Your 401k retirement withdrawal calculator images are ready in this website. 401k retirement withdrawal calculator are a topic that is being searched for and liked by netizens now. You can Find and Download the 401k retirement withdrawal calculator files here. Download all free photos and vectors.

If you’re looking for 401k retirement withdrawal calculator images information connected with to the 401k retirement withdrawal calculator topic, you have visit the right site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

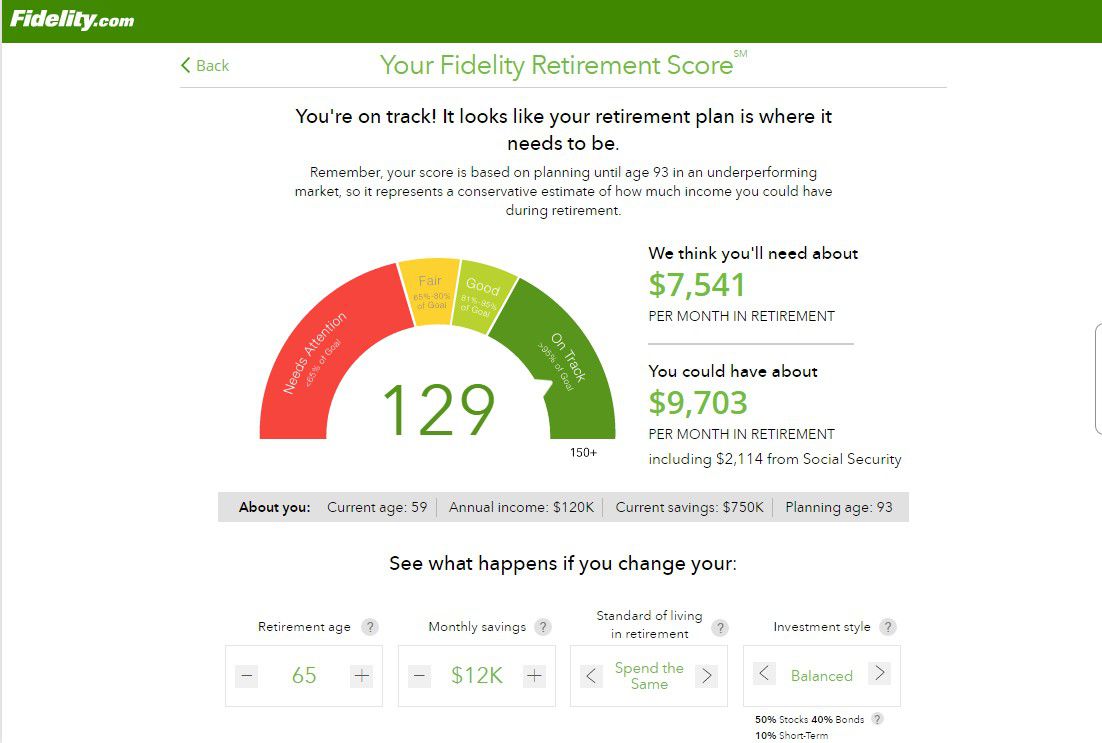

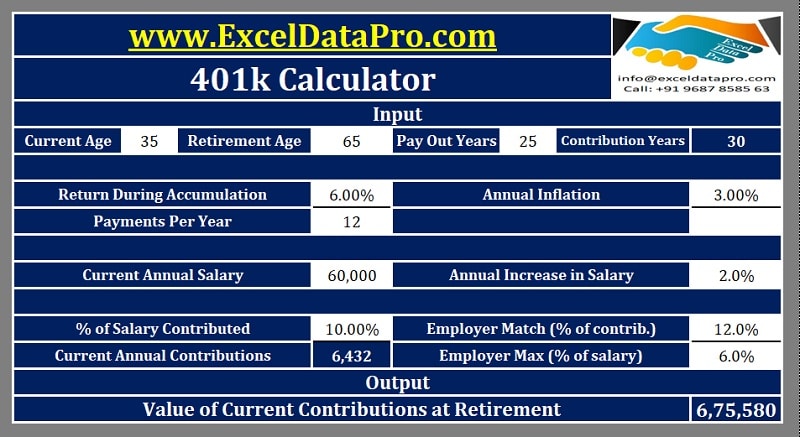

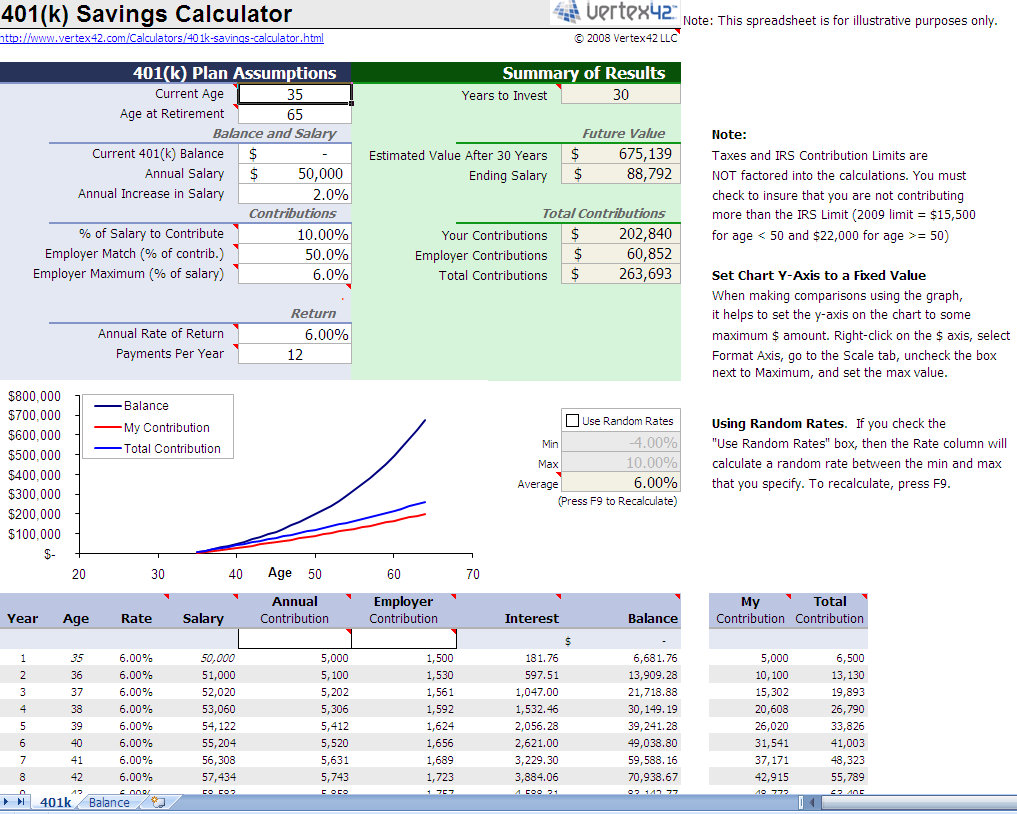

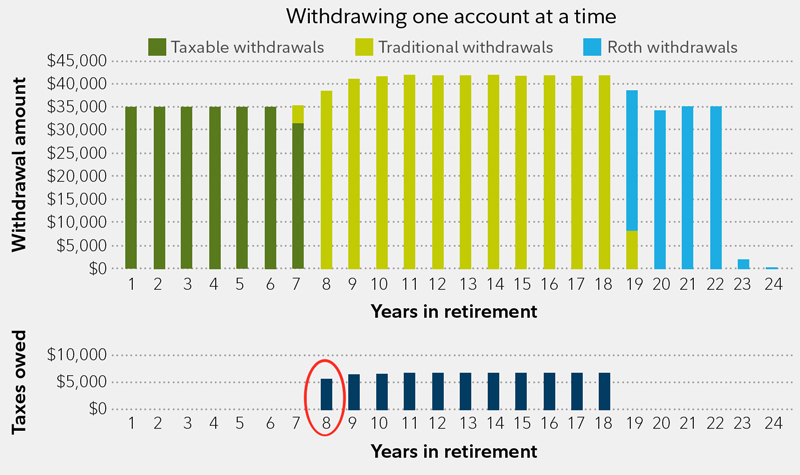

401k Retirement Withdrawal Calculator. Your employer needs to offer a 401(k) plan. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k).

Irs 401k Required Minimum Distribution Table From brokeasshome.com

Irs 401k Required Minimum Distribution Table From brokeasshome.com

In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. Your employer needs to offer a 401(k) plan. We use the current total. So if you retire at age 65, your last contribution occurs when you are actually 64.

To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

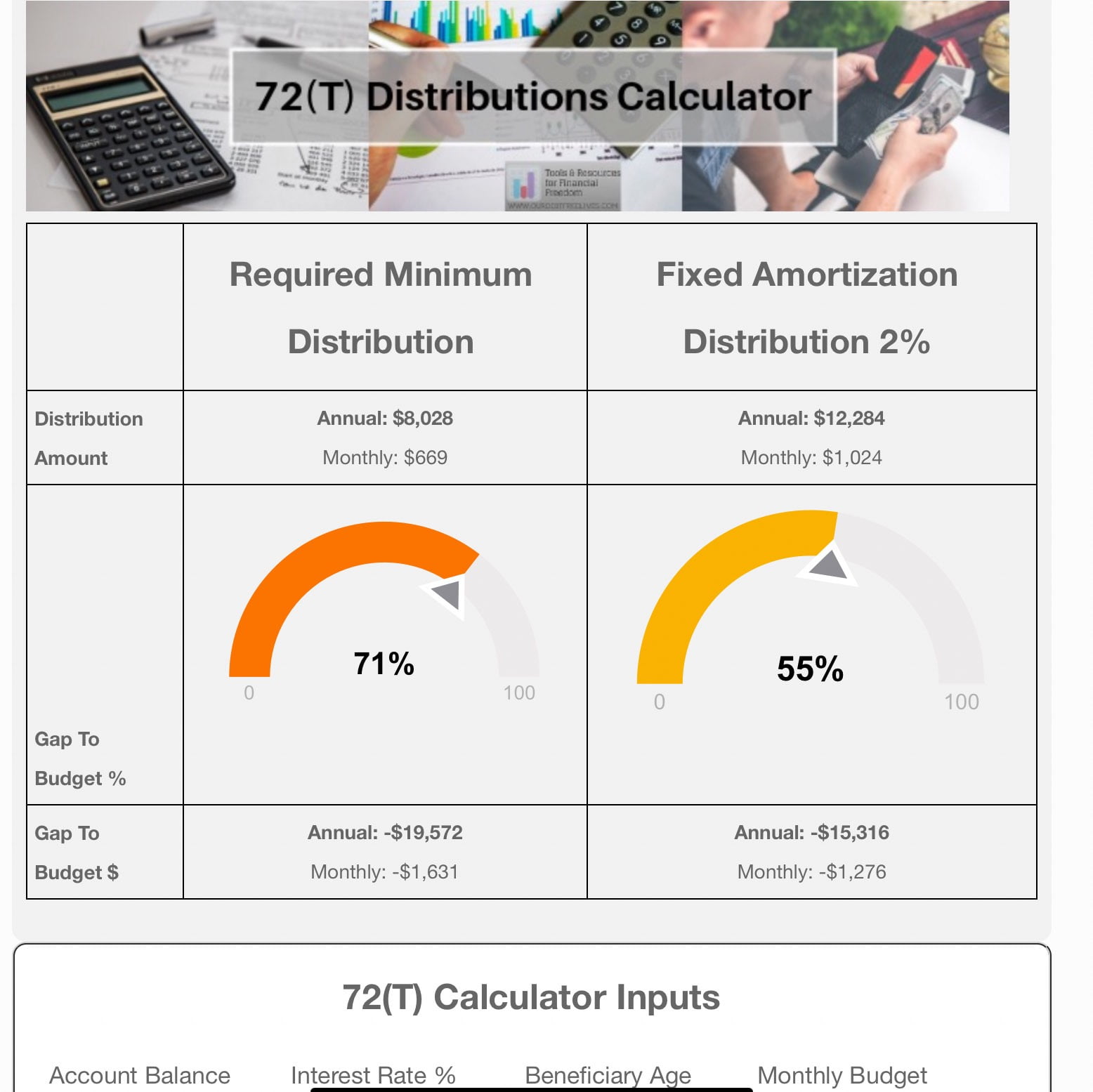

We use the current total. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). But there are often many reasons to. We use the current total. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account.

Source: ourdebtfreelives.com

Source: ourdebtfreelives.com

In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. But there are often many reasons to. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account.

Source: brokeasshome.com

Source: brokeasshome.com

We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. We use the current total. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

But there are often many reasons to. So if you retire at age 65, your last contribution occurs when you are actually 64. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Your employer needs to offer a 401(k) plan. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account.

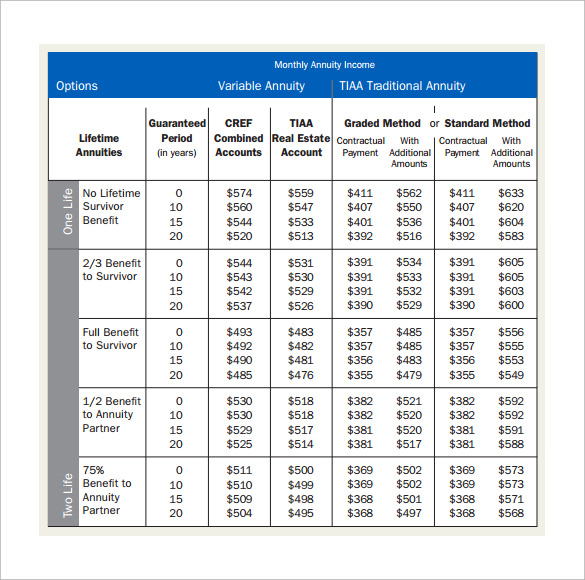

Source: sampletemplates.com

Source: sampletemplates.com

Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. So if you retire at age 65, your last contribution occurs when you are actually 64. Your employer needs to offer a 401(k) plan.

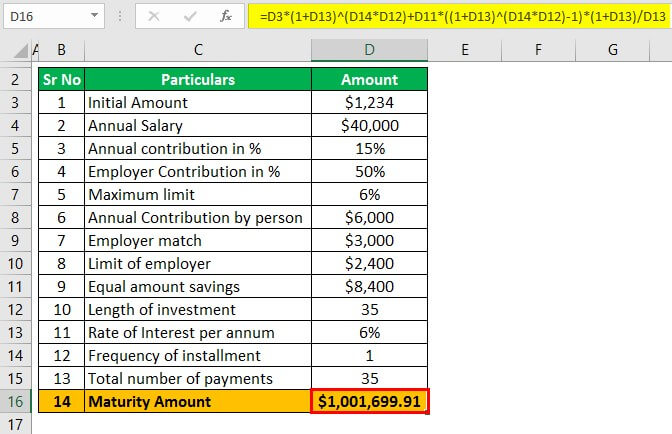

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. But there are often many reasons to. We use the current total. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

Source: financeshed.net

Source: financeshed.net

Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. So if you retire at age 65, your last contribution occurs when you are actually 64. We use the current total.

Source: 401kcalculator.net

Source: 401kcalculator.net

Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. We use the current total. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Your employer needs to offer a 401(k) plan. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time.

Source: mystockmarketbasics.com

Source: mystockmarketbasics.com

So if you retire at age 65, your last contribution occurs when you are actually 64. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. So if you retire at age 65, your last contribution occurs when you are actually 64.

Source: vertex42.com

Source: vertex42.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k).

To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. But there are often many reasons to. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty.

Source: homemade.ftempo.com

Source: homemade.ftempo.com

To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. We use the current total. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

Source: exceldatapro.com

Source: exceldatapro.com

We use the current total. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. But there are often many reasons to.

Source: carrigar.com

Source: carrigar.com

We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. But there are often many reasons to.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). But there are often many reasons to. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial.

Source: carrigar.com

Source: carrigar.com

So if you retire at age 65, your last contribution occurs when you are actually 64. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. We use the current total. So if you retire at age 65, your last contribution occurs when you are actually 64.

Source: advisoryhq.com

Source: advisoryhq.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). To get the most out of this 401 (k) calculator, we recommend that you input data that reflects your retirement goals and current financial. In some cases, it�s possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your retirement age without a penalty. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account.

Source: vertex42.com

Source: vertex42.com

This calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Your employer needs to offer a 401(k) plan. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. So if you retire at age 65, your last contribution occurs when you are actually 64. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k).

Source: vertex42.com

Source: vertex42.com

Our free 401 (k) distribution calculator helps you to determine your withdrawal amount and where you stand with your 401k or ira account. The irs regulations in the united states state that anyone who is older than 70 is required to start withdrawing money from their 401k/ira account. We use the current maximum contributions ($18,000 in 2015 and $53,000 including company contribution) and assume these numbers will grow with inflation over time. We use the current total. This calculator assumes that the year you retire, you do not make any contributions to your 401 (k).

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 401k retirement withdrawal calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.