Your Early retirement now safe withdrawal rate images are available. Early retirement now safe withdrawal rate are a topic that is being searched for and liked by netizens now. You can Find and Download the Early retirement now safe withdrawal rate files here. Get all royalty-free photos.

If you’re looking for early retirement now safe withdrawal rate images information related to the early retirement now safe withdrawal rate interest, you have visit the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Early Retirement Now Safe Withdrawal Rate. Another way to look at the data: As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. The safe withdrawal rate depends on your age. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant.

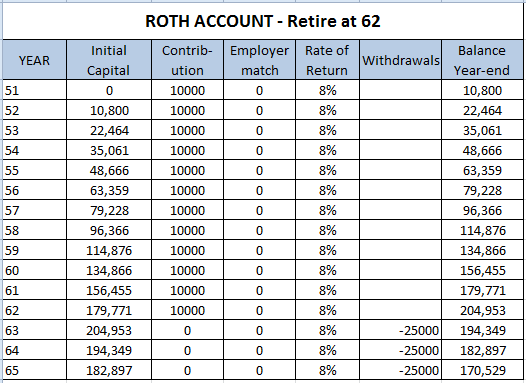

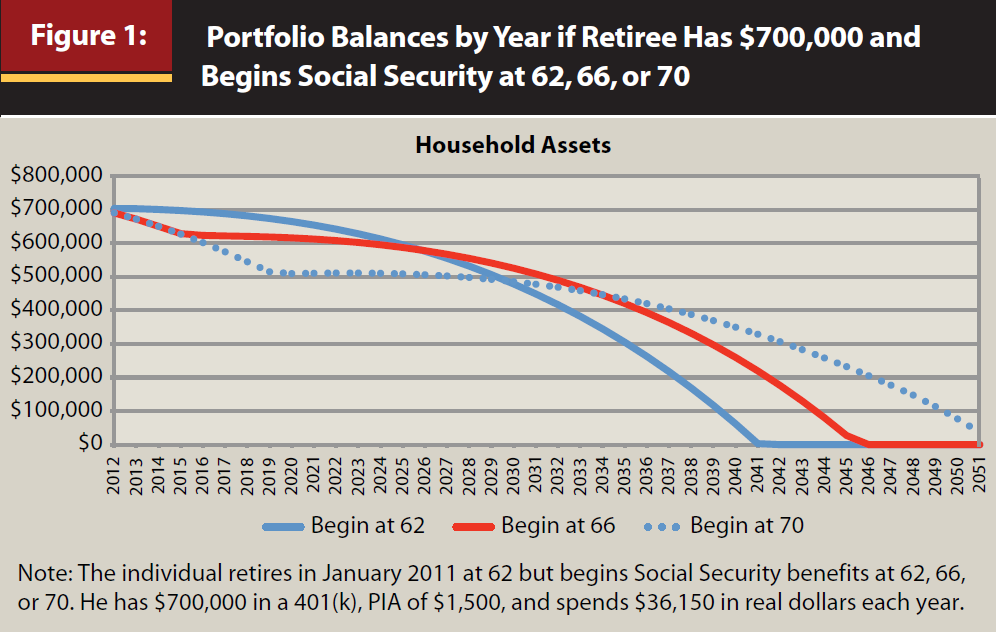

The Ultimate Guide to Safe Withdrawal Rates Part 4 Social Security From earlyretirementnow.com

The Ultimate Guide to Safe Withdrawal Rates Part 4 Social Security From earlyretirementnow.com

Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate. As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. And it’s not all energy and food inflation. Another way to look at the data: From september to december we saw a 2.2% increase, which is a 9.1% annualized rate.

A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years.

Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. And it’s not all energy and food inflation. The safe withdrawal rate depends on your age. Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

And it’s not all energy and food inflation. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. And it’s not all energy and food inflation. Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

The safe withdrawal rate depends on your age. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate. You withdraw 4% a year and run out of money after 50 years! The safe withdrawal rate depends on your age. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. Another way to look at the data: A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. The safe withdrawal rate depends on your age.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. If a retiree could be matched with a saver. You withdraw 4% a year and run out of money after 50 years! And it’s not all energy and food inflation.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. And it’s not all energy and food inflation. If a retiree could be matched with a saver. From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. If a retiree could be matched with a saver. From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. Another way to look at the data:

Source: earlyretirementnow.com

Source: earlyretirementnow.com

A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. You withdraw 4% a year and run out of money after 50 years! As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. And it’s not all energy and food inflation. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. If a retiree could be matched with a saver. You withdraw 4% a year and run out of money after 50 years!

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. The safe withdrawal rate depends on your age. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. You withdraw 4% a year and run out of money after 50 years! And it’s not all energy and food inflation. As stated above, no early retiree should get anywhere close to a 5% withdrawal rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate. Another way to look at the data: You withdraw 4% a year and run out of money after 50 years! As stated above, no early retiree should get anywhere close to a 5% withdrawal rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. If a retiree could be matched with a saver. As stated above, no early retiree should get anywhere close to a 5% withdrawal rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

And it’s not all energy and food inflation. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. Another way to look at the data: As stated above, no early retiree should get anywhere close to a 5% withdrawal rate. The safe withdrawal rate depends on your age.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. The safe withdrawal rate depends on your age. And it’s not all energy and food inflation. Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Another way to look at the data: Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. You withdraw 4% a year and run out of money after 50 years! If a retiree could be matched with a saver. And it’s not all energy and food inflation.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate. You withdraw 4% a year and run out of money after 50 years! From september to december we saw a 2.2% increase, which is a 9.1% annualized rate. Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. And it’s not all energy and food inflation.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Another way to look at the data: Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. Another way to look at the data: A 5% withdrawal rate would have an unacceptably low success rate even after 30 years, and certainly after 60 years. If you invest $1 today and make neither contributions nor withdrawal withdrawals, then the final net worth after, say, 30 years is entirely determined by the compounded average growth rate.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

Not the sequence, because when multiplying the (1+r1) through (1+r30), the order of multiplication is irrelevant. Another way to look at the data: Figure 1 (60/40 portfolio with a 4% safe withdrawal rate) in figure 1, you retire early at age 30 with a $1m portfolio. And it’s not all energy and food inflation. From september to december we saw a 2.2% increase, which is a 9.1% annualized rate.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement now safe withdrawal rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.