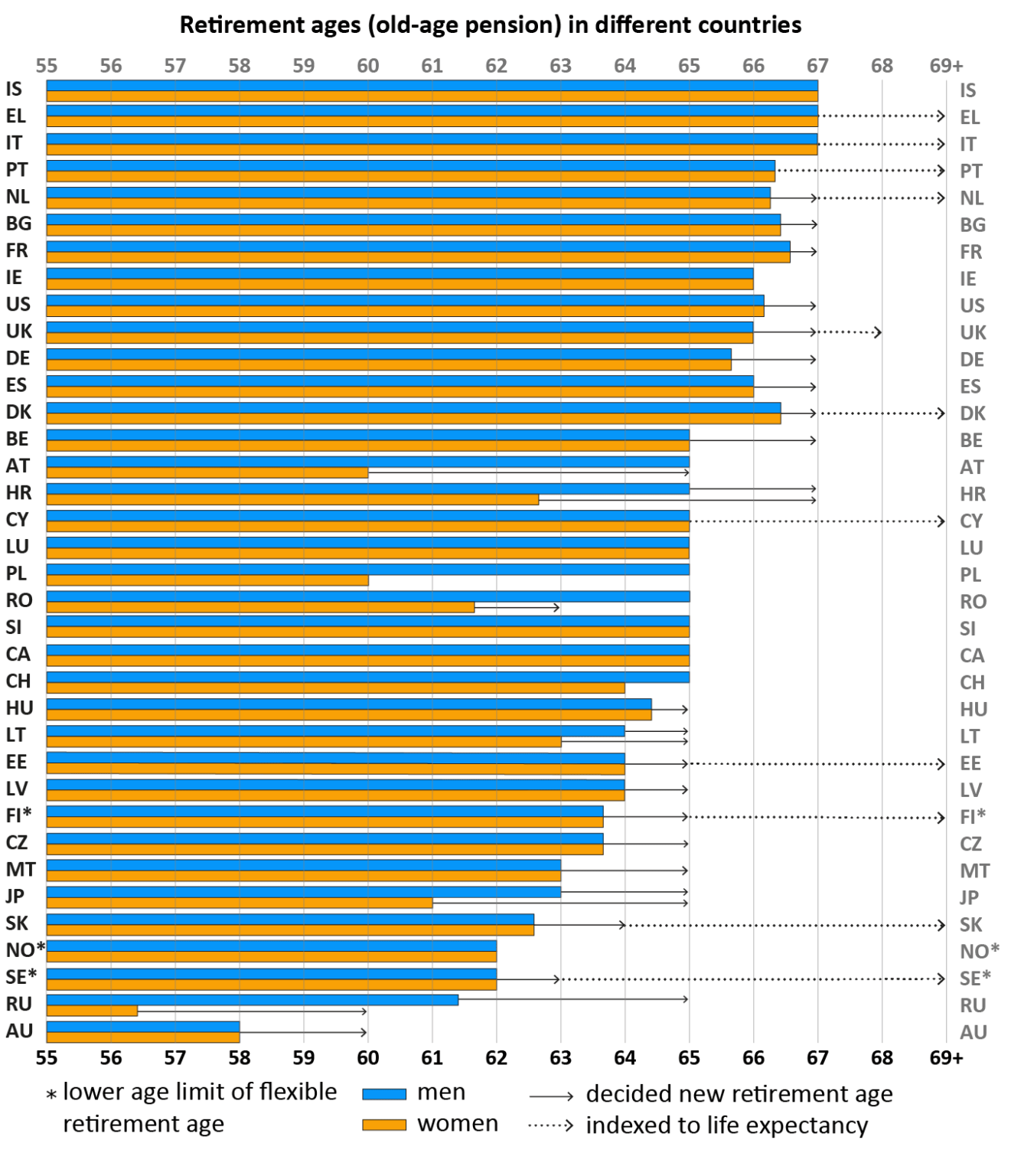

The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached.

During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. For those born between 1943 and 1954, the full retirement age is 66. Anyone born after that date in the 1950s has several months tacked on for full. You have reached age 59 1/2. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus.

Source: trustgroupfinancial.com

Source: trustgroupfinancial.com

The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. The distribution was made to your estate or beneficiary after your death. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras:

Source: thebalance.com

Source: thebalance.com

If you return the cash to your ira within 3 years you will not owe the tax payment. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: For those born between 1943 and 1954, the full retirement age is 66. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. If you return the cash to your ira within 3 years you will not owe the tax payment.

Source: financesay.com

Source: financesay.com

The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: For those born between 1943 and 1954, the full retirement age is 66. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. 401k and other retirement plans. You have reached age 59 1/2.

Source: pocketsense.com

Source: pocketsense.com

Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: The distribution was made to your estate or beneficiary after your death. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached.

Source: moneypip.com

Source: moneypip.com

The distribution was made because you are totally and permanently disabled. The distribution was made to your estate or beneficiary after your death. You have reached age 59 1/2. Anyone born after that date in the 1950s has several months tacked on for full. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty.

Source: webuus.dirnea.org

Source: webuus.dirnea.org

You have reached age 59 1/2. Anyone born after that date in the 1950s has several months tacked on for full. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty.

Source: hoseven.com

Source: hoseven.com

For those born between 1943 and 1954, the full retirement age is 66. 401k and other retirement plans. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. The distribution was made to your estate or beneficiary after your death. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be.

Source: josephlmotta.com

Source: josephlmotta.com

The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. The distribution was made to your estate or beneficiary after your death. The distribution was made because you are totally and permanently disabled. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached.

Source: wikihow.com

Source: wikihow.com

During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. The distribution was made to your estate or beneficiary after your death. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached.

Source: youtube.com

Source: youtube.com

Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. You have reached age 59 1/2. Anyone born after that date in the 1950s has several months tacked on for full. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. For those born between 1943 and 1954, the full retirement age is 66.

Source: mymoneydesign.com

Source: mymoneydesign.com

Anyone born after that date in the 1950s has several months tacked on for full. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras:

Source: financiallysimple.com

Source: financiallysimple.com

One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. The distribution was made because you are totally and permanently disabled. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: For those born between 1943 and 1954, the full retirement age is 66.

The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. You could lose up to 30 percent of your potential benefits. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years.

Source: goodreads.com

Source: goodreads.com

The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. The distribution was made to your estate or beneficiary after your death. The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus.

Source: blog.massmutual.com

Source: blog.massmutual.com

The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. For those born between 1943 and 1954, the full retirement age is 66. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. During the first 36 months, for every month that a beneficiary signs up to receive social security prior to full retirement age the primary insurance amount will be.

Source: dailyfinance.com

Source: dailyfinance.com

The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. 401k and other retirement plans. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. One of the pain points of early retirement is limited access to your nest egg before age 59½ without incurring a 10% penalty. For those born between 1943 and 1954, the full retirement age is 66.

Source: connexcu.wordpress.com

Source: connexcu.wordpress.com

The following exceptions to the penalty apply to early distributions from any qualified retirement plan, including iras: The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus. You could lose up to 30 percent of your potential benefits. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. You have reached age 59 1/2.

Source: socialsecuritydisabilityadvocatesusa.com

Source: socialsecuritydisabilityadvocatesusa.com

If you return the cash to your ira within 3 years you will not owe the tax payment. If you return the cash to your ira within 3 years you will not owe the tax payment. For those born between 1943 and 1954, the full retirement age is 66. The earliest age to claim social security retirement benefits is 62, but there is a substantial early retirement penalty attached. The $2 trillion cares act wavied the 10% penalty on early withdrawals from iras for up to $100,000 for individuals impacted by coronavirus.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement penalty by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.