Your 4 retirement withdrawal calculator images are ready. 4 retirement withdrawal calculator are a topic that is being searched for and liked by netizens today. You can Get the 4 retirement withdrawal calculator files here. Get all free vectors.

If you’re searching for 4 retirement withdrawal calculator images information connected with to the 4 retirement withdrawal calculator keyword, you have visit the right blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

4 Retirement Withdrawal Calculator. 5=interest rate (compounded annually) 3.5=inflation rate. The calculations here can be helpful, as can many other retirement calculators out there. Of course, there are other ways to determine how much to save for retirement. After $800 in withdrawals, you will be left with about $70 in income.

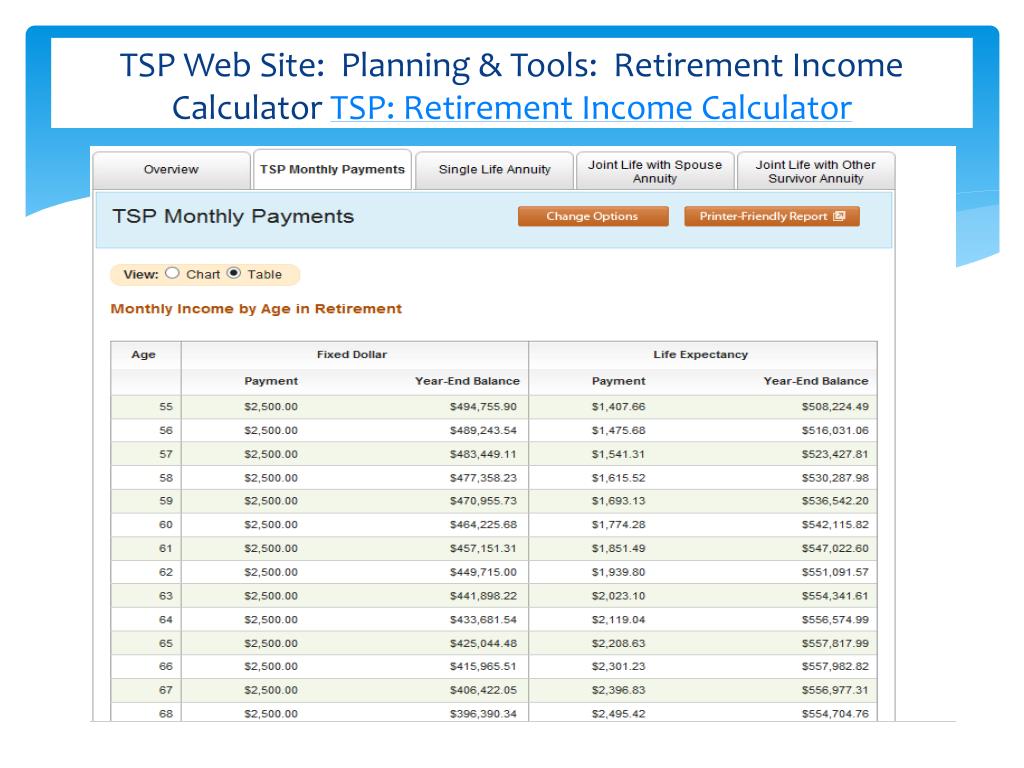

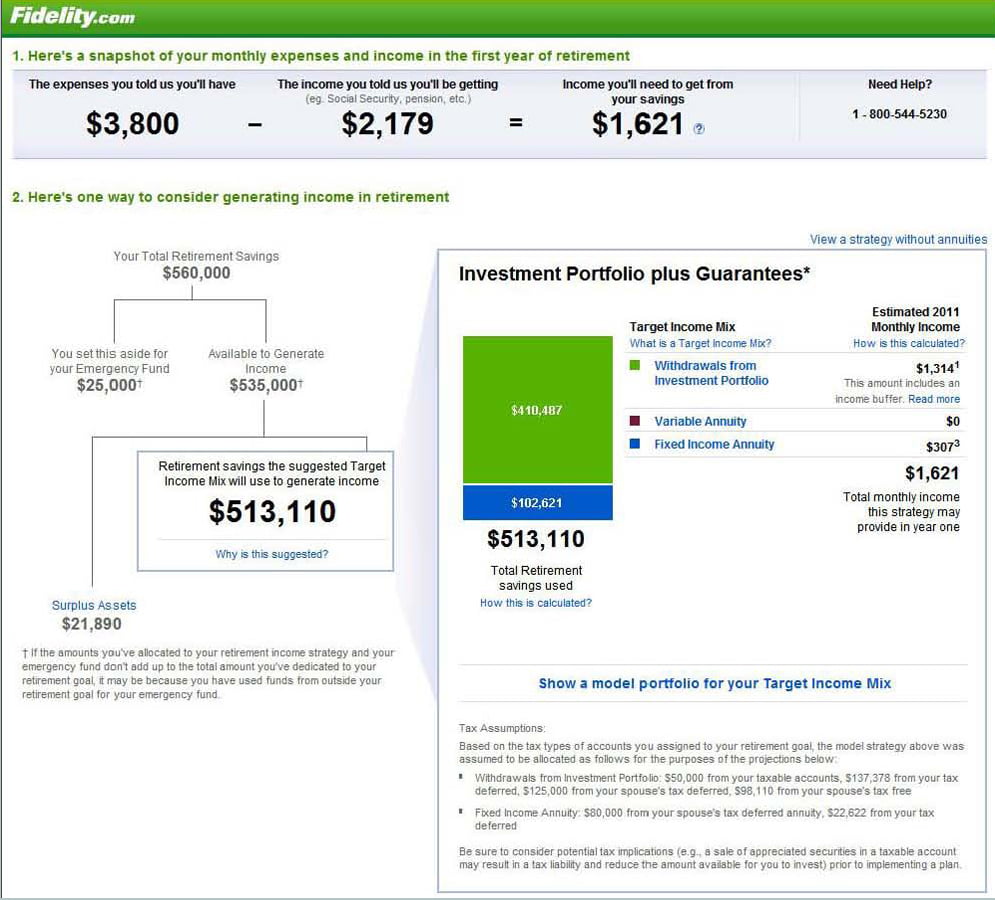

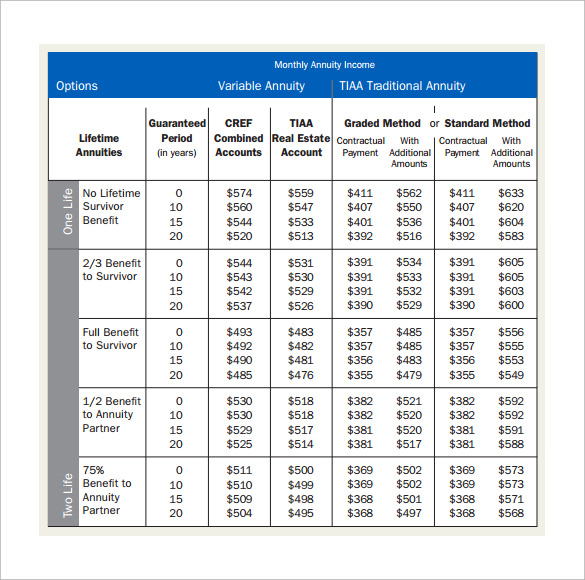

Online Calculator Takes On Annuities Squared Away Blog From squaredawayblog.bc.edu

Online Calculator Takes On Annuities Squared Away Blog From squaredawayblog.bc.edu

$150,000 will result in $870.33 in interest earned at the end of month 1. $150,070 will result in $870.74 in interest earned at the end of month 2. Of course, there are other ways to determine how much to save for retirement. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. After $800 in withdrawals, you will be left with about $70 in income. It provides a baseline understanding for.

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time.

2,702,947.50 or 2702947.5=amount saved at time of retirement. There are no international stocks used in this calculator. At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070. It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. $150,070 will result in $870.74 in interest earned at the end of month 2. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time.

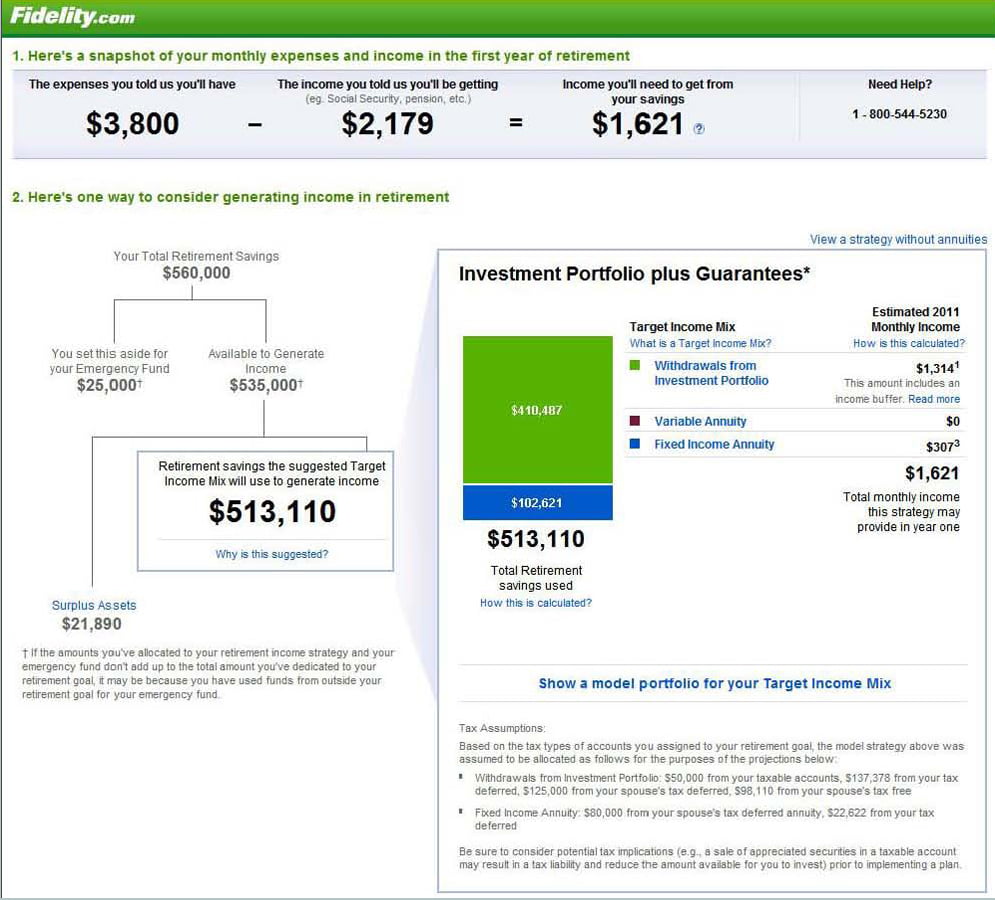

Source: retirewire.com

Source: retirewire.com

The calculations here can be helpful, as can many other retirement calculators out there. $150,070 will result in $870.74 in interest earned at the end of month 2. After $800 in withdrawals, you will be left with about $70 in income. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement.

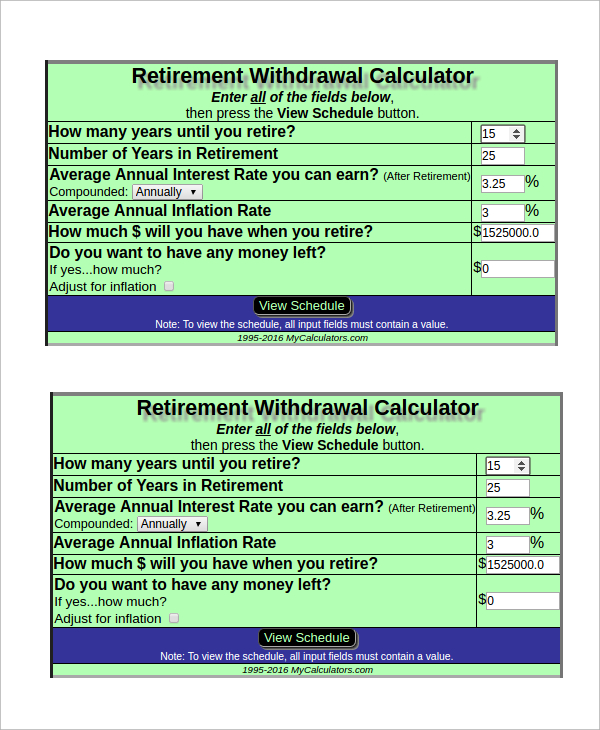

Source: calcuz.blogspot.com

Source: calcuz.blogspot.com

It provides a baseline understanding for. After $800 in withdrawals, you will be left with about $70 in income. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. It provides a baseline understanding for.

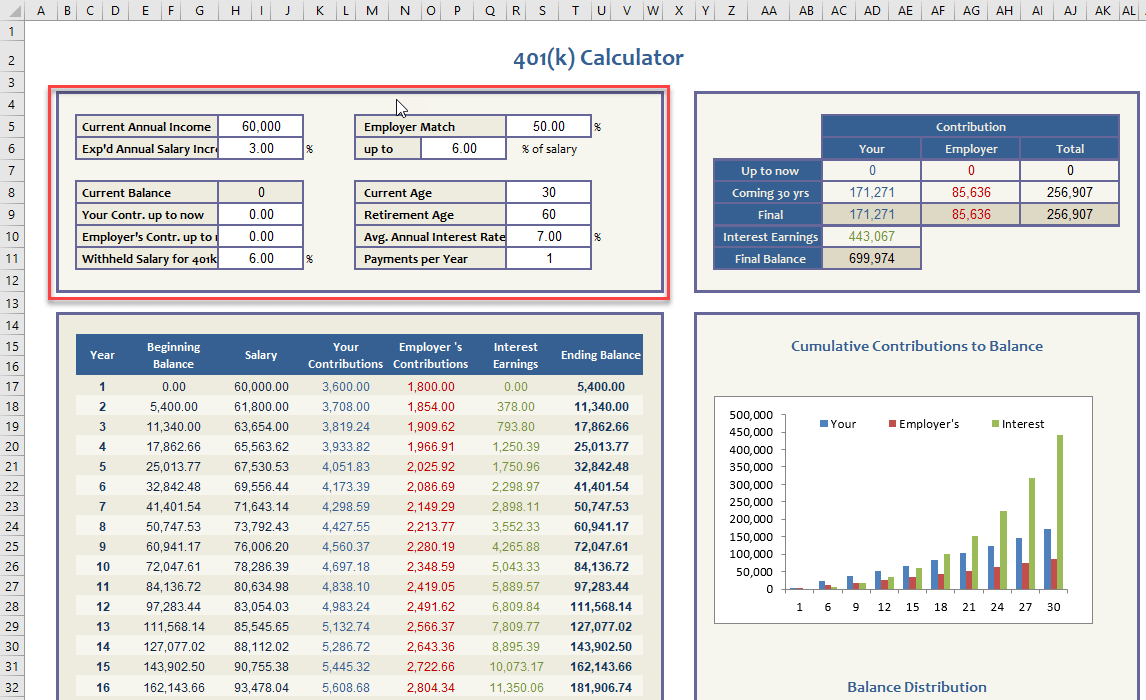

Source: spreadsheetweb.com

Source: spreadsheetweb.com

For these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. Of course, there are other ways to determine how much to save for retirement. $150,070 will result in $870.74 in interest earned at the end of month 2. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. $150,000 will result in $870.33 in interest earned at the end of month 1.

Source: db-excel.com

Source: db-excel.com

It provides a baseline understanding for. After $800 in withdrawals, you will be left with about $70 in income. It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. 2,702,947.50 or 2702947.5=amount saved at time of retirement. $150,000 will result in $870.33 in interest earned at the end of month 1.

Source: formsbirds.com

Source: formsbirds.com

At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070. Of course, there are other ways to determine how much to save for retirement. 25=years until you retire (age 40 to age 65) 35=years of retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement. $150,000 will result in $870.33 in interest earned at the end of month 1.

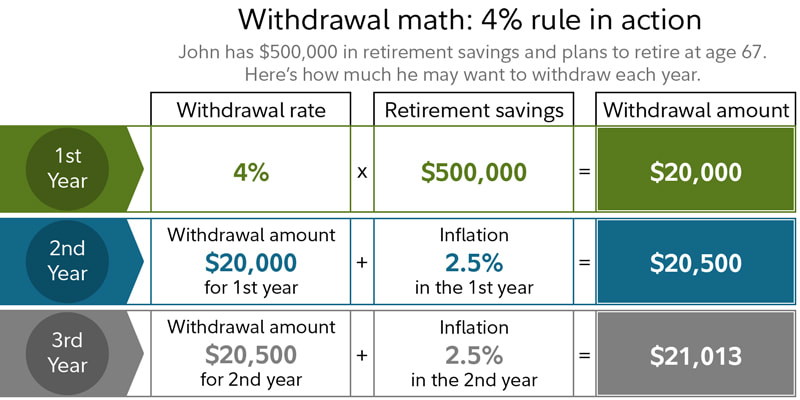

Source: seekingalpha.com

Source: seekingalpha.com

5=interest rate (compounded annually) 3.5=inflation rate. $150,070 will result in $870.74 in interest earned at the end of month 2. $150,000 will result in $870.33 in interest earned at the end of month 1. At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070. Of course, there are other ways to determine how much to save for retirement.

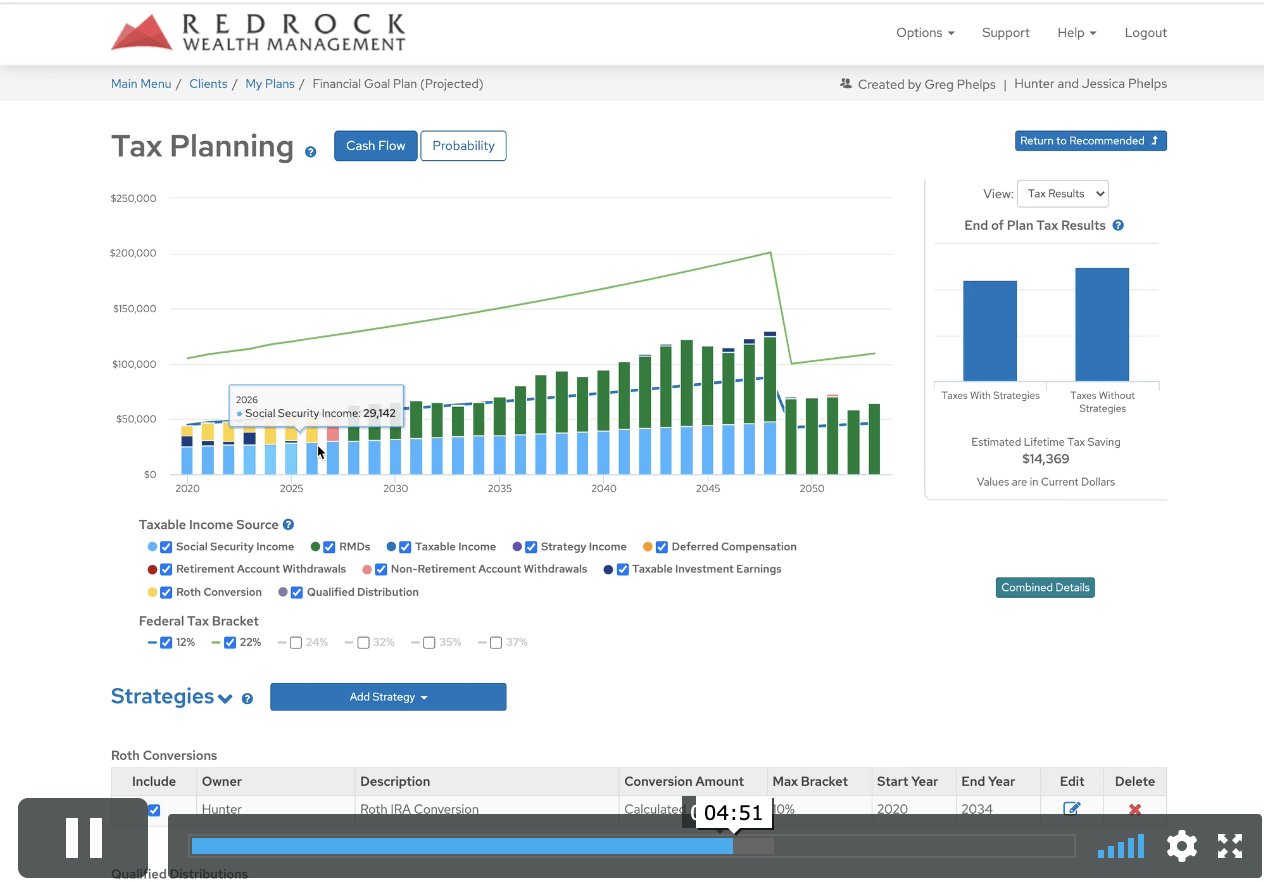

Source: itfdesigncenter.blogspot.com

Source: itfdesigncenter.blogspot.com

Of course, there are other ways to determine how much to save for retirement. Next, you will be provided with a bar graph detailing your earnings, withdrawals and ongoing account balances. It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. There are no international stocks used in this calculator. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement.

Source: theretirementspt.com

Source: theretirementspt.com

First, our retirement withdrawal calculator will tell you approximately how many years your retirement funds may be able to supplement your streams of fixed income, along with a total of your systematic withdrawals. Of course, there are other ways to determine how much to save for retirement. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. After $800 in withdrawals, you will be left with about $70 in income. At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070.

Source: pfwise.com

Source: pfwise.com

$150,000 will result in $870.33 in interest earned at the end of month 1. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. 25=years until you retire (age 40 to age 65) 35=years of retirement. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. Of course, there are other ways to determine how much to save for retirement.

Source: reddit.com

Source: reddit.com

$150,070 will result in $870.74 in interest earned at the end of month 2. The calculations here can be helpful, as can many other retirement calculators out there. 5=interest rate (compounded annually) 3.5=inflation rate. For these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. After $800 in withdrawals, you will be left with about $70 in income.

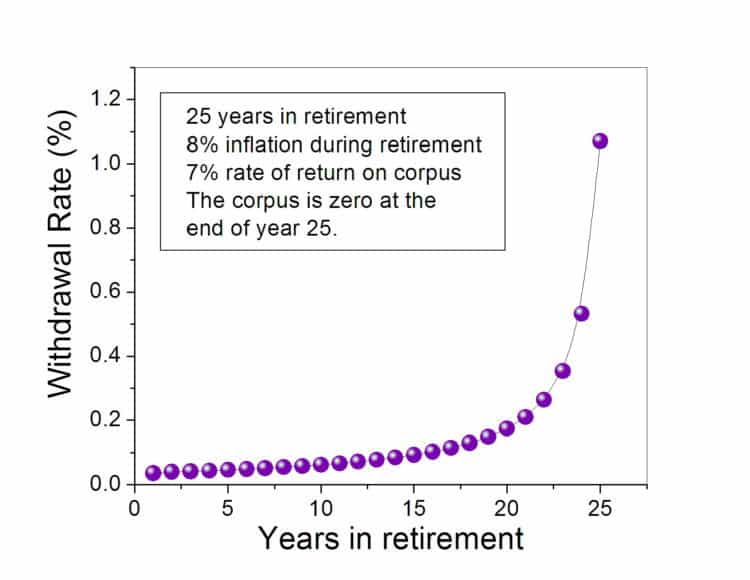

Source: freefincal.com

Source: freefincal.com

It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. Of course, there are other ways to determine how much to save for retirement. There are no international stocks used in this calculator. 25=years until you retire (age 40 to age 65) 35=years of retirement. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement.

Source: youneedabudget.com

Source: youneedabudget.com

It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. First, our retirement withdrawal calculator will tell you approximately how many years your retirement funds may be able to supplement your streams of fixed income, along with a total of your systematic withdrawals. At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. 25=years until you retire (age 40 to age 65) 35=years of retirement.

Source: squaredawayblog.bc.edu

Source: squaredawayblog.bc.edu

$150,000 will result in $870.33 in interest earned at the end of month 1. The calculations here can be helpful, as can many other retirement calculators out there. At the end of month 1, your balance will therefore be $150,000 + $70 = $150,070. Of course, there are other ways to determine how much to save for retirement. 2,702,947.50 or 2702947.5=amount saved at time of retirement.

Source: samplesiteh.blogspot.com

Source: samplesiteh.blogspot.com

There are no international stocks used in this calculator. 2,702,947.50 or 2702947.5=amount saved at time of retirement. Next, you will be provided with a bar graph detailing your earnings, withdrawals and ongoing account balances. It provides a baseline understanding for. The calculations here can be helpful, as can many other retirement calculators out there.

Source: nofisunthi.blogspot.com

Source: nofisunthi.blogspot.com

2,702,947.50 or 2702947.5=amount saved at time of retirement. Next, you will be provided with a bar graph detailing your earnings, withdrawals and ongoing account balances. $150,070 will result in $870.74 in interest earned at the end of month 2. After $800 in withdrawals, you will be left with about $70 in income. It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent.

Source: formtemplate.org

Source: formtemplate.org

There are no international stocks used in this calculator. After $800 in withdrawals, you will be left with about $70 in income. It is the simplest, most straightforward of all possible models by emulating a fixed income (bonds and cash) portfolio with a progressive amortization of principal until all the assets are spent. Of course, there are other ways to determine how much to save for retirement. 5=interest rate (compounded annually) 3.5=inflation rate.

Source: theretirementspt.com

Source: theretirementspt.com

Next, you will be provided with a bar graph detailing your earnings, withdrawals and ongoing account balances. For these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. First, our retirement withdrawal calculator will tell you approximately how many years your retirement funds may be able to supplement your streams of fixed income, along with a total of your systematic withdrawals. The calculations here can be helpful, as can many other retirement calculators out there. There are no international stocks used in this calculator.

Source: nofisunthi.blogspot.com

Source: nofisunthi.blogspot.com

You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time. For these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. 5=interest rate (compounded annually) 3.5=inflation rate. Next, you will be provided with a bar graph detailing your earnings, withdrawals and ongoing account balances. Of course, there are other ways to determine how much to save for retirement.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 4 retirement withdrawal calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.