Your Early retirement age calculator images are available. Early retirement age calculator are a topic that is being searched for and liked by netizens today. You can Download the Early retirement age calculator files here. Get all royalty-free images.

If you’re searching for early retirement age calculator pictures information connected with to the early retirement age calculator keyword, you have come to the ideal blog. Our website always provides you with hints for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

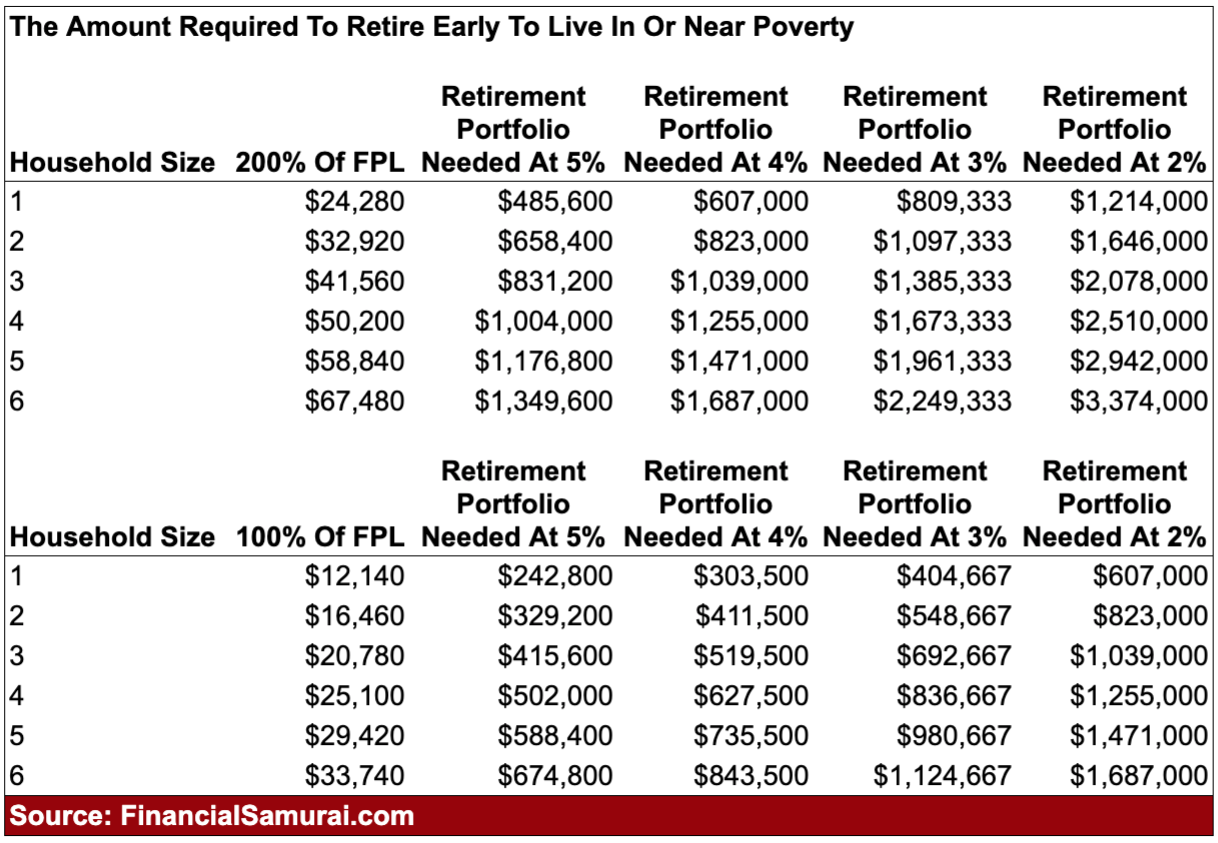

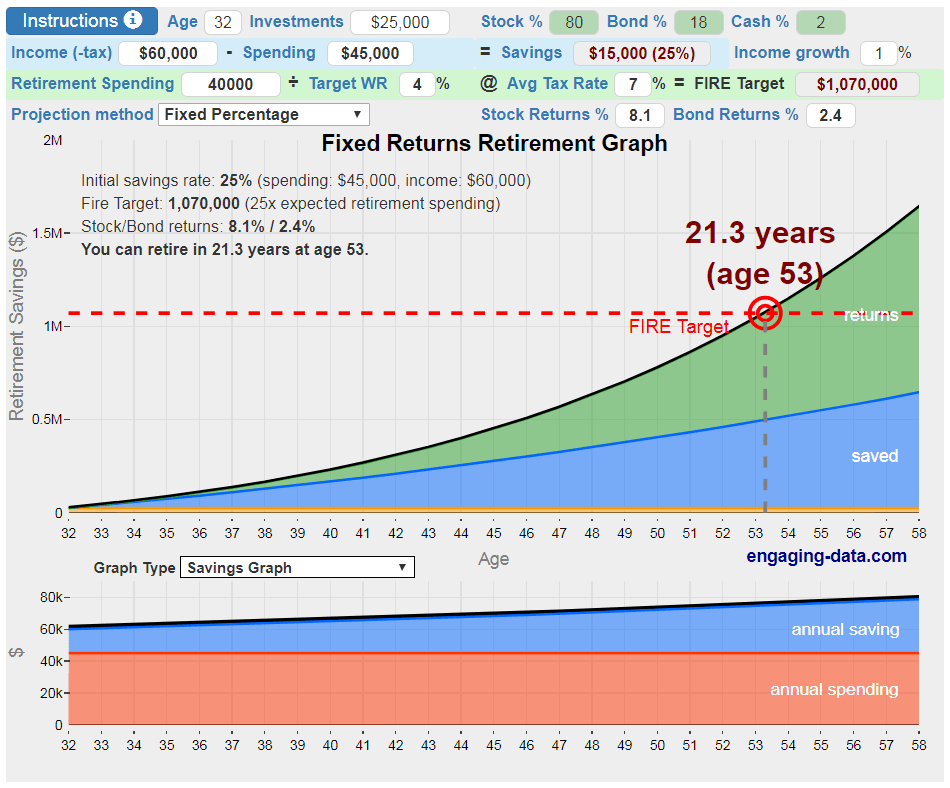

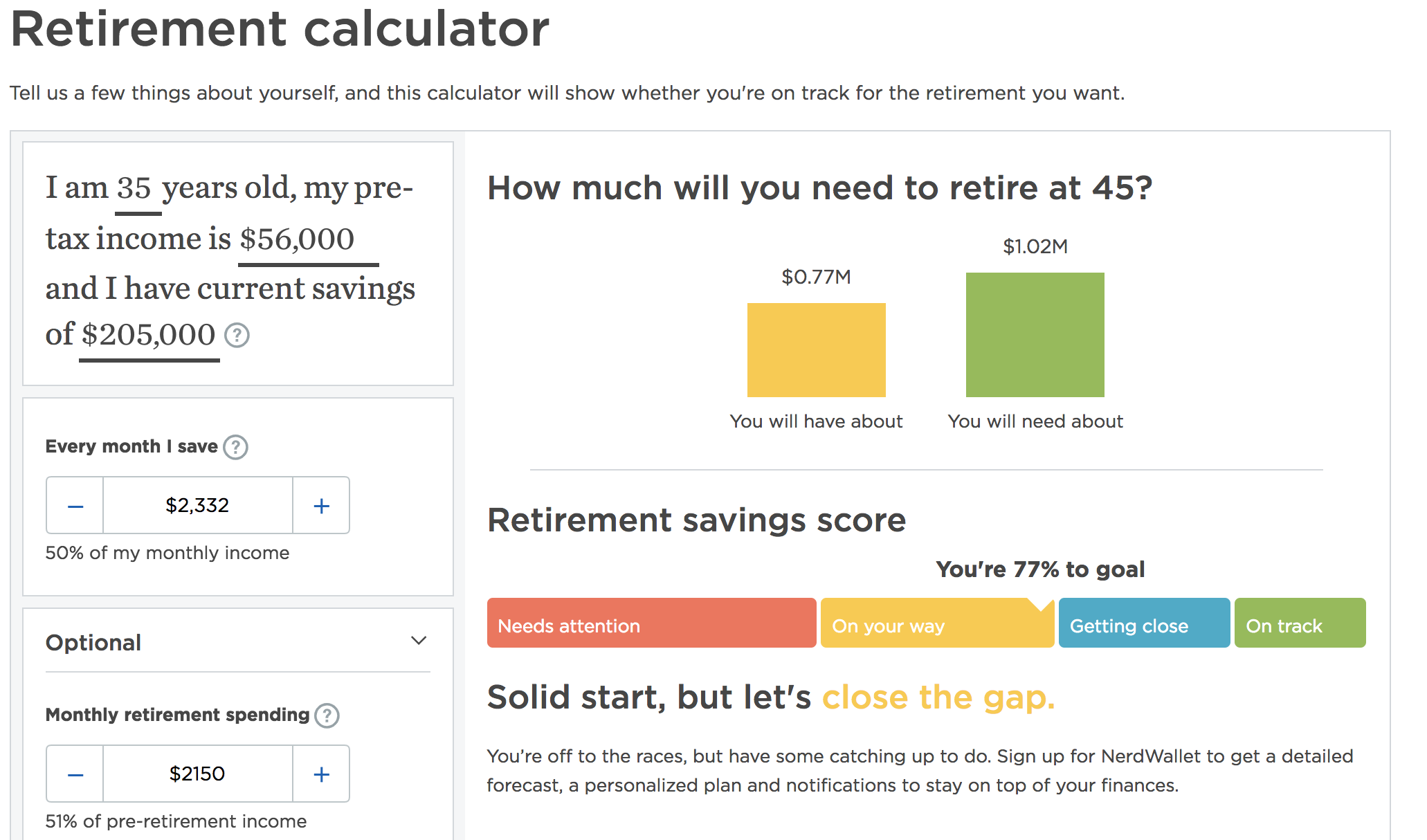

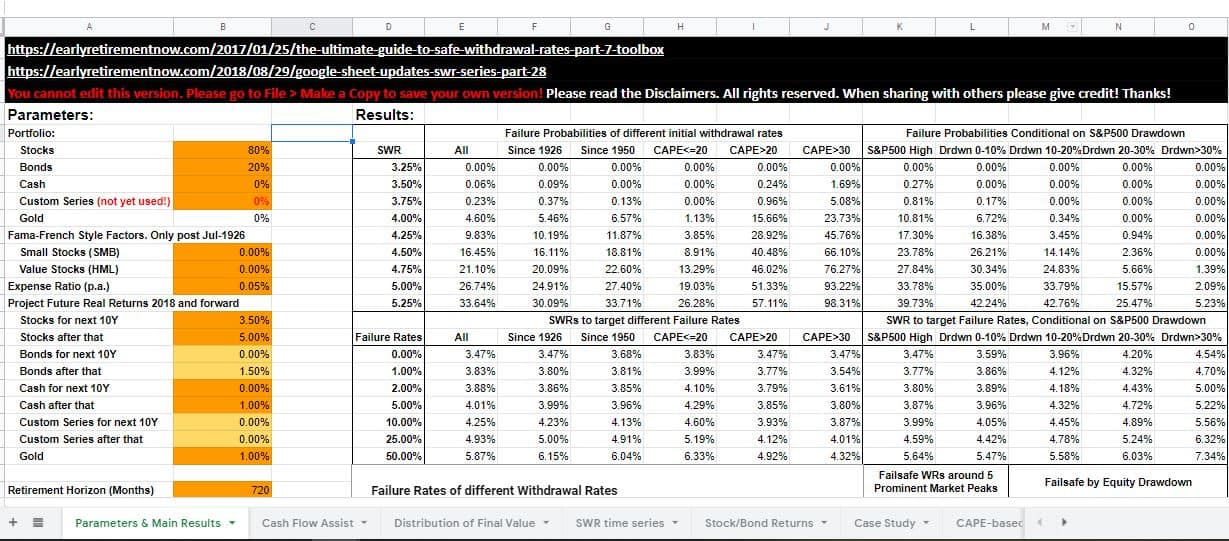

Early Retirement Age Calculator. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. Your annual income after taxes. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. The year and month you reach full retirement age depends on the year you were born.

Germany Retirement Age Calculator Germany Kapas From germanykapas.blogspot.com

Germany Retirement Age Calculator Germany Kapas From germanykapas.blogspot.com

This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. Your annual expenses (usually around 70% of your income) current savings account balance. The calculator allows you to run different scenarios and truly understand how much you need to put away every year to retire earlier than the normal age of 65. If your birthday is january 1st of any year, enter the previous year because that is how we determine your full retirement age.

You will never draw down the principal.

You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Your net worth will never shrink. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. The goal for early retirement is to save and invest as much as possible in a relatively short period of time. Percentage of your income you contribute to savings.

Source: omnicalculator.com

Source: omnicalculator.com

You can find your full retirement age by choosing your birth year in the calculator below, or by using our retirement age chart. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Your annual income after taxes. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. The goal for early retirement is to save and invest as much as possible in a relatively short period of time.

Source: germanykapas.blogspot.com

Source: germanykapas.blogspot.com

You will never draw down the principal. The goal for early retirement is to save and invest as much as possible in a relatively short period of time. You can find your full retirement age by choosing your birth year in the calculator below, or by using our retirement age chart. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; If your birthday is january 1st of any year, enter the previous year because that is how we determine your full retirement age.

Source: ilovefreesoftware.com

Source: ilovefreesoftware.com

Use our retirement age calculator to estimate projected retirement age, number of contributions, total investment and interest earned. Your annual income after taxes. In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. Percentage of your income you contribute to savings. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500.

Source: thatstuffaddsup.com

Source: thatstuffaddsup.com

Percentage of your income you contribute to savings. Percentage of your income you contribute to savings. In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. The year and month you reach full retirement age depends on the year you were born. You will never draw down the principal.

Source: germanykapas.blogspot.com

Source: germanykapas.blogspot.com

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; The goal for early retirement is to save and invest as much as possible in a relatively short period of time. Your net worth will never shrink. Your annual income after taxes.

Source: myretirementpaycheck.org

Source: myretirementpaycheck.org

The goal for early retirement is to save and invest as much as possible in a relatively short period of time. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. The goal for early retirement is to save and invest as much as possible in a relatively short period of time. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: pinterest.com

Source: pinterest.com

If the number of months exceeds 36, then the benefit is further reduced. Your annual income after taxes. Use our retirement age calculator to estimate projected retirement age, number of contributions, total investment and interest earned. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement;

Source: expensivity.com

Source: expensivity.com

Use our retirement age calculator to estimate projected retirement age, number of contributions, total investment and interest earned. Percentage of your income you contribute to savings. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. Your annual income after taxes. The year and month you reach full retirement age depends on the year you were born.

Source: in.pinterest.com

Source: in.pinterest.com

You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. The calculator allows you to run different scenarios and truly understand how much you need to put away every year to retire earlier than the normal age of 65. Your annual expenses (usually around 70% of your income) current savings account balance. Your annual income after taxes. The year and month you reach full retirement age depends on the year you were born.

Source: businessinsider.com

Source: businessinsider.com

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. Percentage of your income you contribute to savings. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. Your annual income after taxes. Your net worth will never shrink.

Source: choosefi.com

Source: choosefi.com

Your annual income after taxes. The calculator allows you to run different scenarios and truly understand how much you need to put away every year to retire earlier than the normal age of 65. You will never draw down the principal. The year and month you reach full retirement age depends on the year you were born. To calculate your fire number, you will need to enter the following information into our calculator:

Source: freefincal.com

Source: freefincal.com

Percentage of your income you contribute to savings. You can find your full retirement age by choosing your birth year in the calculator below, or by using our retirement age chart. The goal for early retirement is to save and invest as much as possible in a relatively short period of time. You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. Your net worth will never shrink.

Source: financialfreedomcountdown.com

Source: financialfreedomcountdown.com

You can retire in 12.4 years with a savings rate of 60% annual expenses 20,000 annual savings 30,000 monthly expenses 1,667 monthly savings 2,500. To calculate your fire number, you will need to enter the following information into our calculator: You can find your full retirement age by choosing your birth year in the calculator below, or by using our retirement age chart. Your net worth will never shrink. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just.

Source: pinterest.com

Source: pinterest.com

This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; You can find your full retirement age by choosing your birth year in the calculator below, or by using our retirement age chart. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. Use our retirement age calculator to estimate projected retirement age, number of contributions, total investment and interest earned.

Source: pinterest.com

Source: pinterest.com

You will never draw down the principal. If the number of months exceeds 36, then the benefit is further reduced. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; The goal for early retirement is to save and invest as much as possible in a relatively short period of time.

Source: wallethacks.com

Source: wallethacks.com

Your annual income after taxes. Percentage of your income you contribute to savings. Your annual income after taxes. You will never draw down the principal. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just.

Source: germanykapas.blogspot.com

Source: germanykapas.blogspot.com

The goal for early retirement is to save and invest as much as possible in a relatively short period of time. You may be able to retire as early as age 60. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; The goal for early retirement is to save and invest as much as possible in a relatively short period of time. With delayed retirement credits , a person can receive his or her largest benefit by retiring at age 70.

Source: retirementcalculatortoday.blogspot.com

Source: retirementcalculatortoday.blogspot.com

The year and month you reach full retirement age depends on the year you were born. You will invest only $229,000, but the interest you earn will be approximately $774,071, bringing your total to just. This calculator makes assumptions your current annual expenses equal your annual expenses in retirement; The goal for early retirement is to save and invest as much as possible in a relatively short period of time. Your annual income after taxes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title early retirement age calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.