Your 401 k retirement bill images are available in this site. 401 k retirement bill are a topic that is being searched for and liked by netizens today. You can Find and Download the 401 k retirement bill files here. Get all free vectors.

If you’re searching for 401 k retirement bill images information linked to the 401 k retirement bill keyword, you have come to the ideal site. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

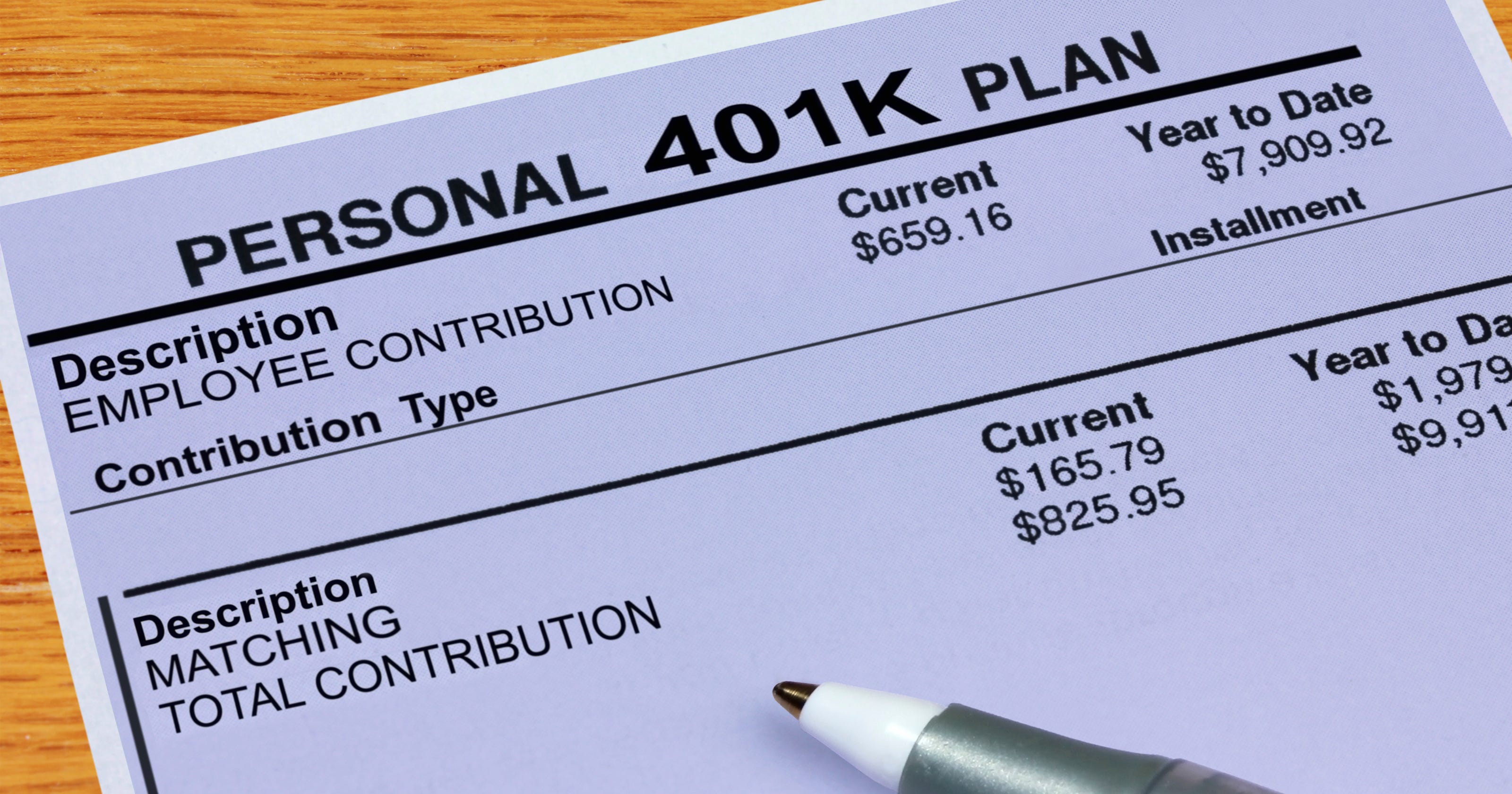

401 K Retirement Bill. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. One proposal would require employers to automatically enroll eligible employees in. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033.

Bill Lockyer The Difference Between a 401(k) and a Pension Plan Bill From billlockyer.com

Bill Lockyer The Difference Between a 401(k) and a Pension Plan Bill From billlockyer.com

Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. One proposal would require employers to automatically enroll eligible employees in.

The new law explained and how it affects you.

Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. One proposal would require employers to automatically enroll eligible employees in. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033.

Source: slideshare.net

Source: slideshare.net

The new law explained and how it affects you. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in.

Source: youtube.com

Source: youtube.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis.

Source: dreamfinancialplanning.com

Source: dreamfinancialplanning.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer.

Source: forbes.com

Source: forbes.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in.

Source: billlockyer.com

Source: billlockyer.com

The new law explained and how it affects you. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. One proposal would require employers to automatically enroll eligible employees in. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you.

Source: thetechsavvycpa.com

Source: thetechsavvycpa.com

Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer.

Source: usatoday.com

Source: usatoday.com

The new law explained and how it affects you. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. One proposal would require employers to automatically enroll eligible employees in. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis.

Source: 401kmaneuver.com

Source: 401kmaneuver.com

One proposal would require employers to automatically enroll eligible employees in. One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you.

Source: moneywiseguys.com

Source: moneywiseguys.com

One proposal would require employers to automatically enroll eligible employees in. The new law explained and how it affects you. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer.

Source: 401kmaneuver.com

Source: 401kmaneuver.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. One proposal would require employers to automatically enroll eligible employees in. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer.

Source: iammrfoster.com

Source: iammrfoster.com

The new law explained and how it affects you. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033.

Source: finder.com

Source: finder.com

Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. The new law explained and how it affects you. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. One proposal would require employers to automatically enroll eligible employees in.

Source: usatoday.com

Source: usatoday.com

Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis.

Source: usatoday.com

Source: usatoday.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. One proposal would require employers to automatically enroll eligible employees in.

Source: money.cnn.com

Source: money.cnn.com

Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. One proposal would require employers to automatically enroll eligible employees in. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. The new law explained and how it affects you. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer.

Source: usatoday.com

Source: usatoday.com

The new law explained and how it affects you. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. One proposal would require employers to automatically enroll eligible employees in.

Source: thetrilogyfoundation.org

Source: thetrilogyfoundation.org

One proposal would require employers to automatically enroll eligible employees in. Tuesday’s legislation would again push back the age americans need to take rmds from retirement accounts like 401 (k)s from the current age of 72 to 73 in 2023, 74 in 2030 and 75 in 2033. The new law explained and how it affects you. Last month congress almost unanimously passed secure 2.0, a bill that makes big changes to rules for 401(k) and 403(b) accounts to address america�s impending retirement crisis. One proposal would require employers to automatically enroll eligible employees in.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 401 k retirement bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.