Your Dave ramsey retirement calculator images are ready in this website. Dave ramsey retirement calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Dave ramsey retirement calculator files here. Get all free photos.

If you’re looking for dave ramsey retirement calculator pictures information related to the dave ramsey retirement calculator keyword, you have come to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

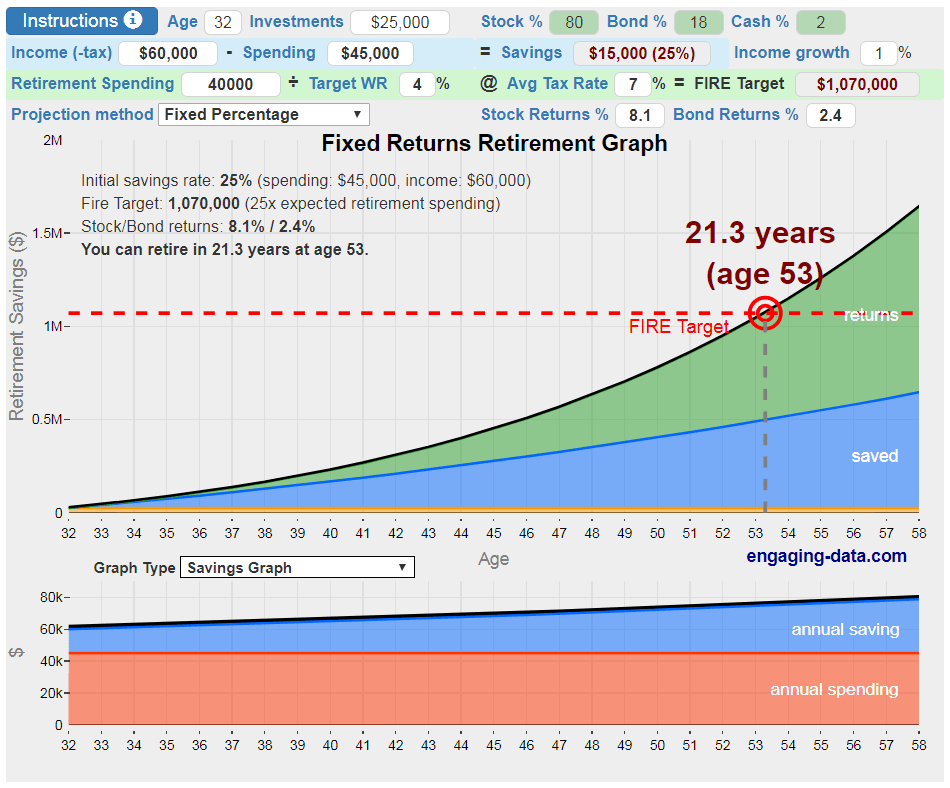

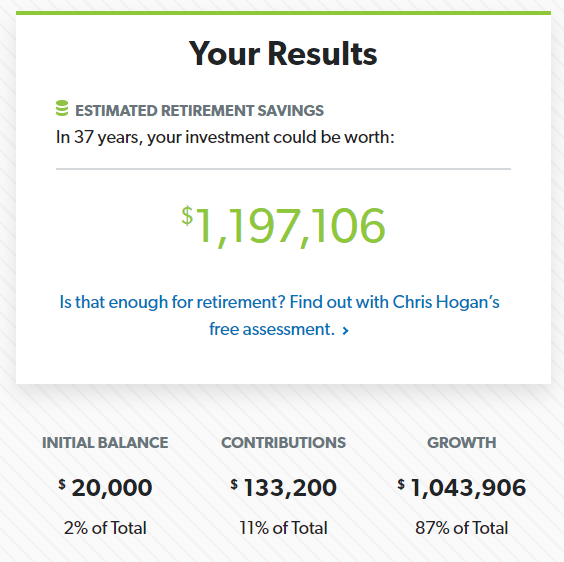

Dave Ramsey Retirement Calculator. Use our calculator to see how your investment portfolio will grow over time. Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier. Save on pinterest for later! With other variables staying constant.

Retirement Calculator Dave Ramsey CALCUZ From calcuz.blogspot.com

Retirement Calculator Dave Ramsey CALCUZ From calcuz.blogspot.com

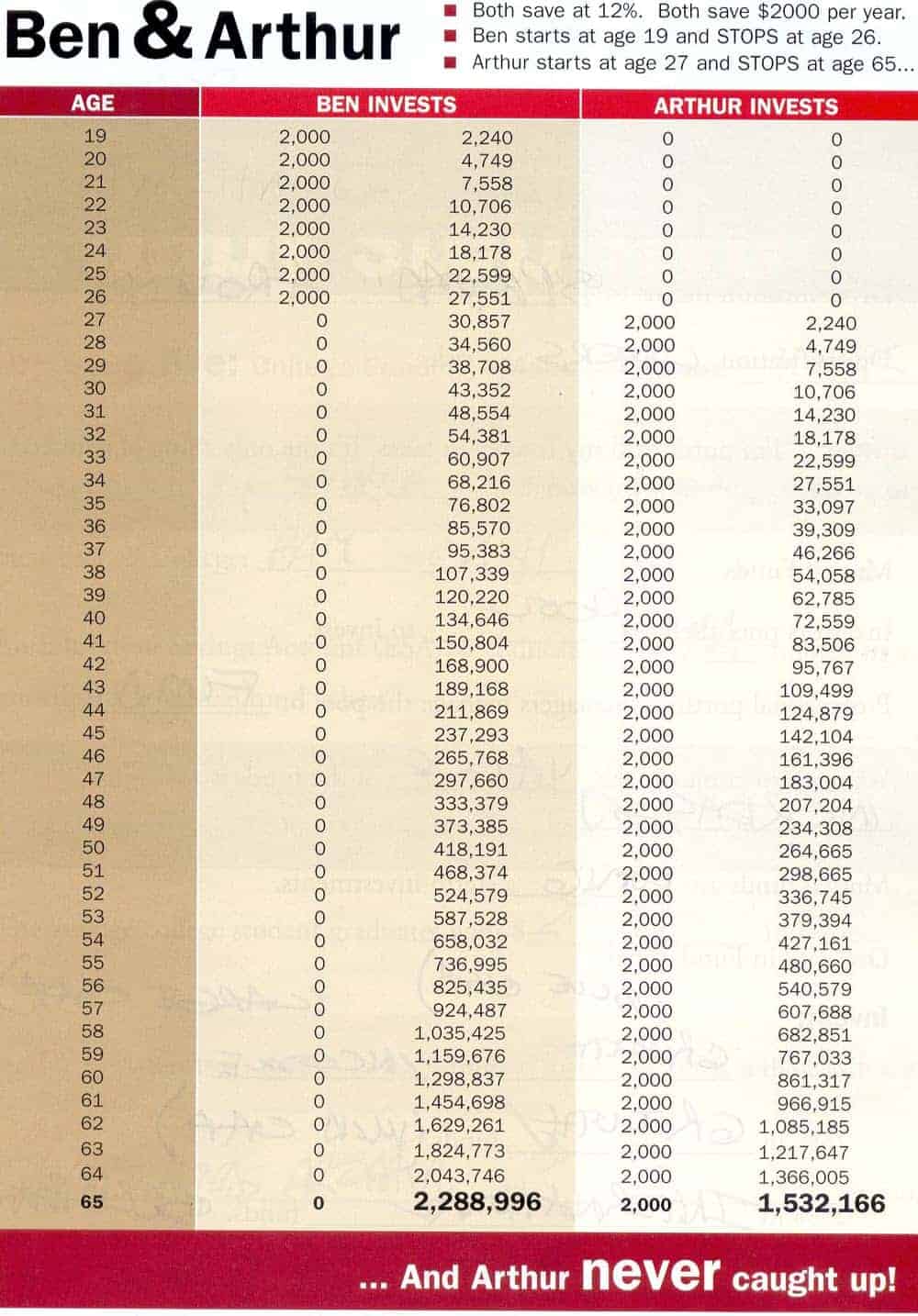

A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. The chart below varies savings per month, and looks at its impact on number of years until retirement. Give this term life insurance calculator a snapshot of your life situation: Save on pinterest for later! Invest your money with confidence and have a game plan for retirement. Inflation is the gradual rise of the general cost of living over time.it hovers around 3% every year, and it affects everything from the price of a.

You earn interest on top of interest.

The chart below varies savings per month, and looks at its impact on number of years until retirement. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. Now, if you know the ramsey program, this is dependent on where you are in your baby steps. The more you save, the earlier you can retire. Save on pinterest for later! Marital status, number of dependents, income, debt and retirement saved.

Source: likeabubblingbrook.com

Source: likeabubblingbrook.com

According to dave’s investment calculator, you would ideally save 15% towards retirement. The more you save, the earlier you can retire. As you work to create your retirement plan, there are five key factors you need to consider before deciding how much money you’ll need in retirement. With other variables staying constant. Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier.

Source: handytaxguy.com

Source: handytaxguy.com

Invest your money with confidence and have a game plan for retirement. Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier. Now, if you know the ramsey program, this is dependent on where you are in your baby steps. According to dave’s investment calculator, you would ideally save 15% towards retirement. The chart below varies savings per month, and looks at its impact on number of years until retirement.

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

Now, if you know the ramsey program, this is dependent on where you are in your baby steps. Invest your money with confidence and have a game plan for retirement. According to dave’s investment calculator, you would ideally save 15% towards retirement. Marital status, number of dependents, income, debt and retirement saved. Invest your money with confidence and have a game plan for retirement.

Source: retipster.com

Source: retipster.com

Save on pinterest for later! Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. Use our calculator to see how your investment portfolio will grow over time. According to dave’s investment calculator, you would ideally save 15% towards retirement. Dave ramsey term life insurance calculator.

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

For example, if you are on baby step 2, you should not be saving for retirement at all. You earn interest on top of interest. Save on pinterest for later! According to dave’s investment calculator, you would ideally save 15% towards retirement. The chart below varies savings per month, and looks at its impact on number of years until retirement.

Source: moolanomy.com

Source: moolanomy.com

Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. For example, if you are on baby step 2, you should not be saving for retirement at all. The chart below varies savings per month, and looks at its impact on number of years until retirement. Now, if you know the ramsey program, this is dependent on where you are in your baby steps. According to dave’s investment calculator, you would ideally save 15% towards retirement.

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

For example, if you are on baby step 2, you should not be saving for retirement at all. Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. Now, if you know the ramsey program, this is dependent on where you are in your baby steps. 5 factors that will impact how much you need for retirement. Save on pinterest for later!

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

Invest your money with confidence and have a game plan for retirement. Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. With other variables staying constant. Dave ramsey term life insurance calculator.

Source: pinterest.com

Source: pinterest.com

Use our calculator to see how your investment portfolio will grow over time. Dave ramsey term life insurance calculator. Invest your money with confidence and have a game plan for retirement. Use our calculator to see how your investment portfolio will grow over time. The more you save, the earlier you can retire.

Source: financialmentor.com

Source: financialmentor.com

With other variables staying constant. Invest your money with confidence and have a game plan for retirement. According to dave’s investment calculator, you would ideally save 15% towards retirement. Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier. Give this term life insurance calculator a snapshot of your life situation:

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

Invest your money with confidence and have a game plan for retirement. You earn interest on top of interest. Give this term life insurance calculator a snapshot of your life situation: Marital status, number of dependents, income, debt and retirement saved. Invest your money with confidence and have a game plan for retirement.

Source: pinterest.com

Source: pinterest.com

Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. 5 factors that will impact how much you need for retirement. According to dave’s investment calculator, you would ideally save 15% towards retirement. Save on pinterest for later! You earn interest on top of interest.

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

You earn interest on top of interest. The more you save, the earlier you can retire. 5 factors that will impact how much you need for retirement. Now, if you know the ramsey program, this is dependent on where you are in your baby steps. Invest your money with confidence and have a game plan for retirement.

Source: moneynation.com

Source: moneynation.com

Save on pinterest for later! Save on pinterest for later! Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. For example, if you are on baby step 2, you should not be saving for retirement at all. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts.

Source: savingadvice.com

Source: savingadvice.com

Give this term life insurance calculator a snapshot of your life situation: For example, if you are on baby step 2, you should not be saving for retirement at all. As you work to create your retirement plan, there are five key factors you need to consider before deciding how much money you’ll need in retirement. Marital status, number of dependents, income, debt and retirement saved. Use our calculator to see how your investment portfolio will grow over time.

Source: pinterest.com

Source: pinterest.com

With other variables staying constant. The chart below varies savings per month, and looks at its impact on number of years until retirement. As you work to create your retirement plan, there are five key factors you need to consider before deciding how much money you’ll need in retirement. Save on pinterest for later! Dave ramsey term life insurance calculator.

Source: agentwealthhustle.com

Source: agentwealthhustle.com

Inflation is the gradual rise of the general cost of living over time.it hovers around 3% every year, and it affects everything from the price of a. Invest your money with confidence and have a game plan for retirement. 5 factors that will impact how much you need for retirement. Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. Invest your money with confidence and have a game plan for retirement.

Source: pinterest.com

Source: pinterest.com

Now, if you know the ramsey program, this is dependent on where you are in your baby steps. Inflation is the gradual rise of the general cost of living over time.it hovers around 3% every year, and it affects everything from the price of a. Your money earns interest every day (if it compounds daily) and then the next day’s interest is calculated based on that total instead of on the principal. The chart below varies savings per month, and looks at its impact on number of years until retirement. Invest your money with confidence and have a game plan for retirement.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title dave ramsey retirement calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.