Your Early retirement 990 images are ready in this website. Early retirement 990 are a topic that is being searched for and liked by netizens now. You can Download the Early retirement 990 files here. Find and Download all royalty-free photos and vectors.

If you’re searching for early retirement 990 images information linked to the early retirement 990 keyword, you have come to the right blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Early Retirement 990. Make an estimation of your retirement savings. Make sure your health insurance is in place. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. This is an income supplement designed to bridge the gap between early retirement and eligibility for social security.

Solved You Are Planning For A Very Early Retirement. You From chegg.com

Solved You Are Planning For A Very Early Retirement. You From chegg.com

Don’t take any risks with your portfolio. Set guidelines for your spending. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. getting ready to dive into early retirement. Make sure your health insurance is in place.

Don’t take any risks with your portfolio.

You’ll claim basic state pension and additional state pension if. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. Make sure your health insurance is in place. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. Don’t take any risks with your portfolio.

Source: chegg.com

Source: chegg.com

To retire early, you need to know how much cash you need to maintain the lifestyle you envision. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. The benefit amount is often equivalent to what the employee would receive from. Set guidelines for your spending. Don’t take any risks with your portfolio.

Source: newhorizonsonline.co.uk

Source: newhorizonsonline.co.uk

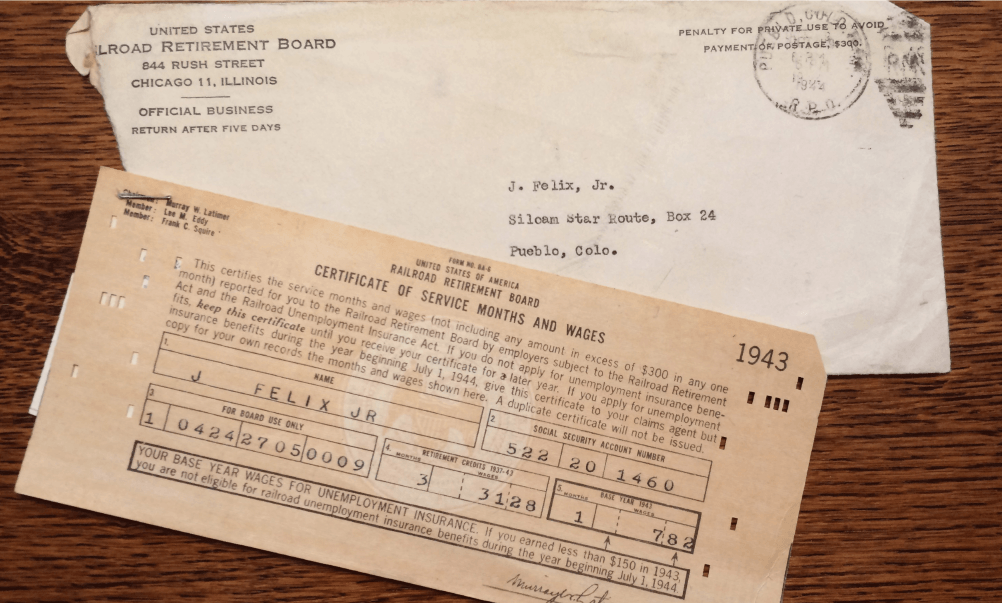

Make an estimation of your retirement savings. “the most critical variable in financial planning, and the. Make sure your health insurance is in place. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. This is an income supplement designed to bridge the gap between early retirement and eligibility for social security.

Source: galvnews.com

Source: galvnews.com

3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. Set guidelines for your spending. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing. Make sure your health insurance is in place. To retire early, you need to know how much cash you need to maintain the lifestyle you envision.

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

The benefit amount is often equivalent to what the employee would receive from. getting ready to dive into early retirement. You’ll claim basic state pension and additional state pension if. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance.

Source: pinterest.com

Source: pinterest.com

getting ready to dive into early retirement. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. Set guidelines for your spending. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. You’ll claim basic state pension and additional state pension if.

Source: blog.medalliongroup.com

Source: blog.medalliongroup.com

getting ready to dive into early retirement. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. You’ll claim basic state pension and additional state pension if. getting ready to dive into early retirement.

Source: 7702taxfreeplan.com

Source: 7702taxfreeplan.com

Make sure your health insurance is in place. Set guidelines for your spending. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. You’ll claim basic state pension and additional state pension if. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance.

The benefit amount is often equivalent to what the employee would receive from. Make an estimation of your retirement savings. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. You’ll claim basic state pension and additional state pension if. The amount you’ll get depends on your national insurance record and when you reach state pension age.

Source: earlyretirementnow.com

Source: earlyretirementnow.com

The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. Make an estimation of your retirement savings. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. The benefit amount is often equivalent to what the employee would receive from.

Source: companytaxreturnbisogun.blogspot.com

Source: companytaxreturnbisogun.blogspot.com

getting ready to dive into early retirement. The amount you’ll get depends on your national insurance record and when you reach state pension age. The benefit amount is often equivalent to what the employee would receive from. Set guidelines for your spending. To retire early, you need to know how much cash you need to maintain the lifestyle you envision.

Source: m3advisor.com

Source: m3advisor.com

The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. The benefit amount is often equivalent to what the employee would receive from. Don’t take any risks with your portfolio. Make sure your health insurance is in place. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing.

Source: blog.medalliongroup.com

Source: blog.medalliongroup.com

This is an income supplement designed to bridge the gap between early retirement and eligibility for social security. To retire early, you need to know how much cash you need to maintain the lifestyle you envision. You’ll claim basic state pension and additional state pension if. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing. 3:30) your 85 or 90 factor is like a financial security beacon, shining brightly in the retirement distance.

Source: chegg.com

Source: chegg.com

You’ll claim basic state pension and additional state pension if. “the most critical variable in financial planning, and the. Make an estimation of your retirement savings. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. The benefit amount is often equivalent to what the employee would receive from.

Source: mighty990.com

Source: mighty990.com

Make sure your health insurance is in place. Set guidelines for your spending. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. Make an estimation of your retirement savings. Don’t take any risks with your portfolio.

Source: chegg.com

Source: chegg.com

getting ready to dive into early retirement. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. You’ll claim basic state pension and additional state pension if. However, many members are deciding to retire before reaching their 85 (otpp) or 90 (omers) factor.and they are doing so without realizing. Don’t take any risks with your portfolio.

Source: pinterest.com

Source: pinterest.com

$10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. Set guidelines for your spending. getting ready to dive into early retirement. $10,989 + ($5,496 × 10) = $10,989 + $54,960 = $65,949. The amount you’ll get depends on your national insurance record and when you reach state pension age.

Source: bearbuypc.com

Source: bearbuypc.com

The benefit amount is often equivalent to what the employee would receive from. getting ready to dive into early retirement. Don’t take any risks with your portfolio. This is an income supplement designed to bridge the gap between early retirement and eligibility for social security. Set guidelines for your spending.

Source: m3advisor.com

Source: m3advisor.com

Make an estimation of your retirement savings. You’ll claim basic state pension and additional state pension if. The closer you get to your qualifying factor, the brighter that beacon (and bigger your pension) is going to be. The benefit amount is often equivalent to what the employee would receive from. To retire early, you need to know how much cash you need to maintain the lifestyle you envision.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title early retirement 990 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.