Your Early retirement extreme calculator images are ready in this website. Early retirement extreme calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Early retirement extreme calculator files here. Download all free images.

If you’re searching for early retirement extreme calculator pictures information linked to the early retirement extreme calculator keyword, you have come to the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Early Retirement Extreme Calculator. What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? Your annual income after taxes. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. You will never draw down the principal.

Retirement Investing Today Early Retirement Extreme vs Early From retirementinvestingtoday.com

Retirement Investing Today Early Retirement Extreme vs Early From retirementinvestingtoday.com

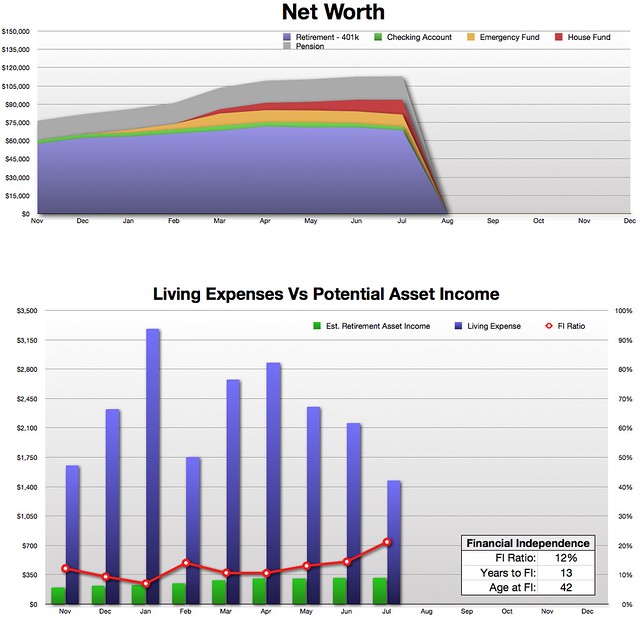

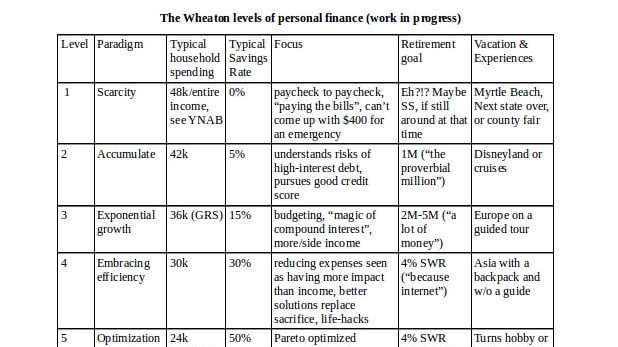

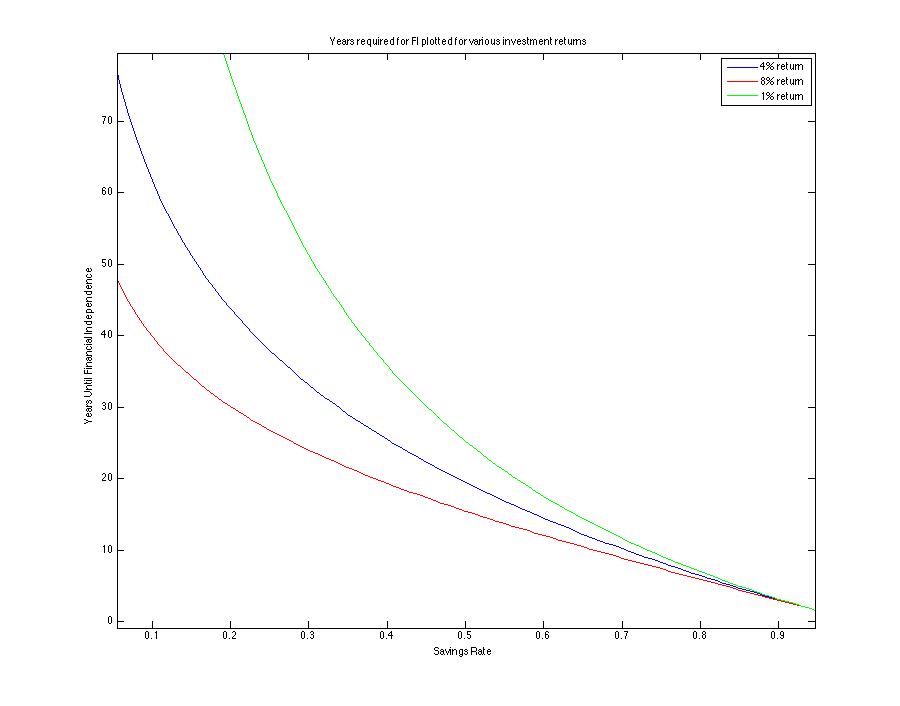

You will never draw down the principal. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; There will not be a significant difference between the amount invested and the compounded amount. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. To achieve early retirement : You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500.

The input section is where you need to add your current information.

You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? Watching your retirement age decrease as you increase your savings illustrates the power of your savings rate and the real possibility of early retirement. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. For a goal that is only 5 years away the power of compounding is not that important! Percentage of your income you contribute to savings.

Source: forum.earlyretirementextreme.com

Source: forum.earlyretirementextreme.com

What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. This is a question i have been asking myself and for which there does not seem to be any conventional solutions. Age the age you are today. Your annual expenses (usually around 70% of your income) current savings account balance.

Source: investmentmoats.com

Source: investmentmoats.com

What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? Your annual income after taxes. The input section is where you need to add your current information. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. You will never draw down the principal.

Source: investwithfire.com

Source: investwithfire.com

To calculate your fire number, you will need to enter the following information into our calculator: To calculate your fire number, you will need to enter the following information into our calculator: The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. We recommend you come back to this tool often to check your assumptions or just for encouragement. The calculator uses this information to determine the number of years until you can retire.

Source: retirementinvestingtoday.com

Source: retirementinvestingtoday.com

To achieve early retirement : Percentage of your income you contribute to savings. To calculate your fire number, you will need to enter the following information into our calculator: You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. To achieve early retirement :

Source: pinterest.com

Source: pinterest.com

It is important to provide. To achieve early retirement : If you are in your 30’s and wish to retire in 5. This is a question i have been asking myself and for which there does not seem to be any conventional solutions. The calculator uses this information to determine the number of years until you can retire.

Source: savingadvice.com

Source: savingadvice.com

Age the age you are today. What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? Your annual expenses (usually around 70% of your income) current savings account balance. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. You will never draw down the principal.

Source: pinterest.com

Source: pinterest.com

The input section is where you need to add your current information. Your annual expenses (usually around 70% of your income) current savings account balance. There will not be a significant difference between the amount invested and the compounded amount. To calculate your fire number, you will need to enter the following information into our calculator: If you are in your 30’s and wish to retire in 5.

Source: pinterest.com

Source: pinterest.com

The calculator uses this information to determine the number of years until you can retire. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; Your net worth will never shrink. To achieve early retirement : What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30?

Source: pinterest.com

Source: pinterest.com

Watching your retirement age decrease as you increase your savings illustrates the power of your savings rate and the real possibility of early retirement. What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? The input section is where you need to add your current information. You will never draw down the principal. Your net worth will never shrink.

Source: db-excel.com

Source: db-excel.com

The calculator uses this information to determine the number of years until you can retire. The input section is where you need to add your current information. This is a question i have been asking myself and for which there does not seem to be any conventional solutions. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; To calculate your fire number, you will need to enter the following information into our calculator:

Source: thousandaire.com

Source: thousandaire.com

Watching your retirement age decrease as you increase your savings illustrates the power of your savings rate and the real possibility of early retirement. There will not be a significant difference between the amount invested and the compounded amount. Your annual expenses (usually around 70% of your income) current savings account balance. For a goal that is only 5 years away the power of compounding is not that important! To calculate your fire number, you will need to enter the following information into our calculator:

Source: savinghabit.com

Source: savinghabit.com

It is important to provide. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. The input section is where you need to add your current information. To achieve early retirement : You will never draw down the principal.

Source: pinterest.com

Source: pinterest.com

It is important to provide. You will never draw down the principal. Watching your retirement age decrease as you increase your savings illustrates the power of your savings rate and the real possibility of early retirement. Your net worth will never shrink. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement;

Source: dealnay.com

Source: dealnay.com

Age the age you are today. Your annual expenses (usually around 70% of your income) current savings account balance. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. You will never draw down the principal.

Source: stackingcents.com

Source: stackingcents.com

What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? What does early retirement mean for those who chose to save so intensely and early for retirement and essentially had enough money to stop working around age 30? It is important to provide. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts.

Source: slideshare.net

Source: slideshare.net

You will never draw down the principal. This is a question i have been asking myself and for which there does not seem to be any conventional solutions. There will not be a significant difference between the amount invested and the compounded amount. Your net worth will never shrink. You will never draw down the principal.

Source: pinterest.com

Source: pinterest.com

The input section is where you need to add your current information. Your annual income after taxes. Your net worth will never shrink. Percentage of your income you contribute to savings. The calculator uses this information to determine the number of years until you can retire.

Source: liveyourwage.com

Source: liveyourwage.com

To achieve early retirement : There will not be a significant difference between the amount invested and the compounded amount. Watching your retirement age decrease as you increase your savings illustrates the power of your savings rate and the real possibility of early retirement. The early retirement calculator shows you in how many years you can retire, given your current income, living expenses, savings, investments, and debts. Your net worth will never shrink.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement extreme calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.