Your Early retirement how much can i earn images are available in this site. Early retirement how much can i earn are a topic that is being searched for and liked by netizens now. You can Get the Early retirement how much can i earn files here. Get all royalty-free photos and vectors.

If you’re searching for early retirement how much can i earn pictures information linked to the early retirement how much can i earn interest, you have visit the right site. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

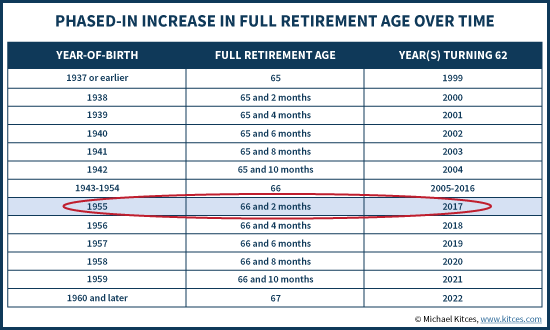

Early Retirement How Much Can I Earn. The social security earnings limits for early retirement full and early retirement age. Full retirement age depends on your year of birth, and ranges from 65 to 67. Social security does not limit the amount of money you can earn at any time, whether you are on. Married retirees filing separately who earn less than $5;

Starting to receive benefits after normal retirement age may result in larger benefits. Married retirees filing separately who earn less than $5; Social security does not limit the amount of money you can earn at any time, whether you are on. Single retirees who earn less than $14,250; With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. Under this rule, you can get a full social security benefit for any whole month you.

Starting to receive benefits after normal retirement age may result in larger benefits.

Single retirees who earn less than $14,250; The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Married retirees filing separately who earn less than $5; D reduction applied to $500, which is 50% of the primary insurance amount in this example. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: pinterest.com

Source: pinterest.com

Full retirement age depends on your year of birth, and ranges from 65 to 67. The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. D reduction applied to $500, which is 50% of the primary insurance amount in this example. Social security does not limit the amount of money you can earn at any time, whether you are on. Starting to receive benefits after normal retirement age may result in larger benefits.

Source: pinterest.com

Source: pinterest.com

Social security does not limit the amount of money you can earn at any time, whether you are on. Starting to receive benefits after normal retirement age may result in larger benefits. Full retirement age depends on your year of birth, and ranges from 65 to 67. Social security does not limit the amount of money you can earn at any time, whether you are on. Married retirees filing separately who earn less than $5;

Source: pinterest.com

Source: pinterest.com

Sometimes people younger than full retirement age retire in the middle of the year and have already earned more than the yearly earnings limit. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Social security does not limit the amount of money you can earn at any time, whether you are on. There is a special rule that applies to earnings for one year, usually the first year of retirement. Sometimes people younger than full retirement age retire in the middle of the year and have already earned more than the yearly earnings limit.

Source: pinterest.com

Source: pinterest.com

With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. D reduction applied to $500, which is 50% of the primary insurance amount in this example. Single retirees who earn less than $14,250; For retirees 65 and older, here’s when you can stop filing taxes: Sometimes people younger than full retirement age retire in the middle of the year and have already earned more than the yearly earnings limit.

Source: emeter.com

Source: emeter.com

Full retirement age depends on your year of birth, and ranges from 65 to 67. Single retirees who earn less than $14,250; There is a special rule that applies to earnings for one year, usually the first year of retirement. Social security does not limit the amount of money you can earn at any time, whether you are on. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: herpaperroute.com

Source: herpaperroute.com

With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. There is a special rule that applies to earnings for one year, usually the first year of retirement. Sometimes people younger than full retirement age retire in the middle of the year and have already earned more than the yearly earnings limit. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: pinterest.com

Source: pinterest.com

Starting to receive benefits after normal retirement age may result in larger benefits. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Married retirees filing separately who earn less than $5; With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. Under this rule, you can get a full social security benefit for any whole month you.

The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Single retirees who earn less than $14,250; For retirees 65 and older, here’s when you can stop filing taxes: There is a special rule that applies to earnings for one year, usually the first year of retirement. Sometimes people younger than full retirement age retire in the middle of the year and have already earned more than the yearly earnings limit.

Source: pinterest.com

Source: pinterest.com

D reduction applied to $500, which is 50% of the primary insurance amount in this example. Married retirees filing separately who earn less than $5; The social security earnings limits for early retirement full and early retirement age. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Single retirees who earn less than $14,250;

Source: pinterest.com

Source: pinterest.com

Starting to receive benefits after normal retirement age may result in larger benefits. Starting to receive benefits after normal retirement age may result in larger benefits. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older; The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Full retirement age depends on your year of birth, and ranges from 65 to 67.

Source: pinterest.com

Source: pinterest.com

Single retirees who earn less than $14,250; 15 rows the percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Under this rule, you can get a full social security benefit for any whole month you. Starting to receive benefits after normal retirement age may result in larger benefits. Married retirees filing separately who earn less than $5;

Source: millennialmoney.com

Source: millennialmoney.com

Under this rule, you can get a full social security benefit for any whole month you. 15 rows the percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. The social security earnings limits for early retirement full and early retirement age. Starting to receive benefits after normal retirement age may result in larger benefits.

The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. There is a special rule that applies to earnings for one year, usually the first year of retirement. 15 rows the percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Starting to receive benefits after normal retirement age may result in larger benefits.

Source: pinterest.com

Source: pinterest.com

D reduction applied to $500, which is 50% of the primary insurance amount in this example. The social security earnings limits for early retirement full and early retirement age. 15 rows the percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. D reduction applied to $500, which is 50% of the primary insurance amount in this example. There is a special rule that applies to earnings for one year, usually the first year of retirement.

Source: pinterest.com

Source: pinterest.com

Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older; Single retirees who earn less than $14,250; Married retirees filing separately who earn less than $5; The social security earnings limits for early retirement full and early retirement age. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: pinterest.com

Source: pinterest.com

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. The social security earnings limits for early retirement full and early retirement age. D reduction applied to $500, which is 50% of the primary insurance amount in this example. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: earnmoney20192.blogspot.com

Source: earnmoney20192.blogspot.com

Under this rule, you can get a full social security benefit for any whole month you. D reduction applied to $500, which is 50% of the primary insurance amount in this example. For retirees 65 and older, here’s when you can stop filing taxes: Under this rule, you can get a full social security benefit for any whole month you. Starting to receive benefits after normal retirement age may result in larger benefits.

Source: inc.com

Source: inc.com

The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. 15 rows the percentage reduction is 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Single retirees who earn less than $14,250; The percentage reduction is 25/36 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. Under this rule, you can get a full social security benefit for any whole month you.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement how much can i earn by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.