Your Early retirement income limit 2022 images are ready in this website. Early retirement income limit 2022 are a topic that is being searched for and liked by netizens now. You can Find and Download the Early retirement income limit 2022 files here. Find and Download all royalty-free photos.

If you’re looking for early retirement income limit 2022 images information connected with to the early retirement income limit 2022 keyword, you have visit the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

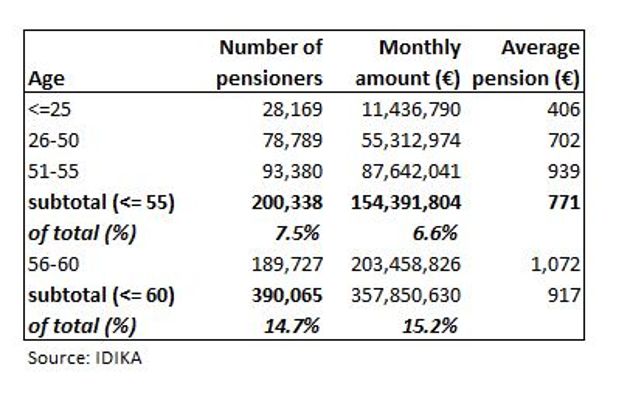

Early Retirement Income Limit 2022. Additional earnings limit for pensioners with an early retirement pension was. Significantly increased as a result of the corona crisis. Pay yourself first and maximize retirement plan contributions. Additional earnings limit for pensioners with an early retirement pension was.

Make Your Retirement Contributions Count Cascade Business News From cascadebusnews.com

Make Your Retirement Contributions Count Cascade Business News From cascadebusnews.com

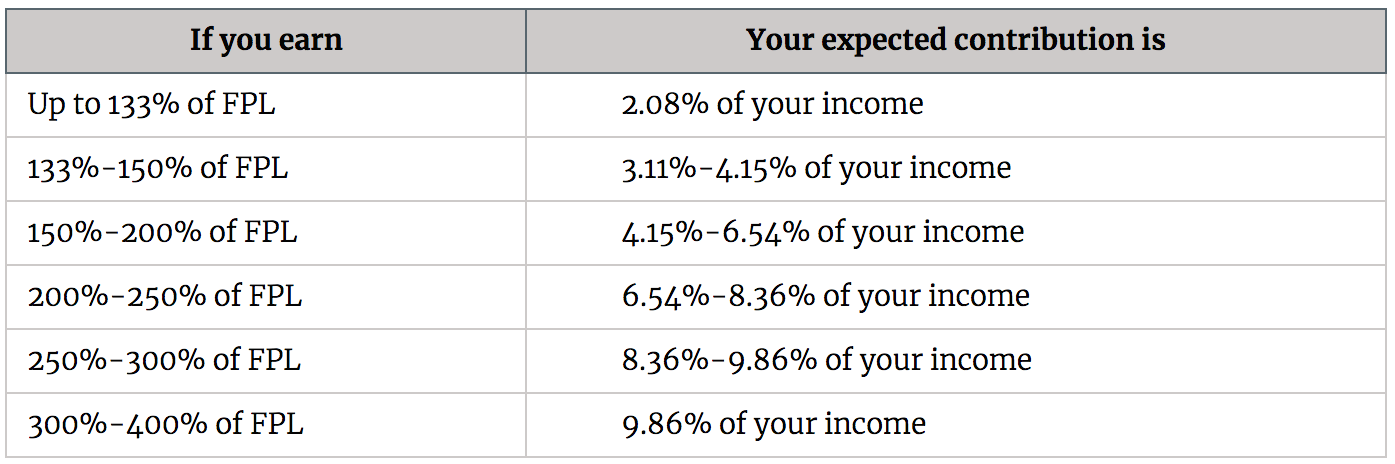

From there, you�ll have $1 in social security withheld for every. Additional earnings limit for pensioners with an early retirement pension was. After age 50, add $1,000 annually while working. As early as 2021, the. To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly.

Significantly increased as a result of the corona crisis.

This applies to taxpayers covered by a workplace retirement plan; From there, you�ll have $1 in social security withheld for every. This applies to taxpayers covered by a workplace retirement plan; In 2022, you can earn up to $19,560 a year without it impacting your benefits. As early as 2021, the. As early as 2021, the.

Source: theinsuranceupdates.com

Source: theinsuranceupdates.com

In 2022, you can earn up to $19,560 a year without it impacting your benefits. After age 50, add $1,000 annually while working. This applies to taxpayers covered by a workplace retirement plan; Significantly increased as a result of the corona crisis. Additional earnings limit for pensioners with an early retirement pension was.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

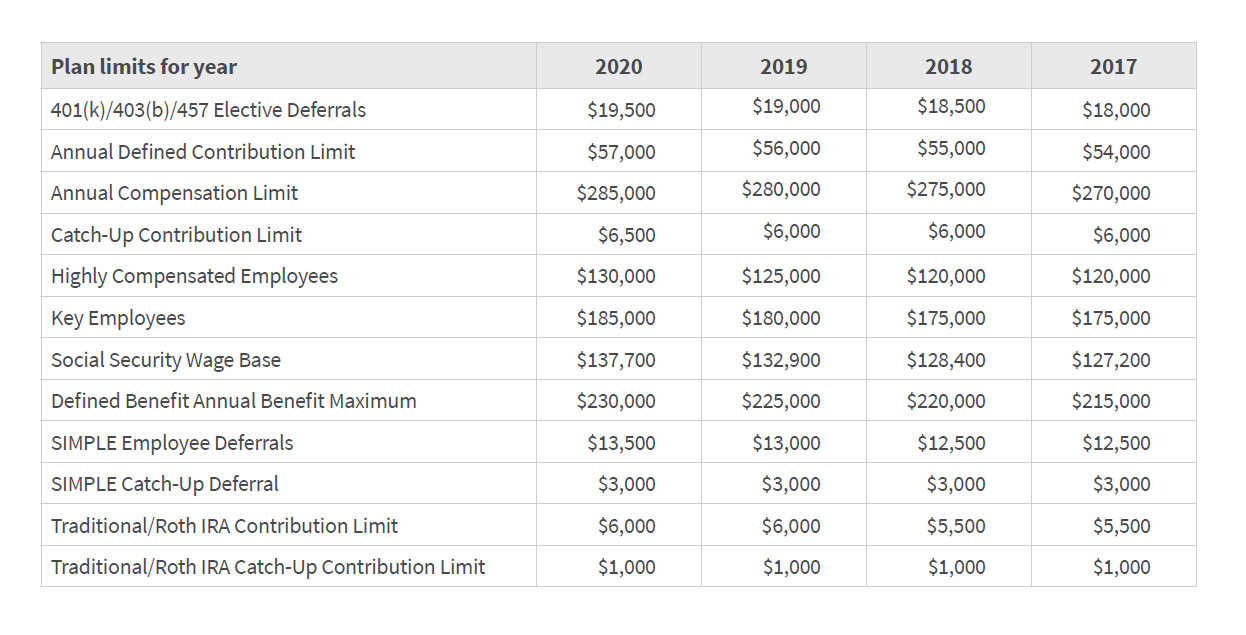

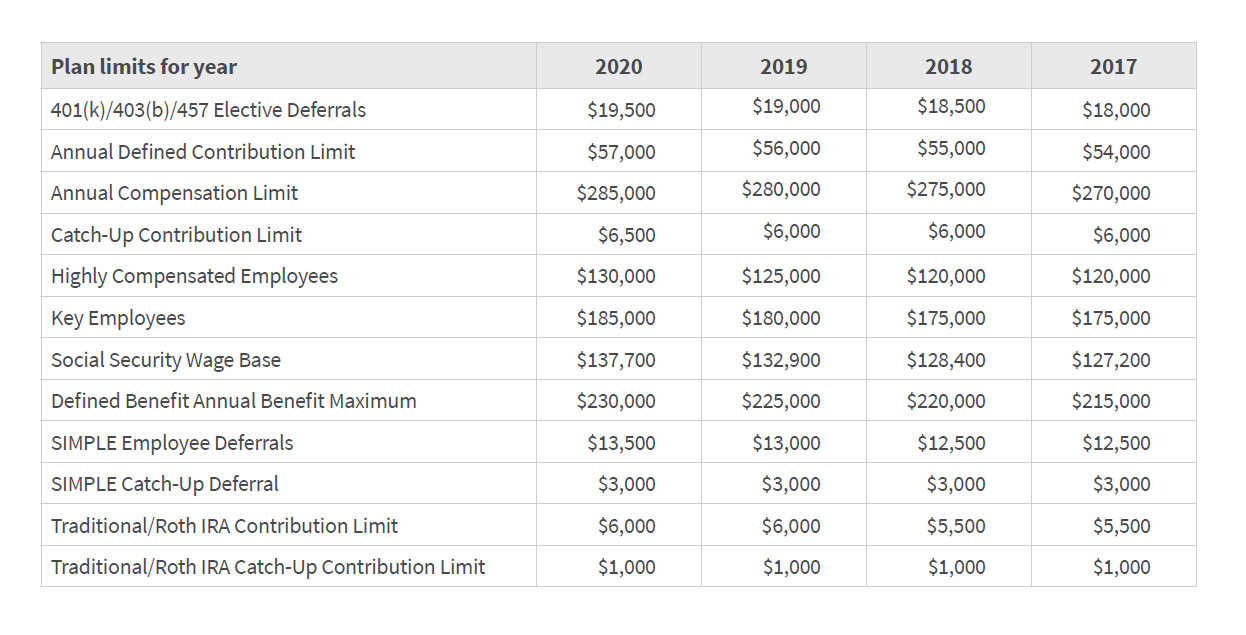

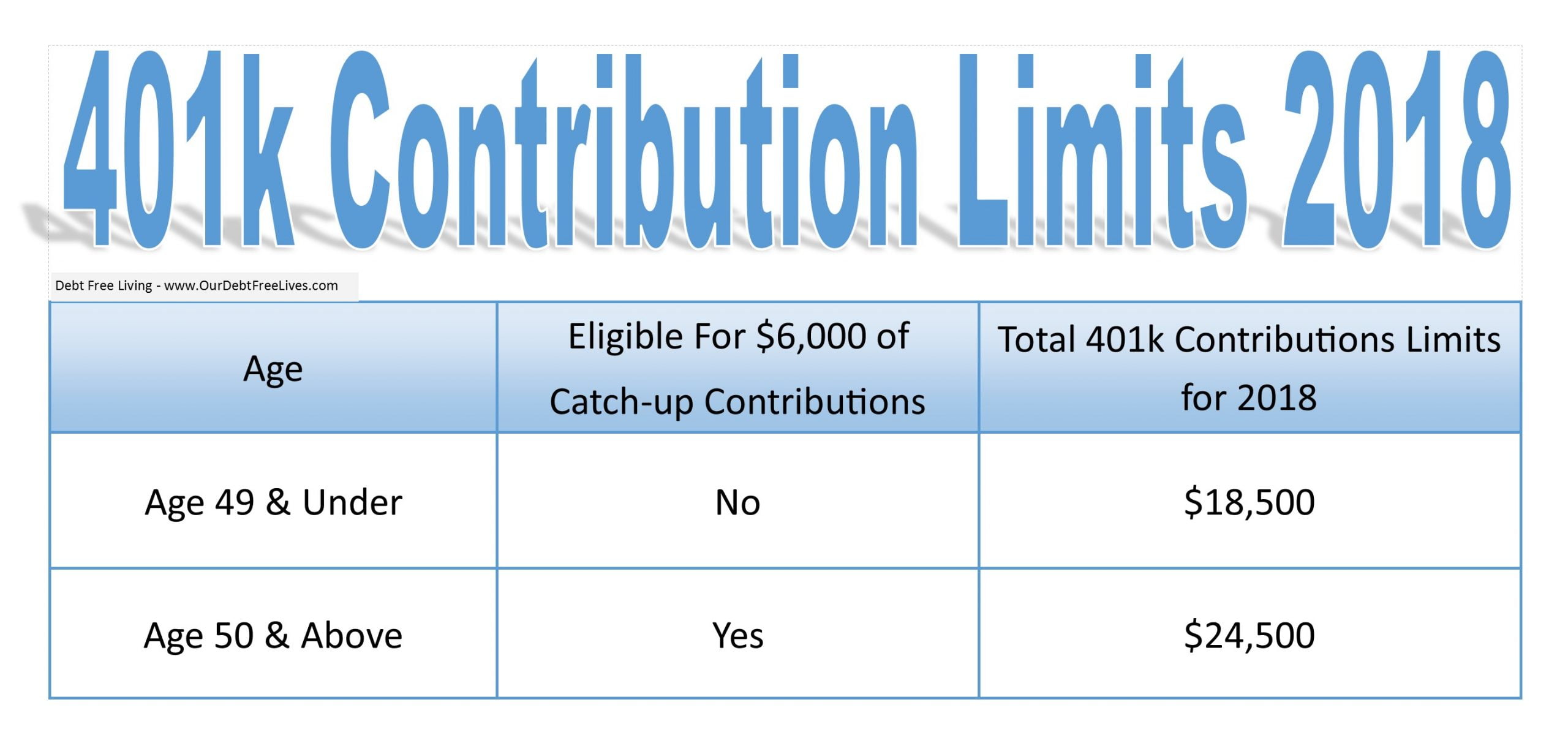

After age 50, add $1,000 annually while working. From there, you�ll have $1 in social security withheld for every. This applies to taxpayers covered by a workplace retirement plan; To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500.

Source: pescatorecooper.cpa

Source: pescatorecooper.cpa

Additional earnings limit for pensioners with an early retirement pension was. Pay yourself first and maximize retirement plan contributions. In 2022, you can earn up to $19,560 a year without it impacting your benefits. Find out here what should apply in 2022. As early as 2021, the.

Source: macropolis.gr

Source: macropolis.gr

To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. As early as 2021, the. As early as 2021, the. Significantly increased as a result of the corona crisis. Do not withdraw funds early from your retirement account.

Source: nomadedigital.net

Source: nomadedigital.net

The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. Additional earnings limit for pensioners with an early retirement pension was. The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. Find out here what should apply in 2022. Additional earnings limit for pensioners with an early retirement pension was.

Source: cascadebusnews.com

Source: cascadebusnews.com

Additional earnings limit for pensioners with an early retirement pension was. To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. Significantly increased as a result of the corona crisis. As early as 2021, the. Additional earnings limit for pensioners with an early retirement pension was.

Source: ourdebtfreelives.com

Source: ourdebtfreelives.com

Additional earnings limit for pensioners with an early retirement pension was. In 2022, you can earn up to $19,560 a year without it impacting your benefits. Significantly increased as a result of the corona crisis. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly.

Source: socialsecurityreport.org

Source: socialsecurityreport.org

As early as 2021, the. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly. This applies to taxpayers covered by a workplace retirement plan; Significantly increased as a result of the corona crisis. Additional earnings limit for pensioners with an early retirement pension was.

Source: pinterest.com

Source: pinterest.com

Pay yourself first and maximize retirement plan contributions. This applies to taxpayers covered by a workplace retirement plan; As early as 2021, the. In 2022, you can earn up to $19,560 a year without it impacting your benefits. Do not withdraw funds early from your retirement account.

Source: early-retirement.org

Source: early-retirement.org

As early as 2021, the. This applies to taxpayers covered by a workplace retirement plan; Significantly increased as a result of the corona crisis. From there, you�ll have $1 in social security withheld for every. Additional earnings limit for pensioners with an early retirement pension was.

Source: financial-planning.com

Source: financial-planning.com

Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly. Do not withdraw funds early from your retirement account. To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. Pay yourself first and maximize retirement plan contributions. After age 50, add $1,000 annually while working.

Source: primepay.com

Source: primepay.com

As early as 2021, the. Find out here what should apply in 2022. As early as 2021, the. Additional earnings limit for pensioners with an early retirement pension was. In 2022, you can earn up to $19,560 a year without it impacting your benefits.

Source: webuus.dirnea.org

Source: webuus.dirnea.org

The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. Find out here what should apply in 2022. Pay yourself first and maximize retirement plan contributions. Find out here what should apply in 2022. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly.

Source: simplywise.com

Source: simplywise.com

The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly. To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. From there, you�ll have $1 in social security withheld for every. Find out here what should apply in 2022.

![Here�s Your Social Security Retirement Age [2020 Guide] Social Here�s Your Social Security Retirement Age [2020 Guide] Social](https://i1.wp.com/socialsecurityportal.com/wp-content/uploads/2020/04/Whats-my-Social-Security-Retirement-Age-2.png?fit=900%2C480&ssl=1) Source: socialsecurityportal.com

Source: socialsecurityportal.com

Significantly increased as a result of the corona crisis. Additional earnings limit for pensioners with an early retirement pension was. Due to the corona crisis, the additional income limit for pensioners with early retirement has currently been raised significantly. In 2022, you can earn up to $19,560 a year without it impacting your benefits. Significantly increased as a result of the corona crisis.

Source: pinterest.com

Source: pinterest.com

The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. After age 50, add $1,000 annually while working. This applies to taxpayers covered by a workplace retirement plan; Additional earnings limit for pensioners with an early retirement pension was.

Source: financestrategists.com

Source: financestrategists.com

Pay yourself first and maximize retirement plan contributions. From there, you�ll have $1 in social security withheld for every. To be eligible, the income limit for a single filer must be less than $129,000 or $204,000 for married and joint filers. This applies to taxpayers covered by a workplace retirement plan; The irs recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500.

Source: cosca.com.au

Source: cosca.com.au

Do not withdraw funds early from your retirement account. From there, you�ll have $1 in social security withheld for every. Significantly increased as a result of the corona crisis. Additional earnings limit for pensioners with an early retirement pension was. As early as 2021, the.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement income limit 2022 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.