Your Early retirement distribution penalty images are ready. Early retirement distribution penalty are a topic that is being searched for and liked by netizens today. You can Download the Early retirement distribution penalty files here. Find and Download all royalty-free vectors.

If you’re searching for early retirement distribution penalty pictures information linked to the early retirement distribution penalty interest, you have visit the right blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

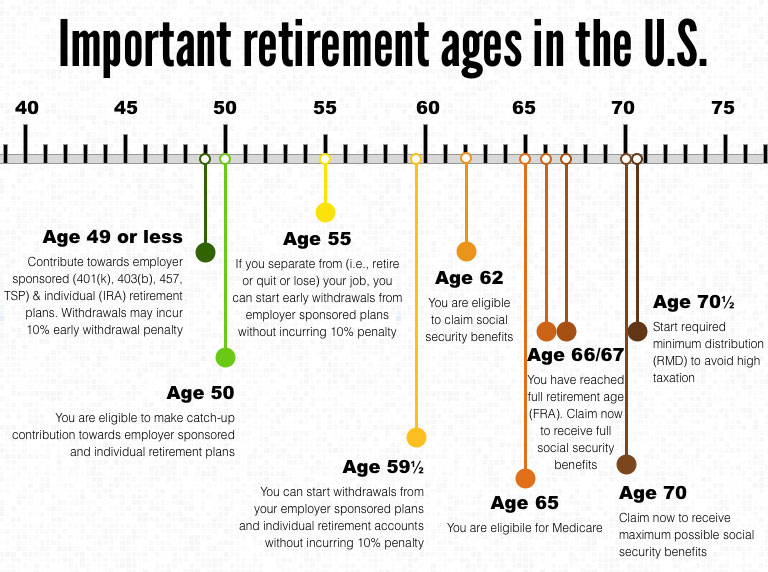

Early Retirement Distribution Penalty. After tax distributions are immune of the 10% penalty. A roth ira can also have a 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty.

How to Take Money Out of a 401(k) Plan From thebalance.com

How to Take Money Out of a 401(k) Plan From thebalance.com

Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. The guidance applies to substantially equal periodic payments, or 72(t), a. After tax distributions are immune of the 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying.

After tax distributions are immune of the 10% penalty.

After tax distributions are immune of the 10% penalty. After tax distributions are immune of the 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. A roth ira can also have a 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty.

Source: trustgroupfinancial.com

Source: trustgroupfinancial.com

The guidance applies to substantially equal periodic payments, or 72(t), a. A roth ira can also have a 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: petropensions.com

Source: petropensions.com

1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. The guidance applies to substantially equal periodic payments, or 72(t), a. A roth ira can also have a 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying.

Source: thebalance.com

Source: thebalance.com

After tax distributions are immune of the 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. After tax distributions are immune of the 10% penalty. A roth ira can also have a 10% penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: dreamstime.com

Source: dreamstime.com

The guidance applies to substantially equal periodic payments, or 72(t), a. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. The guidance applies to substantially equal periodic payments, or 72(t), a. After tax distributions are immune of the 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to.

Source: financial-planning.com

Source: financial-planning.com

19 rows most retirement plan distributions are subject to income tax and may be subject to. The guidance applies to substantially equal periodic payments, or 72(t), a. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: taxuni.com

Source: taxuni.com

Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. A roth ira can also have a 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. After tax distributions are immune of the 10% penalty.

Source: 401kcalculator.net

Source: 401kcalculator.net

A roth ira can also have a 10% penalty. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. A roth ira can also have a 10% penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: affordablecremationurns.com

Source: affordablecremationurns.com

19 rows most retirement plan distributions are subject to income tax and may be subject to. 19 rows most retirement plan distributions are subject to income tax and may be subject to. The guidance applies to substantially equal periodic payments, or 72(t), a. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: financiallysimple.com

Source: financiallysimple.com

1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. 19 rows most retirement plan distributions are subject to income tax and may be subject to. The guidance applies to substantially equal periodic payments, or 72(t), a. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. After tax distributions are immune of the 10% penalty.

Source: aotax.com

Source: aotax.com

1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. 19 rows most retirement plan distributions are subject to income tax and may be subject to. The guidance applies to substantially equal periodic payments, or 72(t), a. After tax distributions are immune of the 10% penalty.

Source: saturnwealth.com

Source: saturnwealth.com

The guidance applies to substantially equal periodic payments, or 72(t), a. The guidance applies to substantially equal periodic payments, or 72(t), a. A roth ira can also have a 10% penalty. After tax distributions are immune of the 10% penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty.

Source: thebalance.com

Source: thebalance.com

Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. The guidance applies to substantially equal periodic payments, or 72(t), a. A roth ira can also have a 10% penalty.

Source: financesay.com

Source: financesay.com

A roth ira can also have a 10% penalty. After tax distributions are immune of the 10% penalty. 19 rows most retirement plan distributions are subject to income tax and may be subject to. A roth ira can also have a 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying.

Source: gudorftaxgroup.com

Source: gudorftaxgroup.com

After tax distributions are immune of the 10% penalty. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. The guidance applies to substantially equal periodic payments, or 72(t), a. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying.

Source: torowealth.com

Source: torowealth.com

A roth ira can also have a 10% penalty. A roth ira can also have a 10% penalty. The guidance applies to substantially equal periodic payments, or 72(t), a. 19 rows most retirement plan distributions are subject to income tax and may be subject to. After tax distributions are immune of the 10% penalty.

Source: retireby40.org

Source: retireby40.org

The guidance applies to substantially equal periodic payments, or 72(t), a. 19 rows most retirement plan distributions are subject to income tax and may be subject to. Even if six months are still off and one will be attaining 59 ½ that same year, the distributions will still be subjected to the penalty. 1 the good news is that transferring an ira from one account to another is not considered a distribution, so you are free to change financial institutions at any time without worrying about paying. The guidance applies to substantially equal periodic payments, or 72(t), a.

Source: buywalls.blogspot.com

Source: buywalls.blogspot.com

After tax distributions are immune of the 10% penalty. Ii) only the taxable portion of the traditional distribution will be subjected to the 10% penalty. A roth ira can also have a 10% penalty. The guidance applies to substantially equal periodic payments, or 72(t), a. After tax distributions are immune of the 10% penalty.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement distribution penalty by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.